Funderpro Review

FunderPro is a proprietary trading firm focused on providing traders access to significant trading capital. It offers a structured evaluation process with achievable profit targets and strict trading rules to ensure disciplined performance. Traders can benefit from direct market access, diverse trading instruments, and competitive profit splits designed to reward success.

The firm emphasizes effective risk management and realistic trading objectives for sustained profitability. FunderPro provides funded accounts for talented traders who demonstrate consistent profits and meet the minimum trading requirements. With support for various trading styles and a clear evaluation process, it caters to traders worldwide aiming to advance their careers in the proprietary trading industry.

What is Funderpro?

FunderPro is a proprietary trading firm offering traders a chance to manage substantial trading capital through funded accounts. It focuses on identifying talented traders who can meet its profit targets and follow specific trading rules. The firm provides a structured evaluation process to ensure traders meet their trading objectives while maintaining risk management discipline.

Traders can access a diverse range of financial instruments on its platform, including forex pairs and other assets. With features like high profit splits, realistic trading requirements, and weekly payouts, FunderPro appeals to both skilled traders and those looking to fast-track their careers. It supports traders worldwide, emphasizing consistent profits and professional growth.

Funderpro Regulation and Safety

FunderPro ensures trader confidence by prioritizing regulation and safety in its operations. As a proprietary trading firm, it adheres to strict standards to protect traders' capital and provide a secure trading environment. Transparency in trading rules and compliance with industry practices strengthen its position in the proprietary trading industry.

With a focus on safety, FunderPro employs robust risk management systems to safeguard accounts and trading platforms. Traders worldwide can rely on its consistent efforts to maintain a regulated and secure trading experience. This makes FunderPro an appealing choice for those seeking a safe platform in the financial markets.

Funderpro Pros and Cons

Pros

- Low fees

- User-friendly

- Multiple assets

- 24/7 support

Cons

- Limited tools

- No demo

- High deposit

- Restricted regions

Benefits of Trading with Funderpro

FunderPro offers traders access to significant trading capital, enabling them to focus on honing their trading skills without the pressure of risking personal funds. With a clear evaluation process, traders can achieve funded accounts by meeting realistic profit targets and adhering to straightforward trading rules.

Traders benefit from high profit splits, allowing them to maximize earnings while maintaining consistency. The platform supports a diverse range of trading instruments, such as forex pairs, giving traders flexibility in their trading strategies. Additionally, FunderPro emphasizes risk management and provides tools for managing real capital gains effectively.

With features like direct market access, weekly payouts, and allowances for holding trades overnight, FunderPro caters to both disciplined traders and those with unique trading styles. Its focus on trader development and success makes it a top choice in the proprietary trading firm industry.

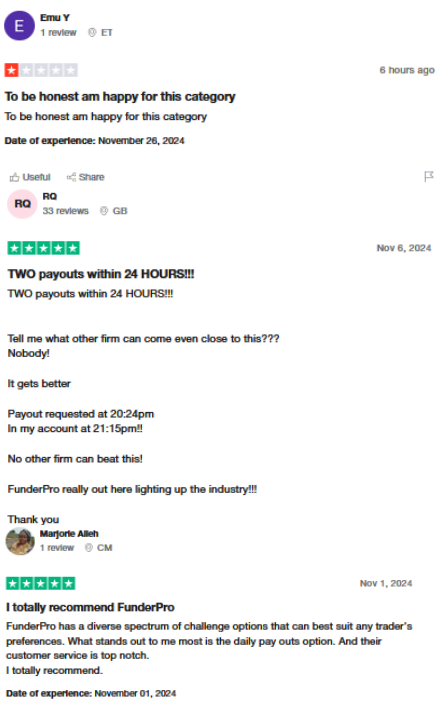

Funderpro Customer Reviews

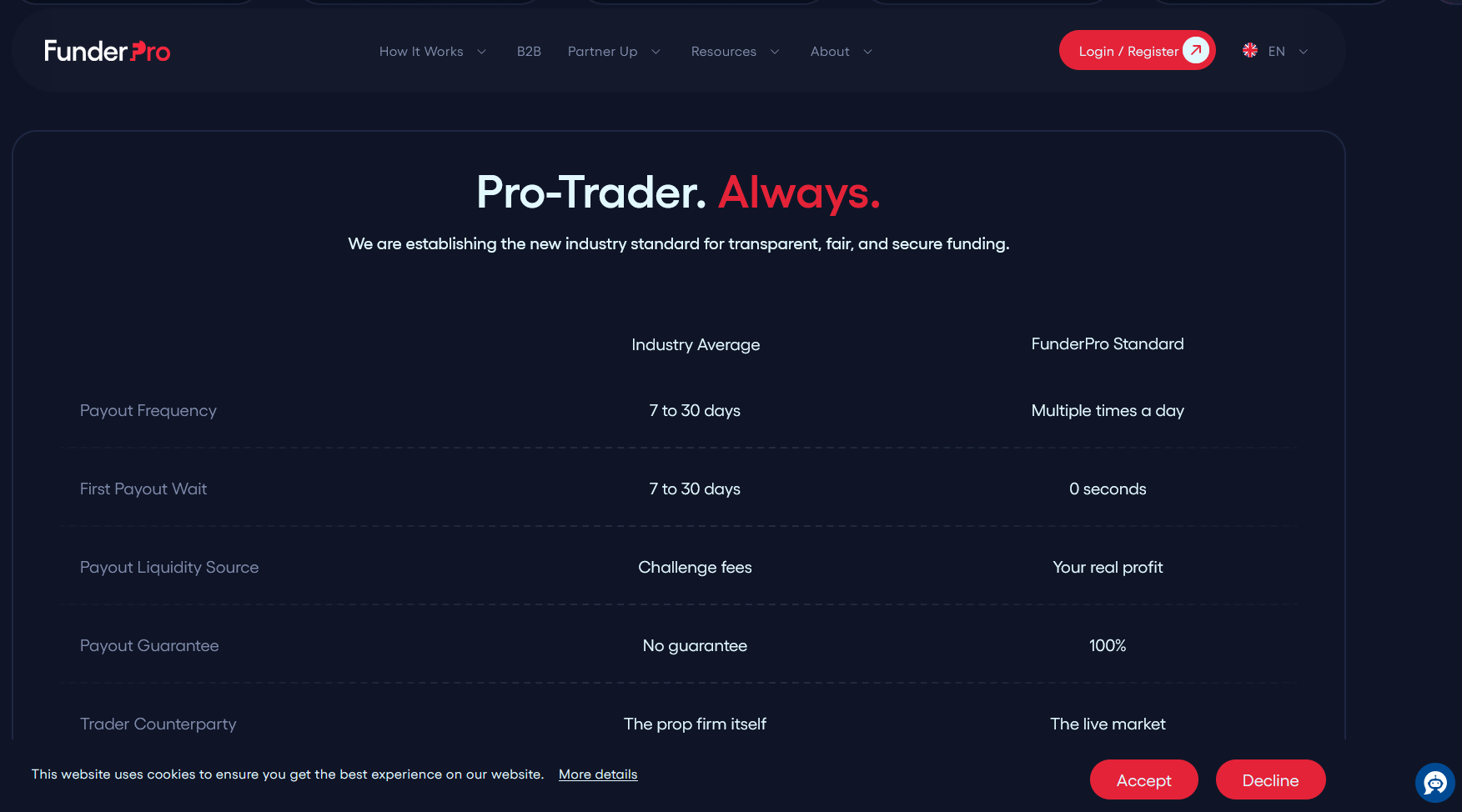

FunderPro has gained attention among proprietary trading firms for its streamlined evaluation process and competitive profit splits. Traders appreciate the platform's focus on achievable profit targets and flexible trading strategies, allowing skilled traders to excel. Many highlight the transparency of its trading rules, including clear guidelines for risk management and trading objectives.

Customer feedback frequently mentions the platform's adaptability for diverse trading styles, including news trading and holding trades overnight. The absence of overly complicated trading rules is a standout feature, enabling disciplined traders to meet their realistic trading objectives efficiently. Weekly payouts and access to real trading capital are commonly cited as strong incentives for traders worldwide.

Funderpro Spreads, Fees, and Commissions

FunderPro offers competitive spreads designed to cater to both new and experienced traders. The spreads vary depending on the trading instrument, with forex pairs typically featuring tighter spreads. This makes FunderPro an appealing option for traders seeking cost-efficient access to the financial markets.

Fees and commissions are kept transparent, ensuring traders understand the cost structure before placing trades. While some trading accounts may include commission-free options, others apply nominal fees based on the account type and trading volume. These low fees encourage traders to meet their trading objectives without incurring excessive costs.

Overall, FunderPro provides a balanced fee structure, aligning with the needs of traders aiming for consistent profits. The focus on clarity and affordability makes it a competitive choice in the proprietary trading industry.

Account Types

Funderpro offers a range of trading account types tailored for traders in the proprietary trading industry. These accounts are designed to help traders achieve their trading objectives, build consistent profits, and manage risk effectively. With realistic trading requirements and achievable profit targets, Funderpro caters to traders of all styles and experience levels.

Fast Track Account

This single-phase challenge is designed for traders aiming to secure funding swiftly. It requires achieving a 14% profit target without breaching a 4% daily drawdown or a 7% overall drawdown, all within an unlimited timeframe.

Regular Account

Structured as a two-phase challenge, the Regular Account allows traders to utilize higher leverage, up to 1:100 for forex. Phase 1 necessitates a 10% profit target, followed by an 8% target in Phase 2, each with a 5% daily and 10% overall drawdown limit. This account type is ideal for those focusing on intraday movements.

Swing Account

Also a two-phase challenge, the Swing Account caters to traders who prefer holding positions over extended periods, including during news events and weekends. It shares the same profit targets and drawdown limits as the Regular Account but offers lower leverage, up to 1:30 for forex, to accommodate longer-term trading strategies.

In Funderpro, there's no maximum limit to the trading period, allowing traders to take their time to hit these goals, but traders must trade for at least five days, the minimum trading days, to move to the next phase. Funded account must not meet the maximum loss as per traders responsibility. Maximum loss will depend on the trader's forex trading style and risk management as Funderpro is true to their profit split and profit taget.

How to Open Your Account

Opening an account with Funderpro is a straightforward process designed to help traders enter the proprietary trading firm industry efficiently. The platform allows talented traders to access significant trading capital, ensuring they meet specific trading requirements and achieve real capital gains.

Step 1: Visit the Funderpro Website

To begin, visit the official Funderpro platform and navigate to the account creation section. Ensure you review the trading requirements and details about the evaluation phases to prepare for the process.

Step 2: Choose Your Account Type

Select the desired challenge account size based on your trading goals and experience. Review information on minimum trading day requirements and achievable profit targets to select an account that aligns with your trading style and risk management approach.

Step 3: Complete the Registration Form

Fill out the registration form with accurate details, ensuring compliance with trading rules and guidelines. This step is essential for verifying your eligibility for a funded account and ensuring access to direct market access.

Step 4: Pay the Evaluation Fee

Proceed to pay the required evaluation fee to begin your journey toward becoming a funded trader. The fee grants you access to trading platforms where you can demonstrate your trading skills and meet specified profit targets.

Step 5: Start Trading

Once registered, start trading on your chosen trading instruments, such as forex pairs or other financial instruments. Follow the consistency rule, meet trading objectives, and ensure effective risk management to progress through the evaluation phases.

Step 6: Achieve Funded Status

After meeting all trading requirements and achieving your realistic trading objectives, you’ll qualify for a funded account. From here, you can focus on maintaining consistent profits and receiving weekly payouts as a Funderpro trader.

Funderpro Trading Platforms

FunderPro is a proprietary trading firm that provides traders with access to significant capital by completing specific trading challenges. The firm offers multiple platforms to cater to diverse trading preferences, including its proprietary TradeLocker platform, which features advanced charting tools, customizable indicators, and seamless TradingView integration for a user-friendly experience across devices.

In addition to TradeLocker, FunderPro recently integrated cTrader, known for its robust trading tools and real-time insights. This platform offers features like advanced price feeds and flexible integrations, enhancing the trading experience for both new and experienced traders. These platforms ensure that users have cutting-edge tools to execute strategies effectively.

What Can You Trade on Funderpro

Funderpro is a leading name in the proprietary trading firm industry, offering talented traders access to trading capital and the opportunity to manage risk effectively while pursuing consistent profits. With a focus on enabling trader success, Funderpro provides access to a diverse range of financial instruments, catering to various trading styles and strategies.

Forex Pairs

Traders on Funderpro can engage in forex trading, accessing a wide variety of currency pairs. This allows skilled traders to apply their forex trading styles to achieve consistent profits and manage risk effectively, even during high-impact news releases.

Stocks

Funderpro also allows traders to trade in equity markets, providing opportunities to engage with real capital gains. This is ideal for traders looking to diversify their trading objectives and strategies beyond forex pairs.

Commodities

Commodities like gold, silver, and oil are available on Funderpro, offering traders a chance to navigate fluctuating markets. These instruments suit disciplined traders who focus on trading success through effective risk management.

Cryptocurrencies

For traders worldwide interested in fintech and blockchain technology, Funderpro provides direct market access to popular cryptocurrencies. This aligns with the proprietary trading industry's commitment to innovation and adaptability.

By offering these financial instruments, Funderpro caters to diverse trading styles, helping traders engage with the financial markets and achieve trading success.

Indices

With access to major indices, Funderpro enables traders to participate in broader market movements. This trading option supports achieving realistic trading objectives within specified profit targets.

Funderpro Customer Support

FunderPro Customer Support is designed to cater to traders’ needs efficiently. It offers prompt assistance to traders worldwide, ensuring seamless communication through email and live chat. Their team is equipped to handle queries about trading platforms, funded accounts, and trading requirements.

The support team ensures that traders can resolve issues related to profit target, account sizes, and evaluation phases without delay. Their service emphasizes providing clear guidance, enabling funded traders to focus on their trading success.

Advantages and Disadvantages of Funderpro Customer Support

Withdrawal Options and Fees

FunderPro offers a range of withdrawal methods designed for convenience and global accessibility. Each option comes with varying processing times and fees, ensuring users can select the most suitable method for their needs. Understanding these options helps traders manage their funds efficiently.

Bank Transfers

Bank transfers are a reliable option for withdrawing funds from FunderPro. While they ensure security, processing times may take 3-5 business days, depending on the bank. Withdrawal fees for this method can vary based on the user's location and bank policies.

Credit and Debit Cards

Withdrawing via credit or debit cards offers faster processing, often completed within 1-3 business days. FunderPro typically charges minimal fees for this method, making it a convenient choice for smaller transactions.

E-Wallets

E-wallet options like PayPal and Skrill provide instant or same-day withdrawals. These methods are ideal for users seeking quick access to their funds, with FunderPro charging competitive fees for their use.

Cryptocurrency

Cryptocurrency withdrawals allow traders to receive funds directly in digital wallets. FunderPro supports major cryptocurrencies with near-instant processing and low fees, catering to tech-savvy users and international clients.

Funderpro Vs Other Brokers

#1. Funderpro vs AvaTrade

FunderPro offers a user-friendly platform with lower fees and a focus on day trading, while AvaTrade provides a more robust toolset, including automated trading and extensive educational resources. AvaTrade supports a wider range of financial instruments and global markets, but FunderPro excels in simplicity and beginner accessibility. However, AvaTrade charges higher fees, making FunderPro more appealing for cost-conscious traders.

Verdict: FunderPro is ideal for beginners seeking affordability and ease, while AvaTrade suits experienced traders needing advanced tools and broader market access. Choose based on your trading expertise and tool requirements.

#2. Funderpro vs RoboForex

FunderPro offers a streamlined platform with low fees and basic tools suitable for beginners, while RoboForex provides a more comprehensive suite of advanced trading tools and multi-asset options catering to experienced traders. RoboForex also excels with its variety of account types and flexible leverage, whereas FunderPro focuses on simplicity and ease of use. However, FunderPro lacks a demo account, unlike RoboForex, which supports demo trading for practice.

Verdict: RoboForex is better suited for seasoned traders who need advanced features and diverse account options. FunderPro is ideal for beginners seeking an intuitive platform with straightforward trading.

#3. Funderpro vs Exness

FunderPro offers a beginner-friendly interface with low trading fees and a straightforward account setup, while Exness provides advanced trading tools and a wider range of account types, making it more appealing to experienced traders. Exness supports a larger variety of instruments, including cryptocurrency pairs, compared to FunderPro’s more limited selection. However, FunderPro’s fee structure is simpler, whereas Exness may charge additional costs for some services.

Verdict: FunderPro is ideal for newcomers prioritizing simplicity and cost-efficiency. In contrast, Exness caters better to seasoned traders seeking diverse options and advanced tools.

Also Read: AvaTrade Review 2024 – Expert Trader Insights

OPEN AN ACCOUNT WITH FUNDERPRO

Conclusion: Funderpro Review

FunderPro offers a unique opportunity in the proprietary trading firm industry, providing talented traders access to funded accounts with realistic trading objectives. The prop firm emphasizes achievable profit targets, allowing traders to develop their trading strategies and manage risk effectively. With high profit splits and flexible trading rules, FunderPro stands out among other prop firms in supporting disciplined traders.

The proprietary trading firm promotes consistent profits by mandating traders to meet specific profit targets and adhere to minimum trading day requirements. By catering to a diverse range of trading styles, including forex trading and news trading, FunderPro enables traders worldwide to showcase their trading skills. For those seeking fast-track evaluation phases and direct market access, this prop trading firm ensures a supportive environment for successful traders aiming for real capital gains.

Funderpro Review: FAQs

What is FunderPro?

FunderPro is a proprietary trading firm that allows traders to manage large funded accounts and earn profit splits.

What is the profit split?

Traders keep up to 80% of the profits they generate.

What is the evaluation process?

Traders must meet profit targets in either one or two phases, depending on the program chosen

OPEN AN ACCOUNT NOW WITH FUNDERPRO AND GET YOUR BONUS