TOGETHER WITH

Hey traders, Ezekiel here! Let’s dive right into your quick market update—what’s moving, why it matters, and how to handle it like a pro.

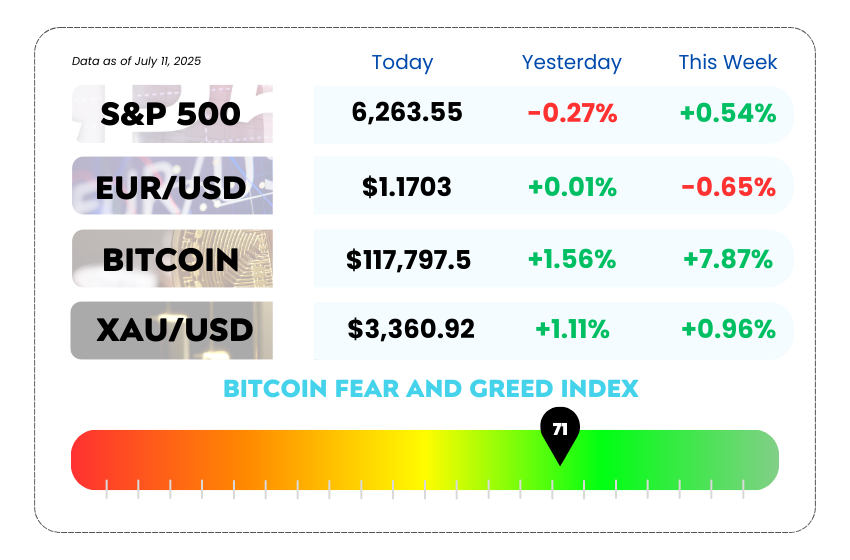

- Today's market mayhem. S&P, EUR/USD, Bitcoin, and XAU/USD today

- Bitcoin explodes past $118K as tech rallies and institutions pile in

- Trump hits Canada with 35% tariffs and hints at even bigger trade shocks

- Ditch the noise and master pure price action strategy with our YouTube video

Powered by Octa – Boost Your Trades with a 50% Bonus 🔥

Let’s face it, smart trades need smart margin. That’s why this week’s edition is brought to you by Octa, the broker helping traders level up without overleveraging.

💡 Octa’s 50% Deposit Bonus gives your account an instant boost, so you can enter trades with more flexibility, more confidence, and more control. Whether you’re starting with $50 or scaling big, that extra margin can be a real edge.

Why traders are all over it:

- 50% bonus on every deposit

- Bonus is usable immediately

- Unlock it by simply trading (Bonus ÷ 2 = standard lots)

- More cushion, better risk management

- Higher-tier users = even better withdrawal terms

📈 It’s both a bonus and a buffer for smarter setups and bigger plays.

👉 Ready to load up your trading account with more firepower? Tap the button below to activate your bonus and trade smarter with Octa.

WEEKLY MARKET MAYHEM🔥

For this week's market mayhem, here’s what we got for you today:

Bitcoin Blasts Past $118K As Risk Appetite Returns And Congress Eyes Crypto Clarity 🚀

Bitcoin is back in beast mode.

The world’s biggest crypto smashed through $118,000, marking a new all-time high and reminding everyone it still knows how to party when markets go risk-on.

This isn’t just a solo sprint. Tech stocks are also pumping, with Nvidia flying past $4 trillion in valuation and the Nasdaq setting fresh records. And just like that, the Bitcoin–Tech Stock Correlation™ is alive and well.

But here’s the real kicker…

Bitcoin’s breakout comes after 2 months of unusually tight sideways action, stuck in a $10K range — uncharacteristically chill for a coin known for its drama. That calm just got shattered in the loudest way possible.

BTC/USD Daily Chart as of July 11th, 2025 at 12:45 UTC (Source: TradingView)

So, what’s fueling the fire? 👇

- Institutional money is rolling in harder than ever

- Corporate wallets are bulking up — MSTR and GME are still stacking sats

- Even Trump’s DJT group filed to launch a “Crypto Blue Chip ETF”

And now, all eyes are on July 14, when Congress kicks off Crypto Week — a legislative binge that could finally define the rules of the road for digital assets.

Oh, and remember that stablecoin framework? The GENIUS Act just passed the Senate and is headed to the House. If it lands, expect more capital flowing into compliant platforms.

Meanwhile, Circle (USDC issuer) jumped 2%, Coinbase and Robinhood also rallied, and everyone’s wondering how far this bull has to run.

🤔 Asia Forex Mentor Insights

Technically speaking, BTC just cleanly broke above key resistance at $115K, completing a textbook bull flag breakout after consolidating in a high base. The next psychological target? $125K, with strong institutional bids expected between $113K–$114.5K on any short-term pullback.

Momentum remains strong, and RSI is stretching into overbought territory — but with macro tailwinds and policy clarity on deck, any dips are likely to be shallow and bought aggressively.

Watch how BTC behaves near $120K. If we hold above, this rally could turn parabolic.

Tariff Tsunami Incoming: Canada Gets Hit, Trump Teases Bigger Waves 🇺🇸🛑

Trump’s latest round of trade drama just got a whole lot louder. This time, the target is Canada, which is now staring down the barrel of a 35% tariff on its goods starting August 1. The announcement dropped on Truth Social (yes, still a thing), where Trump claimed Canada had the audacity to “financially retaliate.” So he’s clapping back — and hard.

But wait, it gets wilder.

Trump's also hinting at 15%–20% blanket tariffs across the board, tossing out the old 10% “reciprocal” rate like expired milk. Oh, and USMCA exemptions? No word on whether they’ll survive the tariff wave. So yeah, Canada’s trade teams are sweating.

BRICS? More like BRICKED.

Trump’s not just playing hardball with allies. He’s going after Brazil, slapping a massive 50% tariff on their exports, and stirring the pot in Lula's backyard. Meanwhile, China’s getting vocal, warning the US not to mess with supply chain dynamics or risk retaliation that might hit faster than you can say “decoupling.”

If that’s not enough tension for you, copper just joined the party. Trump confirmed a 50% tariff on copper imports, including critical-grade materials used in everything from power grids to military hardware. That’s got metal traders and defense contractors on edge — because, you know, inflation wasn’t spicy enough already.

Here's how some other countries are faring:

- Vietnam: Tariff cut to 20% (from 46%), but a 40% rate still looms for transshipped goods. Fun fact: Vietnam had no clue they’d even agreed to this. Classic plot twist.

- European Union: Scrambling to finalize a deal. They’ll take the 10% tariff on most goods, but they’re begging for sector carve-outs before the August 1 clock runs out.

🤔 Asia Forex Mentor Insights

This isn’t just political noise, but a macro minefield as well. Currency traders should be watching the CAD, EUR, and JPY closely, as trade tensions and tariff battles weigh on capital flows and central bank decisions.

The USD/CAD pair is particularly vulnerable here. With Canada now facing a 35% hit on exports, sentiment around the loonie is expected to soften, especially if oil prices stall.

Meanwhile, if the EU deal fails to come together, EUR/USD could test deeper supports as investors price in economic headwinds across the bloc.

And don’t ignore commodity-linked currencies like AUD and NZD — copper tariffs could distort demand-supply expectations and weigh on sentiment.

When politics shakes the globe, charts light up. Stay nimble, stay sharp.

MEMES OF THE DAY

Nothing haunts a trader like the gains they cut too soon 💔

Every “breakout” in a low-volume market 😅