TOGETHER WITH

Today’s edition is powered by FP Markets, a broker built for traders who mean business. Get raw spreads starting at 0.0 pips, lightning-fast execution, and deep liquidity access across MT4, MT5, and cTrader.

Upgrade your setup and trade like a pro with FP Markets 💸

What’s up, traders? Ezekiel here with your market rundown. Let’s break down what’s driving the action and how to stay one step ahead:

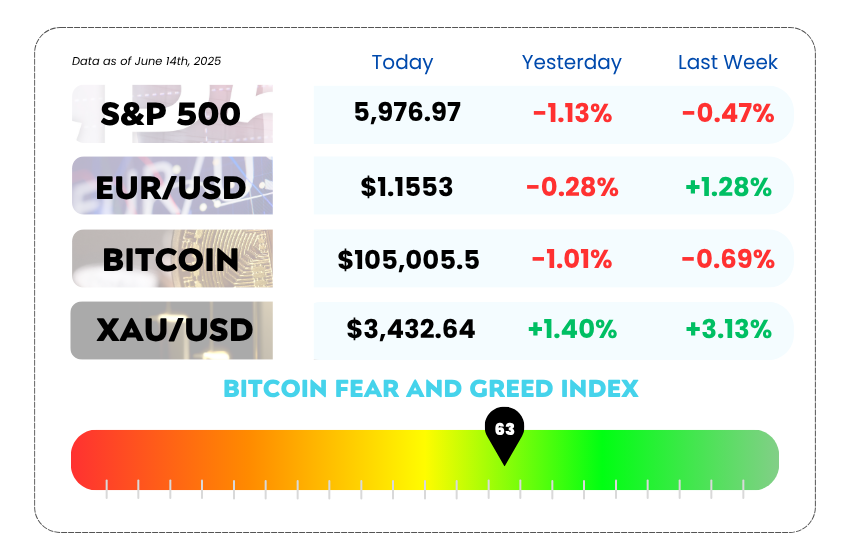

- Today's market mayhem. S&P, EUR/USD, Bitcoin, and XAU/USD today

- Crude spikes 7% as Middle East tensions reignite supply fears

- Robots building robots? AI leaders predict a major job shake-up

- Master trend trading and smart entries using Moving Averages with our YouTube video

Ditch the Dinosaur Spreads — Trade Raw with FP Markets 🦖

Still getting crushed by outdated spreads and sluggish execution? It's 2025 — time to upgrade your setup.

FP Markets delivers raw spreads from 0.0 pips, blazing-fast execution, and deep liquidity that actually helps your trades hit target, not get slipped into oblivion.

Whether you're on MT4, MT5, or the sleek new cTrader, you’re getting:

💥 Zero-markup, zero-nonsense pricing

⚡ Institutional-grade execution speed

💼 Serious trading infrastructure without the suit and tie

👉 Trade smarter, not harder, annd unlock raw spreads now with FP Markets

WEEKLY MARKET MAYHEM🔥

For this week's market mayhem, here’s what we got for you today:

Oil’s Heating Up — And So Is the Middle East 🛢️

Crude oil just went full drama mode. After a 7% spike last Friday, analysts are warning: this could just be the beginning.

Tensions between Israel and Iran are flaring again, and when geopolitical fire meets oil barrels, you get volatility. Big banks are now eyeing $90+ per barrel, with whispers of $100+ if things spiral.

Brent and WTI oil closed the week just under $75, but those numbers don’t tell the whole story. Overnight? We saw intraday jumps over 13% before things cooled down.

📈 The New Price Risk Isn’t Just Supply, It’s The Strait

Goldman Sachs says if Iran’s oil gets knocked offline, the market loses up to 1.75 million barrels/day. That’s a big bite — but what really has traders sweating is the Strait of Hormuz. If that gets blocked? We’re talking 20% of global oil trade disrupted. Boom — oil could shoot past $100 like a meme coin on leverage.

😬 Best Case: Temporary Spike. Worst Case: Buckle Up

Even though Wall Street agrees the “doomsday scenario” is unlikely, the pricing models are already shifting. JPMorgan thinks $120 Brent isn’t off the table if the region ignites.

But here’s the twist: higher oil = higher inflation = big Fed headache. A price surge could wipe out months of cooling inflation and delay rate cuts traders have been betting on.

And if energy costs spike too fast? We could see demand destruction, aka people stop spending, markets wobble, and recession risk re-enters the chat.

🤔 Asia Forex Mentor Insights

This isn’t just a crude story. It’s about how geopolitical flashpoints ripple across FX, commodities, and indices. If oil jumps, expect knock-on effects: USD strength, CAD volatility, and equity sector reshuffles.

Smart traders stay nimble, watch the energy tickers, and prep for tail-risk moves that catch the rest of the market off guard.

AI Just Made Your Resume Nervous 🧠

Jensen Huang and Sam Altman sound off on the job market future

This week, two of AI’s loudest voices — Nvidia’s Jensen Huang and OpenAI’s Sam Altman — dropped some spicy takes about the future of work. Spoiler: robots aren’t coming for your job, they’re building each other now.

Let’s break it down:

🔧 Jensen Huang isn’t sweating

The Nvidia CEO stood on stage at VivaTech and basically said: Relax, AI isn’t a job killer, it’s a job shifter.

Sure, some roles will vanish like floppy disks, but Huang argues AI boosts productivity, and more productivity usually means… more hiring.

Translation? Your job might change — not disappear.

⚠️ But Sam Altman? A little less chill

The OpenAI chief (aka: the guy behind ChatGPT) dropped a blog post saying some jobs are straight up toast. Especially the repetitive, entry-level, office kind.

His outlook: AI tools are already smarter than anyone who’s ever lived, and they’ll soon help design real-world robots that can do physical labor too.

Altman does think humans will adapt, we always do, but he’s clearly setting expectations early: big shifts are coming.

🤖 Robots building robots

Yeah, you read that right. Altman thinks AI-designed machines could soon start building other machines. That’s not science fiction — it’s 2026’s hiring strategy.

So we’ve got one CEO saying AI is an upgrade, and another saying “brace for impact.” Who’s right? Probably both.

NVIDIA Corporation (NASDAQ) Daily Chart as of June 14th, 2025 (Source: TradingView)

🤔 Asia Forex Mentor Insights

Here’s what matters for traders:

- Labor volatility = economic volatility. Expect job reports to get weird as AI adoption scales.

- Productivity spikes may lift GDP — but also unsettle central banks trying to track inflation and employment.

- Tech stocks (like Nvidia) will stay front and center. When the future of work shifts, the companies building the tools will lead the charge.

AI is the new industrial revolution — and markets will move with every update. Stay sharp. The bots aren’t just writing code anymore — they might be rewriting economies too.

MEMES OF THE DAY

When in doubt, go all in and pray. 🙃

Breakout party turned into a funeral real quick 💀