TOGETHER WITH

Today’s edition is brought to you by iFunds, the prop firm that skips the fluff and gets you trading fast.

Say goodbye to evaluations and red tape. iFunds gives you instant access to real capital to trade forex, crypto, stocks, and indices; all from one clean, no-hassle platform.

👉 Claim up to $500K in funding and jump straight into the action.

Hey traders, Ezekiel here. Time to break down what’s moving the markets and what you need to know today.

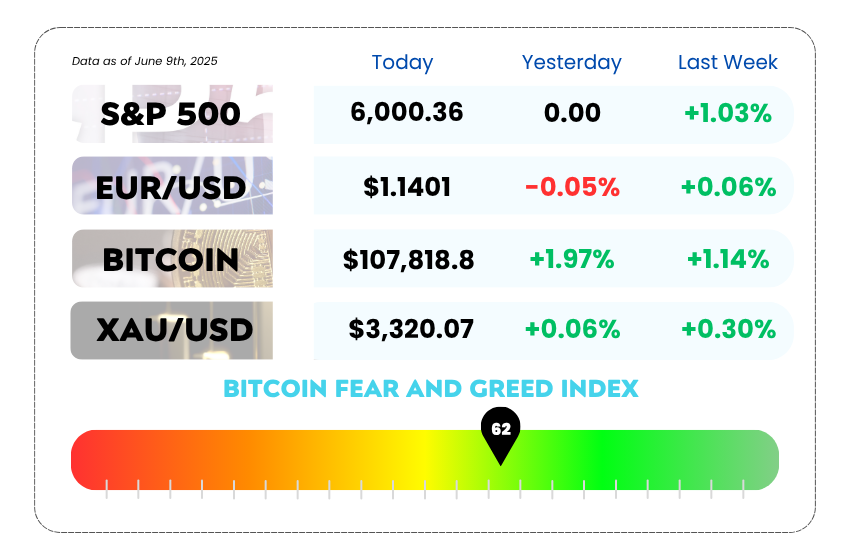

- Today's market mayhem. S&P, EUR/USD, Bitcoin, and XAU/USD today

- Futures tick up while US and China test round two of talks

- Crypto funds hit all-time high as investors seek safety

- Learn how smart money traps retail traders with our YouTube video

How to Do Prop Trading Without the Pain?

Why waste time proving you can trade when you already know you can?

iFunds skips the “challenge” drama and gives you instant capital, up to $500K, no tests, no restrictions, no babysitting.

📈 Here’s what makes iFunds the prop firm killer:

- No evaluations, no targets, no time limits

- Trade how you want — scalping, swing, bots? All good

- Withdraw profits when you want — no monthly hoops

- Instant setup — you're trading in minutes

- Ultra-low fees = more money stays in your pocket

This isn’t a challenge. It’s a head start.

WEEKLY MARKET MAYHEM🔥

For this week's market mayhem, here’s what we got for you today:

US-China Back at the Table, Markets Lean In 💼

After weeks of tariffs, tension, and finger-pointing… the US and China are flirting with peace talks again, and Wall Street is raising an eyebrow (and a few points).

Futures inched up this morning across the board:

- S&P 500 scratched out a new short-term high

- Dow and Nasdaq drifted gently upward

- Volatility? Hit the snooze button 😴

Why? Traders are betting that cooler heads might finally prevail. President Trump and President Xi got on the phone last week, and now their teams are meeting in London to see if they can patch things up — or at least not throw more fire on the trade war dumpster.

S&P 500 Index Daily Chart as of June 9th, 2025 (Source: TradingView)

📉 Tariff Talks, Round 47: Hope or Hype?

Markets are desperate for a win after April’s tariff-induced rollercoaster. Recession whispers got a little quieter thanks to solid jobs data, but confidence is still walking a tightrope.

This week’s bet: If the London talks go well, it could revive that Geneva energy from May — when both sides pretended to play nice.

But don’t pop champagne just yet 🍾

- Both sides are still blaming each other

- The truce is hanging by a tweet

- And in the background? LA is heating up with protests over deportation policies, and Trump just deployed the National Guard like it's a Call of Duty DLC

🍎Apple Hits the AI Stage (Sorta)

Meanwhile, Apple’s WWDC kicks off today, and investors are watching like hawks for any sign of a big AI announcement. But don’t expect fireworks, this year’s show might be more subtle, more Siri, less sizzle.

Wall Street is still hungry for signs that Apple can AI its way into another revenue boom.

🧨 What’s Next: Inflation Incoming

The real heavyweight event this week? Consumer inflation numbers drop Friday, with wholesale data leading the charge Thursday.

If the inflation print comes in hot, the Fed’s rate cut hopes might cool off faster than a FOMO breakout. But if it chills? Cue the soft landing memes 🚀

🤔 Asia Forex Mentor Insights

If US-China talks make progress, expect strength in equities and a potential dip in safe-haven plays like gold and the dollar. But if talks sour, brace for the opposite. Positive trade headlines may weaken the dollar as risk appetite rises, while tariff escalation or inflation surprises could spark a dollar rally.

Keep your eye on Friday's CPI print. A cooler number could fuel hopes for rate cuts, lifting equities and risk assets. A hot read? Expect volatility, especially in tech and rate-sensitive stocks. If S&P 500 continues to hold above 6,000, it signals confidence. A rejection? Could be the start of a pullback.

Crypto Funds Just Hit a New Record and Wall Street’s Not Laughing Anymore 🪙

What started as a speculative gamble is now looking like a serious asset class. Crypto funds just hit an all-time high of $167 billion in assets under management. and no, that’s not a typo.

📊 In May alone, investors poured $7.05 billion into digital asset funds, the biggest monthly inflow since December. While stocks fumbled and gold cooled off, crypto quietly walked up to the spotlight and said: “I’m not just a meme anymore.”

🚀 Bitcoin’s Playing Defense and Offense

Bitcoin has been on a heater, up 15% in the last 3 months. That’s better than gold (+13%) and way ahead of the MSCI World Index (+3.6%).

What’s behind the surge?

Institutional money is finally flowing like a broken faucet. Spot Bitcoin and Ethereum ETFs in the U.S. have given traditional investors a comfy, regulation-wrapped way to jump in.

But this isn’t just a fear-of-missing-out rally. Crypto is turning into a legit hedge. With the U.S. dollar sliding, bond yields spiking, and the equity market acting like someone's moody ex, more pros are leaning into BTC for diversification.

S&P 500 Index Daily Chart as of June 3rd, 2025 (Source: TradingView)

📉 Meanwhile, Stocks and Gold Are Getting Ghosted

While crypto funds hit new highs, global equity funds saw $5.9 billion in outflows last month. Even gold, the “boomer hedge”, got clipped for $678 million, breaking its 15-month inflow streak.

Translation? Money’s on the move, and crypto seems to be the new destination.

That initial ETF hype rush might’ve cooled down, but what we’re seeing now is more sustainable, a slow rotation into crypto as a long-term portfolio staple.

🤔 Asia Forex Mentor Insights

Big picture: This is both a hype cycle and a power shift. While old-school safe havens lose steam, crypto is stepping into its grown-up era.

For traders, that means two things:

- Watch ETF inflows and macro uncertainty since these are the fuel behind the fire.

- Be ready for more institutional volume, but don’t sleep on the volatility (crypto’s still crypto).

MEMES OF THE DAY

When risk management takes a sick day 💀

Just me, my chart, and eternal sideways suffering 📊