TOGETHER WITH

Today’s edition is brought to you by Markets4you, where your deposit goes twice as far. Snag their 100% Bonus and double your capital on the spot, giving you more room to trade, without extra out-of-pocket cost.

👉 Fuel your trades with twice the firepower at Markets4you.

Hey traders, it’s Ezekiel dropping the latest market insights to keep you one step ahead. Let’s dive in!

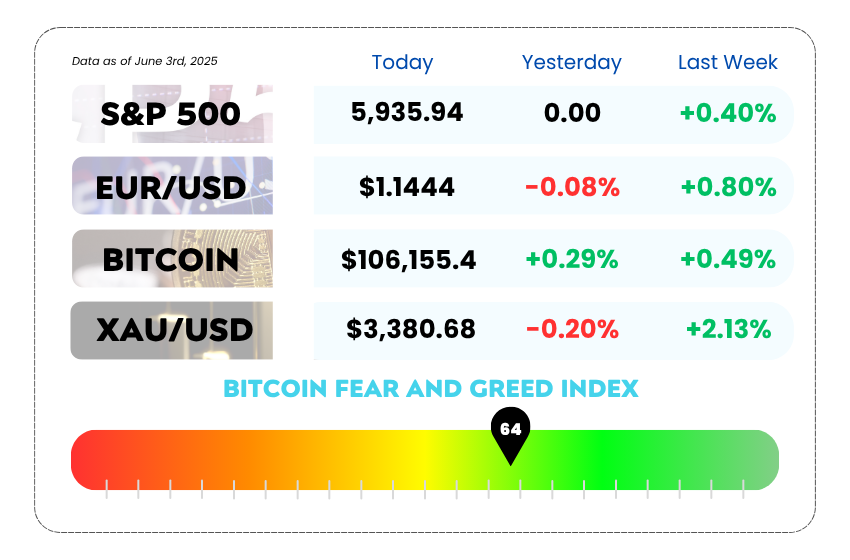

- Today's market mayhem. S&P, EUR/USD, Bitcoin, and XAU/USD today

- Tariffs stir inflation fears and the Fed can’t agree what to do

- Trump’s tariff drama shakes up market calm once again

- Master supply and demand zones the smart money way with our YouTube video

Double Your Deposit, Double Your Trading Power Instantly 🚀

Looking to supercharge your trading game? With Markets4you, you can instantly double your capital and level up your market strategy, no delays, no complications!

Here’s the deal:

- Deposit any amount

- Choose your bonus level

- Instantly get a 100% matching bonus added to your account

- The more you fund, the more bonus power you unlock

Whether you're just starting out or already a pro, this bonus opens the door to more trades, bigger plays, and greater potential returns. 🔥

Why trade with limits when you can trade with leverage?

Unlock your full trading potential, join Markets4you and double your capital today! 💰📊

WEEKLY MARKET MAYHEM🔥

For this week's market mayhem, here’s what we got for you today:

The Fed Is Fighting Itself Over Rate Cuts 🧠

If there’s one thing traders love, it’s clarity. Unfortunately, the Fed is serving us the opposite, a full-blown monetary policy food fight.

The central bank is now split between two camps:

- Team Cut Rates (Eventually) — believes Trump’s tariffs are a short-term headache, not a lasting inflation bomb.

- Team Chill (Hold Steady) — sees risks of long-term inflation and wants to sit tight until the smoke clears.

In short: The Fed is asking itself if this inflation is just a hot flash… or a slow burn. 🔥

💬 Enter Chris Waller — The Fed’s “Cut the Noise” Guy

Fed Governor Chris Waller says the tariff-driven inflation spike? Not that deep.

His logic: no worker shortage, no stimulus hangover, and no evidence of major supply chain wreckage, just yet.

Translation? He’s open to “good news” rate cuts later in 2024, if inflation keeps easing and the job market stays strong. Sounds chill… unless you’re the other half of the Fed.

🪓 Meanwhile, Kashkari & Logan Are Slamming the Brakes

Not everyone’s feeling the optimism.

Minneapolis Fed’s Kashkari and Dallas Fed’s Logan are like, “Let’s not touch the rate dial just yet.”

Their take:

- Tariff drama might drag out for months or years

- Cutting rates too soon could reignite inflation

- Better to wait, watch the data, and avoid a repeat of 2021’s rate regret

Logan even compared fast cuts to a sugar high: feels good now, but crashes hard later. 🍬💥

US Dollar Index Daily Chart as of May 31st, 2025 (Source: TradingView)

🎯 What’s Next for Markets?

With tariffs back in play and economic data on edge, rate decisions are getting political, technical, and emotional.The Fed's May meeting minutes revealed that some officials expect tariffs on stuff like steel and aluminum could raise costs long-term — especially if supply chains buckle again.

That said, there are counterforces:

- Some firms might cut prices to grab market share

- Consumer demand isn’t sky-high

- And any tariff effects may still fade by late 2025

Waller thinks it’ll all level out, but others? They’re not so sure.

🤔 Asia Forex Mentor Insights

Markets love certainty, and we’re not getting it. With inflation, interest rates, and tariff policy all tangled up, expect volatility to rise as the Fed wrestles itself.

Trade the data, not the drama. Stay focused, manage risk, and use market confusion to your advantage. Because while the Fed debates, the market reacts. 📉📈

Futures Dip as Trade Tensions Reboot… Again 📉

Just when Wall Street thought it was safe to exhale… Trump’s tariff tantrum is back.

Overnight futures took a baby step back, Dow, S&P 500, and Nasdaq 100 all dipped about 0.1%, as traders braced for a fresh wave of uncertainty from renewed global trade spats.

China’s clapping back at the accusation that it violated its truce with the US, while the EU's side-eyeing Trump's plan to double tariffs on steel and aluminum like it's 2018 all over again.

Despite the drama, stocks actually rose Monday as traders played it cool, pretending tariffs are just background noise. But futures are already saying, “Yeah, not so fast.”

S&P 500 Index Daily Chart as of June 3rd, 2025 (Source: TradingView)

🎢 Tariff Season 2: Same Show, New Plot Twists

Back in April, Trump dropped a trade bomb with sweeping tariffs. Since then, it’s been non-stop court rulings, reversals, and retaliation threats, a legal ping-pong match that’s exhausting even the most seasoned macro traders.

Now? A federal appeals court paused a previous ruling that would’ve neutered most of Trump’s tariff powers. The next chapter drops June 9, when the administration must respond.

Translation: more uncertainty, more volatility, and more reasons to keep your stops tight.

📊 Data Week Incoming: Traders, Grab Your Popcorn

With earnings season basically in the books (bye-bye Q1), attention is turning to the real market movers, which is economic data.

This week’s lineup:

- Tuesday: JOLTS (aka job openings report)

- Wednesday: ADP employment figures

- Friday: Non-farm payrolls — the big one

All of it matters now because markets want to know: Are tariffs hurting hiring, or are we still chilling in Goldilocks land?

🤔 Asia Forex Mentor Insights

Markets are walking a tightrope right now, inflation’s cooling, earnings are done, and now geopolitics is back on center stage. That means short-term volatility could spike, even if long-term trends stay intact.

This week? Stay data-dependent, hedge the unexpected, and don’t underestimate the headline risk of a well-timed Trump tweet.

MEMES OF THE DAY

Blinked once… breakout gone 😩

This $100 account sleeps better than me 😮💨💤