TOGETHER WITH

Hey traders, Ezekiel here! Let’s get straight to the point with your rapid-fire market update; what’s moving, why it counts, and how to navigate it like a pro.

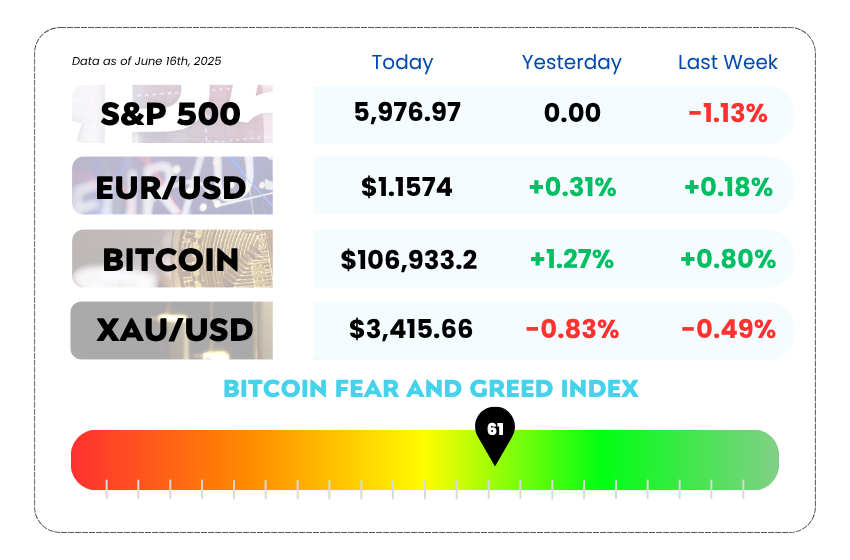

- Today's market mayhem. S&P, EUR/USD, Bitcoin, and XAU/USD today

- Fed faces mounting pressure to cut rates as Trump dials up the heat

- Crude dips but risk of supply shock keeps traders on edge

- Avoid fakeouts and trade smarter in consolidations with our YouTube video

Octa’s 50% Bonus Is Basically Free Trading Ammo 🎯

Looking to strengthen your positions without overextending your capital? Octa’s 50% deposit bonus gives your account an instant boost, so you can take trades with more confidence and flexibility.

Whether you’re starting small or scaling up, this bonus adds extra margin to support your strategy.

Why traders are using it:

- 50% bonus applied to every deposit

- Funds are available right away

- Start from as little as $50

- More margin means smarter trade management

- Bonus becomes withdrawable after meeting a clear volume target

Simple rule:

To unlock the bonus:

Bonus ÷ 2 = Number of standard lots you need to trade

(e.g. $200 bonus = 100 standard lots = bonus unlocked)

Higher-tier users even get easier withdrawal conditions — another reason to level up.

Start stronger, trade smarter — all with Octa.

WEEKLY MARKET MAYHEM🔥

For this week's market mayhem, here’s what we got for you today:

The Fed’s Dot Plot Showdown: Cuts, Chaos, or Just More Waiting? 🧠

Welcome to “Dot Plot Week”, where the Federal Reserve reveals its inner thoughts via a chart that looks like a scatter plot but moves markets like a blockbuster sequel. And this time, the stakes are spicy. 🌶️

Wall Street isn’t asking if rates stay put this week, it’s asking what comes next. Will the Fed still flirt with two rate cuts in 2025, or has the inflation heat turned the doves into hawks?

🏛️ The “Steady Hands” vs. “Cut Now” Debate

Right now, the Fed is doing the policy equivalent of squinting at a puzzle with missing pieces. Tariffs from Trump? Still unclear how much inflation they’ll unleash. Middle East tension? Could push oil (and prices) higher. And yet, recent data says inflation is cooling, at least for now.

So far, the job market’s hanging in there like that one guy still holding AMC. Unemployment’s steady at 4.2%, and wages are rising. That’s giving Powell zero excuses to cut too soon, but it’s also not reason enough to keep rates locked in the vault all year.

💥 Trump, Tariffs & Tension

Trump is turning up the pressure on Powell, calling him a “numbskull” and threatening to “force something” (read: push rate cuts without actually firing anyone… yet).

His argument? Inflation is under control, and tariffs haven’t caused a price surge. Treasury Secretary Scott Bessent backed him up last week, citing recent CPI and PCE prints showing softening price growth.

But Powell isn’t sold. The Fed still sees tariff-related inflation risk as real — especially if global trade takes another hit. The result? Expect a cautious Powell, keeping the door open to cuts while avoiding promises.

📉 Investors Are Watching the Wrong Thing

Everyone’s focused on Wednesday’s Fed decision, but the dot plot is the real headline act. If officials still signal two cuts, markets breathe easy. If they backpedal? Expect stocks to wobble, and bond yields to twitch like they had too much coffee.

Meanwhile, the market’s already betting on a September rate cut — but that depends on whether the job market cools down faster than expected or inflation flares up again.

🤔 Asia Forex Mentor Insights

This week is all about expectations management. Traders shouldn’t get too bullish on cuts, but also shouldn’t ignore the Fed’s long-game approach. Even if nothing changes now, Powell’s still watching for that “just right” moment, and that means volatility could spike depending on how hawkish or dovish the dot plot looks.

Pro Tip: Keep your eye on the Friday CPI data and Powell’s tone. A slightly cautious Fed that keeps the cut door cracked open is bullish for risk assets… but if they slam it shut, brace for a market cooldown. 🧊

Oil Takes a Breather, But the Fire’s Still Burning 🔥

After an explosive 7% rally, oil prices hit the brakes Monday, but don’t get it twisted. This isn’t the calm after the storm… it's the eye of it.

Brent crude opened strong, only to fizzle out and trade down 1%. Why? Because while Israel and Iran are still throwing punches, oil infrastructure has dodged the hits — for now. That’s the only thing keeping $90+ oil from going full send.

Let’s rewind a sec. Last Friday, markets went full panic mode after Israel struck Iran’s nuclear sites and lobbed a shot at the South Pars gas field, taking a production platform offline. But the real panic button — the Strait of Hormuz — hasn’t been hit.

🧨 The $100 Barrel Trigger? It’s Still On the Table

The Strait of Hormuz is the throat of global oil. Around 20% of the world’s daily oil output flows through that narrow waterway. If Iran blocks it? Forget $90 — we could be staring down $120 like it’s 2008 again.

So far, no blockades. But…

- Tanker rates have spiked 20% as shipowners hesitate.

- GPS jamming near Hormuz is messing with navigation.

- Traders are swarming the options market, loading up on bullish calls just in case things explode, literally and figuratively.

In other words, volatility’s the new normal, and smart money is hedging hard.

🧊 Market’s Cooling, But Don’t Get Cozy

Yes, prices pulled back. But that’s mostly because traders are waiting to see if this situation escalates or fizzles out. Even the US President said “maybe they just need to fight it out.” Comforting, right?

Meanwhile, Morgan Stanley bumped its oil forecast up $10, and analysts at RBC are watching potential targets like Kharg Island and Iraq’s oilfields like hawks. The concern? If attacks move from symbolic to strategic, that’s when oil rockets.

👉 Some analysts argue prices could actually fall if no further damage hits infrastructure. But that’s a big “if,” and the risk premium isn’t going anywhere.

🤔 Asia Forex Mentor Insights

Right now, the oil market isn’t trading on supply and demand, it’s trading on geopolitical vibes and missile trajectories. That means volatility is opportunity, but it also means tight risk management is non-negotiable. If you're trading oil-related assets, watch the headlines like you watch your SL.

A blocked Strait = oil explosion

Calm waters = downside correction

Choose your trades wisely. The market’s in “wait-and-react” mode — and so should you be.

MEMES OF THE DAY

When 1% risk turns into 100% regret 🧨

Trading plans by day, existential doubt by night 😵💫