TOGETHER WITH

Hey traders, Ezekiel here! Let’s cut through the noise with your quick-hit market update. Here’s what’s shaking the markets, why it matters, and how to trade it smart.

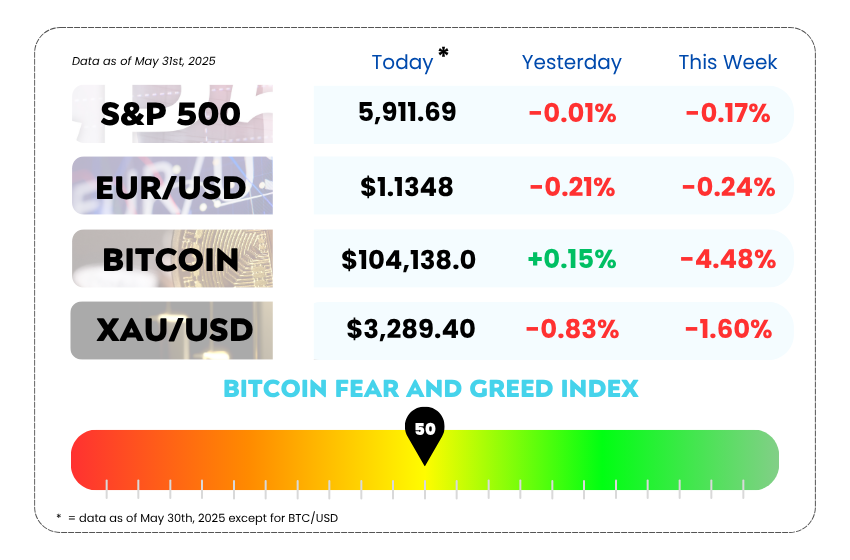

- Today's market mayhem. S&P, EUR/USD, Bitcoin, and XAU/USD today

- The dollar logs its longest losing streak since 2020 as macro cracks widen

- OPEC+ extends output hike in July as power plays heat up

- Learn how to identify and trade Doji candlestick patterns like a pro with our YouTube video

Boost Your Trading Power Instantly with Octa’s 50% Bonus! 💥

Need a little extra firepower in your trades? Octa’s got your back. With their 50% instant deposit bonus, you get more capital to play with, no delays, no nonsense, just more potential.

Whether you’re just starting out or scaling up, this bonus gives your strategy the room it needs to breathe.

Here’s why traders love it:

🔹 Instant 50% bonus on every deposit

🔹 No waiting — funds are ready the moment you hit deposit

🔹 Start with as little as $50

🔹 Bonus gives you more margin = more flexibility

🔹 Want to withdraw the bonus? Just hit a clear volume target

✅ Withdrawal rule (simple math):

Bonus ÷ 2 = Standard lots you need to trade

(Example: $200 bonus → trade 100 lots → bonus unlocked)

🔥 Pro tip:

If you're a higher-tier user, your bonus becomes even easier to withdraw. Yep, it pays to level up.

WEEKLY MARKET MAYHEM🔥

For this week's market mayhem, here’s what we got for you today:

The Dollar’s Losing Streak Just Hit Beast Mode 💸

The US dollar has been hitting the gym… but apparently skipped leg day 🏋️♂️💀

Despite a couple of small gains this week, the greenback just clocked its longest monthly losing streak since 2020, dropping about 0.6% in May. That’s five straight months of Ls for the ol' George Washington.

So what’s dragging it down?

Let’s break it down, Asia Forex Mentor style:

- Uncertainty in US trade and fiscal policy is giving investors the ick

- There’s a spicy new proposal aimed at taxing companies from countries with “discriminatory” tax rules. Translation: foreign investors might start ghosting US assets 👻

- The US needs foreign capital to fund its ballooning debt. Bad timing much?

And the market's making its move:

Speculative traders jacked up their bearish bets against the dollar to $13.3B, up from $12.4B the week before. That’s not a dip, that’s a bellyflop.

US Dollar Index Daily Chart as of May 31st, 2025 (Source: TradingView)

Trump’s trade drama is back 🎭

With court fights brewing over those chaotic tariffs and Trump once again clashing with China over trade terms, it’s no wonder the dollar’s looking a little shaky. Investors aren’t feeling the traditional “safe haven” vibes like they used to.

- US consumer spending? Slowed.

- Imports? Down big time.

- Fed rate cuts? Still off the table… for now.

Meanwhile, emerging market currencies like the South African rand and Mexican peso have been flexing 💪, up more than 4% recently, though Friday saw a slight pullback as traders locked in profits and braced for more global trade noise.

Some dollar buyers crept back in before the weekend, but don’t let that fool you — the real question is whether this dollar downtrend is just catching its breath or getting ready for another slide 🪂

🤔 Asia Forex Mentor Insights

DXY weakness is being driven by a combination of softening US macro data and rising fiscal risk premium. May’s 0.6% drop in the US Dollar Index reflects a broader rotation out of USD as traders price in elevated twin deficits and declining real yields.

Policy risk is adding fuel: A proposed bill targeting “discriminatory tax regimes” is scaring off foreign capital just as the US needs to finance its debt. This raises the risk of structurally weaker USD if foreign inflows dry up, especially from Asia and the EU.

The Fed remains cautious, and May’s data doesn’t meet the bar for rate cuts. But if we get further deterioration, markets may begin front-running dovish Fed pricing, which could accelerate USD downside.

🧠 Key levels to watch:

- DXY support near 103.30 – a break below opens up downside toward 102.50

- EUR/USD resistance at 1.09 – a breakout could trigger momentum buying

- USD/MXN: Pullback could be shallow if EM bid returns on global risk-on sentiment

OPEC+ Just Turned the Oil Tap (a Bit) More, But This Is About Power, Not Just Supply 🛢️

OPEC+ just announced it’s bumping up oil output in July by 411,000 barrels per day, but here’s the plot twist: this isn’t just about meeting demand. It’s about politics, punishment, and market power.

Let’s decode what really went down:

Eight key members, including the heavyweight champs, Saudi Arabia and Russia, have been raising production faster than expected since May. That’s already putting pressure on oil prices, but the July move is a clear signal: OPEC+ is cleaning house.

Why? Because some members have been overproducing without permission, and Riyadh and Moscow don’t like freeloaders. This accelerated increase is their way of saying: “You want to play games? We’ll flood the market and squeeze your margins.” Classic cartel chess ♟️

At this point, the total bump from April through July is 1.37 million bpd, which unwinds over 60% of the group’s 2.2M barrel cut. It’s a controlled return to supply, but with a political undertone.

Not Everyone’s Happy 😬

Some members, like Algeria, wanted to pump the brakes on the hikes. Kazakhstan? Basically said, “We’re not cutting squat,” which stirred up speculation about a bigger output boost for July than what we got. So yes, this is all more chaotic than it looks from the outside.

Oil prices have already felt the pressure. They’ve slid from the $60s in May and closed just under $63 per barrel on Friday. That’s not catastrophic, but it shows how sensitive the market is to both supply headlines and geopolitical friction.

And despite the drama, demand is still expected to rise. Analysts are calling for a 775,000 bpd increase in 2025, while the IEA pegs it closer to 740,000 bpd. So supply might be coming back, but the demand side isn't exactly sleepy either.

🤔 Asia Forex Mentor Insights

Forget the headline, the real story is OPEC+ signaling control and discipline over a fragmented alliance.

Here’s what matters for traders:

- The July hike is symbolic. At just 411k bpd, it’s manageable for the market, but the message it sends is what really moves price: Saudi and Russia are asserting dominance, and that’s likely to cap any rogue supply behavior in Q3.

- With 1.37M bpd unwound, the group is showing it can scale back without wrecking price stability. That increases OPEC+’s credibility, and could reduce implied volatility in energy-linked FX pairs (think: NOK, CAD, RUB).

- Oil prices are still sitting in a fragile zone near $63. If global demand surprises to the upside, especially from China or a Fed pivot, crude could find a strong base here. But any cracks in demand projections, and we’re likely testing $60 psychological support.

- For energy traders and FX pros, this is a classic supply-control vs demand-softness tug of war. If you’re trading commodity currencies, stay nimble, because OPEC politics just got personal.

MEMES OF THE DAY

One Core Program would’ve saved him 😅

Should’ve logged off while I was ahead 😩