Position in Rating | Overall Rating | Trading Terminals |

54th  | 4.4 Overall Rating |  |

FXGT Review

FXGT, short for Forex Global Trading, is an ambitious foreign exchange trading company that commenced operations in 2019. With a dynamic presence in regions like Southeast Asia, Africa, and Japan, the firm has established a substantial foothold within the competitive financial landscape. As a comprehensive broker, FXGT provides a diverse range of trading instruments, including Contract for Difference (CFDs), Stocks, Foreign Exchange (FX), Commodities, Cryptocurrencies, Energies, Indices, and more.

In this detailed review, we aim to provide an exhaustive evaluation of FXGT, emphasizing its unique selling propositions and potential drawbacks. Our objective is to supply you with essential insights about the broker, such as the various account options available, deposit and withdrawal processes, commission structures, and other crucial details. Our balanced perspective combines expert analysis and actual trader experiences to equip you with the necessary information to make an informed decision about considering FXGT as your preferred brokerage service provider.

What is FXGT?

FXGT epitomizes the modern financial trading ecosystem with its digitally advanced, cryptocurrency-friendly approach. Incepted in 2019, the firm is successfully operational in South East Asia, Africa, and Japan, providing a robust range of trading instruments that include but are not limited to CFDs, Stocks, FX, Commodities, Cryptocurrencies, Energies, Indices, etc.

Characterizing itself as a ‘new breed of forex broker,' FXGT leverages the digital revolution in financial markets and the ubiquitous adoption of cryptocurrencies. Its mission revolves around investing in trader success by providing cutting-edge digital tools and a broad array of trading pairs, while continuously striving to offer the most advantageous trading conditions in the market.

Despite being a relative newcomer, FXGT commits to expanding its global footprint through established operations in growth markets like South Africa. South Africa is increasingly becoming a favorite destination for Forex brokers, thanks to its sound regulatory environment, availability of high leverage, and promising scope for global expansion.

Advantages and Disadvantages of Trading with FXGT?

Benefits of Trading with FXGT

FXGT, under the regulation of three distinct financial regulatory authorities, provides a safe trading environment. The initial deposit ranges from a minimum of $5 to a maximum of $50, subject to the chosen payment method. Traders can experience variable spreads across all accounts.

FXGT's partnership program offers a reward of $4-$12 for each lot closed by a referee. The broker provides various account types, including cent and standard accounts for general traders, and Pro and ECN accounts for professional traders.

FXGT boasts of regular and occasional offers and bonus programs, including a no-deposit bonus and a loyalty program. It also provides the flexibility to open accounts, and deposit, and withdraw funds in cryptocurrencies.

FXGT Pros and Cons

Pros:

- Free demo account availability.

- Accepts crypto deposits.

- Low minimum deposit requirement.

- Offers negative balance protection.

- Incorporates MetaTrader 5 (MT5) integration.

- Provides Swap-free account.

- Multiple payment methods are available.

- Virtual Private Server (VPS) available for qualifying traders.

Cons:

- Absence of copy trading functionality.

- Lacks proprietary trading software.

- Limited educational resources.

- Weak regulatory oversight.

- Limited market research capabilities.

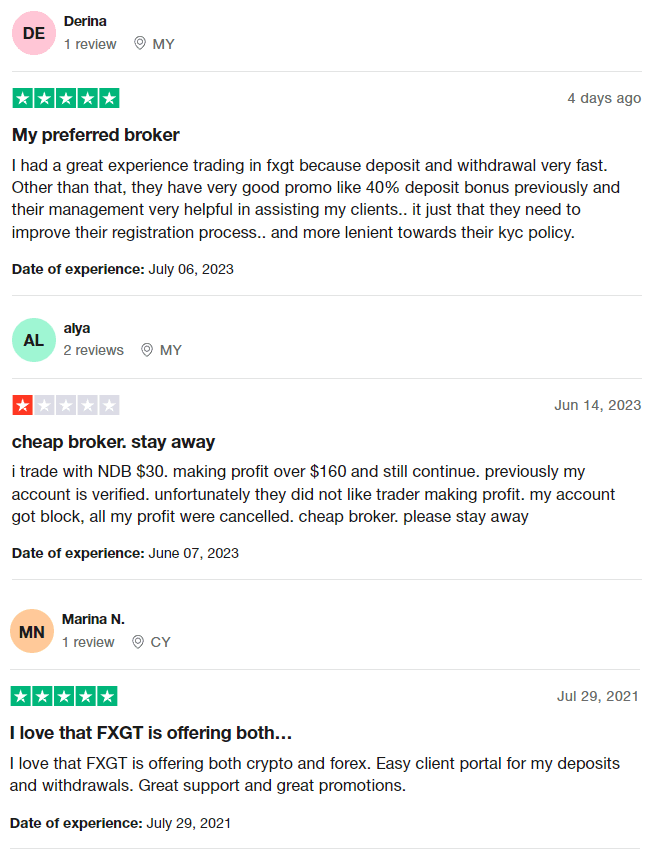

FXGT Customer Reviews

Based on trader feedback, experiences with FXGT are mixed. Some traders laud the broker for its swift deposit and withdrawal process, generous promotions, and diverse range of offerings, including both forex and crypto trading. However, others have reported account suspension and cancellation of profits, which they attribute to the broker's intolerance towards profitable trading.

FXGT Spreads, Fees, and Commissions

FXGT operates a commission-free brokerage service, with all charges incorporated into the spreads. However, ECN Account holders are required to pay a $6 commission fee for trading transactions. The broker uses a floating spread or variable spread mechanism, where the spread depends on market conditions.

FXGT also charges an inactivity fee of $10 per month for dormant accounts. Fortunately, both deposit and withdrawal fees are waived, though this might vary based on the trader's registered region. For those holding overnight positions, swap fees are applicable and vary by instrument. However, these fees are waived for those trading through a Swap-Free account.

Account Types

FXGT provides a variety of account types, tailored to cater to the varied needs of traders. Each account type provides a unique set of features, benefits, and opportunities, allowing clients to tailor their trading experiences to their preferences and strategies.

Mini Account

This account type is an excellent choice for traders who prefer to trade fractional CFD instruments. It includes a wide array of instruments in Forex, Indices, Metals, Energies, Crypto, and the exclusive GTi12 Index. The mini account's fractional capacity appeals to different types of trader profiles, ranging from novice or smaller volume traders to more experienced ones who want a fractional alternative as part of their trading strategy.

Standard FX Account

Focused primarily on FX, this account type is dedicated to Forex traders. It also includes Metals, Indices, Energies, and Stocks and offers leverage of up to 1:1000.

Standard+ Account

With access to all instruments offered by FXGT, this account is suitable for traders looking for high leverage (up to 1000) and bonus scheme promotions. It accommodates trading with hundreds of instruments, including FX, CFDs, Metals, Indices, Energies, Stocks, Cryptos, Synthetic pairs, Defi Tokens, NFTs, and the exclusive GTi12 Index.

Pro Account

Designed for large-volume traders who seek premium trading conditions, the Pro account provides low spreads and zero commission for opening or closing positions. It also offers a leverage of up to 1:1000 on hundreds of instruments from ten asset classes.

ECN Account

This account is suitable for traders comfortable with trading larger volumes. It offers raw spreads on all ten asset classes and competitive trading commissions. Swap charges in the ECN account are lower than all the other GT account types.

Demo Account

A risk-free environment where beginner traders can practice trading skills and experienced traders can test trading strategies using virtual funds.

Swap-Free Islamic Account

A special account for traders following Sharia law, the swap-free Islamic account is provided upon request after funding their accounts.

How to Open Your Account

Opening an account with FXGT is a simple and straightforward process that can be completed in a few easy steps.

- Visit the official FXGT website and click on the “Open Account” button.

- You will then be asked to provide some personal information, including your name, email address, and phone number.

- Choose your preferred trading account type from the options provided.

- You can fund your FXGT account using various payment methods, including bank transfers, credit/debit cards, and e-wallets. The minimum deposit required to open an account is a modest $5, making FXGT accessible to a broad range of investors.

- Once your account is created and funded, you're ready to start trading. You can do this using either the MT4 or MT5 trading platforms, depending on your preference and trading strategy.

What Can You Trade on FXGT

FXGT provides an impressive offering of market instruments totaling 743, providing its clients with a broad range of trading opportunities.

Forex

There are 54 Forex pairs available for trading, which is quite an extensive selection compared to some other Forex brokers.

Cryptocurrencies

Cryptocurrency enthusiasts will appreciate the choice of 32 Cryptocurrencies, along with 11 Synthetic Cryptos, and 5 NFTs. These assets open a new world of trading opportunities in the rapidly growing and volatile crypto market.

Defi Tokens and Coins

With 10 DeFi tokens and 2 coins available, traders can engage with the exciting world of decentralized finance.

Precious Metals

Traders can also diversify their portfolios with 3 Precious Metals, appealing to those who prefer to trade in commodities.

Energies

Energy commodities are also represented with three options available.

Equity Indices

For traders interested in index trading, 10 Equity Indices are on offer.

Stocks

Lastly, equity traders will find a selection of 54 Stocks to choose from.

FXGT Customer Support

FXGT provides a responsive and professional customer support service. Their team is available 24/7 and can be contacted via live chat, email, or phone. The FXGT website also offers an extensive FAQ section where traders can find answers to common questions regarding trading conditions, account management, and more. In addition to English, FXGT customer support is available in several other languages to cater to its international client base.

Advantages and Disadvantages of FXGT Customer Support

Security for Investors

Withdrawal Options and Fees

FXGT offers several withdrawal methods, allowing traders to choose the one that suits them best. These include credit/debit cards, bank wire transfers, and various e-wallets such as Skrill, Neteller, and others. The processing times for withdrawals vary depending on the method used, but e-wallet withdrawals are usually processed within 24 hours.

As for withdrawal fees, FXGT does not charge any fees for most withdrawal methods. However, for some options like bank transfers, there may be fees imposed by the bank. It's important for traders to check the details on the FXGT website or contact customer support for the most accurate information.

FXGT Vs Other Brokers

#1. FXGT vs AvaTrade

FXGT and AvaTrade are both well-known forex brokers with solid reputations, but they offer different advantages. FXGT is known for its wider variety of account types, high leverage, negative balance protection, and the range of cryptocurrencies available for trading. AvaTrade, on the other hand, has a strong educational component, offers more trading platforms, including AvaTradeGO and AvaOptions, and has a wider range of tradable assets beyond forex, including stocks and commodities.

Verdict: Both brokers have their own unique strengths, but if you're seeking a wide range of account types, higher leverage, and an extensive offering of cryptocurrencies, FXGT would be the better choice. However, if a solid educational platform and a broader range of tradable assets are your priorities, then AvaTrade is the more suitable option.

#2. FXGT vs RoboForex

When comparing FXGT and RoboForex, both brokers offer MT4 and MT5 platforms and have competitive spreads. However, FXGT stands out with its negative balance protection, variety of account types, and high leverage, which is beneficial for traders with different risk appetites. RoboForex, conversely, provides a copy trading platform and supports a wider range of deposit and withdrawal methods, which may be a plus for some traders.

Verdict: If high leverage, variety in account types, and negative balance protection are high on your list of priorities, then FXGT would be a better fit. However, if you're interested in copy trading and a wider range of deposit and withdrawal options, RoboForex would be the more favorable choice.

#3. FXGT vs Exness

Comparing FXGT and Exness, both offer competitive spreads and support for MT4 and MT5 platforms. FXGT, however, has the advantage of offering negative balance protection, a wider range of account types, and high leverage. Exness, on the other hand, is known for its faster withdrawal process, transparency, and excellent customer support available in multiple languages.

Verdict: If high leverage, negative balance protection, and a variety of account types are your priorities, FXGT would be a better choice. But, if quick withdrawals, transparency, and strong customer support are more important, then Exness would be the ideal broker for you.

Also Read: Exness Review 2024

Conclusion: FXGT Review

In conclusion, FXGT is an attractive option for those seeking a forex and cryptocurrency broker with a comprehensive offering. With its broad range of account types tailored to different trader preferences, high leverage offering, negative balance protection, and an impressive selection of cryptocurrencies, FXGT caters to both beginners and experienced traders. The broker is regulated by reputable financial institutions, including the FSCA, FSA, and VFSC, adding an extra layer of security for its clients.

FXGT presents a compelling offer for traders interested in forex and cryptocurrency trading. It's a reliable platform with a slew of benefits, but like any broker, it's crucial for potential traders to assess their individual needs and trading goals before committing.

FXGT Review: FAQs

What types of accounts does FXGT offer?

FXGT offers several different account types designed to cater to a range of trading needs. This includes the Standard Account, the Pro Account, and the VIP Account. Each account has its own unique features, trading conditions, and minimum deposit requirements, allowing traders to choose the one that best suits their trading style and experience level.

Does FXGT charge fees on withdrawals and deposits?

Yes, FXGT does impose certain fees on withdrawals and deposits, depending on the payment method used. It's crucial to review the fees associated with your chosen payment method before making a transaction to ensure you are comfortable with them. Remember that these fees can affect the overall profitability of your trades.

I'm based in the US. Can I open an account with FXGT?

Unfortunately, FXGT does not currently accept traders from the United States. It's important to check the list of supported countries before attempting to open an account with FXGT or any other broker.