Best Forex Trading Platform 2025

The Forex trading market can appear to be a scary, confusing place to newcomers. From what the best Forex trading platforms are to how to get started trading it themselves, there are so many questions beginning investors have.

This article helps introduce new people to the Forex market and provides a few quick tips about managing your forex investments. Beginning with MetaTrader 4 (MT4), we've examined the pros and cons of top forex trading platforms and provided the lowdown on how they compare to each other. Next, we proceeded to establish which forex broker is best for each trading platform after considering all the relevant parameters.

First things first, though.

What Is Forex?

Forex (sometimes called foreign exchange, foreign exchange trading, financial trading, or simply forex) is the form of international trading that uses contracts to buy or sell currency at a set rate at a specific time. At the primary level, foreign exchange involves exchanging a currency for another for reasons such as trade, commerce, or tourism.

The foreign exchange market, most times called the forex market, comprises banks, financial institutions, individual investors, and companies. These players trade in different currencies using different currency pairs. Currencies are categorized by the International Monetary Fund (IMF) as either “hard” or “soft” currencies.

Hard currencies are typically those issued by central national governments and are usually considered more stable in times of financial uncertainty. Weak currencies lose value when compared to other currencies. Traders and investors prefer to hold different currencies over the soft currency, which causes this. Low demand is frequently caused by political or economic instability in the country, making the currency's price more volatile. Foreign exchange dealers tend to avoid the currency in such situations, and traders can influence significant fluctuations in the currency's exchange rate even on a limited scale.

The unavailability of a central marketplace for foreign exchange facilitates over-the-counter (OTC) trading of currencies, meaning that transactions are conducted and approved electronically through computer networks between traders. The forex market is almost perpetually active, with trades going on simultaneously in global financial markets such as Singapore, the UK, USA, Australia, Canada, South Africa, Japan, and India. It's also open 24 hours a day and five and a half days a week, with prices marked by their extreme volatility. Investors and speculators looking for ways to trade forex do so either in the spot market (which deals in cash) or in the derivatives market (forwards and futures market).

The basic idea of Forex trading is that there is no exchange fee for making a transaction, the only fee paid is to a broker who transfers the money to your trading account. One of the most important advantages of trading forex that you don't have to put any money into the market yourself; you just place a limit order, which is basically a way to buy or sell a specified amount of currency based on a specific price you set.

Also read: Forex trading videos

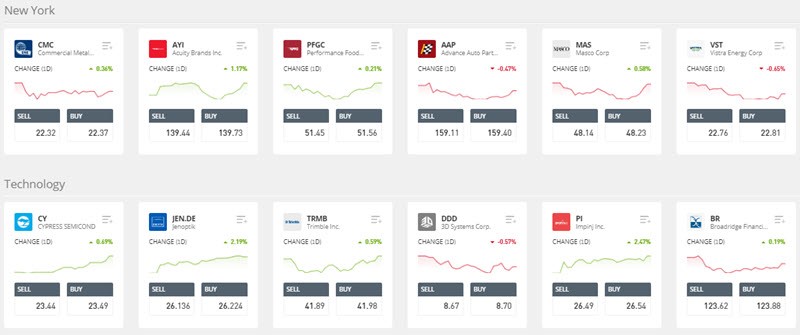

19 Best Forex Trading Platforms

- AvaTrade– Most Compatible Forex Broker with MetaTrader 4 Platform

- Plus500 – Best for Beginners

- AMarkets – Best Broker to work with Cryptocurrencies

- IC Markets– Premier CFD broker for the MetaTrader 5 platform

- Alpari – Best Binary Options Broker

- FP Markets – Best Low-Cost Broker

- FxPro– Premier cTrader forex broker

- RoboForex – Best Multi Asset Trading Platform

- XM – Best Low Stock CFD

- Markets.com – Best Trading Tools

- HF Markets – Best Web Trading Platform

- Interactive Brokers – Best for Day Traders

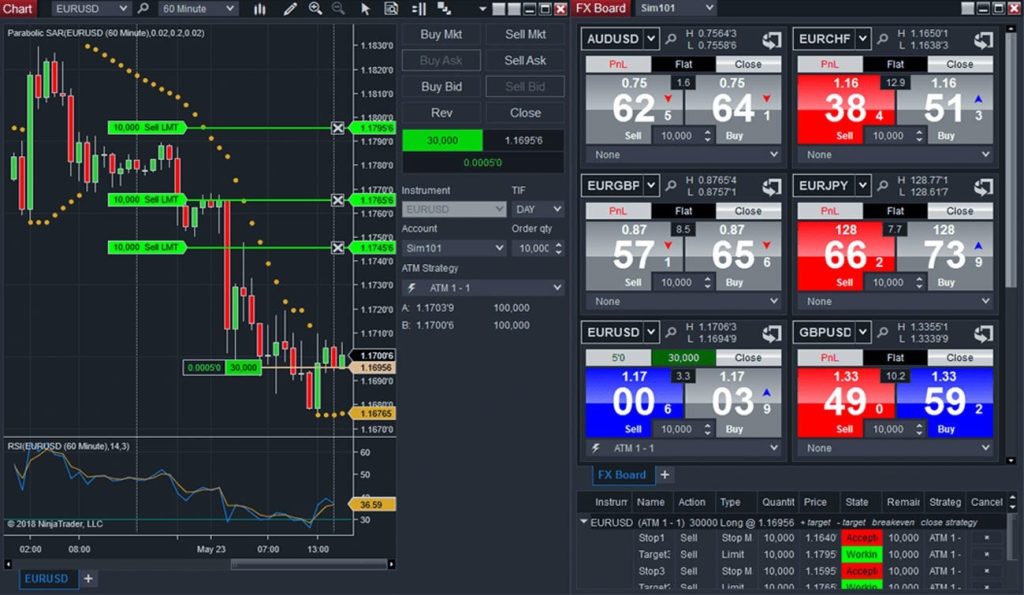

- FXCM – Best with NinjaTrader

- IG– Best customer service

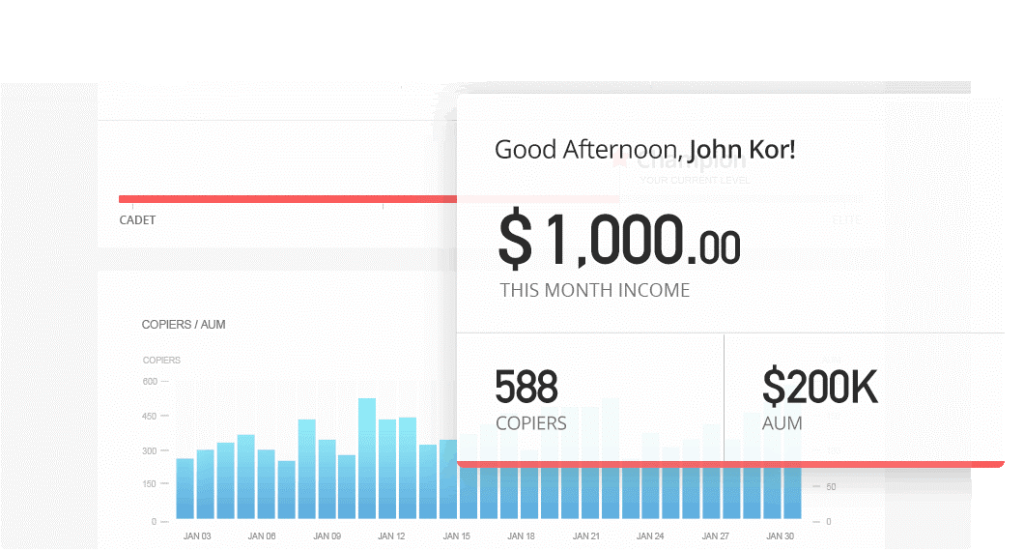

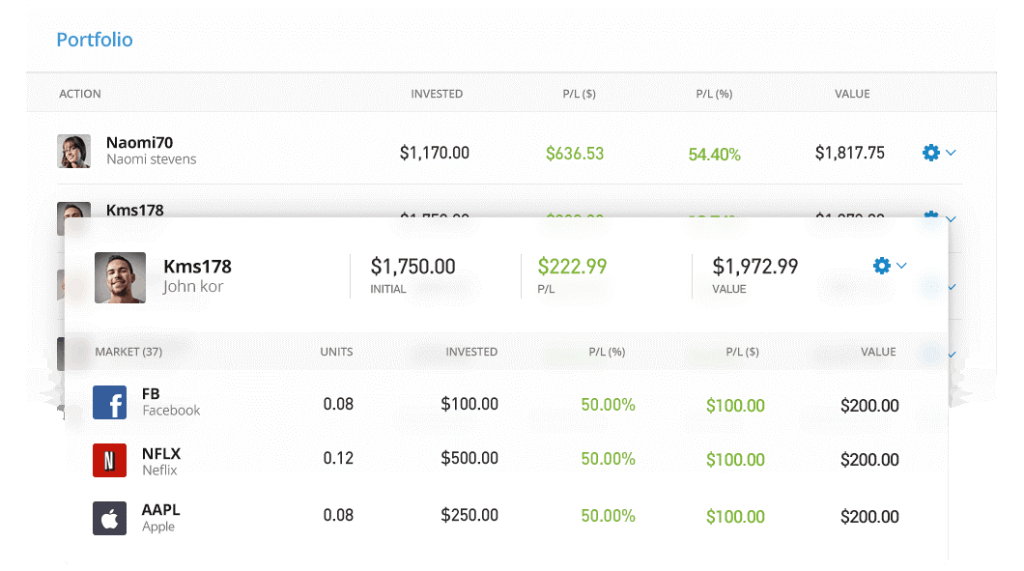

- eToro– Leading forex software for copy trading

- Plus500– Easiest to navigate and most suited to beginners

- TD Ameritrade– Best platform for forex traders in the US

- OANDA– Best for market research offerings

- City Index– Best platform for risk-managed trading

About MetaTrader 4

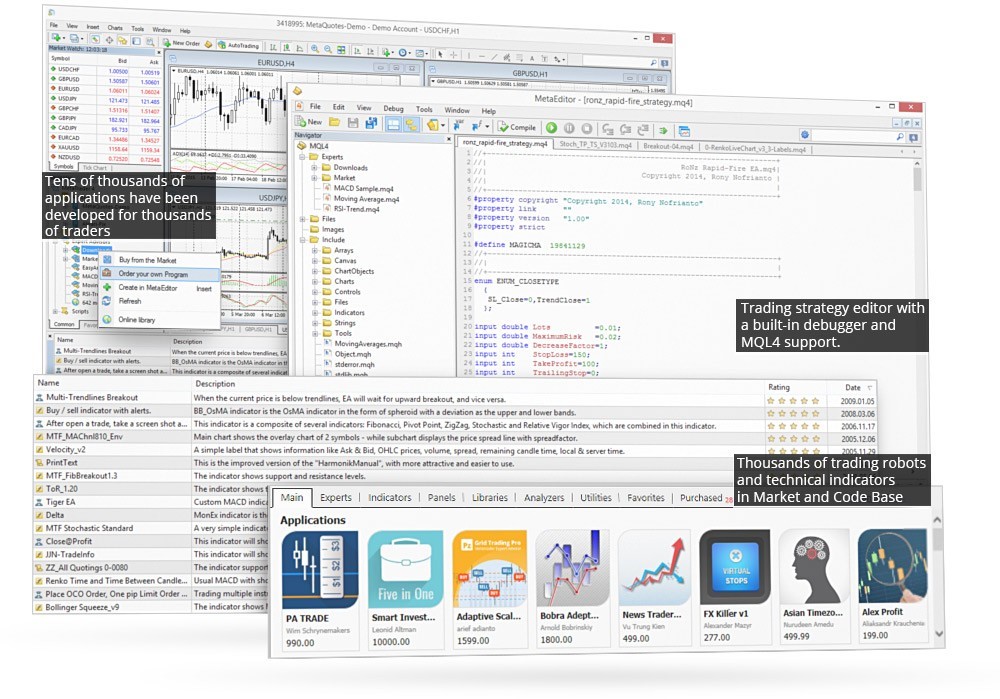

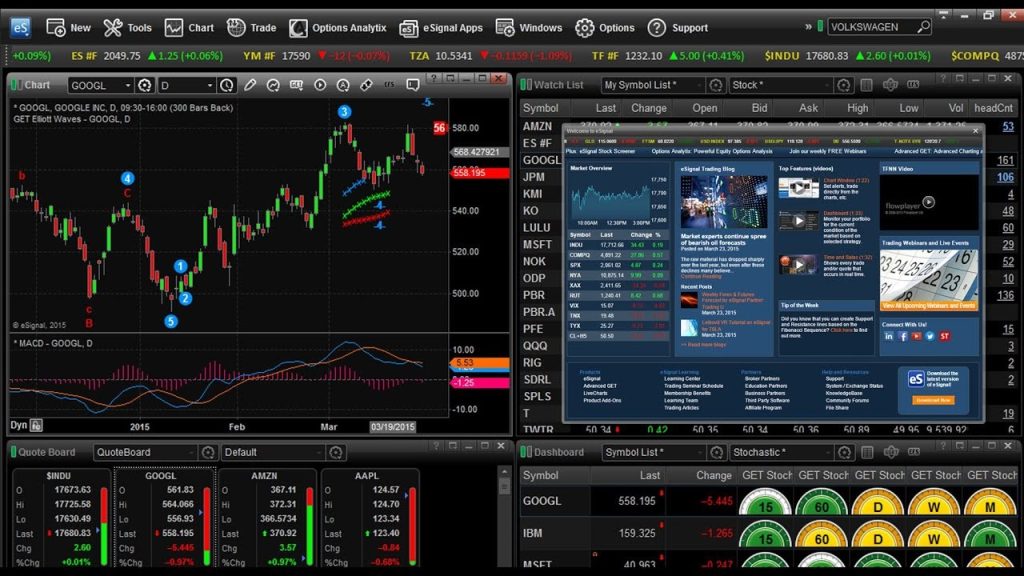

In spite of the introduction of MetaTrader 5 and despite stiff competition from other trading platforms, MetaTrader 4 has been able to hold down its spot as the premier retail platform for currency trading. Developed by MetaQuotes and introduced in 2005, MetaTrader 4 has an active presence in a wide range of markets, including cryptocurrencies, indices, commodities, and of course, forex.

With an overwhelming amount of engagements from forex brokers worldwide, it is by a long mile the most popular forex trading platform. MetaTrader 4 is rated exceptionally high for its adaptability, along with a wide range of other features. The platform offers users around the world the option of trading in real-time with their account number and currently plays host to over 25 million registered users across the globe, performing over 100,000 trades daily.

Features and Advantages of MetaTrader 4

One of the biggest draws of MetaTrader 4 is its simple, interactive, and customizable user interface, which encourages a wholesome trading experience for users. Trust is an expensive currency, and with 15 years in the business, it’s safe to say that MetaTrader has built up large reserves of it. Other factors that contribute to this trading platform’s immense popularity are:

- Interactive charting

- Algorithmic trading, advanced technical analysis, and Expert Advisors

- Fast execution and mobility

- Automated trading

- 30+ built-in indicators

Another feature that counts in MetaTrader’s favor is its integration with multiple leading forex brokers, providing traders with an almost unlimited array of choices.

Drawbacks of MetaTrader 4

The biggest complaint with MetaTrader 4 is its non-support for CFD trading. There are also concerns that the charting package, instruments, and technical indicators do not quite meet up to the standards of other software packages.

3 Best MT4 Brokers

Avatrade

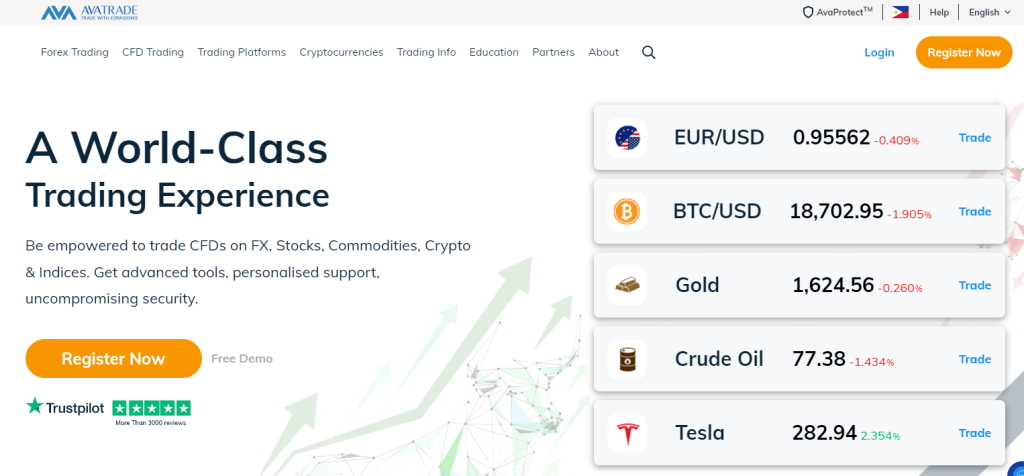

Established in Ireland (their headquarters is in Australia) in 2006, AvaTrade is one of the most reputable and highly regarded forex brokers in the industry. Some of their hallmarks include an easy and convenient web and mobile platform, excellent copy trading opportunities, reasonable pricing, and excellent research tools. However, one feature that stands AvaTrade apart is its enthusiasm and passion for investor education.

Is AvaTrade Safe?

AvaTrade has been in operation since 2006, enough time for it to weather various financial storms, establish a solid footing, and generate trust in investors. Beyond that, AvaTrade is regulated by several (top-tier) regulators including:

- the Central Bank of Ireland

- the BVI Financial Services Commission on the British Virgin Islands

- the Australian Securities and Investments Commission (ASIC)

- the Financial Sector Conduct Authority (FSCA) in South Africa

- the Japanese Financial Services Agency (FSA)

- the Financial Futures Association of Japan (FFAJ)

- the Abu Dhabi Global Market Authorities Financial Services Regulatory Authority (ADGM – FSRA)

In addition, AvaTrade is not affiliated with any bank, does not divulge the financial information of traders, and is not listed on the stock exchange. For investors in the EU, AvaTrade operates an investor protection amount of 20,000 Euros. At the same time, all their clients are entitled to negative balance protection regardless of where they are and regardless of the regulator.

One thing is sure, with its impressive track record and list of top-tier regulators, AvaTrade is thought to be pretty safe indeed by investors, and this is reflected in its Trust Score of 93 out of a scorable 99.

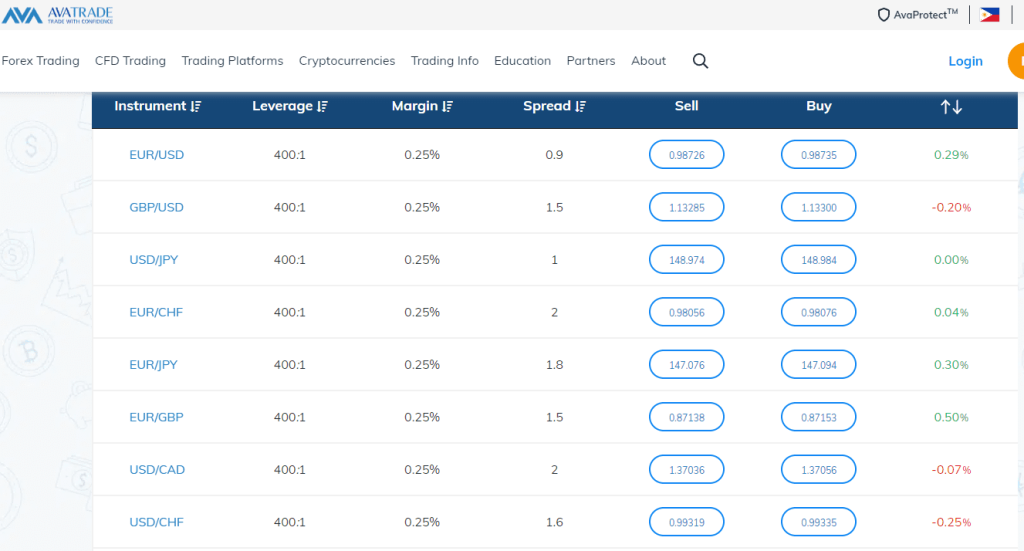

AvaTrade Fees

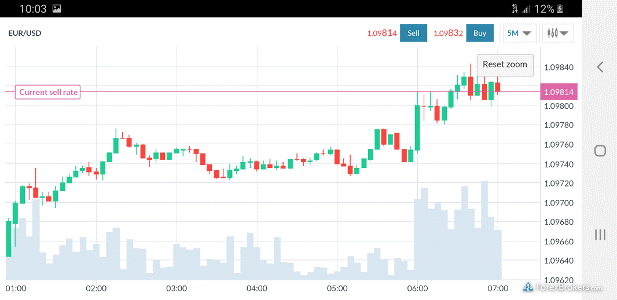

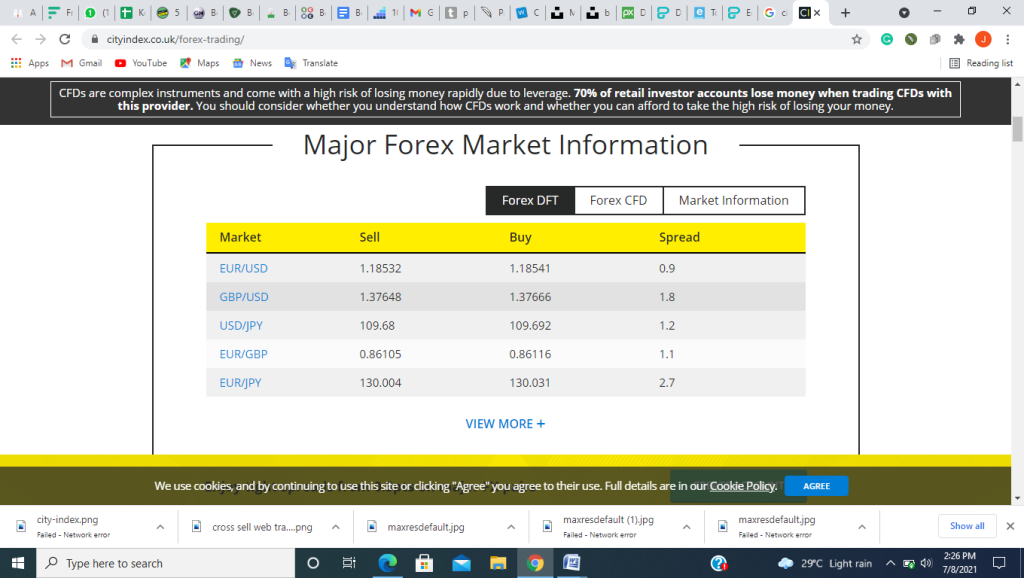

At 0.9 pips for the EUR/USD forex currency pair, AvaTrade’s spread is firmly within the industry average bracket. While a few other platforms are willing to offer lower average spreads, AvaTrade’s transparent pricing and trustworthiness serve to even up the competition a bit. This is without mentioning the fact that AvaTrade bumps down the EUR/USD spreads for investors who it considers to be professional traders.

A more in-depth examination of AvaTrade’s trading fees reveals that AvaTrade’s CFD trading fees are on the low side compared to contemporaries in the industry. In contrast, its forex trading fees are considered to be average. A large chunk of AvaTrade’s forex trading fees is linked to spreads since investors trading on the platform are not charged any account fees. Deposits and withdrawals are also entirely without charges on the platform, and in general, AvaTrade keeps incidental trading fees down to a minimum.

On a more downbeat note, traders whose accounts have been inactive for three consecutive months will have an inactivity fee of $50 per quarter imposed on it. If the account manages to go 12 months without any activity, a further charge of $100 will be imposed. AvaTrade calls this an annual administration fee.

In a nutshell, while AvaTrade’s trading fees are more than reasonable, its non-trading fees are a bit on the high side.

AvaTrade’s Research and Education

While AvaTrade’s provided research tools are not out of the ordinary, AvaTrade sets the gold standard for user education. Its in-house research tools are interactive and easy to grasp, yet beyond a few market analysis videos which it uploads daily on YouTube, there’s a lack of real depth to its in-house research tools offering.

AvaTrade’s third-party content is a different matter entirely. It integrates directly with Trading Central, and Trading Central provides loads of excellent research tools such as expert trading ideas from their Analysts Views, and Forex Featured Ideas sections. Its Economic Calendar also helps you analyze historical trends with greater precision, while the Market Buzz section provides valuable trading information. AvaTrade also offers ZuluTrade and DupliTrade, tools that let traders copy the trades of leading forex experts on the platform.

AvaTrade research tools can be accessed in the following locations:

- WebTrader Trading Platform

- MetaTrader Trading Platform

- AvaOptions Trading Platform

- AvaTrader Website

Beginner traders have access to a wealth of educating material on AvaTrade’s platform. AvaTrade’s in-house material is impressive enough, yet it still bumps up its quality of education by integrating with SharpTrader, which offers several exclusive educational contents.

Combined, over 90 articles and almost 50 videos handle forex topics with different levels of complicatedness. AvaTrader also offers regular webinars and a demo account.

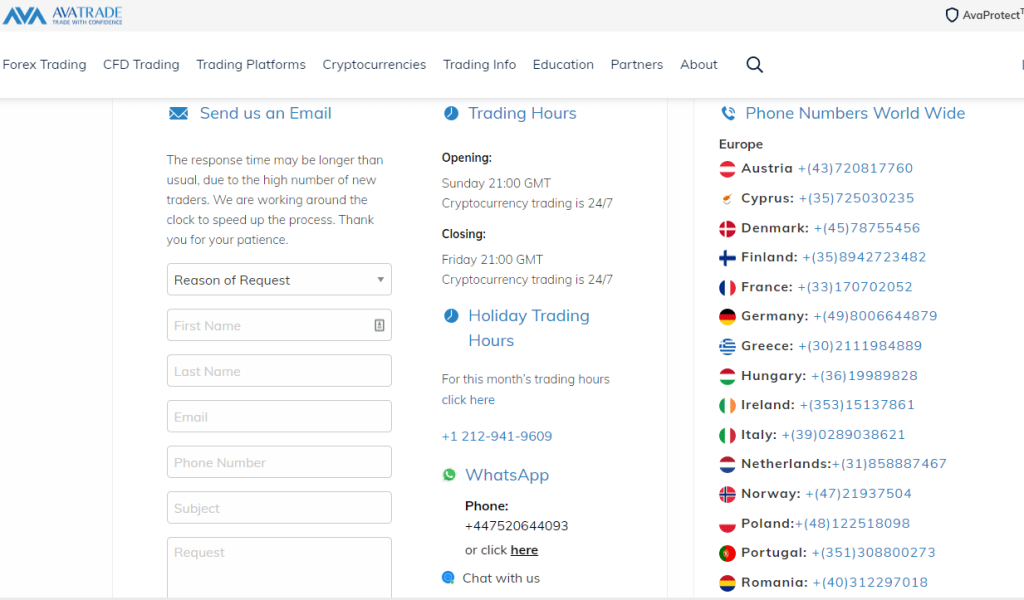

Customer Service

With reasonably prompt response to service issues and a multinational and multilingual staff, AvaTrade’s customer support is better than alright. AvaTrade's customer service boasts a solid reputation, partially because they are a well-regulated and worldwide Forex / CFD brokerage and partly due to the fact that they provide assistance in a wide variety of languages in over 15 different languages – by native speakers.

Traders can reach and interact with them through several platforms, including phone calls, emails, and live chat. Knowledgeable and professional customer care representatives are always on hand to render assistance anytime, as long as the forex market is open.

Why AvaTrade Is The Best Meta Trader 4 Forex Brokers

Boasting integration with excellent third parties, an enviable reputation, and an excellent track record, AvaTrade is a force to reckon with in the forex niche. It’s regulated by some of the most notable regulating bodies in the world, offers consummate security for traders’ funds, and makes account opening on the platform very straightforward and easy. AvaTrade’s spreads are reasonably competitive, while its educational content is practically unmatched throughout the industry. These qualities place AvaTrade among the leading lights when the conversation is about forex brokers.

Exness

Exness provides traders with access to a vast multitude of financial instruments, such as currency pairs, commodities, indices, and cryptocurrencies. The Meta Trader 4 (MT4) trading platform, known for its user-friendly interface, advanced charting tools, and customizable trading options, is the platform's most notable feature.

Is Exness Safe?

When it comes to online trading, security is of the utmost importance, and Exness prioritizes the safety of its clients' funds and personal data. Financial Conduct Authority (FCA) and Cyprus Securities and Exchange Commission (CySEC) are among the reputable regulatory bodies that oversee the company's operations.

In addition, Exness maintains discrete client accounts to ensure that client funds are kept separate from company funds. This segregation provides an added layer of protection in case of any unforeseen circumstances.

Exness Fees

Exness aims to provide transparent and competitive fee structures to its clients. The broker offers two types of accounts: Standard and Raw Spread accounts.

The Standard account has no commission fees, and the trading costs are incorporated into the spreads. On the other hand, the Raw Spread account charges low commissions but provides tighter spreads. Traders can choose the account type that best suits their trading style and preferences.

Furthermore, Exness offers a range of payment options with no deposit fees, making it convenient for traders to fund their accounts. However, it is essential to review the detailed fee schedule on Exness' official website for the most up-to-date information.

Exness Customer Service

Exness prides itself on delivering exceptional customer service. Their multilingual support team is available 24/7 to assist traders with their queries and concerns. Traders can reach out to the support team via email, live chat, or phone, receiving prompt and professional assistance. The customer service representatives are knowledgeable and strive to ensure a positive trading experience for all clients.

Why is Exness one of the best Meta Trader 4 Forex Brokers?

Exness stands out as one of the top Meta Trader 4 Forex brokers for several reasons:

a. Advanced Trading Tools: Exness offers the renowned Meta Trader 4 platform, which provides a comprehensive suite of trading tools, including real-time market analysis, customizable indicators, automated trading systems, and a user-friendly interface.

b. Broad Range of Instruments: Traders on Exness can access a vast selection of financial instruments, including major and minor currency pairs, commodities, indices, and cryptocurrencies. This diversity allows traders to explore various markets and diversify their portfolios.

c. Exceptional Execution Speed: Exness utilizes cutting-edge technology to ensure ultra-fast trade execution, minimizing slippage and enhancing trading precision. This speed is crucial in the fast-paced world of Forex trading, where every second counts.

d. Reliable Customer Support: Exness values its clients and provides multilingual customer support 24/7. Traders can reach out to the support team via email, live chat, or phone to receive prompt assistance with their queries or concerns.

AMarkets

AMarkets is a well-established online brokerage firm specializing in Forex trading and offering access to a vast array of financial instruments. This article attempts to provide a concise summary of AMarkets, covering its security, fees, and customer service, as well as why it is regarded as one of the best MetaTrader 4 Forex brokers.

Since 2007, AMarkets has been an international financial firm. It provides an extensive trading platform for foreign exchange, commodities, indices, and cryptocurrencies. With a global presence in over 200 countries, AMarkets endeavors to provide both novice and experienced traders with a user-friendly and efficient trading experience.

Is AMarkets Safe?

When selecting a merchant, safety is of the utmost importance, and AMarkets prioritizes the safety of its clients' funds and personal information. The International Financial Services Commission (IFSC) of Belize oversees the company's compliance with stringent financial regulations.

AMarkets also employs advanced encryption technology to protect sensitive data, making it a secure platform for traders to execute their transactions.

AMarkets Fee

AMarkets offers competitive fee structures that are transparent and tailored to the needs of different traders. The broker operates on a commission or spread basis, depending on the type of account chosen.

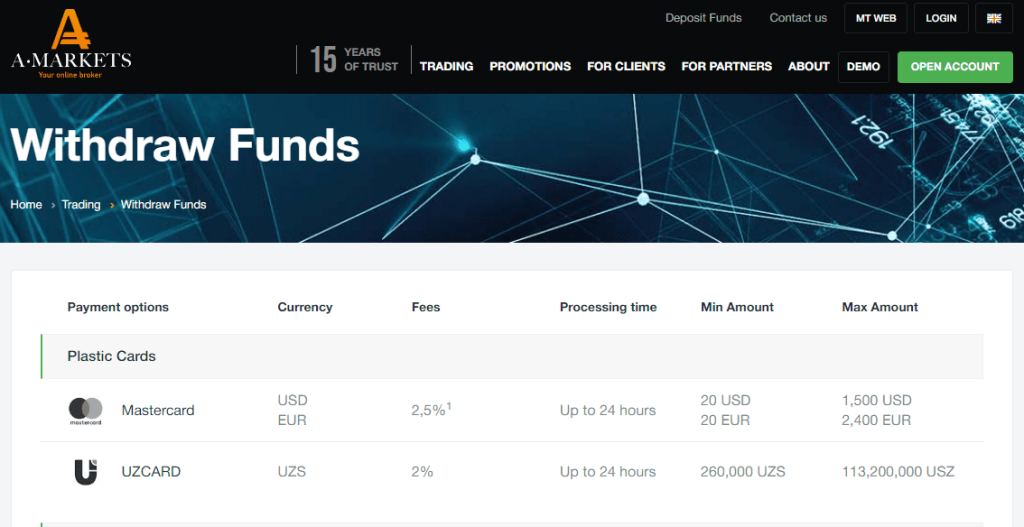

For ECN accounts, AMarkets charges a small commission per trade, while the spreads are typically tighter. On the other hand, Classic accounts have higher spreads but no commission fees. Traders can select the account type that aligns with their trading preferences and strategies.

Furthermore, AMarkets does not impose any deposit or withdrawal fees, allowing clients to manage their funds without incurring unnecessary charges.

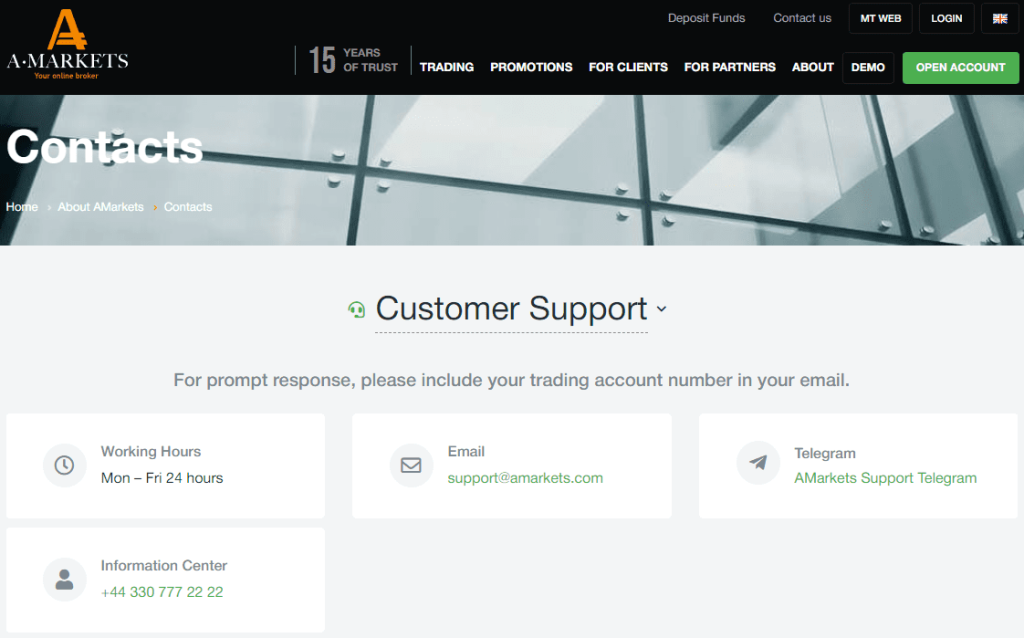

AMarkets Customer Service

AMarkets places a strong emphasis on providing exceptional customer service. The company's support team is available 24/5, offering multilingual assistance to traders worldwide. Clients can reach out to the support team via live chat, email, or phone, ensuring prompt and efficient responses to their queries and concerns.

Moreover, AMarkets provides educational resources, including webinars, tutorials, and market analysis, to help traders enhance their knowledge and skills. This commitment to customer support and education sets AMarkets apart, making it a reliable choice for traders seeking guidance and assistance throughout their trading journey.

Why is AMarkets one of the Best MetaTrader 4 Forex Brokers?

AMarkets stands out as one of the best MetaTrader 4 Forex brokers for several reasons:

a) MetaTrader 4 (MT4) Platform: AMarkets offers the highly acclaimed MT4 platform, known for its robust features, advanced charting tools, and extensive range of technical indicators. With MT4, traders can access real-time market data, execute trades with speed and precision, and automate their strategies using Expert Advisors (EAs).

b) Wide Range of Tradable Assets: AMarkets provides access to a diverse selection of financial instruments, including major and minor currency pairs, commodities, indices, and cryptocurrencies. This extensive range allows traders to diversify their portfolios and take advantage of various market opportunities.

c) Trading Conditions: AMarkets offers competitive trading conditions, including low spreads, fast execution, and flexible leverage options. These favorable conditions enable traders to optimize their trading strategies and potentially enhance their profitability.

d) Innovation and Technology: AMarkets constantly keeps pace with technological advancements in the financial industry. The broker regularly updates its platforms and introduces new features to ensure traders have access to cutting-edge tools and a seamless trading experience.

MetaTrader 5

While MetaTrader 5 has not been able to match up with the popularity of its predecessor more than three years after its development by MetaQuotes, available data suggests that it is on the right track and gaining ground with each passing day. Compared to MT4, MetaTrader 5 is faster and boasts more in-depth market analysis tools. Another point of difference between both platforms is that MetaTrader 5 supports share CFD trading, unlike MT4, which is more based around currency trading.

The platform offers extensive in-depth capabilities with various add-ons through its vast network of third-party solutions, ranging from performing fundamental and qualitative to specialized and quantitative research. It comes in web, internet, and mobile editions and includes features like built-in trading robots, a freelancing directory of strategy creators, copy trading, and virtual hosting. The platform experience is available in over 31 languages and is available for free through your broker.

Features and Pros of MetaTrader 5

- It supports over eight categories of pending orders and over 21 timeframes

- A tremendous number of add-ons and trading robots

- Advanced Market Depth and One-Click Trading

- Netting and hedging position accounting systems

- Biggest platform for algorithmic trading program development

- Full complement of trade orders, including pending and stop-orders

- Broad range of CFDs

- Easily navigable platform

Cons of MetaTrader 5

- Programming language for automated trading is complicated

- Tools and features are much better suited to professionals

- Hedging is disabled for exchange markets

3 Best MT5 Brokers

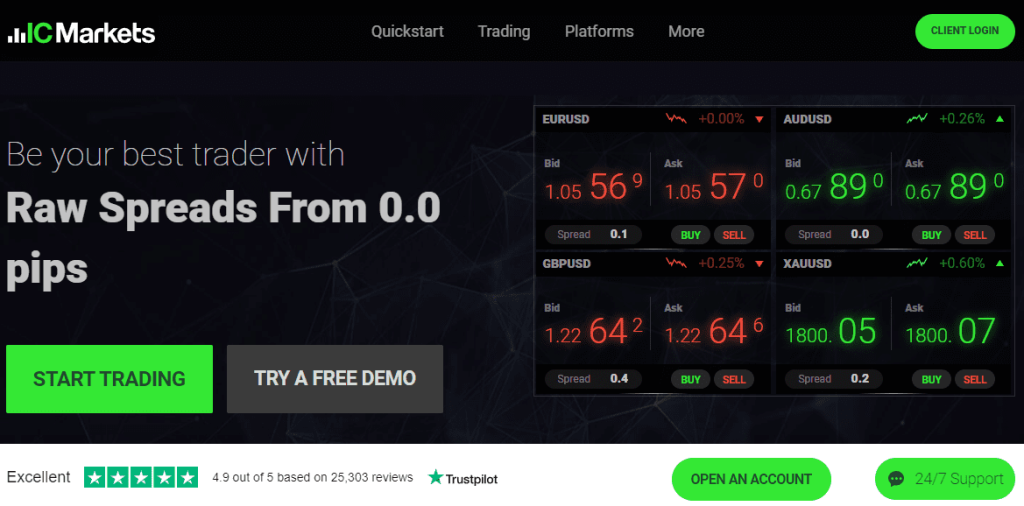

IC Markets

IC Markets was founded in 2007 in Australia, with its headquarters in Sydney. This forex broker is one of the biggest and most famous online brokerage companies, boasting a solid presence in some of the world’s most prominent countries and financial markets.

The company offers the highest available leverage in Australia along with low spreads and trading fees, making it one of the most popular brokerages in the country, despite its billing as an average-risk company. One thing that stands IC Markets out is its vast array of options which offers traders the chance to trade their way. It’s compatible with MetaTrader 4, MetaTrader 5, and cTrader platforms providing an extensive range of CFDs along with rapid ECN trading speeds and low latency, and pretty low commissions.

IC Markets is regulated by the Cyprus Securities and Exchange Commission (CySEC), the Seychelles Financial Supervisory Authority (FSA), and the Australian Securities and Investments Commission (ASIC).

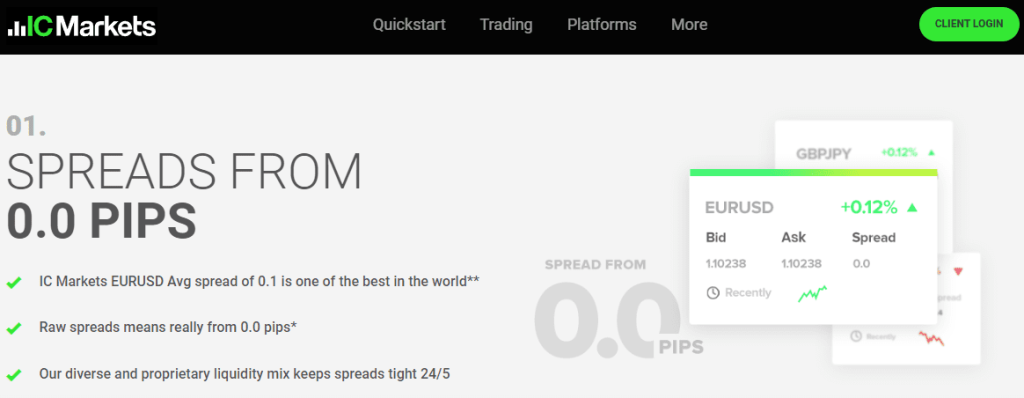

IC Markets Spreads and Commission

IC Markets’ trading and non-trading costs are among the lowest in the industry. The company pegs its average spread on the EUR/USD exchange at 0.1, with market trading fees, forex fees, and CFD fees being similarly competitive, even when commission is added.

Trading expenses differ across the three account types offered by IC Markets. The Standard account is fee-free (spread alone), whereas the Raw Spread and cTrader accounts include commission-based pricing (spread + commission).

Investors on the IC Markets platform are not required to pay deposit, inactivity, or account fees. As a matter of fact, apart from international bank withdrawal fees, which are charged at AUD 20, non-trading prices on the broker would have been null. On the flip side, however, the $200 minimum deposit is rather pricey.

IC Markets’ Markets and Products

While IC Markets has made its name from being primarily a forex broker, it does offer a good range of CFDs. You may trade forex, bitcoin, futures, commodities, bonds, and indices with this account. The maximum leverage, competitive spreads, and commissions differ depending on the CFD traded and the subsidiary to which you have subscribed. The ability to trade share CFDs with an online broker offering ASX stock CFDs such as BHP, NYSE stock CFDs such as Walt Disney, and NASDAQ CFDs such as Google is MT5's distinct edge (Alphabet).

IC Markets’ Tools and Trading Platforms

Because of its execution techniques (i.e., no requotes) and the ability to execute orders within the spread, algorithmic traders are particularly suited to IC Markets. This, coupled with the ultrafast MetaTrader 5 execution speed (about 36.5 ms at the last check), ensures that this broker ranks near the top of the favorite platform in every poll. Traders can pick between MetaTrader and cTrader platform suites while IC Markets completes the package with copy-trading platforms.

The MetaTrader and cTrader suites are available on web-based, desktop-based, and mobile versions. Note that certain functions, such as automated trading, are not available on the mobile versions of the platforms. Traders using the platform have access to a plethora of tools while integration with social copy trading platforms such as ZuluTrade and Myfxbook helps you model your trading strategy after global trading experts. Also, traders who achieve a volume of at least 15 standard lots in any particular month receive an offer of a VPN.

Why IC Markets Is The Best MetaTrader 5 Broker

IC Markets charges the lowest spread along with low commissions and funding fees. The customer service is responsive, the company is very well regulated, and opening an account on the platform is straightforward. It provides an extensive list of tradable instruments, which is a big plus, especially for algorithmic traders. Its integration with both ZuluTrade and Myfxbook is another thing that counts in its favor.

| Broker | Best For | More Details |

|---|---|---|

| Premier CFD broker for the MetaTrader 5 Platform | securely through IC Markets website |

Alpari

Forex broker Alpari is well-known for its extensive array of financial services and cutting-edge trading platforms. Since its founding in 1998, Alpari has become a globally recognized brand, offering online trading services to millions of customers around the globe. The company provides a variety of trading instruments, such as Forex, commodities, indices, and cryptocurrencies, among others.

Is Alpari Safe?

When selecting a Forex broker, safety and security are of paramount importance, and Alpari takes this aspect seriously. Alpari adheres to stringent regulatory compliance and financial standards. Respected authorities such as the Financial Services Authority (FSA) in Saint Vincent and the Grenadines and the International Financial Services Commission (IFSC) in Belize regulate the company. These regulatory bodies guarantee that Alpari operates fairly and transparently, protecting its clients' interests.

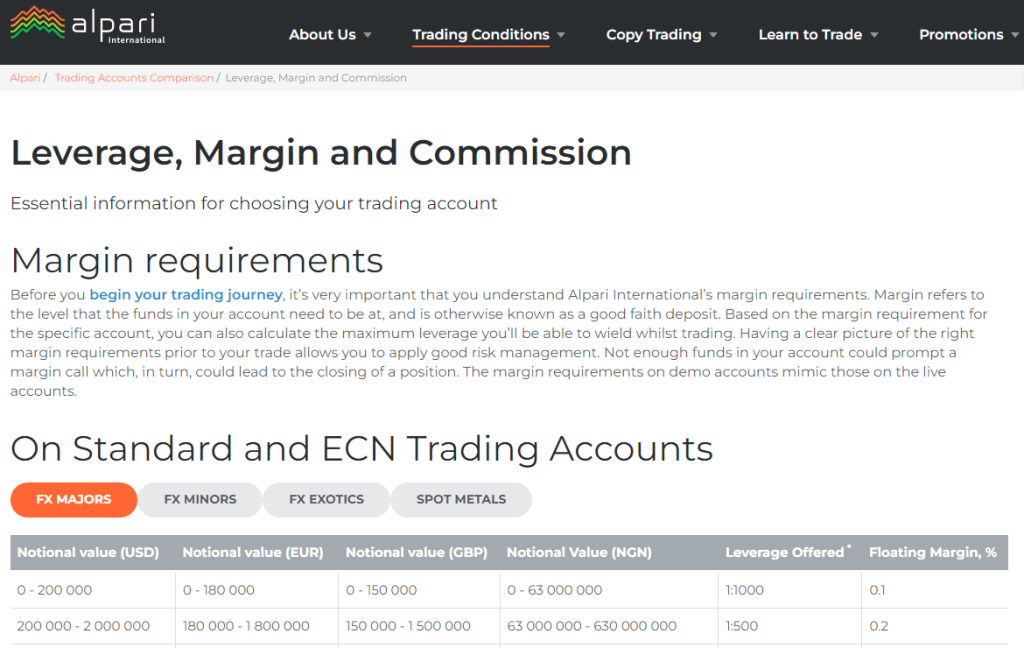

Alpari Fees

Alpari offers competitive and transparent fee structures, making it an attractive choice for traders. The broker provides various account types with different fee structures to cater to diverse trading needs. While specific fees may vary based on the chosen account type and trading instruments, Alpari generally charges low spreads and commissions, allowing traders to optimize their trading costs and enhance potential profitability.

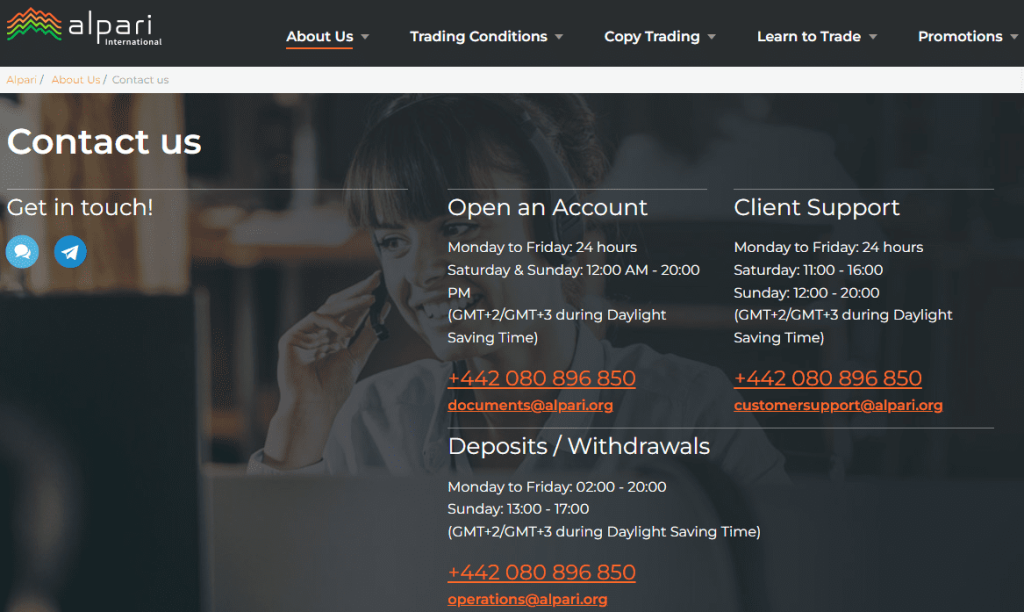

Alpari Customer Service

Alpari excels in providing exceptional customer service to its clients. The broker offers multilingual support through various channels, including phone, email, and live chat. Customer service is renowned for its responsiveness and effectiveness in addressing client inquiries and concerns. In addition to webinars, tutorials, and market analysis tools, Alpari's exhaustive educational resources demonstrate its commitment to customer satisfaction. This support equips traders with the necessary knowledge and instruments to make informed trading decisions.

Why does Alpari one of the Best MetaTrader 5 Forex Brokers?

Several factors distinguish Alpari as one of the top MetaTrader 5 (MT5) Forex brokers:

a) Advanced Trading Technology: Alpari provides access to the robust MetaTrader 5 trading platform, which offers a variety of advanced trading tools and features. MT5 allows traders to execute transactions more quickly, access real-time market data, utilize advanced charting capabilities, and implement automated trading strategies.

b) Diverse Trading Instruments: Alpari provides a vast array of tradable instruments, allowing traders to diversify their portfolios and investigate a variety of market opportunities. In addition to major and minor currency pairs, Alpari provides access to commodities, indices, cryptocurrencies, and more, enabling traders to capitalize on different market conditions.

c) Market Analysis and Research: Alpari equips traders with comprehensive market analysis tools, including real-time news updates, economic calendars, and in-depth research reports. These resources assist traders in making informed trading decisions and staying ahead of market trends.

d) Competitive Trading Conditions: Alpari offers favorable trading conditions, including tight spreads, flexible leverage options, and fast order execution. Traders can choose from different account types based on their preferences and trading strategies, ensuring a tailored trading experience.

e) Educational Resources: Alpari provides a wealth of educational resources to help traders enhance their knowledge and skills. The broker offers educational articles, video tutorials, webinars, and demo accounts, empowering both beginner and experienced traders to improve their trading proficiency.

FP Markets

FP Markets is a reputable online brokerage firm that provides traders with a vast array of financial products and services. With more than 15 years of experience, FP Markets has become a reliable companion for traders seeking access to global financial markets.

FP Markets offers a vast array of trading instruments, including forex, indices, commodities, and cryptocurrencies, to traders. The company is committed to providing superior trading conditions, innovative technology, and outstanding customer service. Through advanced platforms like Meta Trader 5 (MT5), FP Markets enables traders to execute trades efficiently and access a range of powerful trading tools.

Is FP Markets Safe?

Safety is a top priority when selecting a broker, and FP Markets prioritizes the security and protection of client funds. The company is regulated by respected financial authorities such as the Australian Securities and Investments Commission (ASIC) and the Cyprus Securities and Exchange Commission (CySEC). These regulatory bodies enforce strict guidelines and standards to ensure fair treatment of traders and the security of their investments. As a regulated broker, FP Markets follows stringent financial practices, including segregated client accounts and risk management protocols, providing traders with peace of mind regarding the safety of their funds.

FP Markets Fees

FP Markets offers a competitive fee structure designed to provide traders with cost-effective trading. The broker presents transparent pricing with tight spreads and low commissions. Traders can choose from various account types, such as the Standard Account with no commission and raw spreads or the Raw Account with lower spreads and a small commission per trade. FP Markets does not charge any deposit or withdrawal fees, making it convenient for traders to manage their funds.

FP Markets Customer Service

Customer service is crucial for any brokerage, and FP Markets excels in this aspect. The company is committed to providing exceptional support to its clients, offering multilingual customer service representatives available 24/5. Traders can reach the support team through live chat, email, and phone, ensuring prompt assistance and efficient resolution of queries or concerns. FP Markets' dedication to customer satisfaction has earned it accolades and recognition within the industry.

Why is FP Markets one of the Best MetaTrader 5 Forex Brokers?

FP Markets stands out as one of the best Meta Trader 5 Forex brokers for several reasons. Firstly, the broker provides seamless integration with the popular MT5 platform, offering traders a user-friendly and feature-rich trading environment. The platform supports automated trading through Expert Advisors (EAs), advanced charting tools, and a wide range of technical indicators, empowering traders with flexible and customizable trading strategies.

Secondly, FP Markets offers deep liquidity from multiple liquidity providers, ensuring fast execution and minimal slippage. This allows traders to take advantage of tight spreads, enhancing their profitability.

Lastly, FP Markets provides educational resources, including webinars, tutorials, and market analysis, to help traders enhance their knowledge and make informed trading decisions. The broker's commitment to empowering traders and its dedication to technological innovation contribute to its reputation as one of the best Meta Trader 5 Forex brokers in the industry.

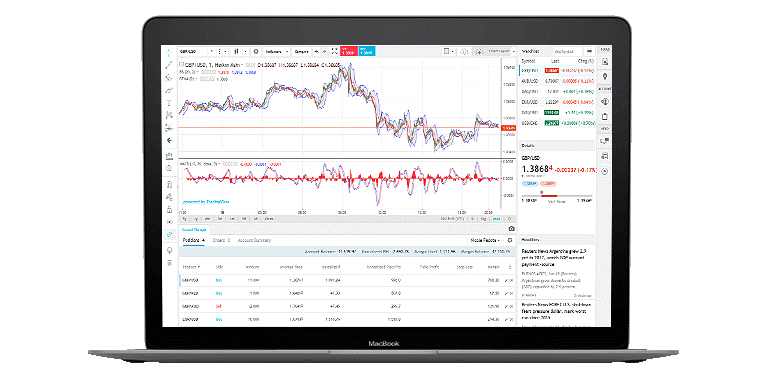

cTrader

cTrader tends to fade into the background when placed side by side with its main competitors. However, it has managed to hold its own quite well and has gone about quietly establishing its reputation. Developed by Spotware in 2011, cTrader has grown in leaps and bounds since then, culminating in its reputation these days as the platform of choice for ECN brokers.

From its spick and uncluttered interface to its multitude of helpful tools, analytics, and charts, cTrader pays remarkable attention to detail, for which it, quite justifiably, gets a lot of plaudits. It also offers reasonably quick execution speeds, and orders can be placed in just a single click. This platform’s STP (Straight To Processing) capabilities, coupled with its more modern look and feel, make it a particular favorite of ECN brokers. Still, cTrader is actually suited to all kinds of traders.

For your benefit, the platform offers a wide selection of indicators and periods. You'll get access to a comprehensive range of indicators (over fifty in all, including Moving Averages, MACD, Stochastic Oscillator, Bollinger Bands, and others) that are organized into four categories: Trend, Oscillator, Volatility, and Volume. Under the 1-hour period, you can access the standard 1, 5, and 15-minute timeframes, but cTrader provides you extra possibilities ranging from 45, 20, and 10 minutes to 1 minute. In general, cTrader has a more significant number of timeframes than other platforms.

Pros of cTrader

A smoother, more intuitive interface, three alternatives for Depth of Market, multiple indicators and timeframes, and Copy Trading. And that's not even all. While cTrader has been in the shade of MetaTrader right from the get-go, one area where experts and traders agree that cTrader has an edge is automated trading. cTrader's cAlgo offers a .NET framework and is programmed with C# language. The difference with MetaTrader's EA is that the former uses MLQ4 or MLQ5, which is a lot more technical and challenging to understand than C#.

Cons of cTrader

While cTrader has been expanding its horizons recently, it's still operating with a fragment of the market share, the largest shares having been cornered by MT4 and MT5. As a result, the platform’s outlook is a lot more niche, which places a limit on the growth of the copy trading experience. Secondly, there's a bit of skepticism among American traders for the London-based Spotware platform.

3 Best cTrader Brokers

FxPro

One of only a handful of brokers that offer both MT4 and MT5 and cTrader platforms, FxPro is one of the most readily identifiable brokerages around. Some of the features that make them so popular are:

- Superb customer service and excellent market execution

- Top-tier regulation

- 7000+ trades executed every second

- True NDD (No Dealing Desk) Execution

- Fast execution speeds for cTrader

- EUR/USD spreads for cTrader are highly competitive

FxPro is a True NDD Broker

Arguably the standout attribute of this broker, FxPro uses straight-through processing technology to execute orders placed on the cTrader platform. NDD implies that they do not get actively involved in trades, earning only through commissions.

As a direct consequence of FxPro's NDD intervention, trades get executed at dizzying speeds, just 11.06 milliseconds. With this arrangement, FxPro supports over 7,000 transactions per second. The broker also controls Tier 1 capital of over €100,000,000.

Is FxPro Safe?

Established in the UK in 2006, FxPro is fully regulated by a Tier 1 regulator and a number of Tier 2 and Tier 3 regulators, meaning it has a low-risk rating. The Financial Conduct Authority, UK (FRN: 509956), and CySEC (Licence: 078/07) are some of the regulators to have approved FxPro, while the company also boasts regulation in South Africa by the South African Financial Sector Conduct Authority under authorization number 45052, the Bahamas (under license number SIA-F184), and Dubai.

The platform offers negative balance protection, and client funds are put in a segregated bank account controlled by tier-1 banks.

FxPro Fees and Commissions

The biggest criticism of FxPro is that their spreads are well above the industry average, and you don't need more than a cursory glance at the books to confirm this. FxPro's spread for EUR/USD on the MetaTrader platform is 1.4 pips, well above the industry average of 0.70 pips. Traders may get more value from the cTrader platform, pegged at 0.2 pips, although commission will be factored in.

Markets and Platforms

Forex traders on the FxPro platform have access to a stunning range of market options, including 70+ currency pairs and future and spot indices, along with more than 260 different instruments. Share trading is also offered in limited forms, while spot metals and spot energies are scaled back massively.

Depending on the size of the lot and on which asset is traded, FxPro offers leverage to traders.

Traders also get the full suite of the MT4, MT5, and cTrader platforms, along with their desktop, mobile, and web-based applications.

Why FxPro Is The Best Broker For cTrader

Great execution speed, actual NDD execution, top-tier regulation, and the ability to execute large orders flawlessly are advantages that FxPro bring to the table. Traders also like this broker's cross-platform integration, detailed supply of research and education materials, seamless deposit and withdrawal methods, and excellent customer service.

RoboForex

RoboForex is a trustworthy online broker that provides a variety of trading services to clients around the globe. The company, which was founded in 2009, has grown to become one of the most prominent participants on the financial markets, offering traders access to a vast array of financial instruments, including forex, stocks, indices, commodities, and cryptocurrencies.

Is RoboForex Safe

Regarding security, RoboForex stands out as a reliable broker. The International Financial Services Commission (IFSC) and the Cyprus Securities and Exchange Commission (CySEC) regulate the company. These regulatory bodies ensure that RoboForex adheres to stringent financial standards, such as the segregation of client funds and the maintenance of adequate capital reserves. Moreover, RoboForex employs advanced encryption technology to safeguard the personal and financial information of customers, thereby ensuring a secure trading environment.

RoboForex Fees

The cost of conducting business is an essential factor for merchants. RoboForex offers competitive and transparent fee structures to traders, allowing them to maximize their profits. The broker provides various account categories with varying commission structures, including fixed and variable spreads, as well as commission-free trading options. Traders can select the account type best suited to their trading manner and preferences, minimizing costs and maximizing potential returns.

RoboForex Customer Service

RoboForex is well-known for its superior customer service. The broker offers multilingual support via multiple channels, including live chat, email, and the telephone. The customer service team is available around-the-clock, ensuring clients in all time zones receive prompt assistance. Whether traders have queries regarding account setup, technical issues, or general inquiries, RoboForex's knowledgeable and receptive support staff is always available to assist.

Why is RoboForex one of the Best cTrader Forex Brokers

RoboForex's commitment to providing an exceptional trading experience on the popular cTrader platform is one of the reasons it is regarded as one of the top cTrader Forex brokers. The cTrader platform is renowned for its sophisticated charting capabilities, user-friendly interface, and extensive selection of trading instruments. RoboForex's seamless integration with cTrader enables traders to access a wide variety of financial markets and execute transactions in record time. Moreover, the broker provides traders with competitive spreads, low latency, and dependable trade execution, allowing them to capitalize on market opportunities with precision and efficiency.

XM

XM is a renowned brokerage firm specializing in providing cutting-edge trading services in the foreign exchange market. With a strong focus on the cTrader platform, XM offers traders a wide range of benefits, including safety, competitive fees, excellent customer service, and a reputation as one of the best cTrader Forex brokers in the industry.

XM is a leading Forex broker that provides traders with access to global financial markets. It offers a comprehensive range of trading instruments, including currency pairs, commodities, indices, stocks, and cryptocurrencies. Traders can access these markets through the cTrader platform, renowned for its advanced features, user-friendly interface, and powerful analytical tools. XM's commitment to innovation and technology ensures traders have access to a seamless and efficient trading experience.

Is XM Safe?

Safety is of utmost importance when choosing a Forex broker, and XM excels in this aspect. XM is regulated by reputable financial authorities, such as CySEC in Europe and ASIC in Australia. These regulatory bodies impose stringent guidelines and oversight, ensuring that XM adheres to the highest industry standards. Additionally, XM keeps client funds segregated in separate accounts, providing an extra layer of security and ensuring that traders' funds are protected.

XM Fees

XM offers highly competitive fees, which contribute to its appeal among traders. The broker operates on a variable spread model, which means that traders pay a small spread on each trade they execute. The spreads offered by XM are among the tightest in the industry, enabling traders to enter and exit positions at favorable prices. Additionally, XM does not charge any commissions on most account types, making it cost-effective for traders to execute their strategies.

XM Customer Service

XM prides itself on delivering exceptional customer service to its clients. The broker understands the importance of efficient support in the fast-paced Forex market. Traders can reach the XM customer support team 24/5 through various channels, including live chat, email, and telephone. The support team consists of knowledgeable professionals who offer prompt assistance with any queries or issues traders may encounter. XM's commitment to customer satisfaction sets it apart from other brokers.

Why is XM one of the Best cTrader Forex Brokers?

XM stands out as one of the best cTrader Forex brokers due to several key factors:

a) Robust Trading Conditions: XM provides traders with access to a vast range of trading instruments, competitive spreads, flexible leverage options, and fast execution speeds. These favorable trading conditions enable traders to implement their strategies effectively.

b) Advanced Technology: XM's integration with the cTrader platform ensures traders have access to advanced charting tools, technical indicators, and customizable features. The platform's user-friendly interface allows traders to analyze markets, execute trades, and manage their portfolios seamlessly.

c) Educational Resources: XM prioritizes trader education and offers an extensive range of educational materials, including webinars, tutorials, market analysis, and trading tools. These resources empower traders of all experience levels to enhance their knowledge and make more informed trading decisions.

d) Account Types: XM offers various account types to cater to different trader preferences, including Micro, Standard, and XM Zero accounts. This flexibility allows traders to choose an account that suits their trading style and capital requirements.

e) Bonuses and Promotions: XM frequently offers attractive bonuses and promotions to its clients, enhancing the trading experience and providing additional value.

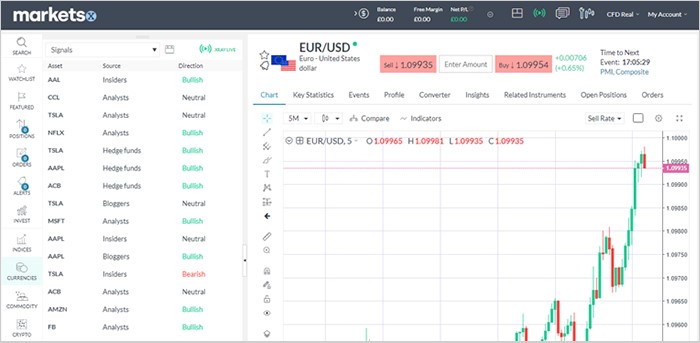

MarketsX

MarketsX is an in-house multi-asset trading platform designed by Markets.com to assist with its brokerage efforts. Pegged as an all-in-one trading platform, it is nonetheless listed on the London Stock Exchange (LSE) as one of the highly prestigious FTSE 250 companies. The platform is one of the brokerages included by Markets.com, the others being MetaTrader 4 and MetaTrader 5.

Strong Points of MarketsX

MarketsX is surprisingly full of interesting features in spite of its limited reach. On the platform, traders are assisted by 88 technical indicators and more than eight different chart types. The interface is also intuitive and able to be personalized with a multitude of drawing tools.

Perhaps the biggest draw of this platform is the plethora of interactive trading tools on offer. There are loads of sentiment analysis, technical, and fundamental tools to pick from, with the advanced charting package being arguably the most functional of them. Honorable mentions are the Hedge Funds investment confidence and Insider Trades, which take stock of the trading made by experts on the platform and reveals insights to traders. There's also a Thomas Reuters-powered stock report.

Cons of MarketsX

Forex traders will not be completely enamored with this platform as it seems to be tailored mainly to the needs and requirements of share dealing, despite its billing as a multi-asset platform.

In addition, the platform is only available to clients of Markets.com, so it somewhat struggles and is characterized by limited accessibility, inevitably.

Markets.com: The Best Trading Tools

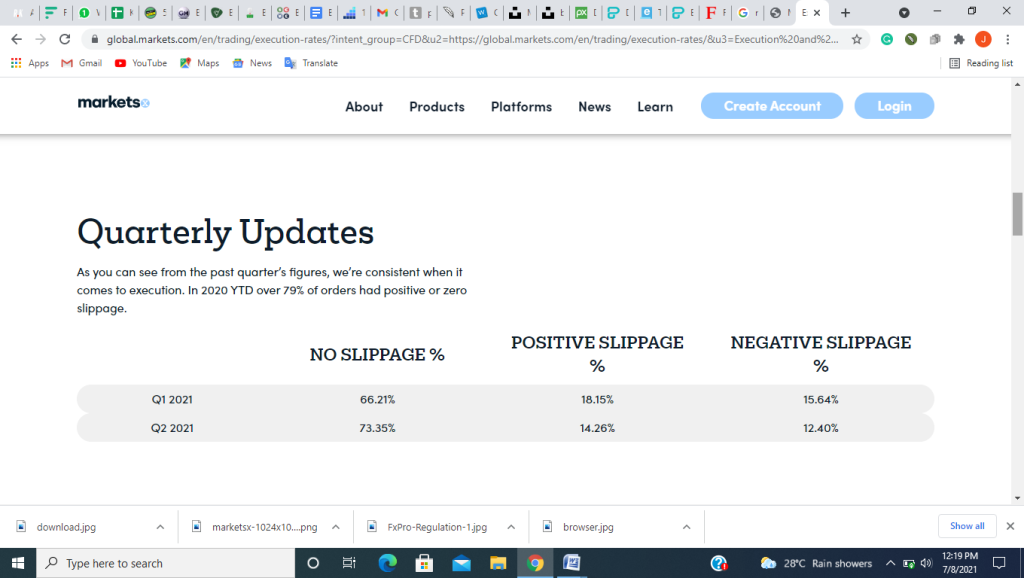

Established in 2008, Markets.com is a CFD and forex broker with a global reputation. Highly regulated and low-risk, traders on the platform are offered a wide range of instruments, including currencies, bonds, shares, indices, commodities, and ETFs, with the number of trading instruments comfortably crossing the 2000 mark.

According to data released by the company, the platform has registered well in excess of five million trading accounts, and the value of trades carried out on Markets.com the previous year is a considerable $185 billion.

Traders praise Markets.com's platform MarketsX, noting its intuitiveness and ease of use, and wide distribution of valuable features, including educational materials, integrated research, and market analysis.

Markets.com's Safety

With regulations by the following financial bodies:

- Financial Conduct Authority (FCA) in the UK

- Australian Securities and Investments Commission (ASIC) in Australia

- Cyprus Securities and Exchange Commission (CySEC) in Europe

- BVI Financial Services Commission (FSC) in the rest of the world

Markets.com is required to be extremely transparent, which translates to very high ratings for safety. The platform is considered low risk; it segregates client funds using tier-1 banks and offers negative balance protection.

Fees and Commissions

Markets.com offers two in-house trading platforms- Marketsx and Marketsi. Marketsi is the more speculative of the two, while Marketsx caters to CFD and Forex traders and is only available to premium traders.

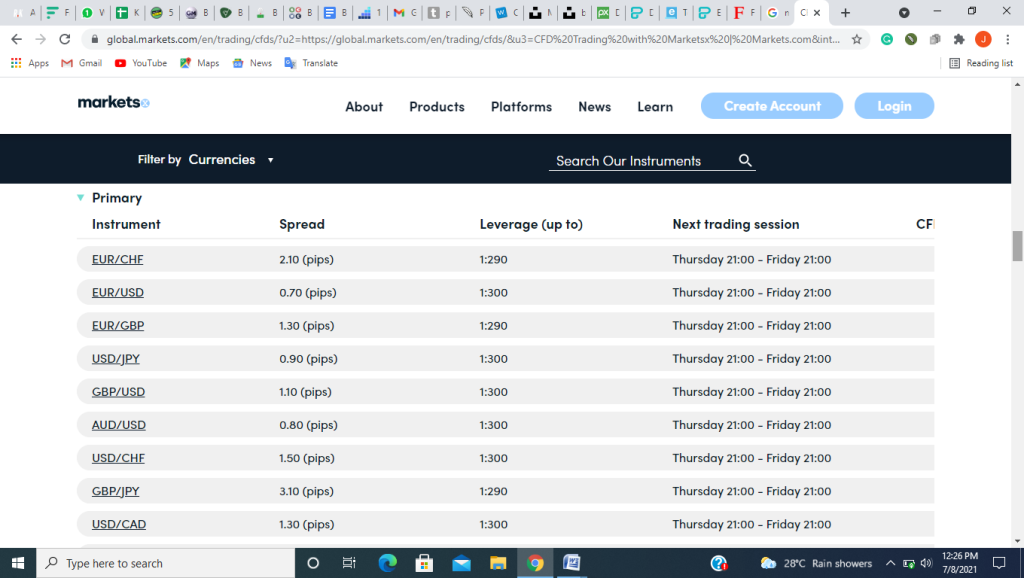

The fees for forex trading on the platform are among the most competitive in the industry. On the other hand, commissions on Index CFDs and Commodities are on the high side. Markets.com charges a spread of 0.7 pips on the EUR/USD currency pair, which is the industry average. It's worth noting that fees are generally significantly lower on Markets.com's in-house platform MarketsX than MT4 and MT5.

The platform imposes a monthly inactivity fee of $10 on accounts that remain inactive after a period of 90 days. Traders on the platform also have to pay marginally higher overnight fees. Beyond this, traders do not have to pay deposit or withdraw charges.

Markets and Products

Markets.com offers a prodigious amount of instruments sourced across a wide range of markets. Traders who use the Marketsx platform have access to approximately 2,200 assets across eight asset classes. With 67 currency pairs and 25 cryptocurrency pairings, forex traders have plenty of options.

A total of 28 commodities are available for cross-asset diversification, with 2,027 individual equities CFDs making up the majority of the offering. 40 Index CFDs, 14 Blends, and 60 ETFs amplify trading potential.

By far the biggest draw of Markets.com is its offer of more than 2,200 assets across eight different sectors.

Tools and Trading Platforms

Traders on the platform can choose from four trading platforms, including MetaTrader 4, MetaTrader 5, Marketsx, and Marketsi. The brokerage platform also offers a mobile app for Android and iOS devices.

Algorithmic trading is available on the MT4 trading platform, but this solution is basic and unreliable. The platform provides thousands of free add-ons, but the really significant ones are anything but free.

The Marketsx and Marketsi platforms are where things get interesting. They're both integrated with Trading Tools, so tools such as Insider Trades, Hedge Funds, Trading Analyst Recommendations, Acuity News Trading Sentiments, Signals, Advanced Charting, and a whole lot more are available to traders for improved analytic acumen.

Research and Education

In-house education offered by this platform is somewhat lacking and falls way short of the standards set by industry leaders. Traders on the hunt for trading insights and market education may have to look elsewhere at other venues offering these resources free of charge.

The story is slightly better on the research front. Markets.com offers 14 excellent trading tools, and this is where the most significant percentage of research offerings are sourced.

Why Markets.com Is The Best For Trading Tools

Markets.com offers a comprehensive and interesting range of trading g tools that can give traders a leg up while navigating the spot and futures market. When you factor in the platform's offer of trade instruments and trading platforms, a clear pattern begins to emerge of Markets.com's efforts at helping traders make better trade decisions and successfully master the market.

NinjaTrader

Created in 2004, NinjaTrader is billed as an advanced charting software for forex. The platform is based off the shores of the USA and commands a significant following from traders based in North America. NinjaTrader is fully registered by the National Futures Association (NFA).

Pros of NinjaTrader

Charts on the platform are fully customizable, while bid/ask data is available in real-time during trades. Multiple pre-configured trade indicators are accessible, along with a wide range of sketching tools. With the ability to create watch lists and indicator values, the Market Analyzer tool assists traders in scanning changes in forex markets. Currency market changes can trigger alerts, and automated strategy programs are pre-programmed.

Cons of NinjaTrader

The biggest drawback to this trading platform is its absence of a mobile app, which is a severely limiting factor these days. Further, the platform can only be found in six foreign exchange brokers' lists, which is perhaps why NinjaTrader has a small community.

3 Best NinjaTrader Brokers

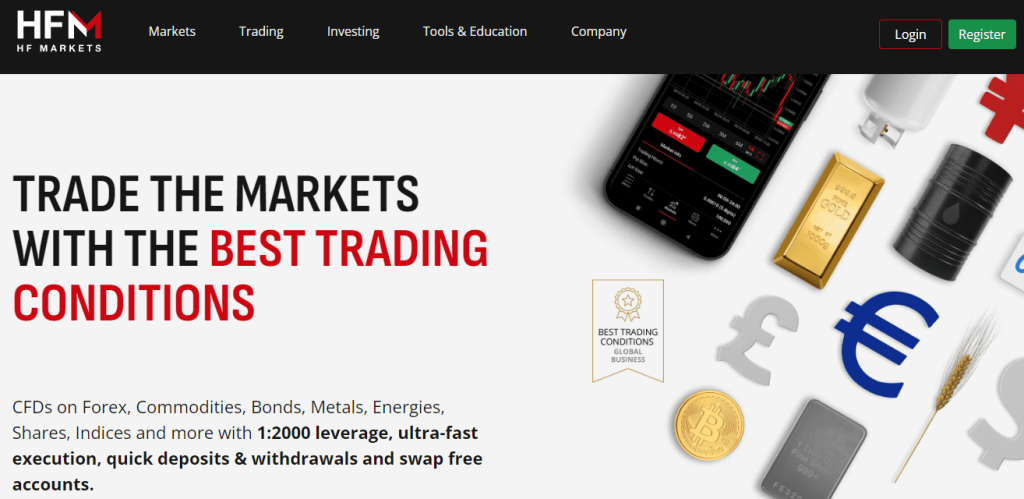

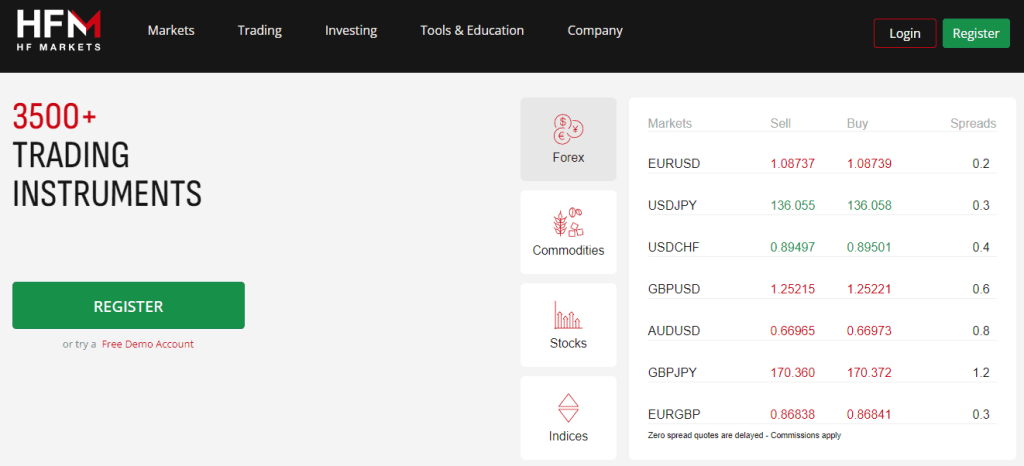

HF Markets

HF Markets offers a wide range of trading instruments, including forex, commodities, indices, stocks, and cryptocurrencies. Traders can access these markets through various platforms, including the popular MetaTrader 4 and MetaTrader 5 platforms, as well as their proprietary trading platform.

Is HF Markets Safe?

When it comes to safety, HF Markets prioritizes the security of client funds. They are regulated by multiple financial authorities, such as the Financial Conduct Authority (FCA) in the UK and the Cyprus Securities and Exchange Commission (CySEC). These regulatory bodies impose strict guidelines to ensure the protection of clients' funds and fair trading practices.

In addition, HF Markets provides clients with segregated accounts, which means that clients' funds are kept separate from the company's operational funds. This provides an extra layer of security and ensures that clients' funds are protected in the event of any financial difficulties faced by the broker.

HF Markets Fees

HF Markets offers competitive and transparent fee structures. The fees associated with trading depend on the type of account and the trading instrument. They offer both fixed and variable spreads, allowing traders to choose the pricing model that suits their trading style. HF Markets also offers commission-based accounts, which provide tighter spreads with a small commission per trade.

Furthermore, HF Markets does not charge any deposit fees, making it convenient for clients to fund their trading accounts. Withdrawal fees may apply depending on the payment method and the client's location. However, HF Markets offers various withdrawal options with minimal charges.

HF Markets Customer Service

HF Markets is well-known for its excellent customer service. They provide multilingual support through various channels, including live chat, email, and phone. Their customer support team is responsive and knowledgeable, addressing client queries and concerns promptly.

Moreover, HF Markets offers educational resources and materials to assist traders in enhancing their trading skills and knowledge. They provide regular market analysis, webinars, and educational articles, empowering traders to make informed decisions.

Why is HF Markets one of the Best NinjaTrader Brokers?

HF Markets stands out as one of the best NinjaTrader Forex brokers for several reasons. Firstly, they offer compatibility with the NinjaTrader platform, which is a widely used trading platform among professional traders. This allows traders to utilize advanced charting tools, automated trading strategies, and custom indicators.

Secondly, HF Markets provides competitive spreads and fast trade execution, ensuring that traders can enter and exit trades at the desired prices. With low latency and reliable order execution, traders can take advantage of market opportunities efficiently.

Lastly, HF Markets offers a range of account types suitable for different trading strategies and experience levels. They provide leverage options, allowing traders to maximize their trading capital. Additionally, they offer Islamic accounts that comply with Shariah law, catering to Muslim traders' specific needs.

Interactive Brokers

Interactive Brokers is a global brokerage firm that enables individuals, traders, and investors to trade a diverse array of financial instruments, including stocks, options, futures, forex, and bonds. They provide access to various exchanges worldwide, allowing clients to trade on over 135 markets in 33 countries. With a robust trading platform and sophisticated tools, IB caters to both retail and institutional traders.

Is Interactive Brokers Safe?

Safety is a crucial aspect when choosing a brokerage. Interactive Brokers is widely recognized for its emphasis on security and financial stability. The company is publicly traded on the Nasdaq stock exchange (IBKR), and its stringent regulatory compliance ensures the protection of client funds. IB adheres to the highest industry standards and operates under the oversight of multiple regulatory bodies, including the Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA). Additionally, Interactive Brokers is a member of the Securities Investor Protection Corporation (SIPC), which provides limited protection for customers in case of brokerage insolvency.

Interactive Brokers Fees

One of the key advantages of Interactive Brokers is its low-cost structure. IB offers competitive commission rates, especially for active traders. The fee structure varies depending on the type of asset being traded and the exchange. For stocks, the commission is typically a fixed rate per share, while options have a base fee plus a per-contract charge. Futures and forex trades involve different fee structures, including spreads and transaction costs. It is worth noting that IB charges various additional fees, such as market data fees and inactivity fees, which may apply depending on the account type and trading activity.

Interactive Broker Customer Service

Interactive Brokers prides itself on its comprehensive customer service. They offer support via phone, email, and live chat, ensuring clients have multiple channels to address their inquiries or concerns. IB's customer service team comprises knowledgeable professionals who are well-equipped to assist clients with various trading-related matters. However, it is important to note that due to their global reach and large client base, response times may vary during peak trading hours.

Why is Interactive Brokers one of the Best NinjaTrader Brokers?

Interactive Brokers stands out as one of the best NinjaTrader Forex brokers for several reasons. First and foremost, IB provides direct market access (DMA) to forex liquidity, enabling traders to execute orders with competitive spreads and fast execution speeds. This feature is highly valued by professional and active forex traders. Additionally, Interactive Brokers offers a wide range of currency pairs, allowing traders to access numerous forex markets worldwide. IB's advanced trading platform integrates seamlessly with NinjaTrader, a popular trading software, providing traders with an intuitive interface and powerful tools for charting, analysis, and automated trading strategies. This combination of robust technology, extensive market access, and competitive pricing makes Interactive Brokers an attractive choice for forex traders using the NinjaTrader platform.

FXCM

In addition to being the best broker on NinjaTrader, FXCM also boasts the best mobile app. The app was developed through its Trading Station platform. Some of the standout features of the Trading Station are:

- Regulated in the UK, Australia, and South Africa

- Offers a good range of financial markets, crypto included

- An offered free demo account

- Mobile app available for iPhone, iPad, and Android devices

- Easy to navigate interface

- Strong emphasis on trader education

- Traders in the UK have the option of spread betting

- Responsive customer service

FXCM offers a demo account to both new and existing customers with the complete range of products and services, including access to third-party applications and indicators, exclusive historical market data, and access to algorithmic trading solutions.

Traders who reside in the UK and Ireland also have access to spread betting and the NinjaTrader 8 app for forex trading.

Why FXCM is Perfect For Mobile Traders

High-volume traders who have a preference for trading with their mobile phones will find FXCM helpful. The platform is regulated and offers integration with both Trading Station and NinjaTrader. Trading Station is widely acknowledged to have the most advanced mobile app on both the iOS and Android platforms.

Beginners may struggle with FXCM's fees, which are on the high side, but Active Traders can potentially save over 62% of costs.

ProRealTime

ProRealTime is one of the few exclusively web-based brokers around. The company was established in France in the year 2001 by developers IT-Finance. ProRealTime offers several advantages, key among them their technical analysis functionality. This broker gives traders the freedom to personalize several tools, including advanced charting and currency market scanners. This platform also supports automated trading, with their software programmed with ProRealCode coding language.

Pros of ProRealTime

The main strength of this trading software is its technical analysis functionality. Traders of macro and micro currencies can make use of over 100 indicators, which expiration dates and strike prices can filter. The interface offers several charts and periods, as well as the ability to trade trend lines across asset classes.

Cons of ProRealTime

Without the option of trading apps, mobile trading is unavailable on this platform. Further, the software is only available to Australian users in demo mode, while the platform is restricted to traders in the USA and Australia with some brokers.

Also read: Is forex legit

IG: The Leading ProRealTime Broker

With over 200,000 traders across the globe on their platform, IG is a strong player in the industry. The company is also listed on the FTSE. Here are some of their most compelling attributes:

- Convenient and reliable account funding methods

- Tier 1 regulation by ASIC, FCA, MAS, and the CFTC

- No minimum deposit is required.

- More than the decent offer of tradable financial markets

- Solid research and education program

IG's Fees and Commissions

IG offers pretty low spreads on both available trading accounts. For advanced traders who favor the spread + commission account in search of low spreads, IG's fees are relatively competitive, although nowhere near as low as the industry leaders in this category.

IG offers spreads of 0.86 pips on the EUR/USD currency exchange for standard accounts, which is higher than the industry average.

IG also charges some non-trading fees, such as financing fees for overnight positions.

Why IG Is Best For ProRealTime

The platform's $0 minimum deposit requirement is attractive. As the world's foremost retail foreign exchange broker, they provide the lowest standard account spreads and the best customer service.

eToro Trading Platform

eToro channels most of its market drive towards the trading of CFDs.The platform is also notable for being the unofficial hub of social trading and copy trading. Traders are drawn to the platform because of its large community of online traders, the diversity of CFD trading options on offer, and the easy and smooth interface of the platform.

Pros of eToro Trading Platform

The eToro trading platform has been designed to make social trading more accessible and more interactive. eToro provides all the tools needed for social trading in-app, negating the need for add-ons or special software.

Another feature that’s worth a mention is the platform’s copy trading function. The two available types are CopyTrader and CopyPortfolio. You may use CopyTrader to follow and imitate the trading tactics of other users. This is especially beneficial for new traders or those with limited free time since they may make sizable gains from other traders' deals.

eToro also lets you analyze the performance of other traders to assist you in identifying the right traders to copy. Further, you get risk management tools to assist you in exiting deals when traders fail to perform.

Cons of eToro Trading Platform

eToro has developed its own set of parameters and terminologies, so even seasoned traders may find themselves stumped on the platform in spite of its simple interface. Traders may find themselves having to start learning these things from scratch.

Another drawback is that eToro is a niche social trading platform with fewer technical indicators and graphical features than specialist CFD platforms.

Is eToro Safe?

eToro is licensed by the CySEC (Cyprus Securities and Exchange Commission) with license 109/10 for European traders and the FCA (Financial Conduct Authority) with license 7973792 for UK traders. It also has several additional licenses, including one from the Australian Securities and Investments Commission (ASIC), but residents of the United States can not access it since it lacks a Commodity Futures Trading Commission (CFTC) license.

With a number of tier-1 regulations to its name, eToro is considered to be a low-risk broker.

eToro Is The Leading Social Trading Broker

A demo account is automatically generated when you open an eToro trading account. Traders are offered $100,000 in virtual capital to play with and practice utilizing the platform's full capabilities. The research feature from eToro investors and industry professionals gathered from financial institutions is included in this demo account.

Markets and Products

eToro currently offers over 47 currency pairings for trading. There are also 17 cryptocurrencies (including bitcoin), 13 indexes, 145 exchange-traded funds (ETFs), and 13 commodities to consider. The most distinctive feature of eToro's financial market is its capacity to trade more stocks in most worldwide marketplaces as a contract for difference.

Plus500

Plus500 is a global multi-asset fintech group offering a proprietary trading platform for Contracts for Difference (CFDs), share dealing, and, in the U.S., futures trading. The platform provides access to a wide range of financial instruments, including forex, commodities, indices, options, and shares, all through an intuitive and user-friendly interface. Plus500 is listed on the London Stock Exchange and is a constituent of the FTSE 250 index.

OPEN A DEMO ACCOUNT ON PLUS500

Is Plus500 Safe?

Safety is a paramount concern for Plus500, which operates under the regulation of multiple financial authorities worldwide. These include the Financial Conduct Authority (FCA) in the UK, the Australian Securities & Investments Commission (ASIC) in Australia, and the Cyprus Securities and Exchange Commission (CySEC) in Cyprus. This extensive regulatory oversight ensures that Plus500 adheres to strict standards regarding client fund protection and transparent trading practices.

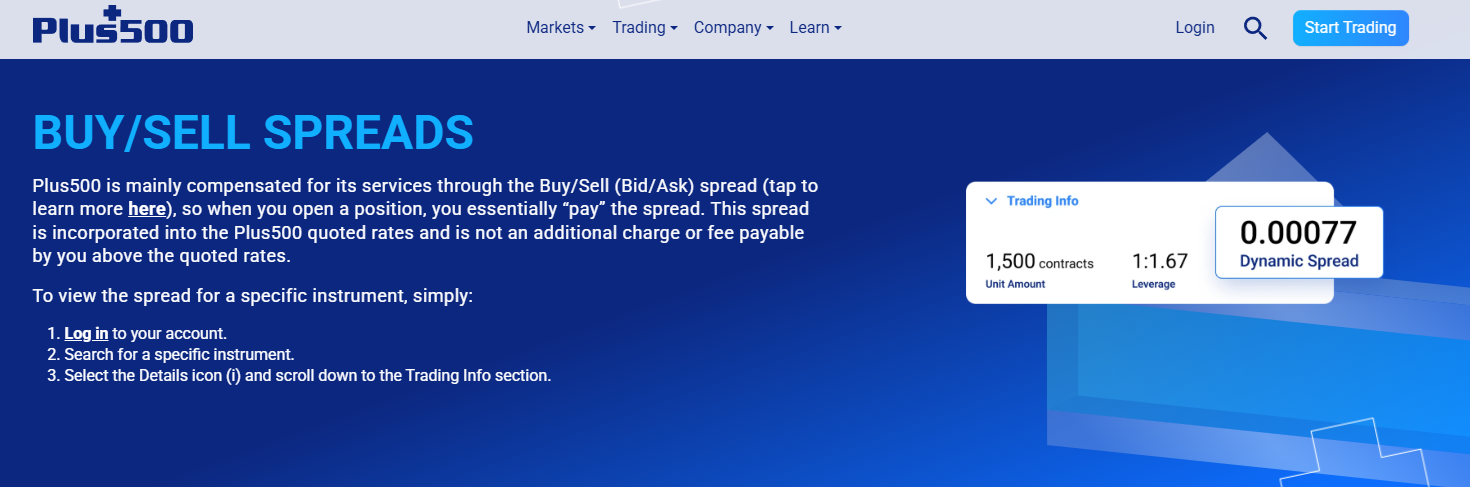

Plus500 Fees

Plus500 primarily generates revenue through the market spread, the difference between the buy and sell prices of an instrument, and does not charge commissions on trades. Additional fees may include an overnight funding fee for positions held after a certain time, a currency conversion fee of up to 0.7% for trades on instruments denominated in a currency different from the account's base currency, and an inactivity fee of up to $10 per month if there is no account activity for at least three months. Notably, there are no fees for deposits, live share CFD prices, real-time forex quotes, opening or closing trades, dynamic charts and graphs, or rolling positions.

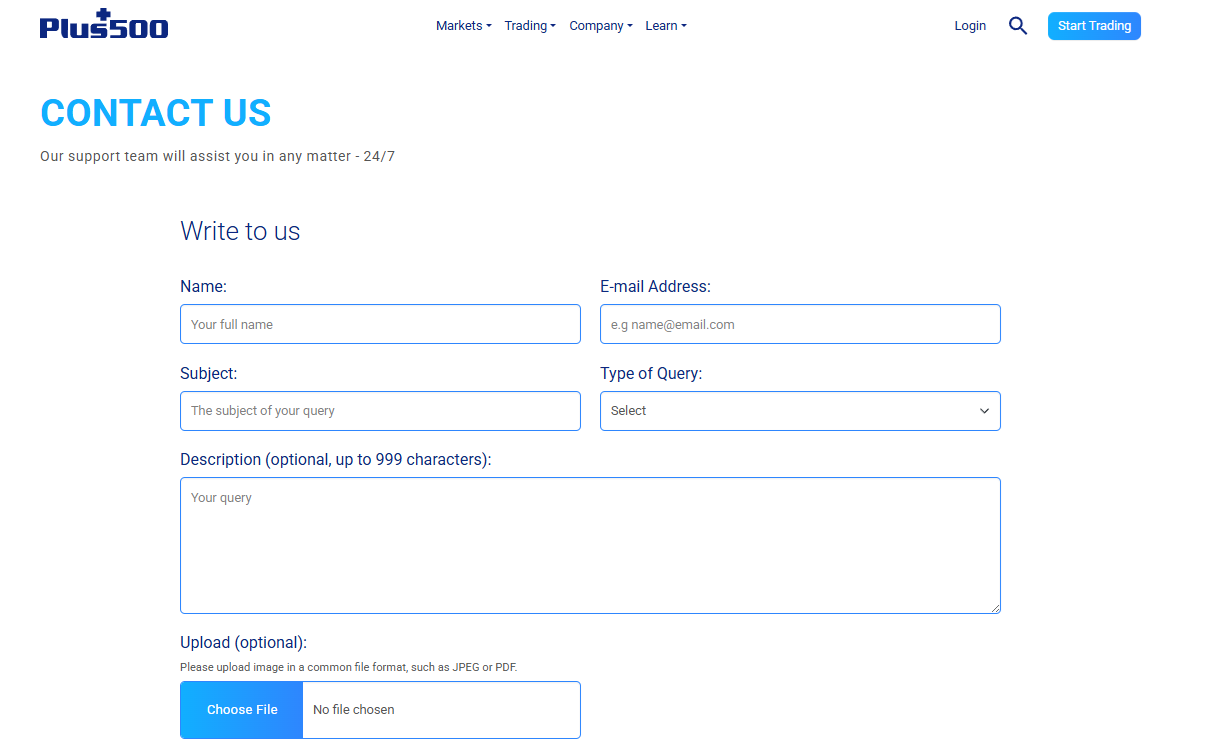

Plus500 Customer Service

Customer service at Plus500 is available 24/7 through various channels, including email and WhatsApp, ensuring that assistance is readily accessible for any inquiries or issues that may arise.

Why is Plus500 One of the Best Forex Trading Platforms

Plus500 is considered one of the best forex trading platforms due to its competitive spreads, user-friendly WebTrader platform, and comprehensive regulatory compliance. The platform offers a broad selection of forex pairs and provides traders with advanced tools and real-time data to make informed trading decisions. Its commitment to security, transparency, and customer support further enhances its reputation as a reliable choice for forex traders.

eSignal

eSignal is widely known and revered throughout the brokerage industry for setting the pace in charting technology. Over several decades of its existence, and to date, it still holds that distinction. The platform is also known for fantastic trading tools and advanced indicators.

Pros of eSignal Software

- Reliable real-time data

- Improved backtesting and scanning

- A wide array of third-party add-ons

- Myriad of technical indicators ad studies

- Advanced charting technology

Cons of eSignal Software

- The platform is expensive, and many traders may be priced out of joining

- Additional symbol units would be welcome

Forex.com Is The Best eSignal Trading Platform

Forex.com's pricing engine software is flawlessly integrated with the TradingView interface, allowing forex traders to trade straight from TradingView charts with the following benefits:

- Charts for mobile trading with over 60 technical indicators that can be customized

- The platform’s parent company (Gain Capital) is listed on the New York Stock Exchange

- +12,000 worldwide financial products are available to you

- There are a variety of dynamic charts (11 chart types)

- A large number of advanced technical instruments (over 65 technical indicators) are available

- There are three distinct sorts of contracts that may be traded (CFDs, spread bets, and spot FX)

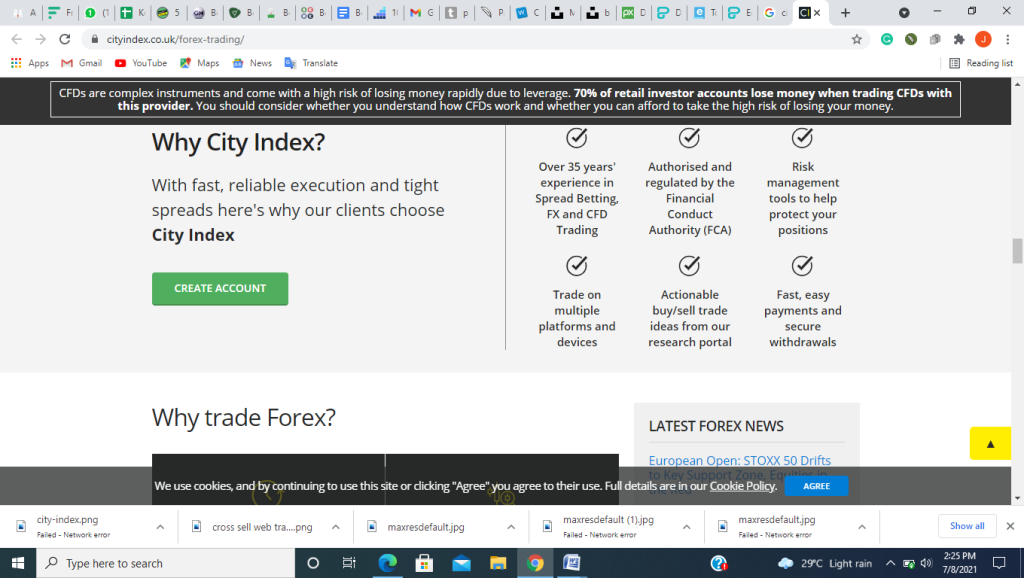

City Index Helps Traders Manage Risks Effectively

With the introduction of risk management features such as automated margin closeout, negative balance protection, and guaranteed stop loss to its Web Trader platform, City Index intends to safeguard its traders’ funds.

Traders Are Offered Access To Intelligent Trading Tools

Traders at City Index have access to various intelligent trading tools to identify fresh trading opportunities. The web-based charts at City Index are powered by TradingView, but they are improved by in-house technology developed by this brokerage trading firm's team of specialists.

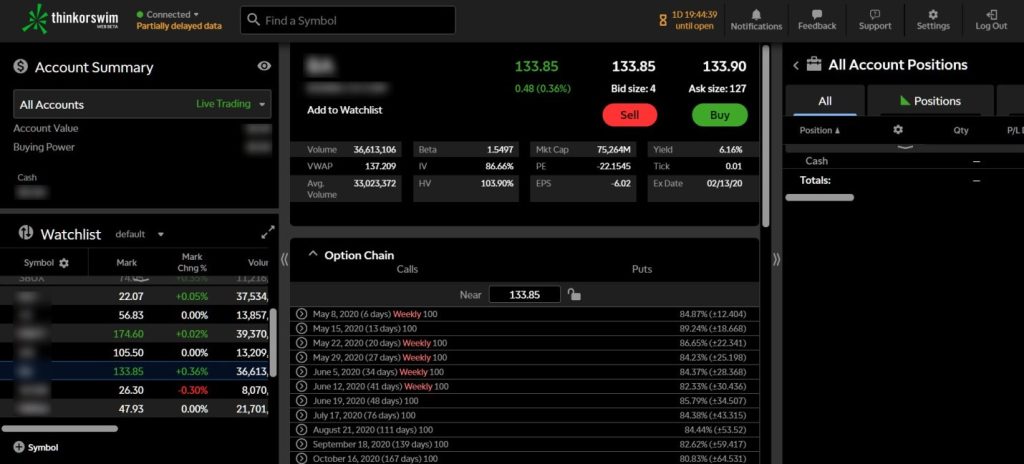

ThinkOrSwim

TD Ameritrade's ThinkorSwim (ToS) is a sophisticated trading platform. Active traders consider it to be one of the greatest trading platforms accessible. It's chock-full of technical analysis and charting tools, as well as software features that may boost a trader's productivity. It’s compatible with mobile, web, and desktop, gaining recognition for being one of only a select few platforms available on Mac.

Pros of ThinkOrSwim

The following are standout features and benefits of the ThinkOrSwim platform:

- Interactive social trading

- Numerous news streams and extensive research capacities

- Over 400 technical studies and 8 Fibonacci tools are among the market-leading research tools available

- The platform is committed to educating novice traders

- Wide variety of charts and other trade instruments

Cons of ThinkOrSwim

- The sheer number of tools and content may get overwhelming

- Beginners face a steep learning curve on the platform

- Traders looking for specific tools may need to use more than one trading system

TD Ameritrade’s ThinkOrSwim Is The Best Platform For US Forex Brokers

With awesome offers such as zero commissions trading and over 70 currency pairs to be traded, TD Ameritrade is staking a concerted claim to be the best forex trading platform in the US. The broker is upfront with its pricing, and traders are never surprised with hidden charges.

Is TD Ameritrade Safe?

Ameritrade Futures & Forex LLC, a subsidiary of TD Ameritrade, which the latter trades under, is regulated by several top regulating bodies within the USA and beyond. These regulators include:

- US Securities and Exchange Commission (SEC)

- National Futures Association (NFA)

- Commodity Futures Trading Commission (CFTC)

- Financial Industry Regulatory Authority (FINRA)

To be approved and licensed by these regulators, brokers would need to segregate client funds and have tier-1 banks do this for them, operate very strict and transparent policies, institute complaints procedures for the resolution of disputes, and put policies in place that guarantee the protection of traders’ funds. In the US, very few brokers are able to satisfy these requirements, apart from Interactive Brokers (IBKR).

Resources and Education

With the education of traders among the stated goals of TD Ameritrade, the platform offers several engaging courses, webinars, videos, articles, and other materials to help traders step up their game and attain full mastery of CFD trading skills. The paperMoney feature is also a great tool that allows you to try out real-life trading scenarios without the added pressure that comes with the risk of losing money.

Also read: Forex Educators

TradeStation

Founded in 1982 and based in Florida, TradeStation is respected for its pioneering roles in advancing trader technology. Futures trading, options trading, mobile trading, as well as specializations like day trading and professional trading, are all areas where TradeStation excels.

Pros Of The TradeStation Platform

- Excellent technical analysis and charting tools

- Stock screener for better personalization

- Wide range of tools for more accomplished trend analysis

- Detailed and well-structured educational materials

- Easy-to-use web and mobile platforms

Cons Of The TradeStation Platform

- Pricing is complicated

- Deposits and withdrawals are far from straightforward

- Not a very beginner-friendly platform

OANDA: The Best TradeStation Broker

Since it was established in 1996, OANDA has been a strong player in the US brokerage field. The company has an established global brand solidified by its sparkling reputation and seamless web trading experience. The platform does not offer a wide range of FX pairs and CFDs, but it makes up for this with its extensive and detailed market research. These are some of the platform's strong points:

- Quick execution with minimal requotes and no order rejections

- Excellent research tools, market analysis, and news

- More than 71 forex currency pairs

- Cutting-edge technical analysis tools

- FCA and NFA regulated

- Straightforward deposits with a wide range of currencies acceptable

- Intuitive and easily navigable platforms

OANDA Tools And Platforms

The online, desktop and mobile versions of OANDA's flagship fxTrade platform are all accessible. Charting, which is powered by TradingView, includes over 80 indicators and other features, including the option to compare several currency pairings on a single chart.

OANDA integrates with third-party platforms to bring algorithmic trading to its users. Traders on the OANDA platform also get the chance to build their own apps using programming languages such as C# and Python. However, OANDA also offers the popular MetaTrader 4 platform for traders that prefer it

Is OANDA Safe?

OANDA is regulated by the following authorities:

- OANDA Corporation is a member of the NFA (#0325821).

- This broker is also a registered Futures Commission Merchant (FCM)

- Retail Foreign Exchange Dealer (RFED) with the CFTC

- Australian Securities and Investment Commission (ASIC)

- Investment Industry Regulatory Organization of Canada (IIROC)

OANDA Europe is regulated and approved by the Financial Conduct Authority (#542574) in the United Kingdom, and clients are covered by the Financial Services Compensation Scheme (FSCS) for up to £85,000 in extra asset protection.

Why OANDA Is Great For TradeStation

With a long and proven track record, along with regulations from tier-1 regulating bodies, OANDA is one of the most trusted forex trading platforms in the US. This broker stands out for its impressive array of research tools and easily navigable web and mobile platforms.

In A Nutshell

We picked MetaTrader 4 as the best forex trading platform based on overriding market consensus, and after an analysis of the immense benefits it offers traders. AvaTrade is the best MT4 trader based on its competitive spreads, excellent research tools and materials, and good customer service.

FAQs

Q: What is the best forex trading platform?

A: The best forex trading platform is MetaTrader 4 due to its popularity, adaptability, and ease of operation. It also offers a wide range of tools, instruments, and integrations, particularly for algorithmic trading.

Q: Which forex trading platform is the best?

A: MetaTrader 4 is the best forex trading platform.

Q: Which is the best forex trading platform for windows 10?

A: Plus500 is highly regarded for its versatility. It works perfectly across a number of platforms, including web, desktop, and mobile. The best forex trading platform for windows 10 is Plus500.