Learn To Trade Forex • Best Forex Trading Course • AsiaForexMentor

Best Forex Broker

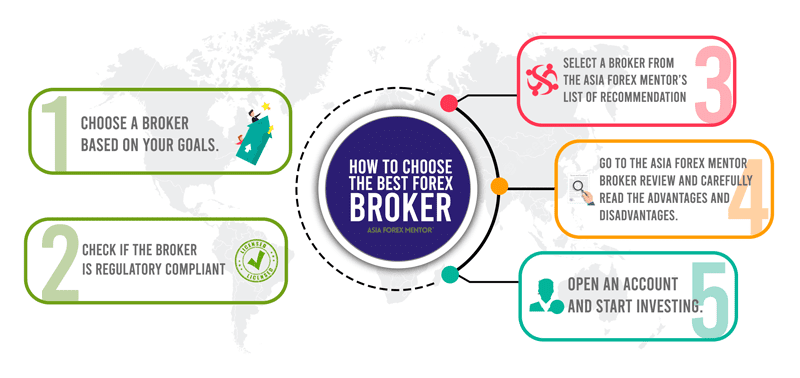

How To Choose The Best Forex Broker

The foreign exchange market is one of the most exciting, fast-paced markets in the financial world. Unfortunately, it is also one of the most volatile, with large swings in currency values commonplace. As a result, choosing the best forex broker for your needs can take time and effort.

To start with forex trading, you just need to explore the best forex brokers and open an account with one that suits your trading style. However, you must do some initial research to find the best forex broker. You can easily find the most suitable broker according to your trading experience and needs.

In this guide, we will discuss how to choose the best forex brokers, why you should start forex trading, the pros and cons of forex, and more. Besides that, to help you choose the best broker, we will compare the features and benefits of some of the leading brokers in the industry to give you an overview of each offer. So, let’s get started.

When looking for the best forex brokers, there are several things you need to consider. These include:

#1 Regulatory Compliance

The first and foremost thing you need to check is whether a reputable body regulates the broker. A good way to check this is to see if the broker is listed on a major exchange. If they are, then they are most likely to be regulated. For example, a reputable forex broker in the USA will be an NFA member registered with the Commodity Futures Trading commission.

#2 Trading Platform

The first and foremost thing you need to check is whether a reputable body regulates the broker. A good way to check this is to see if the broker is listed on a major exchange. If they are, then they are most likely to be regulated. For example, a reputable forex broker in the USA will be an NFA member registered with the Commodity Futures Trading commission.

- Ease of Use

- Real-Time Quotes

- Technical Analysis Tools

- Charting Tools

- Order Management Tools

- Mobile Trading

#3 Account Features

When choosing a forex broker, you must consider the account features. Some of the things you might want to look for include:

- Minimum Deposit Requirements

- Leverage Ratios

- Commissions and Spreads

- Initial Deposit

- Commission Fees

- Leverage and Margin

- Ease of Deposits and Withdrawals

#4 Customer Support

A broker’s customer service should be accessible since Forex trading takes place 24 hours a day, seven days a week. In addition, think about whether it’s easy to get an actual person on the phone. A quick call to a forex broker can indicate their customer service and average wait periods.

What Is A Forex Broker?

A forex broker is an intermediary between traders and the foreign exchange market. They provide a platform where traders can buy and sell currencies and other services such as margin trading, which allows traders to borrow money to trade with.

The role of the forex brokers has become more important in recent years as the forex market has become more accessible to retail investors. Only large financial institutions and banks traded forex in the past, but now many online brokers allow retail investors to trade forex.

Generally, online forex brokers enable traders to largely use electronic trading platforms that the broker supports to execute forex deals. In addition to offering their own software for trading, many popular online forex brokers also support 3rd party MetaQuotes platforms, including MetaTrader 4 and 5 (MT4/5).

In addition, many forex brokers also provide extensive educational information for beginners, which may be utilized to improve their trading knowledge. They might also provide expert Forex market analysis and financial news feeds to assist you in making better trading decisions. Moreover, forex brokers make their money by charging commissions and spreads on the transactions they facilitate.

Why Trade Forex?

A forex transaction is the simultaneous purchase of one currency and the sale of another at a set exchange rate. Forex traders profit by selling one currency pair cheap and expensive or buying one pair high and selling it low.

A significant number of individuals trade forex because it’s a relatively easy process to get started. Once you open a trading account, download a free platform like MetaTrader. Trades can be executed quickly and easily, so traders have the flexibility to set their own pace. Plus, making money is another big motive for why people engage in forex trading.

This is usually where investors begin since they can gain a handle on the market without being overwhelmed by the asset they’re trading.

How Do I Know If My Forex Broker Is Regulated?

It is important to know if your forex broker is regulated. This will ensure that your broker is held accountable to a higher standard and that your funds are protected. The best way to find out is to check the broker’s website or contact them directly.

It is also good to check the regulator’s website to see if the broker is listed. For example, in the United States, you can check with the National Futures Association (NFA) or the Commodity Futures Trading Commission (CFTC). Moreover, check the reviews for your broker to see what other traders have to say about their experience.

Here is how you can determine if your forex broker is regulated:

👍 Check their license number

👍 Check Their Registration Status

👍 Find Their Membership Status

👍 Verify Details

👍 Global Availability

👍 Forex Brokers List

One must comprehend the currency pair offerings, account specifics (initial deposit, deposits/withdrawals, commissions/spreads, leverage, and margin), customer service, regulatory compliance, and trading platforms while thinking about how to select the finest Forex broker in 2022. Before choosing the finest Forex broker, take the time to read customer evaluations from both the broker’s past and present clients to get a sense of how well they performed when offering Forex services to individuals. Finding the best broker to trade with is essential for successful FX trading

The team at AsiaForexMentor.Com spent hours carefully compiling and curating the list of top brokers for this year’s edition of the best Forex brokers 2022. The flexible table below, in particular, offers a thorough comparison of Forex brokers that can be customized to a person’s preferences.

- View comparison

- Read Review

- Read Review

- Read Review

- Read Review

- Read Review

- Read Review

- Read Review

- Read Review

- Read Review

- Read Review

- Read Review

- Read Review

- Read Review

- Read Review

- Read Review

- Read Review

- Read Review

- Read Review

- Read Review

- Read Review

- Dukascopy Bank SA

- Markets.com

- GrandCapital

- FBS

- FreshForex

- FxPro

- Alpari

- DBG Markets

- FIBO Group

- HotForex

- HYCM

- OANDA

- Saxo Bank

- FXCM

- RoboMarkets

- Swissquote

- FXDD

- DeltaStock

- ActivTrades

- Admiral Markets

- NordFX

- BCS Forex

- DeltaStock

- ActivTrades

- Admiral Markets

- NordFX

- BCS Forex

- IFC Markets

- Dukascopy Europe

- Orbex

- EasyMarkets

- XTB.com

- CMC Markets

- Octa FX

- LMFX

- ICM Capital

- PhillipCapital UK

- Hantec Markets

- Finam Forex

- Core Spreads

- Fort Financial Service

- BMFN

- FxGiants

- Degiro

- GO Markets

- Forex.ee

- Tickmill

- Yadix.com

- Instaforex

- etoro

- Swiss Markets

- PSB Forex

- ICE FX

- FriedbergDirect

- TrioMarkets

- iOCBCfx

- UOB Kay Hian

- KGI Futures

- KE Forex

- City Index Singapore

- Haitong

- FXCitizen

- Land FX

- Pepperstone

- Vantage FX

- AXITrader

- Ak Investment

- InvestAZ

- Corner Trader

- Abshire-Smith

| Rank | Forex Broker | Founded | Regulated | Reviews | Payment Systems | Broker Type | Min. Deposit | Max. Leverage | Live Spread Euro/USD | Deposit Bonus | Accounts | Scalping | Bank Broker | VIP accounts | Micro accounts | Cent accounts | Hedging | No deposit Bonus | ECN accounts | Swap-free accounts | Trading instruments | Accepting US traders? | Provision of VPS | STP accounts | Phone Trading | 24-hour support | Number of CFD assets | Mobile trading | Accrual of % to deposit | Trust management | Affiliate program | Country of Headquarters | Countries of offices | Deposit Currency | Trading Conditions | Mobile Trading | Auto Trading | Deposit Method | Withdrawal Method | Trading Platform | Web-based Platform | Number of currency pairs | Stock exchange instruments | Entry to Stock Exchange | Support live chat | FAQ | support language | support website language | Standarad Accounts | Segregated Accounts | Unlimited Demo | Forigen Currency accounts | OCO orders | Trailing Stop | Gauranted Stop Loss | Cashback Rebate | Self-developed trading platform | Availability of API | Autochartist support | Trading signals | Trading with expert advisers | Speed of order execution | Maximum number of trades | Maximum position size | Locked Margin level | Stop Out level | Margin Call level | Fixed Spread | Floating Spread | 4 Digit Quotes | 5 Digit Quotes | No deposit Bonus | Add to Comparison |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

1

|

Read Review | 2006 | ASIC, CBI | Yes |

Warning: Undefined variable $taxonomy in /home/qezi44pa/public_html/wp-content/plugins/wp-custom-repeator/frontend/front-end.php on line 780

Paypal Brokers

|

NDD | 100 $ | 1:400 | N/A | – |

Real

Demo

|

Yes | – | – | – | – | Yes | – | – | – | Currency, CFD’s | – | No | – | No | – | 200 | iOS, Android | – | PAMM | – | Ireland | Australia, Germany | – | Trading conditions | iOS, Android | – | [“MetaTrader 4, Meta Trader 4 Mobile”] | Yes | Yes | 47 | – | – | – | – | – | – | – | – | – | – | No | Yes | No | No | No | No | No | Yes | – | 500 | – | – | 10% | 10% | live spread | – | – | – | – |

Added

|

||

|

2

|

Read Review | 2008 | FCA, ASIC | Yes |

Warning: Undefined variable $taxonomy in /home/qezi44pa/public_html/wp-content/plugins/wp-custom-repeator/frontend/front-end.php on line 780

Cent Account Brokers

|

Multi-Asset | 0 $ | 1:2000 | – | – |

Real

Demo

|

Yes | – | No | No | – | Yes | – | – | – | Currency, CFD’s | Yes | No | – | Yes | – | 8700 | iOS, Android | 10 | LAMM, MAM | – | United Kingdom | UK, Cyprus, Australia, New Zealand, South Africa, Israel, Singapore, and the Seychelles | – | Trading conditions | iOS, Android | MQL.5 Signals | [“MetaTrader 4, MetaTrader 5”] | Yes | Yes | 50 | Promotions, Depositary Receipts (ADR and GDR) | Entry to stock exchanges | – | – | – | – | – | – | – | – | No | Yes | No | No | No | No | No | Yes | – | No limit | 100 лотов | 25% | 10% | 40% | spread | – | – | – | – |

Added

|

||

|

3

|

Read Review | 2005 | ASIC, CySEC, ESMA | Yes |

Warning: Undefined variable $taxonomy in /home/qezi44pa/public_html/wp-content/plugins/wp-custom-repeator/frontend/front-end.php on line 780

Paypal Brokers

|

ECN, STP, NDD | 0 $ | 1:2000 | – | – |

Real

Demo

|

Yes | – | – | – | – | Yes | – | – | – | Currency, CFD’s | No | No | – | No | – | – | iOS, Android | – | – | – | Australia | Australia, Cyprus, UAE, China, St. Vincent and the Grenadines | – | Trading conditions | iOS, Android | MQL.5 Signals | [“MetaTrader 4, MetaTrader 5”] | Yes | No | – | – | – | – | – | – | – | – | – | – | – | No | Yes | No | No | No | No | No | Yes | 0.01 sec | No limit | No limit | 100% | 50% | 30% | spread | – | – | – | – |

Added

|

||

|

4

|

Read Review | 2013 | ASIC, FMA, VFSC, FSC | Yes |

Warning: Undefined variable $taxonomy in /home/qezi44pa/public_html/wp-content/plugins/wp-custom-repeator/frontend/front-end.php on line 780

Scalping Forex Brokers

|

STP | 0$ | 1:500 | – | – |

Real

Demo

|

Yes | – | – | – | – | Yes | – | – | – | Currency, CFD’s | No | No | – | Yes | – | – | iOS, Android | – | PAMM, MAM | – | Australia | – | – | Trading conditions | iOS, Android | – | [“MetaTrader 4, MetaTrader 5”] | Yes | No | 390 | – | – | – | – | – | – | – | – | – | – | No | Yes | No | No | No | No | No | Yes | 0.001 sec | 200 | 100 лотов | – | 50% | 100% | No | Yes | No | Yes | – |

Added

|

||

|

5

|

Read Review | 2008 | FCA, CySEC | Yes |

Warning: Undefined variable $taxonomy in /home/qezi44pa/public_html/wp-content/plugins/wp-custom-repeator/frontend/front-end.php on line 780

Cent Account Brokers

|

MM | 0 $ | 1:500 | N/A | – |

Real

Demo

|

No | – | – | – | – | Yes | – | – | – | Currency, CFD’s | – | No | – | No | – | 20000 | iOS, Android | – | PAMM, LAMM | – | Cyprus | United Kingdom, Cyprus | – | Trading conditions | iOS, Android | MQL.5 Signals | [“MetaTrader 4, MetaTrader 5”] | Yes | No | 39 | – | – | – | – | – | – | – | – | – | – | No | Yes | No | No | No | No | No | Yes | 0.1 sec | – | – | 50% | 50% | 50% | No | Yes | No | Yes | – |

Added

|

||

|

6

|

Read Review | 2009 | ASIC, IFSC | Yes |

Warning: Undefined variable $taxonomy in /home/qezi44pa/public_html/wp-content/plugins/wp-custom-repeator/frontend/front-end.php on line 780

Cent Account Brokers

|

ECN | 20 $ | 1:100 | N/A | – |

Real

Demo

|

Yes | – | – | – | – | Yes | – | – | – | Currency, CFD’s | – | No | – | No | – | 79 | iOS, Android | – | – | – | Cyprus | Australia, Belize | – | Trading conditions | iOS, Android | – | [“MetaTrader 4, Meta Trader 4 Mobile”] | Yes | No | 56 | – | – | – | – | – | – | – | – | – | – | No | Yes | No | No | No | No | No | Yes | – | – | 100 лотов | – | 50% | 100% | No | Yes | Yes | No | – |

Added

|

||

|

7

|

Read Review | 2012 | CySEC, FSA | Yes |

Warning: Undefined variable $taxonomy in /home/qezi44pa/public_html/wp-content/plugins/wp-custom-repeator/frontend/front-end.php on line 780

Cent Account Brokers

|

– | – | – | – | – |

Real

Demo

|

Yes | – | – | – | – | Yes | – | – | – | Currency, CFD’s | – | No | – | – | – | – | – | – | – | – | – | – | – | – | – | – | [“”] | – | – | – | – | – | – | – | – | – | – | – | – | – | No | Yes | No | No | No | No | No | Yes | – | – | – | – | – | – | – | – | – | – | – |

Added

|

||

|

8

|

Read Review | 2018 | CySEC, FCA | Yes |

Warning: Undefined variable $taxonomy in /home/qezi44pa/public_html/wp-content/plugins/wp-custom-repeator/frontend/front-end.php on line 780

Cent Account Brokers

|

– | 0 $ | 1:1000 | – | – |

Real

Demo

|

Yes | – | – | – | – | Yes | – | – | – | Currency, CFD’s | – | No | – | Yes | – | 200 | iOS, Android | 13 | PAMM | – | – | – | – | Trading conditions | iOS, Android | – | [“MetaTrader 4, MetaTrader 5”] | Yes | No | 390 | – | – | – | – | – | – | – | – | – | – | No | Yes | No | No | No | No | No | Yes | 0.1 sec. | – | – | 50% | 50% | 50% | No | Yes | Yes | No | – |

Added

|

||

|

9

|

Read Review | 2011 | CySEC, MISA, FSCA, FSC | Yes |

Warning: Undefined variable $taxonomy in /home/qezi44pa/public_html/wp-content/plugins/wp-custom-repeator/frontend/front-end.php on line 780

Paypal Brokers

|

– | 1 $ | 1:500 | – | – |

Real

Demo

|

Yes | – | – | – | – | Yes | – | – | – | Currency, Cryptocurrencies | – | No | – | Yes | – | 59 | iOS, Android | – | PAMM | – | Saint Vincent | – | – | Trading conditions | iOS, Android | – | [“”] | Yes | No | 44 | – | – | – | – | – | – | – | – | – | – | No | Yes | No | No | No | No | No | Yes | – | – | 1000 лотов | – | 50% | 100% | No | Yes | Yes | Yes | – |

Added

|

||

|

10

|

Read Review | 2007 | BVI FSC | Yes |

Warning: Undefined variable $taxonomy in /home/qezi44pa/public_html/wp-content/plugins/wp-custom-repeator/frontend/front-end.php on line 780

Cent Account Brokers

|

CFD, Multi-Asset | 100 $ | 1:50 | – | – |

Real

Demo

|

Yes | – | – | – | – | Yes | – | – | – | Currency, Cryptocurrencies | Yes | No | – | Yes | – | 70 | iOS, Android | – | – | – | British Virgin Islands | – | – | Trading conditions | iOS, Android | Zulutrade | [“MetaTrader 4, Meta Trader 4 Mobile”] | Yes | No | 50 | – | – | – | – | – | – | – | – | – | – | No | Yes | No | No | No | No | No | Yes | – | No limit | 1000 лотов | – | 10% | 20% | No | Yes | Yes | Yes | – |

Added

|

||

|

11

|

Read Review | 1978 | FINRA, SEC | Yes |

Warning: Undefined variable $taxonomy in /home/qezi44pa/public_html/wp-content/plugins/wp-custom-repeator/frontend/front-end.php on line 780

Cent Account Brokers

|

– | 20 $ | 1:1000 | – | – |

|

Yes | – | – | – | – | Yes | – | – | – | Currency, CFD’s | – | No | – | Yes | – | 78 | iOS, Android | – | – | – | – | – | – | Trading conditions | iOS, Android | – | [“FOREXTrader PRO, MetaTrader 4”] | Yes | Yes | 47 | – | – | – | – | – | – | – | – | – | – | No | Yes | No | No | No | No | No | Yes | – | – | 1000 лотов | – | 10% | 20% | No | Yes | No | Yes | – |

Added

|

||

|

12

|

Read Review | 2014 | FCA, VFSC, FSA, FINRA, ASIC | Yes |

Warning: Undefined variable $taxonomy in /home/qezi44pa/public_html/wp-content/plugins/wp-custom-repeator/frontend/front-end.php on line 780

Cent Account Brokers

|

– | 50 $ | 1:1000 | – | – |

|

Yes | – | – | – | – | Yes | – | – | – | Currency, CFD’s | – | No | – | No | – | – | iOS, Android | – | PAMM | – | – | – | – | Trading conditions | iOS, Android | – | [“”] | – | – | 39 | – | – | – | – | – | – | – | – | – | – | No | Yes | No | No | No | No | No | Yes | – | No limit | – | – | – | – | No | No | Yes | Yes | – |

Added

|

||

|

13

|

Read Review | 2011 | FSCA, CySEC, FSCA | Yes |

Warning: Undefined variable $taxonomy in /home/qezi44pa/public_html/wp-content/plugins/wp-custom-repeator/frontend/front-end.php on line 780

Cent Account Brokers

|

– | 100 $ | 1:1000 | – | – |

|

Yes | – | – | – | – | No | – | – | – | Currency, CFD’s | – | No | – | Yes | – | – | iOS, Android | 7 | – | – | – | – | – | Trading conditions | iOS, Android | – | [“MetaTrader 4, Meta Trader 4 Mobile”] | Yes | No | – | – | NASDAQ (US), NYSE (USA) | – | – | – | – | – | – | – | – | No | Yes | No | No | No | No | No | Yes | 0.001 sec. | No limit | 100 лотов | – | 20 % | 50 % | No | No | Yes | No | – |

Added

|

||

|

14

|

Read Review | 2010 | FCA, FSA | Yes |

Warning: Undefined variable $taxonomy in /home/qezi44pa/public_html/wp-content/plugins/wp-custom-repeator/frontend/front-end.php on line 780

Cent Account Brokers

|

ECN | 1 $ | 1:3000 | N/A | 100 % |

|

Yes | – | – | – | – | Yes | – | – | – | Currency, CFD’s | – | No | – | Yes | – | 300 | iOS, Android | – | – | – | Saint Vincent and the Grenadines | Afghanistan, Vietnam | – | Trading conditions | iOS, Android | – | [“MetaTrader 4, MetaTrader 5”] | Yes | No | 390 | Promotions, Futures | NASDAQ (US), NYSE (USA) | – | – | – | – | – | – | – | – | No | Yes | No | No | No | No | No | Yes | 0.03 sec. | No limit | 20 лотов | 50 % | 20 % | 50 % | No | No | Yes | Yes | – |

Added

|

||

|

15

|

Read Review | 2008 | IFSC | Yes |

Warning: Undefined variable $taxonomy in /home/qezi44pa/public_html/wp-content/plugins/wp-custom-repeator/frontend/front-end.php on line 780

Cent Account Brokers

|

NDD, ECN | 50 $ | 1:30 | N/A | 50 % |

|

No | – | – | – | – | Yes | – | – | – | Currency, CFD’s | – | No | – | Yes | – | – | iOS, Android | – | – | – | Belize | Belize | – | Trading conditions | iOS, Android | – | [“MetaTrader 4, MetaTrader 5”] | Yes | No | – | – | – | – | – | – | – | – | – | – | – | No | Yes | No | No | No | No | Yes | Yes | 0.0001 sec. | 1000 | 1000 лотов | 50 % | 30 % | 50 % | Yes | No | No | Yes | – |

Added

|

||

|

16

|

Read Review | 2007 | FSA | Yes |

Warning: Undefined variable $taxonomy in /home/qezi44pa/public_html/wp-content/plugins/wp-custom-repeator/frontend/front-end.php on line 780

Cent Account Brokers

|

NDD, ECN | 10000 $ | 1:40 | N/A | 25 % |

|

No | – | – | – | – | Yes | – | – | – | CFD’s, Cryptocurrencies | – | No | – | Yes | – | 1000 | iOS, Android | – | – | – | Saint Vincent and the Grenadines | Saint Vincent and the Grenadines | – | Trading conditions | iOS, Android | Etoro | [“eToro Trader”] | Yes | Yes | – | – | – | – | – | – | – | – | – | – | – | No | Yes | No | No | No | No | No | No | – | No limit | – | 20 % | 20 % | 20 % | No | Yes | Yes | No | – |

Added

|

||

|

17

|

Read Review | 2012 | – | Yes |

Warning: Undefined variable $taxonomy in /home/qezi44pa/public_html/wp-content/plugins/wp-custom-repeator/frontend/front-end.php on line 780

Cent Account Brokers

|

NDD, MM | 1000 $ | 1:200 | N/A | – |

|

Yes | – | – | – | – | Yes | – | – | – | Currency, CFD’s | – | No | – | No | – | 495 | iOS, Android | – | – | – | Georgia | Bulgaria, Georgia | – | Trading conditions | iOS, Android | – | [“”] | Yes | Yes | 91 | Promotions, Futures | NASDAQ (US), CME (USA) | – | – | – | – | – | – | – | – | No | Yes | No | No | No | No | No | No | – | – | – | – | – | – | Yes | No | Yes | No | – |

Added

|

||

|

18

|

Read Review | 2007 | RAUFR | Yes |

Warning: Undefined variable $taxonomy in /home/qezi44pa/public_html/wp-content/plugins/wp-custom-repeator/frontend/front-end.php on line 780

Cent Account Brokers

|

ECN, STP | 100 $ | 1:300 | N/A | 30 % |

Real

|

Yes | – | – | – | – | Yes | – | – | – | Currency, CFD’s | – | No | – | Yes | – | 1168 | iOS, Android | – | PAMM | – | Russia | Bangladesh, Ghana | – | Trading conditions | iOS, Android | – | [“Jforex”] | Yes | Yes | – | – | – | – | – | – | – | – | – | – | – | No | Yes | No | No | No | No | No | Yes | – | 200 | 250 лотов | – | 200 % | 100 % | No | Yes | No | Yes | – |

Added

|

||

|

19

|

Read Review | 2008 | ASIC, FCA | No |

Warning: Undefined variable $taxonomy in /home/qezi44pa/public_html/wp-content/plugins/wp-custom-repeator/frontend/front-end.php on line 780

Cent Account Brokers

|

NDD, STP | 10 $ | 1:2000 | N/A | – |

|

Yes | – | – | – | – | Yes | – | – | – | Currency, CFD’s | – | No | – | No | – | 2500 | iOS, Android | – | – | – | Cyprus | United Kingdom, China | – | Trading conditions | iOS, Android | – | [“MetaTrader 4, Market Mobile Trader”] | Yes | Yes | 50 | Promotions, Bonds | NASDAQ (US), CME (USA) | – | – | – | – | – | – | – | – | No | Yes | No | No | No | No | No | Yes | – | No limit | – | – | – | 20 % | No | Yes | Yes | No | – |

Added

|

||

|

20

|

Read Review | 1977 | FCA, CFTC | No |

Warning: Undefined variable $taxonomy in /home/qezi44pa/public_html/wp-content/plugins/wp-custom-repeator/frontend/front-end.php on line 780

Cent Account Brokers

|

MM | 1 $ | – | N/A | – |

Real

|

No | – | – | – | – | No | – | – | – | Currency, CFD’s | – | No | – | Yes | – | 400 | iOS, Android | – | – | – | USA | United Kingdom, Hong Kong | – | Trading conditions | iOS, Android | MQL.5 Signals | [“MetaTrader 4, Meta Trader 4 Mobile”] | Yes | Yes | 20 | Promotions, Futures | NASDAQ (US), CME (USA) | – | – | – | – | – | – | – | – | No | Yes | No | No | No | No | No | Yes | – | No limit | 1000 лотов | 25 % | 20 % | 50 % | No | Yes | Yes | Yes | – |

Added

|

||

|

21

|

Dukascopy Bank SA | 1998 | FINMA | No |

Warning: Undefined variable $taxonomy in /home/qezi44pa/public_html/wp-content/plugins/wp-custom-repeator/frontend/front-end.php on line 780

Cent Account Brokers

|

ECN | 0 $ | 1:1000 | – | – |

|

No | Yes | – | – | – | No | – | – | – | Currency, CFD’s | – | No | – | No | – | – | iOS, Android | – | – | – | Switzerland | Hong Kong, China | – | Trading conditions | iOS, Android | – | [“MetaTrader 4, Meta Trader 4 Mobile”] | No | No | – | – | – | – | – | – | – | – | – | – | – | No | No | No | No | No | No | No | No | 0.2 sec. | No limit | 100 лотов | 50 % | 20 % | 40 % | No | Yes | Yes | No | – |

Added

|

||

|

22

|

Markets.com | 2006 | CySEC | Yes |

Warning: Undefined variable $taxonomy in /home/qezi44pa/public_html/wp-content/plugins/wp-custom-repeator/frontend/front-end.php on line 780

Cent Account Brokers

|

NDD | 100 $ | 1:500 | – | 100% |

|

Yes | – | – | – | – | Yes | – | – | – | Currency, CFD’s | – | No | – | Yes | – | 130 | iOS, Android | 36 | PAMM, LAMM | – | Cyprus | – | – | Trading conditions | iOS, Android | – | [“MetaTrader 4”] | No | No | 390 | – | – | – | – | – | – | – | – | – | – | No | Yes | No | No | No | No | No | Yes | 0.1 sec. | No limit | 100 лотов | 25 % | 20 % | 40 % | No | Yes | Yes | Yes | – |

Added

|

||

|

23

|

GrandCapital | 2006 | – | Yes |

Warning: Undefined variable $taxonomy in /home/qezi44pa/public_html/wp-content/plugins/wp-custom-repeator/frontend/front-end.php on line 780

Cent Account Brokers

|

STP | 0 $ | 1:500 | – | 25 $ |

|

Yes | – | – | – | – | No | – | – | – | Currency, CFD’s | – | No | – | Yes | – | 71 | iOS, Android | – | PAMM, MAM | – | Russia | Azerbaijan, Bangladesh | – | Trading conditions | iOS, Android | – | [“MetaTrader 4, cTrader”] | Yes | Yes | 390 | – | – | – | – | – | – | – | – | – | – | No | Yes | No | No | No | No | No | Yes | 5.0E-5 sec. | No limit | 10000 лотов | – | 20 % | 20 % | No | No | Yes | Yes | – |

Added

|

||

|

24

|

FBS | 2009 | IFSC, NAFD | Yes |

Warning: Undefined variable $taxonomy in /home/qezi44pa/public_html/wp-content/plugins/wp-custom-repeator/frontend/front-end.php on line 780

Cent Account Brokers

|

ECN, STP | 5 $ | 1:1000 | – | 40% |

|

Yes | – | – | – | – | No | – | – | – | Currency, CFD’s | – | No | – | Yes | – | 70 | iOS, Android | – | PAMM | – | Belize | – | – | Trading conditions | iOS, Android | – | [“MetaTrader 4, cTrader”] | Yes | No | 389 | – | – | – | – | – | – | – | – | – | – | No | No | No | No | No | No | No | Yes | – | No limit | No limit | – | 20 % | – | No | Yes | Yes | Yes | – |

Added

|

||

|

25

|

FreshForex | 2004 | KROUFR | Yes |

Warning: Undefined variable $taxonomy in /home/qezi44pa/public_html/wp-content/plugins/wp-custom-repeator/frontend/front-end.php on line 780

Cent Account Brokers

|

NDD, MM | 100 $ | 1:400 | – | – |

|

No | – | – | – | – | Yes | – | – | – | Currency, CFD’s | – | No | – | No | – | – | iOS, Android | – | – | – | Russia | Saint Vincent and the Grenadines | – | Trading conditions | iOS, Android | – | [“MetaTrader 4, Meta Trader 4 Mobile”] | Yes | No | 390 | – | – | – | – | – | – | – | – | – | – | No | Yes | No | No | No | No | No | Yes | 0.3 sec. | 500 | No limit | – | 10 % | 40 % | No | No | No | Yes | – |

Added

|

||

|

26

|

FxPro | 2006 | FCA, CySEC | Yes |

Warning: Undefined variable $taxonomy in /home/qezi44pa/public_html/wp-content/plugins/wp-custom-repeator/frontend/front-end.php on line 780

Cent Account Brokers

|

NDD, ECN | 0 $ | 1:50 | – | – |

|

Yes | – | – | – | – | No | – | – | – | Currency, CFD’s | – | No | – | Yes | – | – | iOS, Android | – | – | – | United Kingdom | United Kingdom, Cyprus | – | Trading conditions | iOS, Android | – | [“MetaTrader 4, Meta Trader 4 Mobile”] | No | Yes | 390 | – | – | – | – | – | – | – | – | – | – | No | Yes | No | No | No | No | No | Yes | 0.01 sec. | No limit | 50 лотов | – | 10 % | 70 % | No | No | Yes | Yes | – |

Added

|

||

|

27

|

Alpari | 1998 | IFSC, NAFD | Yes |

Warning: Undefined variable $taxonomy in /home/qezi44pa/public_html/wp-content/plugins/wp-custom-repeator/frontend/front-end.php on line 780

Cent Account Brokers

|

ECN | 10000 $ | 1:100 | N/A | 100 % |

|

Yes | – | – | – | – | No | – | – | – | Currency, CFD’s | – | No | – | No | – | – | iOS, Android | – | – | – | Russia | Belize, Belarus | – | Trading conditions | iOS, Android | – | [“MetaTrader 4, Oanda FxTrade”] | Yes | Yes | 73 | – | – | – | – | – | – | – | – | – | – | No | Yes | No | No | No | No | No | Yes | – | – | – | – | – | – | No | Yes | Yes | No | – |

Added

|

||

|

28

|

DBG Markets | 2007 | ASIC, FCA, FSCA | Yes |

Warning: Undefined variable $taxonomy in /home/qezi44pa/public_html/wp-content/plugins/wp-custom-repeator/frontend/front-end.php on line 780

Cent Account Brokers

|

– | 0 $ | 1:100 | – | – |

|

Yes | – | – | – | – | Yes | – | – | – | Currency, CFD’s | – | No | – | Yes | – | 32421 | iOS, Android | – | – | – | – | – | – | Trading conditions | iOS, Android | – | [“SaxoTrader”] | Yes | Yes | 148 | Promotions, Futures | NASDAQ (US), CME (USA) | – | – | – | – | – | – | – | – | No | Yes | No | No | No | No | No | Yes | – | – | – | – | – | – | No | Yes | Yes | Yes | – |

Added

|

||

|

29

|

FIBO Group | 1998 | FSC, CNMV | Yes |

Warning: Undefined variable $taxonomy in /home/qezi44pa/public_html/wp-content/plugins/wp-custom-repeator/frontend/front-end.php on line 780

Cent Account Brokers

|

NDD, MM | 100 $ | 1:500 | – | – |

|

Yes | – | – | – | – | Yes | – | – | – | Currency, CFD’s | – | No | – | No | – | 57 | iOS, Android | – | LAMM, MAM | – | Austria | – | – | Trading conditions | iOS, Android | – | [“FXCM Trading Station, MetaTrader 4”] | Yes | Yes | 37 | – | – | – | – | – | – | – | – | – | – | No | Yes | No | No | No | No | No | Yes | 0.2 sec. | No limit | – | – | 100 % | 100 % | No | Yes | No | Yes | – |

Added

|

||

|

30

|

HotForex | 2010 | CySEC, FSC | No |

Warning: Undefined variable $taxonomy in /home/qezi44pa/public_html/wp-content/plugins/wp-custom-repeator/frontend/front-end.php on line 780

Cent Account Brokers

|

NDD | 1000 $ | 1:100 | – | – |

|

Yes | – | – | – | – | Yes | – | – | – | Currency, CFD’s | – | No | – | No | – | 8700 | iOS, Android | – | – | – | Cyprus | Mauritius, Saint Vincent and the Grenadines | – | Trading conditions | iOS, Android | MQL.5 Signals | [“MetaTrader 4, MetaTrader 5”] | Yes | Yes | 50 | Promotions, Depositary Receipts (ADR and GDR) | NASDAQ (US), CME (USA) | – | – | – | – | – | – | – | – | No | Yes | No | No | No | No | No | Yes | – | 200 | 100 лотов | 25 % | 20 % | 100 % | No | Yes | No | Yes | – |

Added

|

||

|

31

|

HYCM | 1977 | FCA | Yes |

Warning: Undefined variable $taxonomy in /home/qezi44pa/public_html/wp-content/plugins/wp-custom-repeator/frontend/front-end.php on line 780

Cent Account Brokers

|

MM | 250 $ | 1:50 | – | 10% |

|

No | – | – | – | – | No | – | – | – | Currency, CFD’s | – | No | – | Yes | – | 200 | iOS, Android | – | – | – | United Kingdom | Hong Kong, Cyprus | – | Trading conditions | iOS, Android | – | [“MetaTrader 4, Advanced Trader”] | No | No | – | – | – | – | – | – | – | – | – | – | – | No | No | No | No | No | No | No | No | – | No limit | No limit | 1 % | 0 % | 0 % | No | Yes | Yes | No | – |

Added

|

||

|

32

|

OANDA | 1996 | ASIC, FCA | Yes |

Warning: Undefined variable $taxonomy in /home/qezi44pa/public_html/wp-content/plugins/wp-custom-repeator/frontend/front-end.php on line 780

Cent Account Brokers

|

– | 100 $ | – | – | – |

|

Yes | – | – | – | – | Yes | – | – | – | Currency, CFD’s | – | No | – | Yes | – | 95 | iOS, Android | – | – | – | USA | Australia, Bangladesh | – | Trading conditions | iOS, Android | – | [“Jforex, MetaTrader 4”] | Yes | Yes | 59 | – | – | – | – | – | – | – | – | – | – | No | Yes | No | No | No | No | No | Yes | – | – | – | – | – | – | No | Yes | Yes | No | – |

Added

|

||

|

33

|

Saxo Bank | 1992 | ASIC, FCA | No |

Warning: Undefined variable $taxonomy in /home/qezi44pa/public_html/wp-content/plugins/wp-custom-repeator/frontend/front-end.php on line 780

Cent Account Brokers

|

ECN, STP | 100 $ | 1:400 | – | – |

|

No | Yes | – | – | – | No | – | – | – | Currency, CFD’s | – | No | – | Yes | – | – | iOS, Android | – | – | – | Denmark | Australia, Brazil | – | Trading conditions | iOS, Android | – | [“DeltaTrader, MetaTrader 4”] | No | No | – | – | – | – | – | – | – | – | – | – | – | No | No | No | No | No | No | No | No | 0.001 sec. | No limit | No limit | – | 20 % | 50 % | No | Yes | Yes | No | – |

Added

|

||

|

34

|

FXCM | 1999 | ASIC, FCA | Yes |

Warning: Undefined variable $taxonomy in /home/qezi44pa/public_html/wp-content/plugins/wp-custom-repeator/frontend/front-end.php on line 780

Cent Account Brokers

|

NDD | 0 $ | 1:500 | – | – |

|

Yes | – | – | – | – | Yes | – | – | – | Currency, CFD’s | – | No | – | Yes | – | 94 | iOS, Android | – | – | – | USA | Australia, United Kingdom | – | Trading conditions | iOS, Android | – | [“”] | – | – | – | – | – | – | – | – | – | – | – | – | – | No | No | No | No | No | No | No | Yes | 0.5 sec. | No limit | 100 лотов | 50 % | 30 % | 100 % | No | Yes | Yes | Yes | – |

Added

|

||

|

35

|

RoboMarkets | 2012 | CySEC | Yes |

Warning: Undefined variable $taxonomy in /home/qezi44pa/public_html/wp-content/plugins/wp-custom-repeator/frontend/front-end.php on line 780

Cent Account Brokers

|

NDD, ECN | 0 $ | 1:1000 | – | – |

|

Yes | – | – | – | – | Yes | – | – | – | Currency, CFD’s | – | No | – | Yes | – | 68 | iOS, Android | – | PAMM | – | Cyprus | Germany, Cyprus | – | Trading conditions | iOS, Android | MQL.5 Signals | [“MetaTrader 4, Meta Trader 4 Mobile”] | Yes | No | – | – | – | – | – | – | – | – | – | – | – | No | Yes | No | No | No | No | No | Yes | – | 100 | 1000 лотов | – | 20 % | 40 % | No | Yes | Yes | Yes | – |

Added

|

||

|

36

|

Swissquote | 1996 | FINMA | Yes |

Warning: Undefined variable $taxonomy in /home/qezi44pa/public_html/wp-content/plugins/wp-custom-repeator/frontend/front-end.php on line 780

Cent Account Brokers

|

STP | 1 $ | 1:200 | – | – |

|

Yes | – | – | – | – | Yes | – | – | – | Currency, Cryptocurrencies | – | No | – | Yes | – | 334 | iOS, Android | – | – | – | Switzerland | – | – | Trading conditions | iOS, Android | MQL.5 Signals | [“MetaTrader 4”] | No | No | – | Promotions, Futures | NASDAQ (US), CME (USA) | – | – | – | – | – | – | – | – | No | Yes | No | No | No | No | No | Yes | 0.005 sec. | 200 | 100 лотов | 25 % | 20 % | 100 % | No | No | Yes | Yes | – |

Added

|

||

|

37

|

FXDD | 2002 | MFSA | No |

Warning: Undefined variable $taxonomy in /home/qezi44pa/public_html/wp-content/plugins/wp-custom-repeator/frontend/front-end.php on line 780

Cent Account Brokers

|

NDD, ECN | 0 $ | 1:400 | – | – |

|

Yes | – | – | – | – | Yes | – | – | – | Currency, CFD’s | – | No | – | Yes | – | 500 | iOS, Android | 7 | – | – | Malta | – | – | Trading conditions | iOS, Android | – | [“MetaTrader 5, MetaTrader 5 Mobile”] | Yes | No | – | – | – | – | – | – | – | – | – | – | – | No | Yes | No | No | No | No | No | Yes | 0.01 sec. | No limit | No limit | – | 10 % | – | No | No | Yes | Yes | – |

Added

|

||

|

38

|

DeltaStock | 1998 | BNB | No |

Warning: Undefined variable $taxonomy in /home/qezi44pa/public_html/wp-content/plugins/wp-custom-repeator/frontend/front-end.php on line 780

Cent Account Brokers

|

NDD, ECN | 100 $ | 1:300 | – | – |

|

Yes | – | – | – | – | Yes | – | – | – | Currency, CFD’s | – | No | – | Yes | – | – | iOS, Android | – | – | – | Bulgaria | – | – | Trading conditions | iOS, Android | – | [“NetTradeX, MetaTrader 4”] | Yes | Yes | – | – | – | – | – | – | – | – | – | – | – | No | Yes | No | No | No | No | No | No | 0.4 sec. | 200 | No limit | – | 200 % | 100 % | No | No | Yes | No | – |

Added

|

||

|

39

|

ActivTrades | 2001 | FCA, CNMV | Yes |

Warning: Undefined variable $taxonomy in /home/qezi44pa/public_html/wp-content/plugins/wp-custom-repeator/frontend/front-end.php on line 780

Cent Account Brokers

|

NDD | 0 $ | 1:40 | – | – |

|

No | – | – | – | – | No | – | – | – | Currency, CFD’s | – | No | – | Yes | – | 34 | iOS, Android | – | – | – | Estonia | Bulgaria, United Kingdom | – | Trading conditions | iOS, Android | – | [“Jforex”] | No | No | 29 | – | – | – | – | – | – | – | – | – | – | No | No | No | No | No | No | No | Yes | 0.002 sec. | – | No limit | 50 % | 85 % | 100 % | No | Yes | No | Yes | – |

Added

|

||

|

40

|

Admiral Markets | 2001 | FCA, CNMV | No |

Warning: Undefined variable $taxonomy in /home/qezi44pa/public_html/wp-content/plugins/wp-custom-repeator/frontend/front-end.php on line 780

Cent Account Brokers

|

NDD, ECN | 500 $ | 1:500 | – | – |

|

Yes | – | – | – | – | Yes | – | – | – | Currency | – | No | – | Yes | – | – | iOS, Android | – | – | – | Vanuatu | – | – | Trading conditions | iOS, Android | – | [“”] | – | – | – | – | – | – | – | – | – | – | – | – | – | No | Yes | No | No | No | No | No | No | – | No limit | – | – | 20 % | – | No | Yes | Yes | No | – |

Added

|

||

|

41

|

NordFX | 2008 | SEBI, VFSC | Yes |

Warning: Undefined variable $taxonomy in /home/qezi44pa/public_html/wp-content/plugins/wp-custom-repeator/frontend/front-end.php on line 780

Cent Account Brokers

|

NDD, ECN | 10 $ | 1:200 | – | 100% |

|

No | – | – | – | – | No | – | – | – | Currency, CFD’s | – | No | – | Yes | – | – | iOS, Android | – | – | – | Saint Vincent and the Grenadines | India, Thailand | – | Trading conditions | iOS, Android | Zulutrade | [“MetaTrader 5, MetaTrader 5 Mobile”] | Yes | No | – | – | – | – | – | – | – | – | – | – | – | No | Yes | No | No | No | No | No | Yes | 0.1 sec. | – | 50 лотов | 50 % | 20 % | – | No | Yes | No | Yes | – |

Added

|

||

|

42

|

BCS Forex | 2006 | MFSA | No |

Warning: Undefined variable $taxonomy in /home/qezi44pa/public_html/wp-content/plugins/wp-custom-repeator/frontend/front-end.php on line 780

Cent Account Brokers

|

NDD, ECN | 100 $ | 1:300 | – | – |

|

Yes | – | – | – | – | Yes | – | – | – | Currency | – | No | – | Yes | – | 2000 | iOS, Android | – | – | – | Malta | – | – | Trading conditions | iOS, Android | – | [“MetaTrader 4, Meta Trader 4 Mobile”] | No | No | 59 | – | – | – | – | – | – | – | – | – | – | No | Yes | No | No | No | No | No | Yes | – | No limit | – | – | – | – | No | Yes | Yes | No | – |

Added

|

||

|

43

|

DeltaStock | 1998 | BNB | No |

Warning: Undefined variable $taxonomy in /home/qezi44pa/public_html/wp-content/plugins/wp-custom-repeator/frontend/front-end.php on line 780

Cent Account Brokers

|

NDD, ECN | 1 $ | 1:5000 | – | – |

|

No | – | – | – | – | No | – | – | – | Currency, CFD’s | – | No | – | No | – | – | iOS, Android | – | PAMM | – | Bulgaria | – | – | Trading conditions | iOS, Android | – | [“”] | No | No | 109 | – | – | – | – | – | – | – | – | – | – | No | Yes | No | No | No | No | No | No | – | – | 1000 лотов | – | 10 % | 30 % | Yes | No | Yes | No | – |

Added

|

||

|

44

|

ActivTrades | 2001 | FCA, CNMV | Yes |

Warning: Undefined variable $taxonomy in /home/qezi44pa/public_html/wp-content/plugins/wp-custom-repeator/frontend/front-end.php on line 780

Cent Account Brokers

|

NDD | 0 $ | 1:200 | – | – |

|

No | – | – | – | – | Yes | – | – | – | Currency, CFD’s | – | No | – | No | – | 100 | iOS, Android | 3 | PAMM | – | Estonia | Bulgaria, United Kingdom | – | Trading conditions | iOS, Android | – | [“”] | Yes | Yes | 101 | Promotions, Futures | NASDAQ (US), LSE (United Kingdom) | – | – | – | – | – | – | – | – | No | Yes | No | No | No | No | No | No | 0.09 sec. | – | No limit | 5 % | 50 % | 100 % | Yes | No | Yes | No | – |

Added

|

||

|

45

|

Admiral Markets | 2001 | FCA, CNMV | No |

Warning: Undefined variable $taxonomy in /home/qezi44pa/public_html/wp-content/plugins/wp-custom-repeator/frontend/front-end.php on line 780

Cent Account Brokers

|

NDD, ECN | 1 $ | 1:400 | – | – |

|

Yes | – | – | – | – | Yes | – | – | – | Currency, CFD’s | – | No | – | Yes | – | – | iOS, Android | – | – | – | Vanuatu | – | – | Trading conditions | iOS, Android | – | [“MetaTrader 4”] | Yes | Yes | – | – | – | – | – | – | – | – | – | – | – | No | Yes | No | No | No | No | No | Yes | – | – | – | – | – | – | No | Yes | No | No | – |

Added

|

||

|

46

|

NordFX | 2008 | SEBI, VFSC | Yes |

Warning: Undefined variable $taxonomy in /home/qezi44pa/public_html/wp-content/plugins/wp-custom-repeator/frontend/front-end.php on line 780

Cent Account Brokers

|

NDD, ECN | 100 $ | 1:400 | – | 100% |

|

No | – | – | – | – | No | – | – | – | – | – | No | – | No | – | – | iOS, Android | – | – | – | Saint Vincent and the Grenadines | India, Thailand | – | Trading conditions | iOS, Android | – | [“MetaTrader 4”] | Yes | No | – | – | – | – | – | – | – | – | – | – | – | No | No | No | No | No | No | No | No | – | – | – | – | – | – | Yes | Yes | No | No | – |

Added

|

||

|

47

|

BCS Forex | 2006 | FSA | No |

Warning: Undefined variable $taxonomy in /home/qezi44pa/public_html/wp-content/plugins/wp-custom-repeator/frontend/front-end.php on line 780

Cent Account Brokers

|

NDD, ECN | 250 $ | 1:200 | – | 50% |

|

No | Yes | – | – | – | No | – | – | – | – | – | No | – | No | – | 1500 | iOS, Android | – | – | – | Cyprus | – | – | Trading conditions | iOS, Android | – | [“MetaTrader 4”] | Yes | Yes | 46 | – | – | – | – | – | – | – | – | – | – | No | No | No | No | No | No | No | Yes | – | – | 50 лотов | 50 % | 30 % | 30 % | Yes | Yes | Yes | Yes | – |

Added

|

||

|

48

|

IFC Markets | 2006 | FSC, CySEC | No |

Warning: Undefined variable $taxonomy in /home/qezi44pa/public_html/wp-content/plugins/wp-custom-repeator/frontend/front-end.php on line 780

Cent Account Brokers

|

STP | 0 $ | 1:500 | – | – |

|

Yes | – | – | – | – | Yes | – | – | – | Currency, CFD’s | – | No | – | No | – | 10042 | iOS, Android | – | – | – | Latvia | Latvia | – | Trading conditions | iOS, Android | – | [“MetaTrader 4, Meta Trader 4 Mobile”] | Yes | Yes | 389 | – | – | – | – | – | – | – | – | – | – | No | Yes | No | No | No | No | No | Yes | – | 200 | – | – | – | – | No | No | No | Yes | – |

Added

|

||

|

49

|

Dukascopy Europe | 2010 | FCMC | No |

Warning: Undefined variable $taxonomy in /home/qezi44pa/public_html/wp-content/plugins/wp-custom-repeator/frontend/front-end.php on line 780

Cent Account Brokers

|

ECN | 100 $ | 1:500 | – | – |

|

No | – | – | – | – | No | – | – | – | Currency, CFD’s | – | No | – | No | – | 44 | iOS, Android | – | – | – | Russia | – | – | Trading conditions | iOS, Android | – | [“CMC Next Generation”] | Yes | Yes | 27 | – | – | – | – | – | – | – | – | – | – | No | Yes | No | No | No | No | No | Yes | 0.1 sec. | – | – | – | 15 % | 25 % | No | Yes | No | Yes | – |

Added

|

||

|

50

|

Orbex | 2014 | VFSC | Yes |

Warning: Undefined variable $taxonomy in /home/qezi44pa/public_html/wp-content/plugins/wp-custom-repeator/frontend/front-end.php on line 780

Cent Account Brokers

|

ECN, STP | 50 $ | 1:1000 | – | – |

|

Yes | – | – | – | – | Yes | – | – | – | Currency, CFD’s | – | No | – | No | – | 92 | iOS, Android | – | – | – | Cyprus | Australia, China | – | Trading conditions | iOS, Android | – | [“cTrader, MetaTrader 4”] | Yes | No | 47 | – | – | – | – | – | – | – | – | – | – | No | Yes | No | No | No | No | No | Yes | – | – | 100 лотов | – | 15 % | 30 % | No | Yes | No | Yes | – |

Added

|

||

|

51

|

EasyMarkets | 2001 | ASIC, CySEC | Yes |

Warning: Undefined variable $taxonomy in /home/qezi44pa/public_html/wp-content/plugins/wp-custom-repeator/frontend/front-end.php on line 780

Cent Account Brokers

|

MM | 200 $ | 1:200 | – | – |

|

Yes | – | – | – | – | Yes | – | – | – | Currency, CFD’s | – | No | – | No | – | 49 | iOS, Android | – | MAM | – | United Kingdom | Hungary, Germany | – | Trading conditions | iOS, Android | – | [“MetaTrader 4, Meta Trader 4 Mobile”] | Yes | No | 32 | – | – | – | – | – | – | – | – | – | – | No | Yes | No | No | No | No | No | Yes | – | – | – | – | – | – | No | No | No | Yes | – |

Added

|

||

|

52

|

XTB.com | 2002 | FCA, CNMV | Yes |

Warning: Undefined variable $taxonomy in /home/qezi44pa/public_html/wp-content/plugins/wp-custom-repeator/frontend/front-end.php on line 780

Cent Account Brokers

|

NDD, STP | 200 $ | 1:400 | – | – |

|

Yes | – | – | – | – | Yes | – | – | – | Currency, CFD’s | – | No | – | No | – | 59 | iOS, Android | – | – | – | United Kingdom | Australia, Austria | – | Trading conditions | iOS, Android | – | [“MetaTrader 4, Meta Trader 4 Mobile”] | Yes | No | 37 | – | – | – | – | – | – | – | – | – | – | No | Yes | No | No | No | No | No | Yes | – | – | 50 лотов | – | 50 % | 100 % | No | Yes | Yes | No | – |

Added

|

||

|

53

|

CMC Markets | 1989 | ASIC, FCA | Yes |

Warning: Undefined variable $taxonomy in /home/qezi44pa/public_html/wp-content/plugins/wp-custom-repeator/frontend/front-end.php on line 780

Cent Account Brokers

|

NDD, STP | 1000 $ | 1:200 | – | – |

|

Yes | – | – | – | – | Yes | – | – | – | Currency, CFD’s | – | No | – | No | – | 80 | iOS, Android | – | MAM | – | Saint Vincent and the Grenadines | United Kingdom | – | Trading conditions | iOS, Android | – | [“MetaTrader 4, Meta Trader 4 Mobile”] | Yes | No | 42 | – | – | – | – | – | – | – | – | – | – | No | Yes | No | No | No | No | No | Yes | – | 500 | – | – | 20 % | – | No | Yes | Yes | No | – |

Added

|

||

|

54

|

Octa FX | 2011 | FCA, FSA | Yes |

Warning: Undefined variable $taxonomy in /home/qezi44pa/public_html/wp-content/plugins/wp-custom-repeator/frontend/front-end.php on line 780

Cent Account Brokers

|

ECN | 0 $ | 1:200 | – | 50 % |

|

Yes | – | – | – | – | Yes | – | – | – | Currency, CFD’s | – | No | – | No | – | 3000 | iOS, Android | 14 | – | – | USA | USA | – | Trading conditions | iOS, Android | – | [“MetaTrader 4, Meta Trader 4 Mobile”] | Yes | No | 30 | Promotions, Futures | NASDAQ (US), NYSE (USA) | – | – | – | – | – | – | – | – | No | Yes | No | No | No | No | No | Yes | – | – | – | 50 % | 30 % | 30 % | No | Yes | Yes | No | – |

Added

|

||

|

55

|

LMFX | 2015 | – | Yes |

Warning: Undefined variable $taxonomy in /home/qezi44pa/public_html/wp-content/plugins/wp-custom-repeator/frontend/front-end.php on line 780

Cent Account Brokers

|

NDD | 100 $ | 1:400 | – | – |

|

Yes | – | – | – | – | Yes | – | – | – | Currency, CFD’s | – | No | – | No | – | 200 | iOS, Android | – | PAMM | – | United Kingdom | China, Mauritius | – | Trading conditions | iOS, Android | – | [“MetaTrader 4, MetaTrader 5”] | Yes | Yes | 47 | – | – | – | – | – | – | – | – | – | – | No | Yes | No | No | No | No | No | Yes | – | – | – | – | 10 % | 10 % | No | Yes | Yes | No | – |

Added

|

||

|

56

|

ICM Capital | 2009 | – | Yes |

Warning: Undefined variable $taxonomy in /home/qezi44pa/public_html/wp-content/plugins/wp-custom-repeator/frontend/front-end.php on line 780

Cent Account Brokers

|

NDD | 1 $ | 1:240 | – | – |

|

No | – | – | – | – | No | – | – | – | Currency, CFD’s | – | No | – | No | – | 1605 | iOS, Android | – | – | – | United Kingdom | Australia | – | Trading conditions | iOS, Android | – | [“CoreTrader, MetaTrader 4”] | Yes | Yes | 33 | – | – | – | – | – | – | – | – | – | – | No | Yes | No | No | No | No | No | Yes | – | – | – | – | 20 % | 20 % | No | No | No | Yes | – |

Added

|

||

|

57

|

PhillipCapital UK | 1975 | ASIC, FCA | No |

Warning: Undefined variable $taxonomy in /home/qezi44pa/public_html/wp-content/plugins/wp-custom-repeator/frontend/front-end.php on line 780

Cent Account Brokers

|

NDD | 5 $ | 1:1000 | – | – |

|

Yes | – | – | – | – | Yes | – | – | – | Currency, CFD’s | – | No | – | No | – | * | iOS, Android | 5 | – | – | United Kingdom | Hong Kong, United Arab Emirates | – | Trading conditions | iOS, Android | – | [“MetaTrader 4, NinjaTrader”] | Yes | No | 35 | Promotions | NASDAQ (US), CME (USA) | – | – | – | – | – | – | – | – | No | Yes | No | No | No | No | No | Yes | 0.1 sec. | – | 100 лотов | – | 10 % | 30 % | No | No | Yes | Yes | – |

Added

|

||

|

58

|

Hantec Markets | 2009 | FCA | Yes |

Warning: Undefined variable $taxonomy in /home/qezi44pa/public_html/wp-content/plugins/wp-custom-repeator/frontend/front-end.php on line 780

Cent Account Brokers

|

NDD | 0 $ | 1:400 | – | – |

|

Yes | – | – | – | – | Yes | – | – | – | Currency, CFD’s | – | No | – | No | – | 90 | iOS, Android | – | LAMM, MAM | – | Russia | Russia | – | Trading conditions | iOS, Android | – | [“MetaTrader 4, Meta Trader 4 Mobile”] | Yes | No | 22 | Funds (ETF) | – | – | – | – | – | – | – | – | – | No | Yes | No | No | No | No | No | No | – | – | – | – | 100 % | 110 % | No | Yes | Yes | Yes | – |

Added

|

||

|

59

|

Finam Forex | 1994 | CBR, NAFD | No |

Warning: Undefined variable $taxonomy in /home/qezi44pa/public_html/wp-content/plugins/wp-custom-repeator/frontend/front-end.php on line 780

Cent Account Brokers

|

NDD, DMA | 50 $ | 1:500 | – | – |

|

Yes | Yes | – | – | – | Yes | – | – | – | Currency, CFD’s | – | No | – | No | – | 250 | iOS, Android | – | MAM | – | Ireland | Australia, Germany | – | Trading conditions | iOS, Android | – | [“MetaTrader 4, Meta Trader 4 Mobile”] | Yes | No | 389 | – | – | – | – | – | – | – | – | – | – | No | No | No | No | No | No | No | Yes | 0.01 sec. | – | 80 лотов | – | 20 % | 40 % | No | No | No | Yes | – |

Added

|

||

|

60

|

Core Spreads | 2014 | FCA | Yes |

Warning: Undefined variable $taxonomy in /home/qezi44pa/public_html/wp-content/plugins/wp-custom-repeator/frontend/front-end.php on line 780

Cent Account Brokers

|

NDD | 0 $ | – | – | 50 % |

|

No | – | – | – | – | No | – | – | – | CFD’s, Exchange | – | No | – | No | – | 100 | iOS, Android | – | – | – | United Kingdom | – | – | Trading conditions | iOS, Android | – | [“DEGIRO WebTrader”] | Yes | Yes | – | Promotions, Futures | NASDAQ (US), CME (USA) | – | – | – | – | – | – | – | – | No | No | No | No | No | No | No | Yes | – | – | – | – | – | – | No | Yes | Yes | No | – |

Added

|

||

|

61

|

Fort Financial Service | 2010 | IFSC | No |

Warning: Undefined variable $taxonomy in /home/qezi44pa/public_html/wp-content/plugins/wp-custom-repeator/frontend/front-end.php on line 780

Cent Account Brokers

|

NDD, ECN | 200 $ | 1:300 | – | 50 % |

|

Yes | – | – | – | – | Yes | – | – | – | Currency, CFD’s | – | No | – | No | – | 67 | iOS, Android | – | – | – | Belize | Malaysia | – | Trading conditions | iOS, Android | – | [“MetaTrader 4, Meta Trader 4 Mobile”] | Yes | No | 43 | – | – | – | – | – | – | – | – | – | – | No | Yes | No | No | No | No | No | Yes | – | – | – | – | 20 % | 80 % | Yes | No | No | Yes | – |

Added

|

||

|

62

|

BMFN | 1988 | ASIC, FCA | No |

Warning: Undefined variable $taxonomy in /home/qezi44pa/public_html/wp-content/plugins/wp-custom-repeator/frontend/front-end.php on line 780

Cent Account Brokers

|

NDD, DMA | – | 1:500 | – | 20 % |

|

Yes | – | – | – | – | Yes | – | – | – | Currency, Cryptocurrencies | – | No | – | No | – | 51 | iOS, Android | – | PAMM | – | United Kingdom | Australia, Bulgaria | – | Trading conditions | iOS, Android | – | [“MetaTrader 4, Meta Trader 4 Mobile”] | Yes | No | 45 | – | – | – | – | – | – | – | – | – | – | No | Yes | No | No | No | No | No | Yes | – | – | – | – | 15 % | 30 % | No | No | Yes | Yes | – |

Added

|

||

|

63

|

FxGiants | 2015 | ASIC, FCA | Yes |

Warning: Undefined variable $taxonomy in /home/qezi44pa/public_html/wp-content/plugins/wp-custom-repeator/frontend/front-end.php on line 780

Cent Account Brokers

|

ECN, STP | 10 $ | 1:500 | – | 20 % |

|

Yes | – | – | – | – | Yes | – | – | – | Currency, CFD’s | – | No | – | No | – | 84 | iOS, Android | – | – | – | Cyprus | Cyprus | – | Trading conditions | iOS, Android | – | [“MetaTrader 4”] | Yes | No | 62 | – | – | – | – | – | – | – | – | – | – | No | Yes | No | No | No | No | No | Yes | 0.1 sec. | – | – | – | 30 % | 100 % | No | Yes | Yes | No | – |

Added

|

||

|

64

|

Degiro | 2008 | BaFin | Yes |

Warning: Undefined variable $taxonomy in /home/qezi44pa/public_html/wp-content/plugins/wp-custom-repeator/frontend/front-end.php on line 780

Cent Account Brokers

|

NDD | 25 $ | 1:500 | – | – |

|

Yes | – | – | – | – | Yes | – | – | – | Currency, CFD’s | – | No | – | No | – | 77 | iOS, Android | – | MAM | – | Bulgaria | Netherlands | – | Trading conditions | iOS, Android | – | [“MetaTrader 4, Meta Trader 4 Mobile”] | No | No | 56 | – | – | – | – | – | – | – | – | – | – | No | Yes | No | No | No | No | No | Yes | – | – | – | – | 50 % | 100 % | No | No | No | Yes | – |

Added

|

||

|

65

|

GO Markets | 2006 | ASIC | No |

Warning: Undefined variable $taxonomy in /home/qezi44pa/public_html/wp-content/plugins/wp-custom-repeator/frontend/front-end.php on line 780

Cent Account Brokers

|

NDD | 100 $ | 1:400 | – | – |

|

Yes | – | – | – | – | Yes | – | – | – | Currency, CFD’s | – | No | – | No | – | 4600 | iOS, Android | – | – | – | Australia | – | – | Trading conditions | iOS, Android | – | [“MetaTrader 4, Meta Trader 4 Mobile”] | Yes | Yes | 63 | – | – | – | – | – | – | – | – | – | – | No | Yes | No | No | No | No | No | Yes | – | 200 | – | – | 50 % | 80 % | No | Yes | No | Yes | – |

Added

|

||

|

66

|

Forex.ee | 2004 | FSA | No |

Warning: Undefined variable $taxonomy in /home/qezi44pa/public_html/wp-content/plugins/wp-custom-repeator/frontend/front-end.php on line 780

Cent Account Brokers

|

NDD, ECN | 250 $ | 1:500 | – | 15 % |

|

No | – | – | – | – | No | – | – | – | – | – | No | – | No | – | – | iOS, Android | – | PAMM, MAM | – | Saint Vincent and the Grenadines | – | – | Trading conditions | iOS, Android | – | [“”] | No | No | – | – | – | – | – | – | – | – | – | – | – | No | No | No | No | No | No | No | No | – | 5 | – | – | – | – | Yes | Yes | No | Yes | – |

Added

|

||

|

67

|

Tickmill | 2014 | FCA, SIBA | Yes |

Warning: Undefined variable $taxonomy in /home/qezi44pa/public_html/wp-content/plugins/wp-custom-repeator/frontend/front-end.php on line 780

Cent Account Brokers

|

NDD | 100 $ | 1:500 | – | – |

|

Yes | – | – | – | – | Yes | – | – | – | Currency, CFD’s | – | No | – | No | – | – | – | – | PAMM | – | Seychelles | United Kingdom | – | Trading conditions | – | – | [“MetaTrader 4”] | Yes | Yes | 389 | – | — | – | – | – | – | – | – | – | – | No | Yes | No | No | No | No | No | Yes | – | – | 350 лотов | 100 % | 20 % | 100 % | No | Yes | No | No | – |

Added

|

||

|

68

|

Yadix.com | – | – | – |

Warning: Undefined variable $taxonomy in /home/qezi44pa/public_html/wp-content/plugins/wp-custom-repeator/frontend/front-end.php on line 780 – |

– | 200 $ | 1:40 | – | – |

|

No | – | – | – | – | Yes | – | – | – | Currency | – | No | – | No | – | 17 | iOS, Android | – | – | – | – | – | – | Trading conditions | iOS, Android | – | [“MetaTrader 5, MetaTrader 5 Mobile”] | Yes | No | 17 | – | – | – | – | – | – | – | – | – | – | No | Yes | No | No | No | No | No | No | – | – | 10 лотов | – | 50 % | 45 % | No | Yes | No | Yes | – |

Added

|

||

|

69

|

Instaforex | – | – | – |

Warning: Undefined variable $taxonomy in /home/qezi44pa/public_html/wp-content/plugins/wp-custom-repeator/frontend/front-end.php on line 780

Cent Account Brokers

|

– | 1500 $ | 1:300 | – | – |

|

Yes | – | – | – | – | Yes | – | – | – | Currency, CFD’s | – | No | – | No | – | 63 | iOS, Android | – | PAMM, MAM | – | – | – | – | Trading conditions | iOS, Android | – | [“MetaTrader 4”] | No | No | 3 | – | – | – | – | – | – | – | – | – | – | No | Yes | No | No | No | No | No | Yes | – | – | 1000 лотов | 50 % | 50 % | 100 % | No | Yes | No | Yes | – |

Added

|

||

|

70

|

etoro | – | – | – |

Warning: Undefined variable $taxonomy in /home/qezi44pa/public_html/wp-content/plugins/wp-custom-repeator/frontend/front-end.php on line 780

Cent Account Brokers

|

– | 30 $ | 1:33 | – | – |

|

No | – | – | – | – | No | – | – | – | Currency, CFD’s | – | No | – | No | – | 200 | iOS, Android | – | – | – | – | – | – | Trading conditions | iOS, Android | – | [“FXCM Trading Station”] | Yes | No | 36 | – | – | – | – | – | – | – | – | – | – | No | Yes | No | No | No | No | No | No | – | – | 500 лотов | – | 25 % | 90 % | No | Yes | No | Yes | – |

Added

|

||

|

71

|

Swiss Markets | 2012 | CySEC | Yes |

Warning: Undefined variable $taxonomy in /home/qezi44pa/public_html/wp-content/plugins/wp-custom-repeator/frontend/front-end.php on line 780

Cent Account Brokers

|

STP | 0 $ | 1:300 | – | – |

|

Yes | – | – | – | – | Yes | – | – | – | Currency, CFD’s | – | No | – | No | – | 101 | iOS, Android | – | PAMM, MAM | – | Germany | Cyprus | – | Trading conditions | iOS, Android | – | [“MetaTrader 4, Meta Trader 4 Mobile”] | Yes | No | 49 | – | – | – | – | – | – | – | – | – | – | No | Yes | No | No | No | No | No | Yes | – | – | – | – | 30 % | 200 % | Yes | No | Yes | No | – |

Added

|

||

|

72

|

PSB Forex | 2016 | CBR, NAFD | No |

Warning: Undefined variable $taxonomy in /home/qezi44pa/public_html/wp-content/plugins/wp-custom-repeator/frontend/front-end.php on line 780

Cent Account Brokers

|

NDD | 500 $ | 1:35 | – | – |

|

Yes | Yes | – | – | – | Yes | – | – | – | Currency, CFD’s | – | No | – | No | – | 500 | iOS, Android | – | – | – | Malaysia | – | – | Trading conditions | iOS, Android | – | [“iOCBC”] | Yes | Yes | 35 | – | – | – | – | – | – | – | – | – | – | No | Yes | No | No | No | No | No | No | – | – | – | – | 30 % | 100 % | No | Yes | Yes | No | – |

Added

|

||

|

73

|

ICE FX | 2015 | – | No |

Warning: Undefined variable $taxonomy in /home/qezi44pa/public_html/wp-content/plugins/wp-custom-repeator/frontend/front-end.php on line 780

Cent Account Brokers

|

STP | 1000 $ | 1:50 | – | 100 % |

|

No | – | – | – | – | No | – | – | – | Currency, CFD’s | – | No | – | No | – | – | iOS, Android | – | – | – | Canada | Cyprus | – | Trading conditions | iOS, Android | – | [“MetaTrader 4, UTRADE FX Elite”] | Yes | Yes | 34 | Bonds, Depositary Receipts (ADR and GDR) | NYSE (USA), LSE (United Kingdom) | – | – | – | – | – | – | – | – | No | Yes | No | No | No | No | No | No | – | – | – | – | 20 % | 100 % | No | Yes | Yes | No | – |

Added

|

||

|

74

|

FriedbergDirect | 2008 | IIROC | No |

Warning: Undefined variable $taxonomy in /home/qezi44pa/public_html/wp-content/plugins/wp-custom-repeator/frontend/front-end.php on line 780

Cent Account Brokers

|

NDD, STP | 0 $ | 1:50 | – | – |

|

Yes | – | – | – | – | Yes | – | – | – | Currency, Exchange | – | No | – | No | yes | 127 | iOS, Android | – | – | – | Cyprus | Germany | – | Trading conditions | iOS, Android | – | [“CQG Trader”] | Yes | Yes | 11 | Promotions, Futures | CME (USA), NYSE (USA) | yes | yes | English, Chinese | English, Chinese | – | – | – | – | No | Yes | No | No | No | No | No | No | – | – | – | – | 20 % | 100 % | No | Yes | Yes | No | – |

Added

|

||

|

75

|

TrioMarkets | 2014 | CySEC | Yes |

Warning: Undefined variable $taxonomy in /home/qezi44pa/public_html/wp-content/plugins/wp-custom-repeator/frontend/front-end.php on line 780

Cent Account Brokers

|

ECN, STP | 1000 $ | 1:50 | – | – |

|

Yes | – | – | – | – | Yes | – | – | – | Currency, CFD’s | – | No | – | No | yes | 1000 | iOS, Android | – | – | – | Singapore | – | – | Trading conditions | iOS, Android | – | [“Currenex Classic, KE Trade”] | Yes | Yes | 44 | Promotions, Futures | CME (USA), NYSE (USA) | yes | yes | English | English | – | – | – | – | No | Yes | No | No | No | No | No | No | – | – | – | – | 30 % | 100 % | No | Yes | Yes | No | – |

Added

|

||

|

76

|

iOCBCfx | 2004 | MAS | No |

Warning: Undefined variable $taxonomy in /home/qezi44pa/public_html/wp-content/plugins/wp-custom-repeator/frontend/front-end.php on line 780

Cent Account Brokers

|

NDD | 0 $ | 1:50 | – | – |

|

Yes | Yes | – | – | – | Yes | – | – | – | Currency, CFD’s | – | No | – | No | yes | 4500 | iOS, Android | – | – | – | Singapore | – | – | Trading conditions | iOS, Android | – | [“MetaTrader 4, AT Pro”] | Yes | Yes | 58 | – | – | yes | yes | English | English | — | – | – | – | No | Yes | No | No | No | No | No | Yes | – | 500 | – | – | 30 % | 100 % | No | Yes | No | No | – |

Added

|

||

|

77

|

UOB Kay Hian | 2000 | MAS | No |

Warning: Undefined variable $taxonomy in /home/qezi44pa/public_html/wp-content/plugins/wp-custom-repeator/frontend/front-end.php on line 780

Cent Account Brokers

|

NDD | 100 $ | 1:50 | – | – |

|

Yes | – | – | – | – | Yes | – | – | – | Currency, CFD’s | – | No | – | No | yes | 100 | iOS, Android | – | – | – | Singapore | United Kingdom, Hong Kong | – | Trading conditions | iOS, Android | – | [“MetaTrader 4, Currenex Classic”] | Yes | No | 6 | – | – | yes | yes | English, Chinese | English, Chinese | – | – | – | – | No | Yes | No | No | No | No | No | Yes | – | – | – | – | 50 % | 100 % | No | Yes | Yes | No | – |

Added

|

||

|

78

|

KGI Futures | 2001 | MAS | No |

Warning: Undefined variable $taxonomy in /home/qezi44pa/public_html/wp-content/plugins/wp-custom-repeator/frontend/front-end.php on line 780

Cent Account Brokers

|

NDD | 0 $ | 1:1000 | – | – |

|

Yes | – | – | – | – | Yes | – | – | – | Currency | – | No | – | No | yes | 38 | iOS, Android | – | – | – | Singapore | China | – | Trading conditions | iOS, Android | – | [“MetaTrader 4, Meta Trader 4 Mobile”] | Yes | No | 35 | – | – | yes | yes | English, Chinese | English, Chinese | – | – | – | – | No | Yes | No | No | No | No | No | Yes | – | – | – | – | 30 % | 100 % | No | Yes | Yes | Yes | – |

Added

|

||

|

79

|

KE Forex | 1972 | MAS | No |

Warning: Undefined variable $taxonomy in /home/qezi44pa/public_html/wp-content/plugins/wp-custom-repeator/frontend/front-end.php on line 780

Cent Account Brokers

|

NDD | 0 $ | 1:500 | – | – |

|

No | – | – | – | – | No | – | – | – | – | – | No | – | No | yes | – | iOS, Android | – | – | – | Singapore | – | – | Trading conditions | iOS, Android | Zulutrade | [“”] | Yes | No | – | – | – | yes | yes | English, Arab | English, Vietnamese | – | – | – | – | No | No | No | No | No | No | No | No | – | – | – | – | – | – | Yes | Yes | No | No | – |

Added

|

||

|

80

|

City Index Singapore | 2006 | MAS | No |

Warning: Undefined variable $taxonomy in /home/qezi44pa/public_html/wp-content/plugins/wp-custom-repeator/frontend/front-end.php on line 780

Cent Account Brokers

|

MM | 300 $ | 1:400 | – | – |

|

Yes | – | – | – | – | Yes | – | – | – | Currency, CFD’s | – | No | – | No | yes | 93 | iOS, Android | – | MAM | – | Singapore | Australia, United Kingdom | – | Trading conditions | iOS, Android | Zulutrade | [“MetaTrader 4, cTrader”] | Yes | No | 31 | – | – | yes | yes | English, Russian | English, Arab | – | – | – | – | No | Yes | No | No | No | No | No | Yes | – | – | – | – | 20 % | 90 % | No | No | No | Yes | – |

Added

|

||

|

81

|

Haitong | 2010 | MAS | No |

Warning: Undefined variable $taxonomy in /home/qezi44pa/public_html/wp-content/plugins/wp-custom-repeator/frontend/front-end.php on line 780

Cent Account Brokers

|

NDD, ECN | 200 $ | 1:500 | – | – |

|

Yes | Yes | – | – | – | Yes | – | – | – | Currency, CFD’s | – | No | – | No | yes | 56 | iOS, Android | – | PAMM, MAM | – | Singapore | – | – | Trading conditions | iOS, Android | Zulutrade | [“MetaTrader 4, MetaTrader 5”] | Yes | No | 38 | – | – | yes | yes | English | English, Vietnamese | – | – | – | – | No | Yes | No | No | No | No | No | Yes | – | – | – | – | 50 % | 80 % | No | No | No | Yes | – |

Added

|

||

|

82

|

FXCitizen | 2010 | VFSC | No |

Warning: Undefined variable $taxonomy in /home/qezi44pa/public_html/wp-content/plugins/wp-custom-repeator/frontend/front-end.php on line 780

Cent Account Brokers

|

NDD, ECN | 200 $ | 1:400 | – | – |

|

Yes | – | – | – | – | Yes | – | – | – | Currency, CFD’s | – | No | – | No | yes | 134 | iOS, Android | – | MAM | – | Belize | – | – | Trading conditions | iOS, Android | – | [“MetaTrader 4”] | Yes | No | 83 | – | – | yes | yes | English | English, Arab | – | – | – | – | No | Yes | No | No | No | No | No | Yes | – | – | – | – | 20 % | 90 % | No | No | No | Yes | – |

Added

|

||

|

83

|

Land FX | 2013 | FCA, FSCS | No |

Warning: Undefined variable $taxonomy in /home/qezi44pa/public_html/wp-content/plugins/wp-custom-repeator/frontend/front-end.php on line 780

Cent Account Brokers

|

NDD, ECN | 0 $ | 1:100 | – | 10 % |

|

Yes | – | – | – | – | Yes | – | – | – | Currency, Exchange | – | No | – | No | yes | 100 | iOS, Android | – | – | – | United Kingdom | Egypt, Indonesia | – | Trading conditions | iOS, Android | – | [“TradeAll”] | Yes | Yes | 28 | Futures, Promotions | NASDAQ (US), NYMEX (USA) | yes | yes | English, Turkish | English, Turkish | – | – | – | – | No | Yes | No | No | No | No | No | No | – | 1000 | – | – | 50 % | 100 % | Yes | No | Yes | No | – |

Added

|

||

|

84

|

Pepperstone | 2010 | ASIC | Yes |

Warning: Undefined variable $taxonomy in /home/qezi44pa/public_html/wp-content/plugins/wp-custom-repeator/frontend/front-end.php on line 780

Cent Account Brokers

|

ECN | 1000 $ | 1:1000 | – | – |

|

Yes | – | – | – | – | Yes | – | – | – | Currency, CFD’s | – | No | – | No | yes | 99 | iOS, Android | – | – | – | Australia | China, USA | – | Trading conditions | iOS, Android | – | [“MetaTrader 4, MetaTrader 5”] | Yes | Yes | 44 | – | – | yes | yes | Azerbaijani, English | Azerbaijani, English | – | – | – | – | No | Yes | No | No | No | No | No | Yes | – | – | – | – | 20 % | 40 % | No | No | No | Yes | – |

Added

|

||

|

85

|

Vantage FX | 2009 | ASIC | Yes |

Warning: Undefined variable $taxonomy in /home/qezi44pa/public_html/wp-content/plugins/wp-custom-repeator/frontend/front-end.php on line 780

Cent Account Brokers

|

ECN | 100 $ | 1:200 | – | – |

|

No | – | – | – | – | No | – | – | – | Currency, CFD’s | – | No | – | No | yes | 1000 | iOS, Android | – | – | – | Australia | – | – | Trading conditions | iOS, Android | – | [“Cornu00e8rTrader”] | Yes | Yes | 28 | Promotions, Futures | NASDAQ (US), NYSE (USA) | yes | yes | English, Italian | English, Italian | – | – | – | – | No | Yes | No | No | No | No | No | No | – | – | – | – | 50 % | 100 % | No | No | Yes | No | – |

Added

|

||

|

86

|

AXITrader | 2007 | ASIC, FCA | Yes |

Warning: Undefined variable $taxonomy in /home/qezi44pa/public_html/wp-content/plugins/wp-custom-repeator/frontend/front-end.php on line 780

Cent Account Brokers

|

NDD | 1 $ | 1:200 | – | – |

|

Yes | – | – | – | – | Yes | – | – | – | Currency, CFD’s | – | No | – | No | yes | – | iOS, Android | – | – | – | Australia | United Kingdom, United Arab Emirates | – | Trading conditions | iOS, Android | – | [“MetaTrader 4, Vortex MT”] | Yes | No | 20 | Promotions, Futures | NASDAQ (US), NYSE (USA) | yes | yes | English, Arab | English, Arab | – | – | – | – | No | Yes | No | No | No | No | No | Yes | – | – | – | – | 5 % | 5 % | Yes | No | No | Yes | – |

Added

|

||

|

87

|

Ak Investment | 1996 | SPK | No |

Warning: Undefined variable $taxonomy in /home/qezi44pa/public_html/wp-content/plugins/wp-custom-repeator/frontend/front-end.php on line 780

Cent Account Brokers

|

NDD, DMA | 500 $ | 1:500 | – | – |

|

Yes | – | – | – | – | Yes | – | – | – | Currency, CFD’s | – | No | – | No | yes | – | iOS, Android | – | MAM | – | Turkey | – | – | Trading conditions | iOS, Android | – | [“MetaTrader 4, Meta Trader 4 Mobile”] | Yes | No | 51 | – | – | yes | yes | English, Deutsch | English, Arab | – | – | – | – | No | Yes | No | No | No | No | No | Yes | – | – | – | – | – | 100 % | No | Yes | Yes | No | – |

Added

|

||

|

88

|

InvestAZ | 2010 | FSP, SPK | No |

Warning: Undefined variable $taxonomy in /home/qezi44pa/public_html/wp-content/plugins/wp-custom-repeator/frontend/front-end.php on line 780

Cent Account Brokers

|

ECN | 0 $ | 1:100 | – | – |

|

Yes | – | – | – | – | Yes | – | – | – | Currency, CFD’s | – | No | – | No | yes | – | iOS, Android | – | – | – | New Zealand | – | – | Trading conditions | iOS, Android | – | [“”] | Yes | Yes | 35 | – | – | yes | yes | English | English, Chinese | – | – | – | – | No | Yes | No | No | No | No | No | Yes | – | – | – | – | – | 100 % | No | Yes | No | Yes | – |

Added

|

||

|

89

|

Corner Trader | 2012 | FINMA | No |

Warning: Undefined variable $taxonomy in /home/qezi44pa/public_html/wp-content/plugins/wp-custom-repeator/frontend/front-end.php on line 780

Cent Account Brokers

|

MM | 100 $ | 1:400 | – | – |

|

Yes | – | – | – | – | Yes | – | – | – | Currency, CFD’s | – | No | – | No | – | 56 | iOS, Android | – | – | – | Switzerland | – | – | Trading conditions | iOS, Android | – | [“MetaTrader 4, Meta Trader 4 Mobile”] | Yes | No | 27 | – | – | yes | yes | English | English | – | – | – | – | No | Yes | No | No | No | No | No | Yes | – | – | – | – | – | 100 % | No | Yes | Yes | No | – |

Added

|

||

|

90

|

Abshire-Smith | 2011 | FCA, FSCS | No |

Warning: Undefined variable $taxonomy in /home/qezi44pa/public_html/wp-content/plugins/wp-custom-repeator/frontend/front-end.php on line 780

Cent Account Brokers

|

STP, DMA | 0 $ | 1:100 | – | – |

|

Yes | – | – | – | – | Yes | – | – | – | Currency, CFD’s | – | No | – | No | – | 47 | iOS, Android | – | – | – | United Kingdom | – | – | Trading conditions | iOS, Android | – | [“MetaTrader 5, MetaTrader 5 Mobile”] | Yes | No | 32 | – | – | – | – | – | – | – | – | – | – | No | Yes | No | No | No | No | No | Yes | – | – | – | – | 20 % | 100 % | No | Yes | Yes | Yes | – |

Added

|

10 Best Forex Brokers

Avatrade is a regulated forex broker that offers online trading services in more than 250 instruments across multiple markets, including forex, indices, commodities, shares, and cryptos. In addition, it carries seven regulations on seven different continents, including UAE, South Africa, Japan, Australia, Europe, and the British Virgin Islands.

With Avatrade, you can start trading with a minimum deposit of $100 and leverage of up to 400:1. Traders can also take advantage of the broker’s numerous bonuses, including a welcome bonus of up to $10,000 and an Avapoints loyalty program to earn extra points.

In addition, traders can trade several instruments, including forex pairs, commodities, stocks, indices, bonds, ETFs, and Vanilla Options. Furthermore, AvaTrade is regulated by seven international commissions to ensure the safety of our customers: CBI (EU), B.V.I. FSC (British Virgin Islands), ASIC (Australia), FSCA (RSA), FRSA (UAE), FSA, and FFAJ (Japan).

Advantages

- Regulated online broker with a wide range of trading tools and instruments

- Traders will have complete peace of mind as customer service operates available 24/5 in 14 different languages

- AvaTrade offers Islamic (Swap-free) accounts to Muslim traders

- Brokers can use segregated accounts for reliable customer funds storage

- Traders can access several pieces of training and webinars that are useful for novice to expert traders

Disadvantages

- AvaTrade charges the inactivity fee based on the trader's account and currency

- This platform doesn't support US traders because of regulatory restrictions

Plus500 is a global multi-asset fintech group that operates proprietary technology-based trading platforms, offering customers a range of trading products, including Contracts for Difference (CFDs), share dealing, and futures trading. The company is listed on the London Stock Exchange's Main Market under the symbol PLUS and is a constituent of the FTSE 250 index.

Founded in 2008, Plus500 has expanded its services internationally, establishing subsidiaries in the UK, Cyprus, Australia, Israel, Seychelles, Singapore, Bulgaria, Estonia, the United States, Dubai, Indonesia, the Bahamas, and Japan. The company offers a comprehensive portfolio of over 2,800 instruments, providing clients with access to a wide array of financial markets.

Plus500 is committed to delivering a user-friendly trading experience through its advanced platforms, which are accessible via web and mobile applications. The company emphasizes client fund security by holding customer funds in segregated accounts, adhering to regulatory requirements. Additionally, Plus500 provides 24/7 customer support and offers various educational resources to assist traders in making informed decisions.

Advantages

- Easy to navigate for beginners and experienced traders

- No extra charges on trades, only spreads apply

- Excellent customer support

- Access to over 2,800 financial instruments

Disadvantages

- Fewer learning materials than competitors

- Some instruments have higher trading costs

- Charges $10 per month after three months of inactivity

FP Markets, established in 2005, is a global online forex and CFD broker headquartered in Sydney, Australia. Founded by Matthew Murphie, the company has expanded its presence with entities in regions including Cyprus, South Africa, Kenya, Seychelles, Bahamas, Mauritius, and St. Vincent & the Grenadines. FP Markets offers a diverse range of trading instruments, encompassing forex, shares, indices, commodities, digital currencies, bonds, and ETFs, accessible through platforms such as MetaTrader 4, MetaTrader 5, cTrader, TradingView, and Iress.

Regulated by top-tier authorities like the Australian Securities and Investments Commission (ASIC) and the Cyprus Securities and Exchange Commission (CySEC), FP Markets ensures compliance with stringent financial standards. The broker is recognized for its competitive trading conditions, offering tight spreads starting from 0.0 pips, leverage up to 500:1, and rapid execution speeds facilitated by Equinix servers. Clients can start trading with a minimum deposit of $100 and benefit from 24/7 multilingual customer support.