OANDA Review

Are you in search of a broker that caters to your investment needs? If so, OANDA might be the right choice for you. This broker provides innovative features and competitive commissions and spreads to make trading more accessible and user-friendly.

In this review of OANDA, we will cover everything you need to know about the broker. We will discuss the platform's features, trading conditions, customer support, regulatory status, and ultimately determine if OANDA meets our experts' strict evaluation criteria. Without further ado, let's begin.

What is OANDA?

OANDA is a good forex and CFD trading platform that has been operating for over 25 years. The platform offers traders access to a range of markets, including forex, commodities, indices, and bonds, with a range of trading instruments to suit different strategies and investment goals.

With headquarters in New York City and regional offices in Singapore, London, and Tokyo, OANDA has built a reputation as one of the innovative trading platform, with a focus on providing traders of all levels of experience with the tools, resources, and support they need to succeed in the highly competitive world of forex and CFD trading.

OANDA's objective is to provide traders with a fair, transparent, and reliable trading platform that puts the needs of its customers first. The platform is committed to providing traders with a range of competitive trading conditions, including tight spreads, no commission fees, and flexible leverage options, as well as access to a range of trading platforms and tools designed to help traders develop effective trading strategies and manage their risk effectively.

OANDA also places a strong emphasis on education and support, with an extensive knowledge base, trading academy, and customer support options designed to help traders of all levels of experience succeed.

Advantages and Disadvantages of Trading with OANDA

Benefits of Trading with OANDA

Trading with OANDA has several benefits that can help traders succeed in the forex and CFD trading industry. One of the key benefits of trading with OANDA is the platform's competitive trading conditions. OANDA offers some of the tightest spreads in the industry, which allows traders to access a range of markets and instruments at a low cost. Additionally, OANDA charges no commission fees on trades, which can help traders save money over time. The platform also offers flexible leverage options, which allows traders to manage their risk effectively.

Another benefit of trading with OANDA is the platform's innovative trading technology. OANDA's proprietary trading platform is highly regarded for its advanced charting tools, sophisticated trading algorithms, and user-friendly design. The platform also offers access to real-time market data and a range of technical indicators, which can help traders make informed trading decisions based on the latest market trends. OANDA's trading technology is designed to help traders execute trades quickly and efficiently, which can be essential in fast-moving markets.

In addition to its competitive trading conditions and innovative trading technology, OANDA also offers a range of educational resources and customer support options. The platform's trading academy and extensive knowledge base provide traders with the tools and resources they need to develop effective trading strategies and manage their risk effectively.

Finally, OANDA's customer support team is available to assist traders 24/5 through a range of channels, including phone, email, and FAQs. This level of support can be invaluable for traders who are just starting out or who need assistance navigating the platform or resolving issues.

Overall, trading with OANDA offers traders a range of benefits that can help them succeed in the highly competitive world of CFD and forex trading.

OANDA Pros and Cons

Pros:

- Availability of numerous training material, online courses, and videos

- Availability of a Demo account

- OANDA has obtained licences from four different regulators

Cons:

- Complex and lengthy complaint procedure

- OANDA does not consider claims of traders with small accounts

- Does not consider claims for moral damage

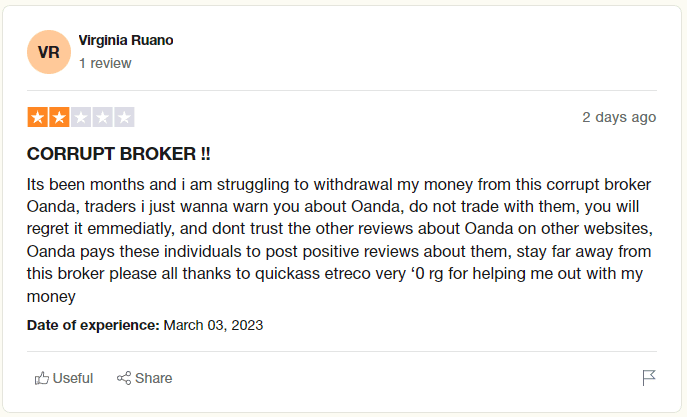

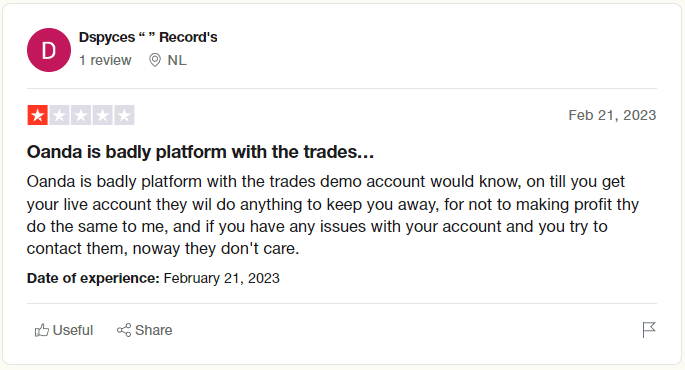

OANDA Customer Reviews

OANDA has received a rating of 3.7 out of 5 stars on Trustpilot based on over 300 reviews. The majority of the reviews are positive, with many customers praising the platform's reliability, ease of use, and customer support. One recent review even went so far as to compliment the platform's design, stating that it provided clients with a “truly remarkable trading experience”.

However, some customers have noted issues with withdrawal procedures and customer support, reporting long wait times and unprofessional customer assistance.

Overall, Trustpilot reviews suggest that OANDA is a well-regarded and trustworthy broker for traders seeking access to global financial markets. While there have been reports of slower withdrawals and other minor problems, the platform's impressive design and functionality make it an attractive choice for many traders.

OANDA Spreads, Fees, and Commissions

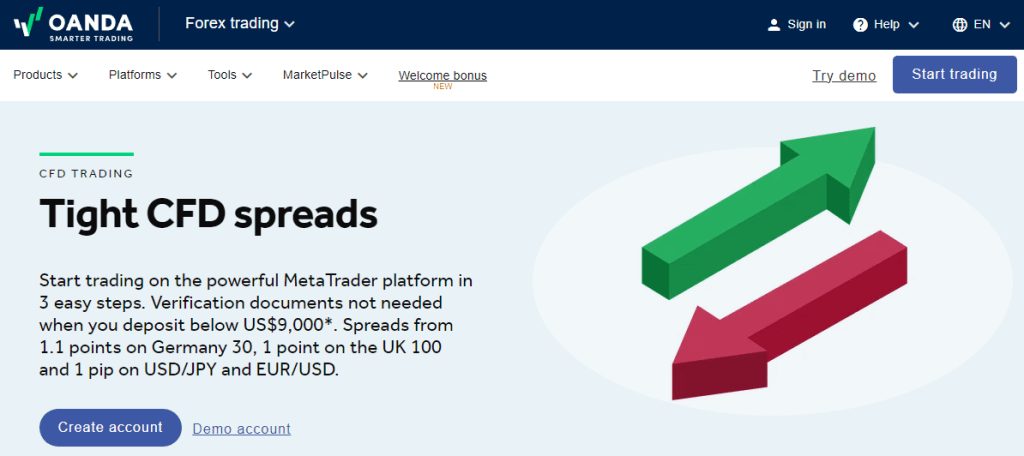

OANDA offers some of the tightest spreads in the forex and CFD broker industry, making it a popular choice among traders looking to minimize their trading costs. The platform's spreads are variable, meaning they fluctuate based on market conditions, but they are generally very competitive. For example, OANDA's average spread on EUR/USD is typically around 0.9 pips, which is significantly lower than many other forex brokers.

Additionally, OANDA does not charge any commission fees on trades, which can help traders save money over time, but it is important to remember that OANDA has a minimum spread value per trade of $11.

One of the unique features of OANDA's trading platform is its “core pricing” model. This model is designed to ensure that traders always receive the best available bid/ask prices from OANDA's liquidity providers. In other words, OANDA guarantees that its spreads are always competitive, even during times of market volatility or low liquidity. This can help traders avoid unexpected trading costs and ensure that they are always getting a fair price on their trades.

While OANDA does not charge commission fees on trades, there are some other fees that traders should be aware of. For example, traders who hold positions overnight may be subject to swap fees, which are charges for rolling over their positions to the next trading day. Additionally, traders who use OANDA's MetaTrader 4 platform may be subject to a small commission fee on trades. However, these fees are generally very low and are offset by the platform's competitive spreads and innovative trading technology.

Overall, OANDA's transparent fee structure and competitive trading conditions make it an attractive option for traders looking to minimize their trading costs.

Account Types

OANDA offers several different account types to cater to the needs of different types of traders. Here's a breakdown of each account type and its features:

- Standard Account: The Standard account is OANDA's most basic account type. It offers competitive spreads starting from 1.1 pips, no commission fees, and the ability to trade on all of OANDA's available instruments. Traders can open a Standard account with a minimum deposit of $1.

- Premium Account: The Premium account is designed for traders who want access to additional features and benefits. This account type offers lower spreads than the Standard account, starting at 0.8 pips, as well as priority customer support and access to OANDA's premium research and analysis tools. Traders can open a Premium account with a minimum deposit of $20,000.

- Core Account: The Core account is a new account type that offers ultra-tight spreads starting at 0.2 pips, with no commission fees. This account is designed for traders who prioritize low trading costs above all else. Traders can open a Core account with a minimum deposit of $1.

- Swap-Free Account: The Swap-Free account is designed for traders who adhere to Shariah law, which prohibits the charging or paying of interest. This account type offers no rollover charges or interest payments, making it a popular choice among Muslim traders. Traders can open a Swap-Free account with a minimum deposit of $1 and the floating spread on this account starts from 1.6 pips.

- Premium Core Account: The Premium Core account is the most exclusive account type offered by OANDA. This account type offers the tightest spreads of any OANDA account, starting from 0.2 pips, as well as access to OANDA's premium research and analysis tools, priority customer support, and a range of other benefits. Traders can open a Premium Core account with a minimum deposit of $20,000.

For all account types, OANDA offers leverage that varies from 1:1 to 1:200, depending on the trading instruments that are being traded.

Overall, OANDA's account types offer a range of features and benefits that can cater to the needs of different types of traders. Whether you're a beginner or an experienced trader, OANDA's flexible account options make it easy to find an account type that suits your individual trading preferences and needs.

How To Open Your Account?

Opening an account with OANDA is a straightforward process that can be completed in a few simple steps. Here is a general overview of the process:

- Choose your account type: OANDA offers several different account types, including individual, joint, corporate, and trust accounts. Choose the account type that best suits your needs and click on the “Open an account” button on the OANDA website.

- Provide personal information: You will be asked to provide personal information, including your name, address, phone number, and email address. You will also need to provide a valid form of identification, such as a passport or driver's license.

- Choose your trading platform: OANDA offers several trading platforms, including its proprietary trading platform and MetaTrader 4. Choose the trading platform you prefer and select your account type.

- Fund your account: Once your account has been approved, you will need to fund your account in order to start trading. OANDA offers several funding options, including bank transfer, credit/debit card, and PayPal.

- Verify your account: In order to comply with anti-money laundering regulations, OANDA requires all new account holders to verify their identity. This can be done by providing a copy of your passport or driver's license, as well as a recent utility bill or bank statement.

Once your account has been approved and verified, you will be ready to start trading.

What Can You Trade on OANDA

OANDA offers a wide range of trading instruments for clients to trade on its platform. Here are some of the key financial instruments that can be traded on OANDA:

- Forex: OANDA is primarily known for its forex trading offering. The platform offers over 70 currency pairs, including major, minor, and exotic pairs.

- CFDs: OANDA also offers a range of contracts for difference (CFDs) on a variety of financial instruments, including indices, commodities, and bonds.

- Precious Metals: Traders can also trade precious metals such as gold, silver, platinum, and palladium on OANDA's platform.

- Cryptocurrencies: OANDA also offers trading on a range of cryptocurrencies, including Bitcoin, Ethereum, and Litecoin.

- Treasury Bonds: Traders can also access a range of government treasury bonds, including US, UK, and Japanese bonds.

Overall, OANDA's diverse range of financial instruments allows traders to build a diversified portfolio and manage their risk effectively.

OANDA Customer Support

OANDA offers a range of customer support options to help traders get the assistance they need quickly and easily. The platform's customer support team is available 24/5 via phone and email, ensuring that traders can get help whenever they need it.

OANDA also offers a comprehensive online help center that contains a wealth of resources, including FAQs, trading guides, and video tutorials. This can be a helpful resource for traders looking to learn more about the platform's features and trading tools. One of the standout features of OANDA's customer support is its commitment to transparency and accountability. The platform has a dedicated team of customer service agents who are trained to provide prompt and courteous assistance to all users.

In Addition, OANDA regularly publishes information about its customer service performance, including average wait times and satisfaction ratings. This level of transparency helps to build trust and confidence among traders and ensures that the platform is held accountable for providing high-quality customer support.

Overall, OANDA's customer support is widely regarded as being among the best in the industry. The platform's commitment to transparency, accountability, and prompt service ensures that traders can get the help they need quickly and easily.

Advantages and Disadvantages of OANDA Customer Support

Security for Investors

Withdrawal Options and Fees

OANDA offers a variety of withdrawal options to accommodate the needs of its traders. Withdrawals can be made using bank wire transfer, credit or debit card, PayPal, or Skrill. Each method may have different fees and processing times, so it is important for traders to carefully consider which option is best for their needs. In general, electronic payment methods such as PayPal and Skrill may offer faster processing times and lower fees than bank wire transfer or credit/debit card withdrawals.

OANDA does not charge any fees for the first withdrawal of the month made using bank wire transfer or electronic payment methods. However, subsequent withdrawals within the same month are subject to a $15 commission fee. Additionally, there may be fees charged by the receiving bank or payment processor, so traders should be aware of these potential charges when choosing a withdrawal method. Credit or debit card withdrawals may be subject to a fee of up to 1.5% of the withdrawal amount, depending on the card issuer.

Overall, OANDA's withdrawal options and fees are competitive with other online trading platforms. Traders have a variety of options to choose from, and the lack of fees for most withdrawal methods is a definite advantage. Additionally, OANDA aims to process withdrawals quickly and efficiently, with most requests being processed within one to two business days.

OANDA Vs Other Brokers

#1. OANDA vs Avatrade

OANDA and AvaTrade are both regulated online brokers that offer a wide range of financial instruments, including forex, commodities, and indices. While OANDA requires a minimum deposit of just $1, AvaTrade's minimum deposit is $100. Additionally, OANDA offers a wider range of account types than AvaTrade.

In terms of trading platforms, OANDA offers a powerful proprietary platform, a web trading platform, and a mobile platform, while AvaTrade offers both its own platform and the popular MetaTrader platform.

When it comes to fees and commissions, AvaTrade is known for being competitive. However, OANDA offers different account types that don't charge commissions at all.

In conclusion, the comprehensive analysis of our experts shows that OANDA slightly outperforms AvaTrade for both beginner and advanced traders thanks to its many account types and features.

#2. OANDA vs Roboforex

Both OANDA and Roboforex are well-regulated brokers that offer a wide range of financial instruments through their proprietary trading platforms. However, OANDA stands out by offering the ability to trade cryptocurrencies and options, which are not available on Roboforex.

Furthermore, our review of OANDA indicates that the broker does not charge any trading fees, while Roboforex charges spread and commission fees on certain instruments. Therefore, for investors seeking lower commissions and tighter spreads, OANDA may be the better option.

#3. OANDA vs Alpari

Both OANDA and Alpari offer a wide range of financial products, including forex, commodities, indices, stocks, and cryptocurrencies. However, Alpari offers a more diverse selection of stocks, with over 4,000 individual stocks available for trading.

Moreover, OANDA only offers a maximum leverage of 1:200, which is significantly lower than the maximum leverage of 1:1000 offered by Alpari.

Regarding trading fees, both brokers offer competitive pricing. OANDA has a transparent fee structure with no commissions and tight spreads, while Alpari offers low spreads on most trading instruments.

In conclusion, considering the similar commissions but larger financial instruments selection offered by Alpari, we conclude that Alpari is slightly better than OANDA.

Conclusion: OANDA Review

OANDA is a reputable online trading platform that offers a wide range of financial instruments, competitive spreads, and a user-friendly interface. With its extensive experience in the financial industry and its strong regulatory compliance, OANDA is a reliable and trustworthy broker for traders of all levels.

One of the standout features of OANDA is its low minimum deposit requirement, making it accessible to traders with different budgets. Additionally, the various account types available, including the swap-free option, provide flexibility and cater to different trading styles.

Although OANDA's fees and commissions are competitive, traders should be aware of potential charges for certain withdrawal methods and credit/debit card withdrawals. However, the efficient withdrawal process and the availability of multiple options for deposit and withdrawal make it easy for traders to manage their funds.

Overall, OANDA's combination of a robust trading platform, excellent customer support, and strong regulatory compliance make it a solid choice for traders seeking a reliable online broker.

OANDA Review FAQs

Is OANDA regulated?

OANDA is a regulated online trading platform that operates in compliance with the rules and regulations set by various financial regulatory authorities around the world. The platform is registered and licensed by several regulatory bodies, including the Commodity Futures Trading Commission (CFTC), the Financial Conduct Authority (FCA), the Monetary Authority of Singapore (MAS), the Australian Securities and Investments Commission (ASIC), and the Investment Industry Regulatory Organization of Canada (IIROC).

What is OANDA minimum deposit?

OANDA has a very low minimum deposit requirement for its standard trading account, as well as its core and swap-free accounts. Traders can open an account with OANDA and start trading with just $1. This makes OANDA an attractive option for traders who are just starting out or who are looking to test the waters without investing a large amount of money upfront.

It is important to note that some other account types, such as the premium account, have instead a $20,000 minimum deposit requirement. However, for traders who are interested in opening a standard, core, or swap-free account, the low minimum deposit requirement makes it easy to get started with OANDA.

How long does OANDA withdrawal take?

On average, OANDA processes withdrawal requests within one to two business days. However, the time it takes for the funds to reach the trader's account can vary depending on the withdrawal method chosen.

Withdrawals made via electronic payment methods such as PayPal or Skrill may be processed more quickly than withdrawals made via bank wire transfer. Additionally, traders should keep in mind that some withdrawal methods may be subject to additional fees or charges.

Overall, traders can expect a relatively efficient and timely withdrawal process when using OANDA.