Position in Rating | Overall Rating | Trading Terminals |

53rd  | 4.1 Overall Rating |   |

Doo Prime Review

In this Doo Prime review, the article will tackle about an online forex broker offering access to a range of trading instruments, including forex, stocks, and cryptocurrencies. Doo Prime provides a seamless trading platforms experience with platforms like MetaTrader 4 and MetaTrader 5.

The broker is known for its low spreads, competitive pricing, and a user-friendly interface. Doo Prime is regulated by several financial authorities, ensuring a safe and transparent trading environment.

Additionally, Doo Prime offers fast trade execution and a variety of account types, making it suitable for both beginners and experienced traders. In the financial markets, it is important for a forex broker to be reviewed just like this. Forex market is no joke and it should be analyzed carefully before entering.

What is Doo Prime?

Doo Prime is a global online broker that offers access to a wide range of financial instruments, including forex, stocks, and cryptocurrencies. It operates on popular trading platforms like MetaTrader 4 and MetaTrader 5, which are known for their advanced features and ease of use. This makes it suitable for both novice and experienced traders who are looking for a seamless trading experience.

The broker is regulated by multiple financial authorities, ensuring a safe and reliable environment for its users. With strict oversight, traders can feel more secure in knowing their funds are protected and the operations are transparent. This level of regulation is crucial for building trust, especially in the online trading industry where security is a top concern.

Doo Prime stands out with its competitive pricing model, offering low spreads and quick trade execution. This makes it attractive to traders who want to minimize costs and take advantage of tight market conditions. Whether you’re just starting out or have years of experience, Doo Prime provides a flexible platform for different trading strategies.

Doo Prime Regulation and Safety

Doo Prime operates under the regulation of multiple financial authorities, which is crucial for ensuring a safe trading environment. The broker is licensed by the Financial Conduct Authority (FCA) in the UK, the Vanuatu Financial Services Commission (VFSC), Seychelles Financial Services Authority (FSA), Financial Industry Regulatory Authority (FINRA) with license numbers SEC: 8-41551 and CRD: 24409, respectively Doo Financial Australia Limited – Regulated by the Australian Securities & Investments Commission (ASIC), among others. These regulatory bodies impose strict guidelines to protect traders and maintain transparency in business operations.

One of the key advantages of being regulated by reputable authorities is the enhanced security it offers to traders. Client funds are typically kept in segregated accounts, meaning they are not mixed with the broker’s operational funds. This provides an extra layer of protection, especially in the unlikely event of the broker facing financial difficulties.

Additionally, Doo Prime implements industry-standard security measures, including SSL encryption and two-factor authentication (2FA), to safeguard personal data and transactions. These security features ensure that traders can execute their trades and manage their accounts with confidence, knowing their information is well-protected.

Doo Prime Pros and Cons

Pros

- Low spreads

- Fast execution

- Regulated broker

- User-friendly platforms

Cons

- Limited assets

- No US clients

- Withdrawal fees

- Limited research tools

Benefits of Trading with Doo Prime

Trading with Doo Prime offers a reliable platform and competitive trading conditions, designed to accommodate both novice and experienced traders. The broker provides access to global financial markets, including forex, commodities, and indices, ensuring users have a range of options to diversify their investments.

Doo Prime's advanced trading technology supports fast execution speeds and lower spreads, essential for traders seeking precision and reduced costs in high-frequency trading. Additionally, the platform integrates well with popular trading software, such as MT4 and MT5, making it versatile and user-friendly.

With 24/7 customer support and multiple account types tailored to different trading styles, Doo Prime ensures that users receive the guidance and flexibility they need. The broker's commitment to security and transparency makes it a strong choice for those looking to trade with confidence.

Doo Prime Customer Reviews

Customer reviews of Doo Prime are generally positive, with many users appreciating the broker’s low spreads and fast trade execution. Traders often highlight the ease of using platforms like MetaTrader 4 and MetaTrader 5, which are well-regarded for their functionality and features.

However, some users express concerns over withdrawal fees and occasional delays in processing funds. For those who prioritize fast access to their money, this could be a drawback. Despite this, the majority of users report a smooth trading experience overall.

Another common point in reviews is the broker’s regulatory status, which reassures traders about the safety of their funds. While there are some criticisms, Doo Prime’s commitment to security and transparency remains a major selling point for most of its clients.

Doo Prime Spreads, Fees, and Commissions

Doo Prime offers competitive spreads across its various asset classes, including forex, commodities, and indices. The broker provides both floating and fixed spreads, depending on the type of account chosen by the trader. Forex spreads typically start as low as 0.1 pips for major currency pairs, making it an attractive option for traders seeking cost-effective trades.

In terms of fees, Doo Prime does not charge a deposit fee, which makes it convenient for traders looking to transfer funds into their accounts. However, withdrawal fees may apply depending on the payment method used. Additionally, there may be inactivity fees charged to accounts that remain dormant for a specified period, so it's essential to stay active to avoid these charges.

For commissions, Doo Prime operates on a commission-based model for certain account types. While the broker’s standard accounts may have no commissions, more advanced account options like ECN accounts come with a commission per lot traded. This commission structure is designed to provide better spreads for professional traders who require tighter pricing on trades.

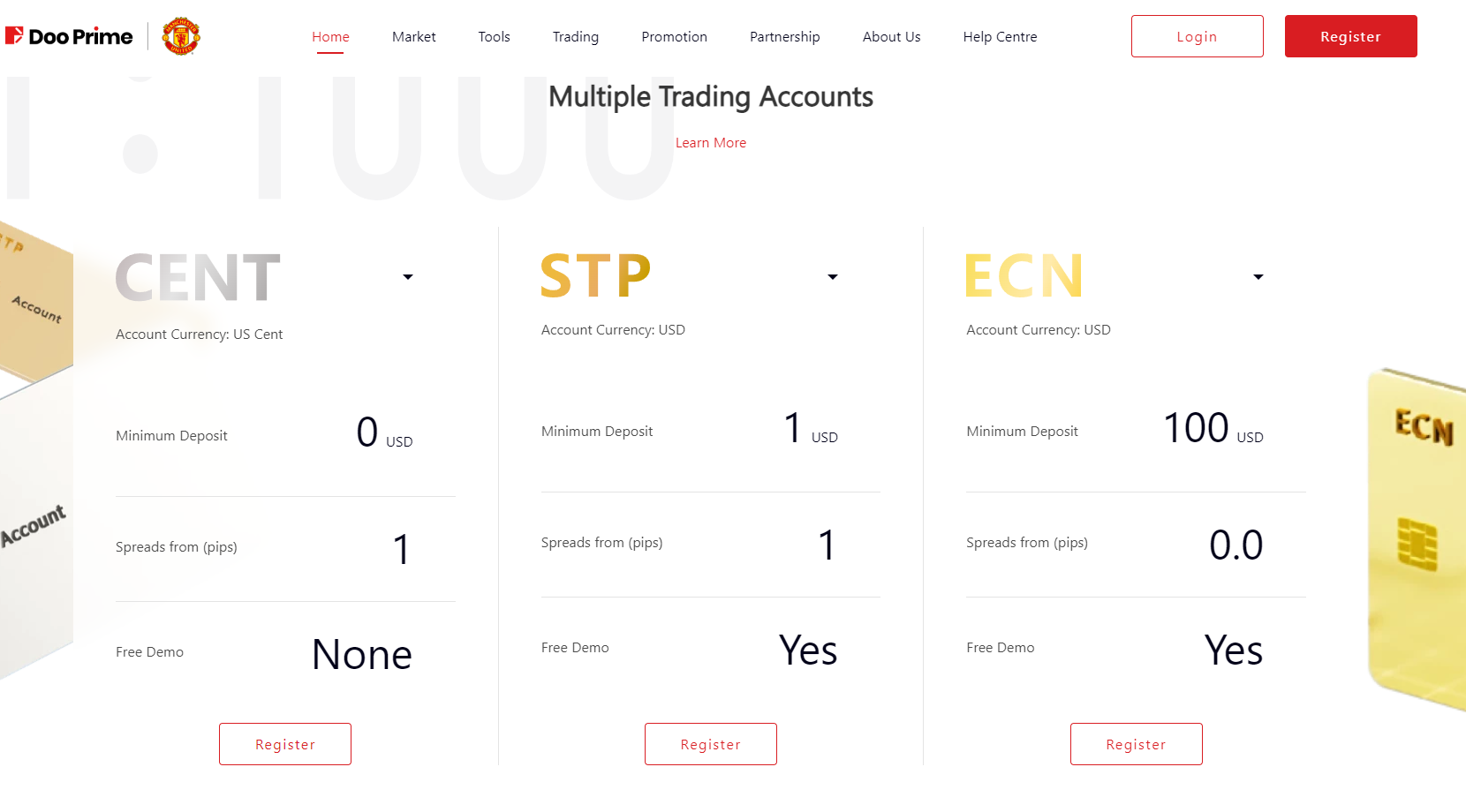

Account Types

Doo Prime offers a variety of live trading accounts tailored to meet the needs of different traders, from beginners to experienced professionals. Each account is designed with unique features to accommodate varying trading styles and capital levels.

Cent Accounts

Ideal for beginners, this account allows trading with smaller volumes using cents as the base currency, making it easier to manage risk while learning the markets. This account requires trader to put minimum deposit.

Standard Accounts

A popular choice for regular traders, it offers competitive spreads, no commissions on certain assets, and access to a wide range of financial instruments. This account requires trader to put minimum deposit.

ECN Accounts

Designed for experienced traders, this account provides direct market access, lower spreads, and faster execution speeds, but typically includes commission charges per trade. This account requires trader to put minimum deposit.

Demo Accounts

Doo Prime offers demo accounts designed for traders to practice and refine their skills without the risk of real capital. These accounts provide a simulated environment with real-time market data, making them ideal for beginners or those testing new strategies.

Doo Prime allows traders to open multiple accounts to cater to different trading strategies and needs. This flexibility enables users to manage separate accounts, such as demo accounts for practice and live accounts for real trading, or to diversify across different account types like Standard, ECN, and Cent. This feature is particularly beneficial for traders looking to experiment with varying strategies or asset classes without impacting their main account.

Islamic Accounts

For traders adhering to Sharia law, this swap-free account ensures that no interest is charged on overnight positions while still offering the full range of trading services. This account requires trader to put minimum deposit.

Retail investor accounts are available to open 24/7 around the world. Doo Prime can provide technical analysis tools and trading skills educational resources in forex trading. Demo account is also available for a beginner trader.

How to Open Your Account

Opening an account with Doo Prime is easy and can be done in just a few steps. Here's how:

Step 1: Registration

Visit the Doo Prime website and complete the registration form with your personal information, such as your email and phone number.

Step 2: Verification

Submit the required identification documents to complete the Know Your Customer (KYC) process and verify your identity.

Step 3: Choose Your Account Type

For traders to identify which account style they need in their trading journey, the traders must identify and read the offered account types in the website.

Step 4: Funding Your Account

After verification, deposit funds into your account using your preferred payment method. Minimum deposit are required in every account except demo account.

Step 5: Start Trading

Once your account is funded with the minimum deposit, log in to the Doo Prime trading platform and start trading in the global markets. It can be a good way for more experienced traders to test out their strategies before investing funds.

To manage traders account, simply go to the account manager once the account open. All account like cent account, ecn account, and all accounts has account manager. Cent and stp accounts requires a minimum deposit to initiate. In the financial industry, it is normal for an account to require a minimum deposit.

Doo Prime Trading Platforms

Doo Prime provides access to several advanced trading platforms, including MetaTrader 4 (MT4) and MetaTrader 5 (MT5). Both platforms are widely used in the trading community for their user-friendly interfaces and robust features. MT4 is popular among forex traders for its simplicity, while MT5 offers more advanced tools like expanded timeframes and an economic calendar, making it suitable for those trading multiple asset classes.

In addition to the MetaTrader platforms, Doo Prime also offers Doo Prime InTrade, a proprietary platform designed to enhance the trading experience. InTrade provides a range of analytical tools and a customizable interface, enabling traders to personalize their trading environment according to their strategies. It is accessible through web browsers, desktop applications, and mobile devices, offering flexibility for traders on the go.

Doo Prime's platforms are also equipped with algorithmic trading capabilities, allowing users to implement automated strategies through expert advisors (EAs) on MT4 and MT5. These tools can be beneficial for traders who want to execute trades based on pre-set conditions without needing to be actively engaged in the market.

What Can You Trade on Doo Prime

Doo Prime offers a diverse range of financial instruments for traders, allowing them to participate in multiple global markets. These include forex, stocks, indices, commodities, and cryptocurrencies, providing ample opportunities for different trading strategies.

Forex

Doo Prime allows users to trade a wide range of currency pairs, including major pairs like EUR/USD and GBP/USD, minor pairs, and exotic pairs involving less common currencies. Forex trading involves speculating on currency price movements based on economic, political, and market trends, making it an active market 24/5 and popular for both beginners and experienced traders.

Stock Indices

With Doo Prime, traders can access global stock indices and trade contracts for difference (CFDs) on prominent indices like the S&P 500, NASDAQ, and FTSE 100. This allows traders to speculate on the performance of major companies and stock markets without owning the actual stocks. Indices are useful for gauging market health, while stock CFDs enable traders to go long or short, leveraging opportunities in rising or falling markets.

Commodities

Doo Prime offers trading in both hard and soft commodities, such as precious metals (gold and silver) and energy products (crude oil and natural gas). Commodities often act as a hedge against inflation and currency devaluation, making them popular among traders looking for long-term and safe-haven investments. Energy commodities are particularly appealing due to their high volatility and correlation with global economic and geopolitical factors.

Cryptocurrencies

The platform provides access to popular digital assets like Bitcoin, Ethereum, and other altcoins. Cryptocurrency trading allows traders to capitalize on high market volatility and round-the-clock trading, as these markets operate 24/7. With Doo Prime’s access to crypto CFDs, traders can speculate on price movements without owning the underlying asset, providing flexibility in both rising and declining markets.

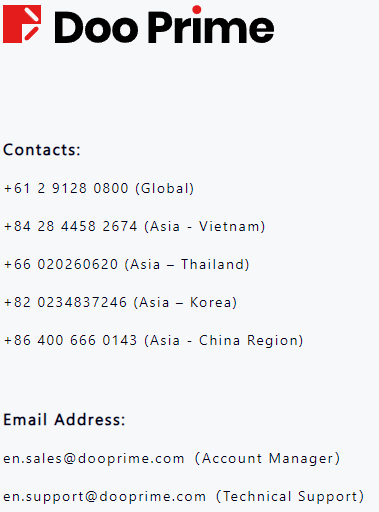

Doo Prime Customer Support

Doo Prime provides a comprehensive customer support system aimed at assisting traders at every stage of their trading journey. Support is available through multiple channels, including live chat, email, and phone, ensuring that users can receive help promptly, whether they have technical issues, account queries, or trading-related questions.

The support team is available 24/5 to align with global trading hours, allowing traders to access assistance during peak market times. Additionally, Doo Prime offers support in multiple languages to cater to its diverse international client base, making it easier for users worldwide to communicate effectively with support representatives.

For further assistance, Doo Prime’s website includes a detailed FAQ section and educational resources, providing self-service options for common inquiries and enhancing trader knowledge. This combination of live support and resources makes it convenient for users to resolve issues and gain insights into trading best practices.

Advantages and Disadvantages of Doo Prime Customer Support

Withdrawal Options and Fees

Doo Prime offers several withdrawal methods to make accessing funds convenient and efficient for traders. Each option has its own processing times and potential fees, allowing users to choose based on their needs.

Bank Transfers

A secure method for larger withdrawals, with processing times typically ranging from 1-5 business days. Fees vary based on the bank and country. For deposits, you can use local and international bank transfers, credit cards, Apple Pay, Google Pay, Epay, Skrill, Fasapay and HWGC

Credit/Debit Cards

Provides a quick and easy option for withdrawing smaller amounts. Processing times can vary but usually take up to 3 business days, with potential fees depending on the card issuer.

E-Wallets

Options like Neteller and Skrill offer faster processing times, usually within 24 hours. These are suitable for traders seeking more immediate access to their funds, though some fees may apply based on the provider.

Cryptocurrency

Allows withdrawal in digital assets such as Bitcoin, with transactions often completed within a few hours. Fees can vary based on network congestion but are generally transparent on Doo Prime’s platform.

Doo Prime Vs Other Brokers

#1. Doo Prime vs AvaTrade

Doo Prime and AvaTrade are both respected brokers with extensive offerings, though they cater to slightly different trading needs. Doo Prime provides a broad selection of assets, including forex, stocks, indices, commodities, and cryptocurrencies, emphasizing low spreads and fast execution speeds, especially attractive for active traders. Additionally, Doo Prime’s regulation through authorities like the Financial Services Authority (FSA) and the Vanuatu Financial Services Commission (VFSC) offers assurance of its standards. AvaTrade, on the other hand, is regulated across multiple jurisdictions, including the Central Bank of Ireland and the Australian Securities and Investments Commission (ASIC), making it a solid choice for traders prioritizing high regulatory oversight. AvaTrade also supports a variety of platforms, including its proprietary AvaTradeGO, along with MT4 and MT5, and is known for offering fixed spreads, which appeal to traders seeking predictable costs. Both brokers support algorithmic trading, though Doo Prime’s competitive pricing structure might better suit those seeking tight spreads, while AvaTrade’s comprehensive regulatory backing might appeal more to security-focused traders.

Verdict: Doo Prime is optimal for traders looking for low spreads and efficient execution across a variety of assets, making it a good fit for active traders. AvaTrade’s multiple regulatory licenses and fixed spreads offer added security, positioning it as a reliable choice for those valuing consistent fees and strong oversight.

#2. Doo Prime vs RoboForex

Doo Prime and RoboForex both offer extensive trading options, though they cater to slightly different types of traders. Doo Prime provides access to a wide range of markets, including forex, stocks, indices, commodities, and cryptocurrencies, with a focus on competitive spreads and fast execution, which appeals to high-frequency traders. It is regulated by authorities such as the FSA and VFSC, ensuring a secure trading environment. RoboForex, meanwhile, offers similar assets but places a particular emphasis on account variety, offering options like Cent Accounts for micro-lot trading, which can be beneficial for beginner traders or those testing strategies with smaller funds. RoboForex is regulated by the International Financial Services Commission (IFSC) and offers access to unique features such as its CopyFX platform, ideal for traders interested in copy trading and social trading options. While both brokers offer MetaTrader 4 and 5, RoboForex’s diverse account types and unique features may provide additional flexibility.

Verdict: Doo Prime stands out for its competitive pricing and fast execution, ideal for active and high-frequency traders. RoboForex’s account variety and unique platforms like CopyFX make it an attractive choice for new traders or those exploring copy trading and micro-lot options.

#3. Doo Prime vs Exness

Doo Prime and Exness both provide extensive trading options and platforms, though each caters to different trader priorities. Doo Prime offers a variety of markets, including forex, stocks, indices, commodities, and cryptocurrencies, with an emphasis on low spreads and rapid execution, which is appealing to active and high-frequency traders. It operates under the oversight of regulators like the FSA and VFSC, ensuring safety and reliability. Exness, on the other hand, is regulated by multiple authorities, including CySEC and the FCA, making it highly attractive for those focused on strong regulatory backing. Exness also supports unique features such as unlimited leverage on certain accounts and instant withdrawals, which appeal to traders looking for greater flexibility and quick access to funds. Both brokers provide the MetaTrader 4 and 5 platforms; however, Exness’s additional options like unlimited leverage and instant withdrawal capabilities can give it an edge for traders requiring flexible risk management.

Verdict: Doo Prime is optimal for traders prioritizing low spreads and efficient execution across diverse assets, ideal for those trading frequently. Exness’s strong regulatory backing, instant withdrawal, and unique leverage options make it a solid choice for traders seeking flexible risk management and faster fund access.

Also Read: AvaTrade Review 2024 – Expert Trader Insights

OPEN AN ACCOUNT WITH DOO PRIME

Conclusion: Doo Prime Review

Doo Prime is a versatile and competitive broker that caters to traders looking for a secure, efficient trading experience across multiple asset classes, including forex, stocks, indices, commodities, and cryptocurrencies. With its low spreads, fast execution, and advanced trading platforms like MetaTrader 4 and 5, Doo Prime is well-suited for both beginners and high-frequency traders seeking cost-effective trading. Additionally, its regulatory oversight from bodies such as the FSA and VFSC ensures a safe and transparent environment, enhancing its credibility as a broker.

Doo Prime's range of account types and flexible withdrawal options, along with support for automated trading strategies, make it adaptable for various trading needs. Whether a trader is focused on frequent trades with tight spreads or values a diverse portfolio, Doo Prime provides a reliable and robust platform. Overall, it stands out as a broker with comprehensive offerings and dependable support, suitable for traders at all levels.

This makes Doo Prime legit in terms of withdraw funds, local bank transfers, currency conversion fees, trading fees, social trading platform, execute trades efficiently, according to brokers ratings. Doo Prime accounts like Cent account, ECN account, swap free accounts, their trading platform and trading instruments, everything in the financial markets proves that Doo Prime is a trusted broker.

Also Read: FXTM Review 2024 – Expert Trader Insights

Doo Prime Review: FAQs

What trading platforms does Doo Prime offer?

Doo Prime provides access to MetaTrader 4 (MT4) and MetaTrader 5 (MT5), as well as its proprietary platform, Doo Prime InTrade. These platforms support a range of trading features for both novice and experienced traders.

Is Doo Prime regulated?

Yes, Doo Prime is regulated by multiple financial authorities, including the Regulated by the Seychelles Financial Services Authority (SC FSA), Doo Prime Mauritius Limited – Regulated by the Mauritius Financial Services Commission (MU FSC) and the Vanuatu Financial Services Commission (VFSC), ensuring compliance and security for traders.

What assets can I trade on Doo Prime?

Doo Prime offers a wide selection of assets, including forex, stocks, indices, commodities, and cryptocurrencies, allowing traders to diversify their portfolios.

OPEN AN ACCOUNT NOW WITH DOO PRIME AND GET YOUR BONUS