At Asia Forex Mentor, we understand that choosing the best forex brokers in India can feel overwhelming with so many options out there. Whether you're new to forex trading or a seasoned trader looking to optimize your strategy, finding a reliable broker is key. In India, where the forex market is growing fast, it's important to pick a broker that's not only SEBI-regulated but also offers competitive spreads, solid forex trading platforms, and great customer support. After all, your broker should make your trading journey easier, not harder.

In 2025, several brokers have made a name for themselves as top picks for forex traders in India. These brokers offer user-friendly forex trading apps, low trading costs, and robust platforms like MetaTrader 4 and MetaTrader 5. Whether you want to trade forex on the go using the best forex trading app or need a more comprehensive desktop solution, the brokers on our list have something for everyone. Let's break down the top choices that stand out for Indian traders this year.

Overview of Forex Trading in India

Forex trading in India has had a somewhat cautious history. In the early days, the forex market in India was tightly regulated, with strict limitations on who could trade and under what circumstances. Initially, only banks and large financial institutions were allowed to trade forex, and individuals were kept away from direct participation in the market. However, as technology advanced and global financial markets opened up, forex trading in India slowly became more accessible to retail traders.

Today, the Securities and Exchange Board of India (SEBI) regulates forex brokers to ensure that trading activities are safe and transparent for Indian investors. SEBI plays a key role in making forex trading legal and protecting the interests of traders by ensuring that brokers adhere to strict rules. It is important for Indian traders to choose brokers that are SEBI-registered to avoid any legal complications. In addition, the Reserve Bank of India (RBI) also sets guidelines for currency trading, limiting forex traders to trade only specific currency pairs involving the Indian Rupee (INR).

With the rise of technology, there has been a surge in the number of online forex brokers and trading platforms available to Indian forex traders. These platforms, like MetaTrader 4 (MT4) and MetaTrader 5 (MT5), have made it easier to access the forex market. Thanks to the availability of forex trading apps, traders can now trade forex from their mobile devices. The popularity of these forex trading platforms has skyrocketed, providing Indian traders with the opportunity to access global markets, develop trading strategies, and manage trades more conveniently. This has also contributed to the growth of international forex brokers offering services tailored to Indian traders with localized support, lower trading costs, and a variety of account types.

Criteria for Choosing the Best Forex Broker in India

When selecting the best forex broker in India, there are several key criteria to focus on. These factors ensure that your trading experience is not only secure but also optimized for cost and convenience. Here's what to consider:

- Regulation and Security: Always choose a broker regulated by trusted authorities like SEBI or international bodies such as FCA or CySEC. This ensures the broker is legal, safe, and keeps your funds protected in segregated accounts.

- Trading Platforms and Ease of Use: Look for brokers that offer user-friendly platforms such as MetaTrader 4 (MT4), MetaTrader 5 (MT5), or mobile trading apps. These platforms should come with advanced charting tools and customization options for both beginners and experienced traders.

- Spreads, Fees, and Commissions: Compare the spreads (difference between buy/sell prices) and ensure they are competitive, especially for major forex pairs. Check if there are any additional account maintenance fees or commissions, and go for brokers with lower trading costs.

- Customer Support and Localization: Choose a broker that offers excellent customer support, preferably with assistance in local languages, and support available during India's trading hours. This ensures quick help when needed.

- Payment Options and Demo Accounts: Ensure the broker provides convenient payment methods like bank transfers, UPI, or e-wallets. Also, check if they offer a demo account so you can test the platform before investing real money.

The 5 Best Forex Brokers in India

#1. AvaTrade: Best Overall for Traders in India

What is AvaTrade?

AvaTrade is a globally trusted broker that has built a strong reputation in India due to its user-friendly platforms and solid regulatory backing. Offering MetaTrader 4 (MT4), MetaTrader 5 (MT5), and its proprietary AvaTradeGO app, the broker ensures that traders of all levels can access their accounts easily, whether on desktop or mobile. Regulated by authorities like ASIC, CySEC, and the Central Bank of Ireland, AvaTrade guarantees a secure trading environment. With access to over 1,000 financial instruments, including forex, commodities, indices, and cryptocurrencies, AvaTrade is a top choice for Indian traders seeking versatility and trust.

Advantages and Disadvantages of AvaTrade

AvaTrade Fees and Commissions

Regarding fees and commissions, AvaTrade is competitive, especially for traders looking to avoid high costs. The broker offers zero commissions on most trades, with spreads starting as low as 0.9 pips on major forex pairs. Additionally, there are no fees for deposits or withdrawals, making it cost-effective for frequent traders. However, be aware of the inactivity fee of $50 after three months of no trading activity, as well as a $100 annual administration fee if your account remains inactive for 12 months. This fee structure keeps trading costs low for active traders while penalizing inactive accounts.

OPEN AN ACCOUNT NOW WITH AVATRADE AND GET YOUR WELCOME BONUS

#2. Exness

What is Exness?

Exness is a popular international broker, well-regarded for its reliability, competitive pricing, and accessibility in India. Although it is not regulated by SEBI, it is governed by international regulatory bodies such as CySEC and FCA, ensuring a secure trading environment for Indian traders. Exness offers access to over 100 currency pairs with tight spreads starting from 0.1 pips, making it a strong choice for both beginners and experienced traders. The platform supports MetaTrader 4 (MT4), MetaTrader 5 (MT5), and mobile trading apps, providing flexibility for traders who prefer to trade forex on the go.

Advantages and Disadvantages of Exness

Exness Fees and Commissions

In terms of fees and commissions, Exness is known for offering zero commissions on many trades, while maintaining highly competitive spreads. For Indian traders, the broker provides low trading costs with spreads as tight as 0.1 pips for major forex pairs. There are no hidden fees for deposits or withdrawals, making it a cost-effective choice for active traders. However, overnight fees (swap fees) may apply if positions are held open beyond a trading day, depending on the currency pair and trade size.

OPEN AN ACCOUNT NOW WITH EXNESS AND GET YOUR WELCOME BONUS

#3. FP Markets

What is FP Markets?

FP Markets, established in 2005, is a globally recognized Forex and CFD broker offering access to a wide range of financial instruments, including forex, indices, commodities, stocks, and cryptocurrencies. The broker operates under the regulation of the Australian Securities and Investments Commission (ASIC), ensuring compliance with stringent financial standards and providing a secure trading environment. FP Markets is acclaimed for its tight spreads, fast execution speeds, and support for advanced trading platforms such as MetaTrader 4, MetaTrader 5, cTrader, and TradingView, making it a top choice among Forex brokers.

Advantages and Disadvantages of FP Markets

FP Markets Fees and Commissions

In India, FP Markets offers competitive fees and commissions across its account types. The Standard Account features zero commissions, with costs incorporated into the spread, starting from 1.0 pips for major currency pairs. The Raw Account provides spreads from 0.0 pips, with a commission of $3 per lot per side. Notably, FP Markets does not impose inactivity fees or account maintenance charges.

OPEN AN ACCOUNT NOW WITH FP MARKETS AND GET YOUR WELCOME BONUS

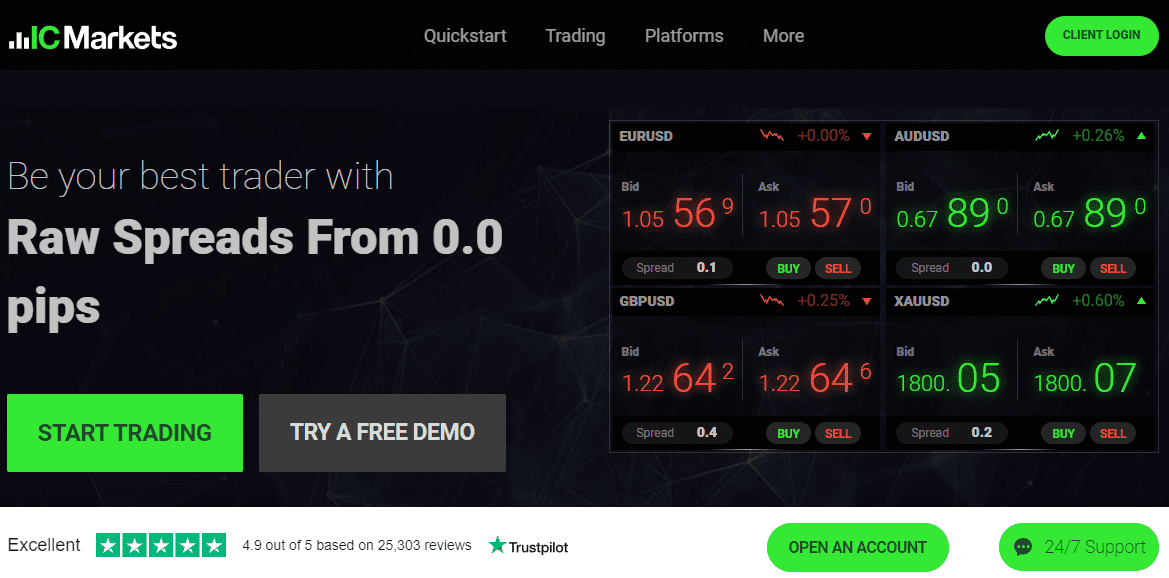

#4. IC Markets

What is IC Markets?

IC Markets is a globally recognized broker that is highly recommended for Indian traders due to its excellent reputation and strong regulatory framework. Founded in 2007, it is regulated by major financial authorities such as ASIC, CySEC, and FSA, ensuring a secure trading environment. IC Markets offers access to a wide range of instruments, including forex, commodities, indices, and cryptocurrencies, making it a great option for traders looking to diversify their portfolios. Additionally, the broker supports popular platforms like MetaTrader 4 (MT4), MetaTrader 5 (MT5), and cTrader, which are equipped with advanced charting tools and automated trading capabilities, catering to both beginners and experienced traders.

Advantages and Disadvantages of IC Markets

IC Markets Fees and Commissions

IC Markets is known for offering competitive pricing, particularly with its Raw Spread Account, where spreads can start as low as 0.0 pips for major pairs like EUR/USD. Traders are charged a commission of $3.50 per lot, making it highly cost-effective compared to other brokers. There are no inactivity fees, and deposit/withdrawal fees depend on the method used, with some, like card withdrawals, being free, while bank transfers can incur a fee of around $20. This transparency and low-cost structure make IC Markets a top choice for Indian traders looking to minimize their trading costs.

OPEN AN ACCOUNT NOW WITH IC MARKETS AND GET YOUR BONUS

#5. Interactive Brokers

What is Interactive Brokers?

Interactive Brokers is a globally renowned brokerage that stands out for its advanced trading platforms, comprehensive market access, and strong regulatory framework. In India, while it is regulated by SEBI for domestic stocks and derivatives, it also offers access to over 150 global markets. Interactive Brokers is known for its Trader Workstation (TWS) and IBKR Mobile, which provide real-time data, advanced charting tools, and professional-grade analytics. With robust security features and adherence to global standards, Interactive Brokers is a top choice for Indian traders seeking a trusted and versatile platform for forex, stocks, and derivatives.

Advantages and Disadvantages of Interactive Brokers

Interactive Brokers Fees and Commissions

Interactive Brokers offers some of the lowest trading costs in the industry. For Indian markets, commissions range from ₹6 to ₹20 per order for stock trades on the NSE, and there are no account maintenance fees or inactivity fees. For forex, it charges low commissions based on trade size, with spreads starting as tight as 1/10 pip. Additionally, traders benefit from zero deposit fees and free DEMAT account openings, making it a cost-effective broker for both active and occasional traders.

OPEN AN ACCOUNT NOW WITH INTERACTIVE BROKERS AND GET YOUR BONUS

How to Get Started with Forex Trading in India in 2025

Step 1: Open a Trading Account with a Forex Broker

The first step to trading forex in India is choosing a reliable broker. Look for brokers regulated by SEBI or trusted international authorities like FCA or CySEC. Once you’ve selected a broker, opening a trading account typically involves providing personal information, completing the KYC process, and verifying your identity. Make sure the broker offers support for Indian currency pairs and provides a user-friendly platform like MetaTrader 4 or MetaTrader 5.

Step 2: Choose Between a Demo and a Live Account

If you're new to forex, start with a demo account. A demo allows you to practice trading without using real money, giving you time to get familiar with the platform and test strategies risk-free. Once you’re confident, switch to a live account to start trading with real capital. It’s recommended to stay on a demo account until you're comfortable with key tools and concepts.

Step 3: Learn Key Trading Strategies

For beginners, focus on simple and effective trading strategies like trend following and support/resistance trading. These strategies help you identify market trends and key price levels to make informed decisions. Stick to trading popular currency pairs such as USD/INR and EUR/INR, which offer good liquidity in the Indian forex market.

Step 4: Manage Risk Effectively

Risk management is crucial in forex trading. Always use tools like stop-loss orders to minimize potential losses. Limit the amount of leverage you use and avoid overtrading, especially as a beginner. Start with smaller trade sizes and increase gradually as you gain confidence and experience. Always remember: only trade money you can afford to lose.

Conclusion

In conclusion, choosing the best forex broker in India requires looking at factors like regulation, low spreads, platform usability, and customer support. The brokers we discussed, including IC Markets, Exness, and AvaTrade, stand out for offering a secure trading environment, strong platform choices like MetaTrader 4 and MetaTrader 5, and cost-effective trading options. Whether you're just getting started with a demo account or you're an experienced trader seeking advanced trading tools, these brokers provide excellent choices for Indian traders in 2025. Take your time to find the broker that best fits your trading style, and remember to always manage your risk as you trade forex.

Also Read: The 5 Best Forex Brokers in Vietnam in 2025

FAQs

Can I trade forex legally in India?

Yes, forex trading is legal in India, but it must be done through SEBI-regulated brokers and only involves trading certain currency pairs like USD/INR, EUR/INR, GBP/INR, and JPY/INR. Trading speculative forex with foreign brokers that are not SEBI-regulated is not permitted.

What is the minimum deposit required to start forex trading in India?

The minimum deposit varies depending on the broker. Some brokers offer micro accounts with a low deposit starting at $10, while others may require a higher minimum of $100 or more. It’s best to check with the broker you choose.

What are the most popular forex trading platforms in India?

The most popular platforms include MetaTrader 4 (MT4) and MetaTrader 5 (MT5), both known for their user-friendly interfaces and powerful trading tools. Many brokers also offer their own mobile apps for convenient trading on the go.