FBS Review

FBS is one of the top-notch brokers that was founded back in 2009. They offer trading services for various instruments such as CFDs, Forex, indices, metals, cryptocurrencies, etc. And let’s be honest – they’re one of the most reliable brokers around as they are regulated by multiple well-reputed financial authorities, including the Australian Securities and Investments Commission (ASIC), Cyprus Securities and Exchange Commission (CySEC), Financial Sector Conduct Authority (FSCA), and the International Financial Services Commission of Belize (IFSC).

But that’s not all. FBS also offers a huge selection of tools and resources to help you with trading. From educational materials and tutorials to technical analysis tools and a wide range of research portals — they have everything you need to make informed decisions. To top it off, they offer comprehensive customer service and support. So if you’re ever stuck with a query or want advice, their friendly team is always on hand to help.

In this detailed review, we will discuss what FBS is, the pros and cons of trading with FBS, a complete analysis of their trading conditions, and more. So if you are considering opening an account with this broker, keep reading to find out everything you need! By the end, you’ll be ready to decide if FBS is the right broker for you. Let’s get started!

What is FBS?

FBS is an online trading broker founded in 2009, and it allows access to the international markets for trading forex and CFDs. FBS is regulated by Tradestone Limited and overseen by the Cyprus Securities & Exchange Commission (CySEC). FBS is registered in Cyprus, as outlined in the company's customer agreement.

FBS' international offices are regulated by the IFSC (International Financial Services Commission) of Belize and operated by FBS Markets Inc. The broker firm, headquartered in Cyprus, is associated with more than 17 million traders from 150 countries worldwide.

FBS is a regulated broker that adheres to various legislation environments, which has resulted in excellent trading capabilities with useful tools and authorized trading services. This, in turn, has pushed the development of FBS even further. In this review, we will cover its trading proposal conditions and see whether this broker is competitive enough to cut.

Advantages and Disadvantages of Trading with FBS

Benefits of Trading with FBS

If you’re looking for a reliable trading partner and want to benefit from the best possible trading experience, FBS is an excellent choice. Here’s why:

Robust Regulation – Regulated by the CySEC, which means it complies with strict financial regulations. This ensures the safety of your funds and offers a more secure trading environment.

- Wide Selection of Instruments – Wide range of instruments to trade, including Forex pairs and CFDs. This allows you to diversify your portfolio.

- Good Liquidity – FBS provides great liquidity, meaning you can make quick and easy trades without worrying about slippage or delays.

- Training Material – Offers free educational materials and resources to help you better understand the markets.

- Automated Trading – Support automated trading, so you can easily set up your strategies and let the platform do the rest for you.

- Hedging – Offers hedging capabilities, allowing you to diversify your risk and protect your capital.

FBS combines productivity, unique trading tools, and instruments with other major functionalities to ensure customers enjoy an all-inclusive trading experience. According to traders' reviews, the stock indices and futures contracts greatly add to an already impressive offering. Moreover, you can use the virtual funds in the demo account for risk-free trading.

In addition, the broker has won numerous awards, including the Best Broker in Asia several times, confirming its excellent quality of services. With this broker, you can trade robots and make money off the news. It's also good for day trading and different strategies that take a while. As a result, orders are executed fast, and spreads are low. Also, there is an option to have a swap-free account — this follows Sharia law.

FBS traders trade through popular platforms such as MetaTrader 4 and MetaTrader 5. Both desktop versions for Windows and MAC are available, as well as mobile versions for devices running Android and iOS. You can also use a web-based terminal, and FBS offers a proprietary mobile platform as well. Android users can trade on it now, but an iOS version is in the works.

FBS Pros and Cons

FBS is an excellent choice for investing in stocks and stock indexes. With low fees and no inactivity fee, FBS makes it easy and affordable to get started. Besides, the account opening process is fast and simple, while deposits and withdrawals are free of charge and user-friendly. The customer service and education materials are also excellent.

On the downside, FBS only offers a limited number of products restricted to CFDs. Additionally, few account base currencies are available, and non-EU clients need protection against investments.

Pros

- Good liquidity

- Low index and stock CFD fee

- No in-activity fee is charged, and there is negative balance protection

- Offers a leverage of up to 1:3000

- Lucrative deposit bonuses.

Cons

- Few currency options

- There is no investor protection for non-EU traders

- Slim product portfolio – CFDs only

- This broker doesn't work in Japan, Canada, the USA, and Israel

Analysis of the Main Features of FBS

3.9 Overall Rating |

4.0 Execution of Orders |

3.8 Investment Instruments |

4.0 Withdrawal Speed |

4.0 Customer Support |

3.7 Variety of Instruments |

4.0 Trading Platform |

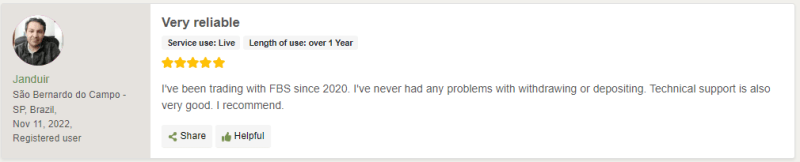

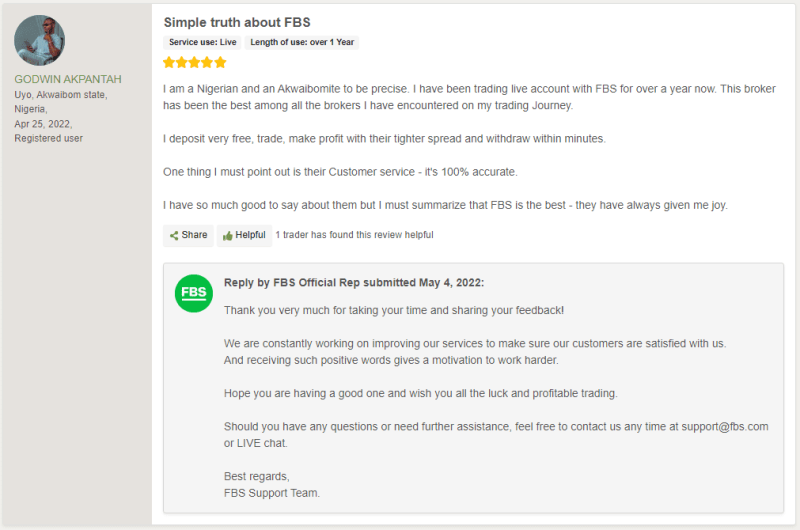

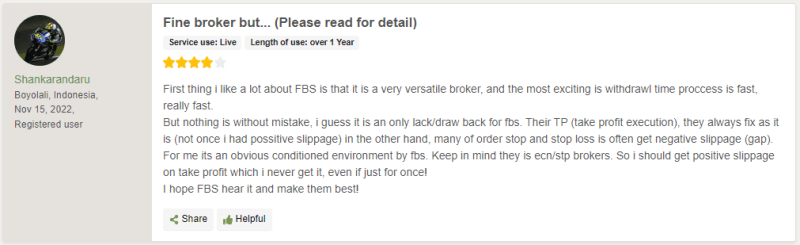

FBS Customer Reviews

We have checked the reviews of multiple traders and found that most have had a positive experience with FBS. Most customers are satisfied with low spreads, order execution, and customer service. The traders also appreciate the convenience of the trading platform and the low fees that FBS offers.

As with any other broker, traders must be careful of slippage and price fluctuations. But, in general, we found that most reviews were positive, with traders satisfied with the services provided by FBS.

FBS Spreads, Fees, and Commissions

Let's look at the FBS spreads, fees, and commissions:

FBS Spreads

By trading with a standard spread account, you will have the option to start from 1 pip. On the other hand, if you open a cent account, you are offered a tight spread.

- The average spread on a Standard account for the EUR-USD pair is 0.9, while on the Cent Account EUR-USD spread is 3 pips.

- The international offering is slightly different, with ECN accounts offering raw spread and commission charges per lot.

FBS Trading Fee

Stock and index CFD fees are low with FBS, but forex CFD fees are average. Also, take note that the cost structure differs between account types. Let's take an example of the FBS Standard account in this review, as we have selected several instruments in different asset classes:

- Forex: EURUSD, GBPUSD, AUDUSD, EURCHF and EURGBP

- Stock index CFDs: EUSTX50 and SPX

- Stock CFDs: Vodafone and Apple

A standard trade usually consists of buying a leveraged position, holding it for around one week, and then selling. To ensure we had enough volume, we chose positions that were $2,000 for the stock index and stock CFDs transactions and $20,000 for forex deals. The leverage we used was:

- For stock CFDs: 5:1

- For stock index CFDs: 20:1

- For forex: 30:1

FBS Non-trading Fees

FBS distinguishes itself from its competitors by not charging an inactivity fee, which is a great plus. In addition, other non-trading fees are low. For example, there is no deposit, withdrawal, or account fee.

FBS Leverages

This versatile trading platform allows users to make leveraged trades based on the account type and geographical region. For example, Cent and Standard account holders in the EU are given maximum leverage of 30:1.

The ECN Account at FBS offers a leverage of up to 500:1 for traders outside the EU, 1000:1 for the Cent Account, and 3000:1 for other types of Accounts. In addition, the margin requirement is 40% or lower, and if the margin call is reached, then the platform has the right to close any open positions held by users.

How FBS Fees Compare to other Brokers

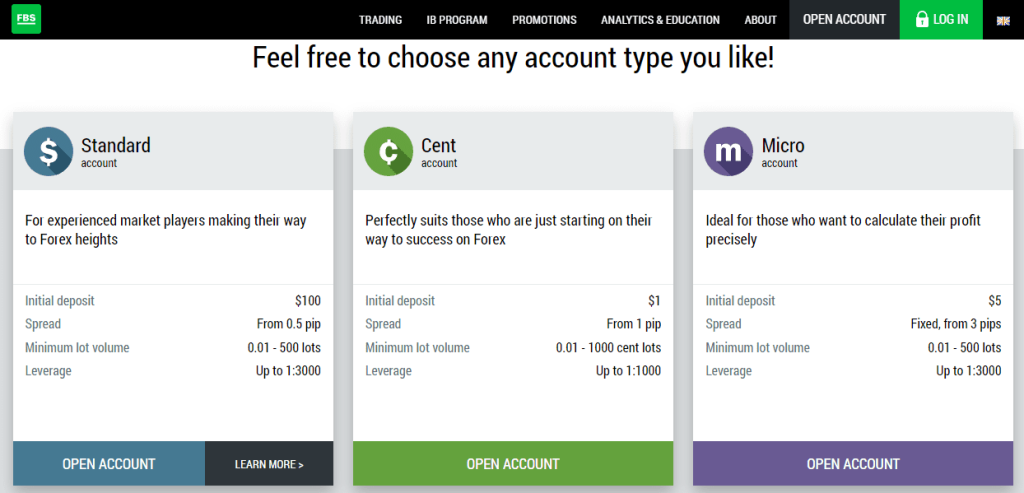

Account Types

FBS offers different account types, and traders can use the one that best suits their trading needs.

Standard Account (Suitable for Intermediate Traders)

This account is best used for intermediate forex traders who want to make more money from the foreign exchange market.

FBS broker Standard Account offers competitive spreads and doesn't charge a commission fee. In addition, it allows traders to utilize leveraged trading up to 1:3000 and provides exciting bonuses.

This account allows one to trade forex, stocks, indices, metals, and energies. In addition, standard account holders can open a demo account at the MetaTrader platforms and practice trading for free. Here is a snapshot of the features you can expect from the FBS standard account:

- Platforms: MT4, MT5

- Trade size: From 1 micro lot

- Leverage: Up to 1:3000 (IFSC, FSCA) and up to 1:30 (CySEC, ASIC)

- Markets: Forex, commodities, indices, shares (150+ assets).

- Commissions: 1 pip spread as well as a rollover fee, $0 commission

- Minimum Deposit: $100

Cent Account (Best for Beginners)

Forex or copy trading might be right for you if you're just starting to trade. To get started, sign up with the Cent Account of FBS. You only need an initial deposit of USD 1 to begin low-risk market trading.

Our Cent Account allows users to get started with a small amount of money displayed in cents. This is recommended for new users who want to try their trading strategy without risking losing money. With this account type, you can perfect your swing strategy before going live and investing more significant sums.

The Account enables traders to conduct trading with small lot sizes and up to 1:1000 leverage. Below is a snapshot of the features you can expect from this account type:

- Platforms: MT4, MT5

- Trade size: From 1 micro lot

- Leverage: Up to 1:1000 (IFSC, FSCA) and 1:30 (CySEC, ASIC).

- Markets: Forex, indices, metals (55+ assets)

- Commissions: 1-pip floating spreads with an overnight rollover fee for open positions and $0 commission

- Minimum Deposit: $10

Micro Account (Best for Seasoned Traders)

The Micro Account is perfect for individual traders who want to monitor their daily trading profits. With access to various advanced tools and calculators, including the Trader's Calculator, they can get an accurate estimate of their potential earnings.

You only need to deposit USD 5 and verify your account to start social trading and investing in assets.

With the Micro Account, traders can take advantage of a large variety of bonus deals and promos that include cashback and a 100% Deposit fees bonus. With an extremely low spread of 3 pips and a leverage up to 3000:1, this account is optimal for experienced traders who have mastered different strategies to minimize losses. Below is the snapshot of features you can expect from the FBS micro account:

- Trade size: From 1 micro lot

- Leverage: Up to 1:3000

- Markets: Forex, metals (30+ assets)

- Commissions: Fixed spreads from 3 pips and $0 commission

- Minimum Deposit: $10

Zero Spread Account (Suitable for Scalpers)

The main feature of the Zero Spread Account is that there are no spreads involved in trading sessions. This allows traders to make more accurate predictions about their market revenues and ultimately increase profits.

The Account holders are charged a commission fee of USD 20 for each lot, but there are no spreads for trading. This is your recommended account type if you seek to engage in high-speed trading by maintaining a maximum of 200 pending orders and open positions simultaneously.

FBS traders can also get a level-up bonus and a 100% deposit bonus to trade in precious metals, foreign exchange currencies, and international base currency pairs. Below are the main features of zero spread account:

- Trade size: From 1 micro lot

- Leverage: Up to 1:3000

- Markets: Metals, Forex (30 assets)

- Commissions: Fixed spreads from 0 pips and $20 commission per lot.

- Minimum Deposit: $500

ECN Account (Suitable for Experienced Traders)

With an ECN account, traders can buy and sell assets directly without going through a broker. This makes it a lot easier to get top prices for your trades. If you have a large sum of money to work with, we recommend opening an ECN Account, as the minimum deposit fee for this account type is USD 1000.

Some other notable advantages that the ECN account provides include low spreads starting from only 1 pip, a large number of liquidity providers for trading, and quick access to the best market quotes.

The ECN Account allows users to conduct unlimited trading orders and maintain multiple open positions at the same time. Below are the main features of the ECN account:

- Trade size: From 1 micro lot

- Leverage: Up to 1:500

- Markets: 25 currency pairs

- Commissions: Negative spreads down to -1 pips and a commission of $6

- Minimum Deposit: $1000

Crypto Account

If you want to trade various cryptocurrencies with low spreads, sign up for the Crypto Account at FBS. You can trade Bitcoin, Ethereum, and altcoins with a floating spread of 1 pip.

FBS broker offers over a hundred financial instruments for trading and investment and enables crypto trading with low spreads and fixed leverage of 1:5. Additionally, FBS makes it easy to deposit funds with conventional methods. Below are the features offered by this account type:

- Trade size: From 1 micro lot

- Platforms: MT5, FBS Trader

- Leverage: p to 2:1 (CySEC, ASIC) and 20:1 (IFSC, SFSA).

- Markets: Cryptocurrencies (166+ crypto assets)

- Commissions: Charged spreads from 1 pip and a commission of $0.05%, rollover fee for holding an overnight position

- Minimum Deposit: $1

Demo Account

FBS trader provides demo trading on various assets to Standard and Cent Account traders. The mt4 and mt5 platforms also allow demo trading, whereas other Islamic account trading platforms only provide access through their proprietary platform. The trade demo account is beneficial for creating trading strategies and styles before proceeding into the live markets.

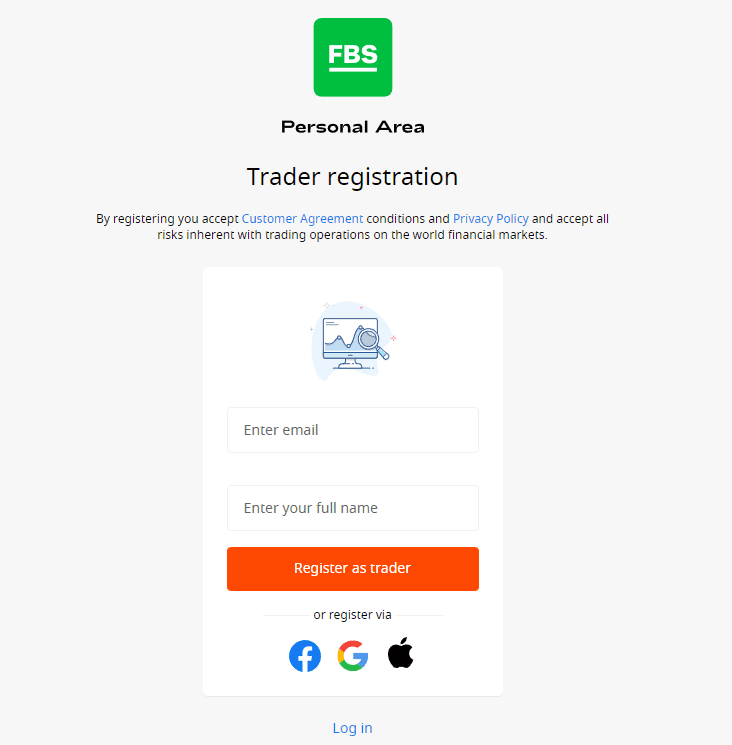

How To Open Your Account?

Traders can now open their account by following the below steps:

- New traders need to go to the official website of FBS and click on open account to register.

- Enter your email and full name and click the ‘Register as trader' button. (You can also sign-up using your Gmail, Facebook, or Apple account).

- For successful registration, submit your ID for KYC verifications.

- In the next step, verify the email address and make the minimum deposit in the certain account to get started.

What Can You Trade on FBS?

FBS traders can use several assets wide range of instruments, including:

Metals

Professional traders can trade gold and silver for USD currency. The lot size is 5000 for silver, whereas it is only 100 for gold. Between 10-20 lies the minimum spread, with the typical 30 spread somewhat higher.

Forex

For forex TV, the minimum spreads typically fall between 0.3 and 26; however, no swap-free option trading facility is available for exotic forex currencies.

Commodities

The average spread for energy commodity trading is between 8 and 14. The commodities can be purchased in 10,000-unit lots, and the orders are executed in US dollars.

Indices

FBS has various indices available for trading, and the average spread ranges from 14 to 1800. The most commonly traded indices in lot sizes of 10 include USD 500, EU 50, and USD 30.

Exotic Forex

Depending on the currency, the minimum spread for trading a standard lot (100,000 of the base currency) abroad ranges from 5 to 44.1 units.

Stocks

Traders need to trade with a minimal spread between 1-50 when dealing in stocks, while the average spread is 2-200. When trading stocks, the order value is calculated by multiplying the lot volume by the stock's opening price. The commission fee for trading stocks is 0.7% of this total order value.

Cryptocurrencies

When trading cryptocurrency, traders can exchange crypto coins for other assets, like fiat money or precious metals. The minimum spread size for a standard 1-lot order ranges from 275 to 25010.

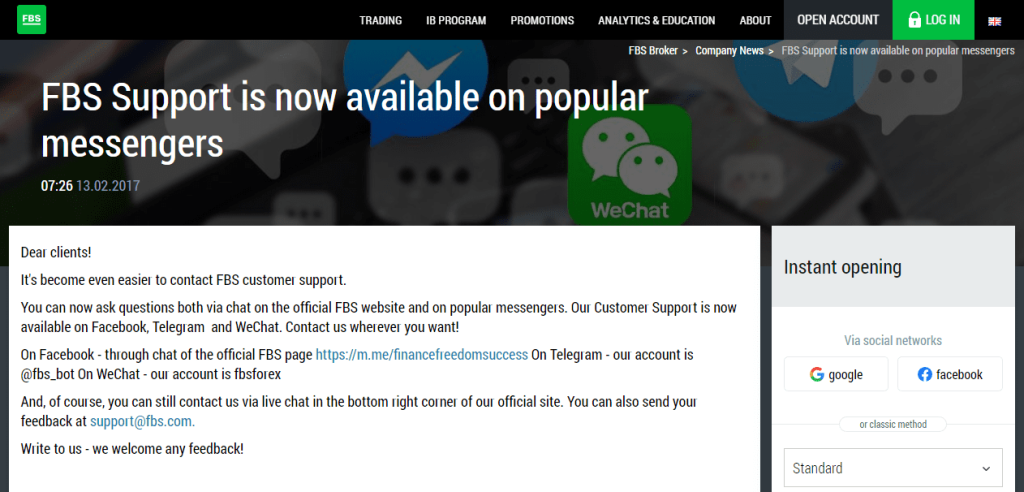

FBS Customer Support

This broker offers 24/7 customer support via live chat, international phone lines, emails, Whatsapp, or social media platforms. Their support team is quite responsible, according to many traders' reviews. However, some reviews suggest that customer service needs to be more accessible.

Advantages and Disadvantages of FBS Customer Support

Contacts Table

Security for Investors

FBS is a fully regulated and licensed broker that follows the rules and regulations of the Cyprus Securities and Exchange Commission (CySEC). This brokerage has appropriate measures to protect customers’ funds and data. It also offers a secure online trading environment, with encryption technology and other measures to ensure your funds are safe.

In addition, FBS offers a variety of tools and services to make sure that investors’ investments are secure, such as negative balance protection, margin call, and stop loss orders. It also provides an investor compensation fund to protect traders in case of broker bankruptcy or insolvency.

Withdrawal Options and Fees

FBS traders can conveniently deposit and withdraw money through various payment options, including bank transfers and e-wallets like Neteller, Mastercards, Visa, and Skrill. Please note that the bank transfer system is only available to users located within the EU.

Transactions that use a payment processor are almost instantaneous. However, it takes at least 48 hours to confirm the deposit and withdrawal methods for transactions made through bank transfer. Moreover, withdrawals are only made in euros.

If you want to withdraw money from our international offices, there will be a transaction fee. In addition, government-issued ID documents may be requested for verification if you wish to withdraw large amounts.

FBS Vs Other Brokers

Here is an in-depth analysis of FBS vs. some of the best brokers.

#1. FBS vs Avatrade

Avatrade is a popular name among novice and professional traders in the financial market. Avatrade entered the trading market in 2006 and has become one of the leading companies in its field since then. As a result, the customers of Avatrade have reached a remarkable number and continue to grow daily.

However, when compared with Avatrade, we have observed that Avatrade outperforms FBS for many reasons. For instance, Avatrade is regulated by the Central Bank of Ireland, MiFID, and 3 other major financial service commissions. On the other hand, FBS is regulated by the Cyprus Securities and Exchange Commission. Furthermore, Avatrade offers to trade more than 250 assets, while FBS offers only 180.

In addition, AvaTrade offers 55 currency pairs, but FBS only offers 45 different pairs. Avatrade offers a wider range of payment methods, including debit and credit cards. However, FBS does not offer direct bank transfers for deposits and withdrawals, which is a downside.

Overall, AvaTrade offers better customer service and more assets than FBS. This makes it a better choice for traders looking for a reliable and secure brokerage. However, the credibility of FBS can be underestimated as it comes with several account types that makes this broker a great choice.

So, depending on what you are looking for in an online brokerage, both Avatrade and FBS offer reliable services. It all comes down to your individual preferences and needs as a trader. Ultimately, you should choose a broker that best suits your requirements.

#2. FBS vs Roboforex

RoboForex is another online broker that offers a wide range of financial services, including Forex trading, CFDs, cryptocurrency trading, and stocks. The company is regulated by CySEC, as well as other financial bodies.

RoboForex offers a variety of account types for traders. These include the ECN, Pro-Cent, and Prime accounts. FBS also offers a range of account types, including Standard and Cent accounts.

The major difference between FBS and RoboForex is the fees. The fees charged by FBS are relatively lower than those charged by RoboForex. Moreover, FBS offers more deposit and withdrawal options than RoboForex.

Both RoboForrex and FBS are good online brokerages offering reliable services. However, FBS offers more options, lower fees, and better customer service. This makes it a great choice for traders looking to trade small amounts. Moreover, there is a major difference between the minimum deposit that both brokers require. FBS ECN accounts require a minimum deposit of $1000, while Roboforex's minimum deposit, even for R StocksTrader, is 100 USD/EUR.

So, depending on what you are looking for in an online brokerage, both RoboForex and FBS offer reliable services. However, Roboforex has a slight edge over FBS when it comes to the variety of assets they offer. Therefore, if you are looking for a broker that offers multiple asset classes, then Roboforex may be a better choice.

#3. FBS vs Alpari

Alpari is a popular option because it provides advanced security measures, a low-commission rate, and an easy-to-use trading interface. Most importantly, Alpari gives traders access to various trading instruments. Our annual evaluation shows that Alpari offers better pricing than most other options on the market.

Alpari and FBS both offer MetaTrader 4 (MT4) and Meta Trader 5 (MT5) trading platforms to their clients and the option of copy trading. The major difference between both platforms is the type of trading instruments both brokers offer. Alpari has major instruments like CFDs, currency pairs, and metals, while FBS offers Forex, CFDs, indices, metals, energies, Cryptocurrency, and more.

Alpari is a multi-asset and foreign exchange (FX) broker that offers retail investors several platforms and account types. Despite being operational in over 50 countries, it largely focuses its customer base in Eastern Europe through online partnerships with local banks and payment providers. Alpari also has an expanding array of CFD markets but needs more regulatory licenses from top-tier jurisdictions as compared to other brokers in the market.

Overall, both platforms offer reliable services and have their own advantages. For example, Alpari offers an extensive product range, but FBS has lower spreads and commissions. So, it all comes down to which online broker best meets your individual requirements.

How FBS Trading Options Compare against other Brokers

Conclusion: FBS Review

FBS is a reliable forex broker that offers access to the global financial markets with competitive trading conditions. Its regulated status and 24/7 support make it a suitable broker for international traders. FBS also provides user-friendly trading platforms, tools, powerful analytics, and news to keep traders informed.

Moreover, it offers an impressive range of withdrawal and deposit options with no fees to ensure your funds are secure. The only downside is that the regulator needs to consider private traders with smaller amounts. Moreover, a few improvements would improve this website, like launching more trading instruments and removing geo-blocking restrictions.

FBS seems the perfect choice for traders of all levels — from the novice to the professional. And with their ongoing commitment to excellence, we can only expect great things from FBS in 2024!

FBS Review FAQs

Is FBS a trusted broker?

FBS is 100% trustworthy and reliable, and this transparent forex broker complies with IFSC. Additionally, FBS is regulated by Cyprus Securities and Exchange Commission CySEC — evidenced by its registration number 119717, which is available for public verification.

Can you withdraw profit from FBS?

FBS traders can easily withdraw their profits through payment methods, including bank transfers and e-wallets like Neteller, Mastercards, Visa, and Skrill. Please note that the bank transfer system is only available to users located within the EU.

How long does it take to withdraw from FBS?

Transactions that use a payment processor are almost instantaneous. It takes at least 48 hours to confirm the deposit and withdrawal methods for transactions made through the bank transfer. Moreover, withdrawals are only made in euros.