TOGETHER WITH

Today’s edition is brought to you by FP Markets, your go-to broker for raw spreads from 0.0 pips and elite execution on MT4 & MT5. With tight pricing, lightning-fast trade speed, and deep liquidity, FP Markets gives you the edge you need to trade with confidence and control.

👉 Click here to start trading with FP Markets today! 💸

What’s up traders, Ezekiel here with a fast market check-in. Let’s break down what’s shaking the markets, why it matters, and how you can stay one step ahead:

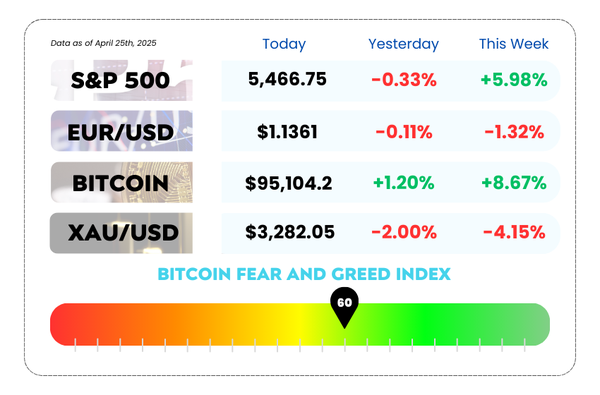

- Today's market mayhem. S&P, EUR/USD, Bitcoin, and XAU/USD today

- Dollar holding strong, but China's giving mixed vibes

- Big tech built the S&P, but tariffs might tear it down

- Spot the hidden flag pattern used by elite traders in this video

🔥 Trade with Ultra-Tight Spreads on MT4 & MT5 with FP Markets 🔥

Looking for razor-sharp execution and spreads that don’t eat into your profits?

FP Markets delivers spreads from as low as 0.0 pips on the world’s leading platforms, MT4 and MT5.

✅ Lightning-fast execution

✅ Deep liquidity

✅ Zero distractions — just pure trading power

Ready to upgrade your trading conditions?

WEEKLY MARKET MAYHEM

For this week's market mayhem, here’s what we got for you today:

💵 US Dollar Stays Chill… But Uncertainty’s the Name of the Game 💵

The US Dollar Index (DXY) ended the week on a slight high note, not exactly popping champagne, but not crying in the corner either. Traders are split on where it’s headed next, mostly thanks to some mixed signals flying around about US-China trade talks.

The US side hinted that negotiations might be happening, which helped lift both the equity markets and the Greenback. But over in China, officials were singing a different tune, suggesting that nothing formal is really on the table.

So now markets are left doing what they do best: overthinking everything.

On top of that, there’s chatter that China could ease up on some tariffs, stuff like medical supplies, ethane, even leased planes. That sounds like a win… but Chinese authorities stayed vague, which didn’t exactly boost confidence.

🗓 Light Calendar, Heavy Vibes

The economic calendar is running on low power mode right now. The Fed is in its blackout period ahead of its May 7 meeting — which means no hints, no headlines, and no fun.

Only notable release?

- Final read on April’s University of Michigan Consumer Sentiment

- Plus inflation expectations, which could spice things up a bit 🌶️

📈 Key Levels for the Dollar

The DXY looks like it wants to rally… but it's hanging on headlines more than hard data right now.

Upside checkpoints:

- 99.58 — recent fake-out zone

- 100.22 — previous support from back in Sept 2024

- 101.90 — the “we’re so back” level

Bearish backslide possibilities:

- 97.73 — could get hit fast if things turn south

- Below that? 96.94, and if the floor really drops out, we’re looking at 95.25 or even 94.56 — levels not seen since 2022 🧊

Also in the mix? A potential peace deal between Russia and Ukraine. If that happens, the Euro could get a lift, which would likely drag the Dollar down with it. Global politics still holding the remote control here.

US Dollar Index Daily Chart as of April 25, 2025 (Source: TradingView)

🤔 Asia Forex Mentor Insights

The DXY is in limbo, it’s got upside potential, but everything hinges on external headlines. One hot trade headline and we could see a break above 100. But a surprise peace deal in Europe or a sudden shift in China’s tone could pull it in the other direction.

This is a trader’s environment, stay nimble, stay sharp, and don’t fall asleep at the charts. 😴📉📈

🚨 Free Live Webinar: Master Naked Price Action with Asia Forex Mentor & Markets4you 🚨

Tired of cluttered charts and lagging indicators? It’s time to trade smarter, not harder.

Asia Forex Mentor and Markets4you are teaming up to bring you a FREE live webinar that unlocks the real power behind Naked Price Action Trading the clean, no-indicator approach that top traders swear by.

📅 Live with Ezekiel Chew, founder of Asia Forex Mentor and one of the most respected mentors in the trading world, you'll learn how to strip your charts down and read the market like a pro — just pure price movement and psychology.

📅 Date: April 29, 2025

🕖 Time: 7:00 PM (GMT +8)

📍 Location: Online via Zoom

💥 Admission: Absolutely FREE

✅ Here’s What You’ll Discover:

- The core rules of naked price action trading

- How to spot high-probability setups without the clutter

- Techniques to read market psychology straight from price moves

- Proven methods to anticipate market direction with confidence

🚀 Seats are limited, so grab yours before they're gone!

🧨 The S&P’s Dirty Secret: It’s Basically a Giant Tech Bubble in a Tariff Minefield 🧨

For years, US stocks have been riding a rocket 🚀 powered almost entirely by tech. Apple, Nvidia, Microsoft, the usual suspects. But now? That rocket might be heading straight into a trade war wall. And most of the market isn’t buckled in.

Here’s what’s not obvious at first glance:

Most of the profit growth in the S&P 500 since 2004 came from one place: which is tech. Strip that out, and the rest of the index is kinda… meh. Margins have barely grown for non-tech sectors, and that’s a big problem if tariffs crank up the pressure.

So when you hear “tariffs might go as high as 32.6%,” don’t just think about rising costs. Think about what happens when the only part of the market carrying the team starts to struggle too. 👎

💸 The Margin Mirage

Everyone’s been high-fiving over strong earnings lately, but zoom out and it’s clear:

- Tech is the margin king with forecasts close to 34%

- The rest of the S&P 500? Barely holding 13-14%

And that’s before factoring in what these new tariffs could do. These numbers are already soft, and any extra weight from trade restrictions could snap them like a cheap tripod.

S&P 500 Daily Chart as of April 25th, 2025 (Source: TradingView)

🤖 Tech’s Dominance Is a Double-Edged Sword

It’s not just that tech is dominant, it’s too dominant. The sector’s oversized weight means that if it sneezes, the whole index catches a cold. And tariffs? They’re the perfect storm:

- Tech companies rely heavily on global supply chains

- Many are exposed to Asia (hello, China tension 👋)

- And their valuations are still rich, meaning even small hits can lead to big selloffs

We’ve already seen signs of that pressure this month, with the S&P wobbling after tariff talk got real. And with the average tariff rate already sitting near 23%, and climbing, that risk is only getting hotter.

📉 Earnings Forecasts Already Getting Trimmed

2025 earnings growth estimates for the S&P have already been slashed from ~13% to under 8%. And we’re not even in peak trade war mode yet. If tech slows down from here, it could blindside investors still betting on “business as usual.”

That dream run we saw from 2023 to early 2024? Mostly tech. If that engine stalls, the S&P’s got no backup plan.

🤔 Asia Forex Mentor Insights

The market’s been riding a one-engine plane — tech. And tariffs are now targeting that engine. Most other sectors don’t have the margin strength or momentum to pick up the slack.

We’re watching this closely because the narrative isn’t about trade deals anymore, it’s about whether the entire structure of the S&P 500 is way more fragile than people think.

Key takeaway: If you’re not factoring in trade risks and tech vulnerability in your outlook… you might be flying blind. ✈️💥

MEMES OF THE DAY

Next candle: “I do what I want.” 🕺📉📈

It’s not a loss until you close, right? RIGHT?! 😅💀