TOGETHER WITH

Today’s edition is brought to you by iFunds, the prop firm that makes you forget endless challenges and progress bars. iFunds hands you the capital day one, so you can do what you came here to do: trade.

👉 Up to $500K in instant funding.

Hey traders, Ezekiel here. Let’s dig into today’s market movers and what they mean for your next trade.

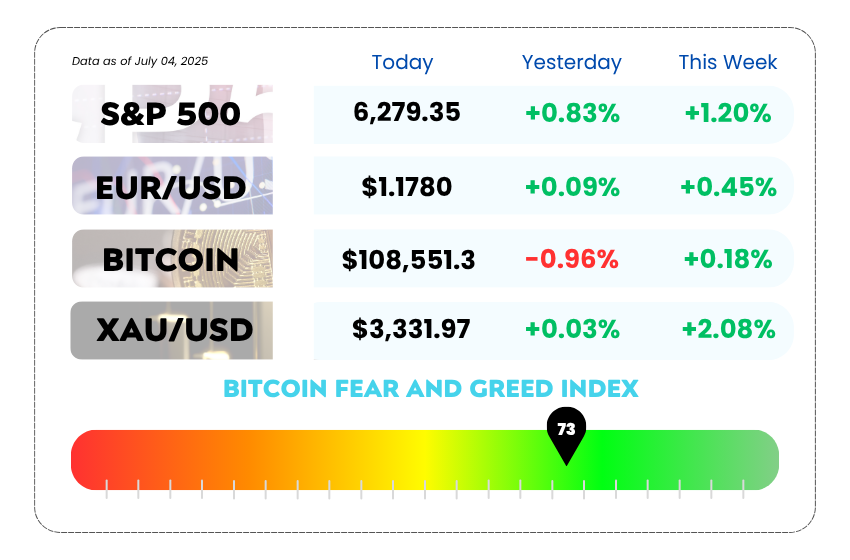

- Today's market mayhem. S&P, EUR/USD, Bitcoin, and XAU/USD today

- The deadline is here: Countries scramble as U.S. tariffs kick in

- The dollar’s down bad as July 9 tariff shockwave gets closer

- Discover how to avoid liquidity traps and trade like smart money with our YouTube video

The Prop Firm Without the Games 🧠

Most prop firms make you jump through hoops, challenges, targets, time limits, just to maybe get funded.

iFunds skips the circus. No tests, no monthly resets, no waiting. Just straight-up trading capital, ready to go.

Here’s what traders are loving:

- Instant access to up to $500K

- No evaluation phases or performance pressure

- Withdraw profits anytime — no strings attached

- Works with scalping, swing trading, bots — however you trade

- Clean fee structure that doesn’t eat your wins

If you're tired of “prove yourself first” models, this might be your shortcut.

WEEKLY MARKET MAYHEM🔥

For this week's market mayhem, here’s what we got for you today:

Tariff Tsunami: Trump’s 70% Shockwave Is Locked and Loaded🧨

Markets might be rallying, but the tariff timer is ticking louder than ever. President Trump just confirmed: letters are going out, deals are drying up, and tariffs as high as 70% are about to slam U.S. trade partners like a freight train with no brakes.

The date to fear? July 9. The White House’s self-imposed deadline for trade deals is here, and if you’re not in Trump’s “approved” club, expect those sweet exports to come with a side of extra taxes.

Here’s the twist: This isn’t your 2018 trade war replay. This time, Trump’s starting with tariffs and working backward, handing out penalty rates first, and daring countries to negotiate their way out.

💌 Incoming: The Tariff Love Letters

The first batch of “friendly reminders” (read: tariff threats) started going out Friday. These letters lay out exact tariff rates effective August 1 — ranging anywhere from 10% to 70%, depending on the country’s vibe with Team Trump.

So far, only a handful of countries have successfully made it to the “deal done” zone. The rest? Staring at a potential export apocalypse.

Let’s check the leaderboard:

- China: Getting a rare break. Restrictions on chip software and ethane exports are being lifted as part of a chill-down deal. Big win for firms like Synopsys and Cadence.

- Vietnam: Got a deal — but not without bruises. Imports will face a 20% tariff, down from the 46% threat. But don’t try to sneak Chinese goods through — that’ll cost you 40%.

- Japan: Not vibing. Negotiations broke down, and Trump’s ready to slap 30-35% tariffs or whatever number he feels like. Ouch.

- EU: Willing to accept 10% across the board, but lobbying for exceptions on pharma, booze, chips, and aircraft. Trump’s got 50% in his back pocket if things go south.

- Canada: Pulled a 180, scrapped its digital tax, and came back to the table. A deal could be close — if they hustle.

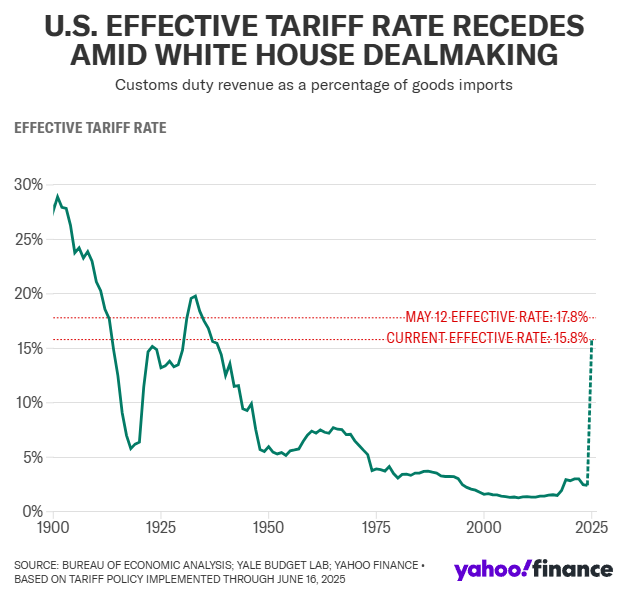

United States of America's Effective Tariff Rates from 1900 to 2025 (Source: Yahoo Finance)

🤔 Asia Forex Mentor Insights

Here’s what really matters for traders:

📈 Volatility Is the Main Course: With Trump’s tariff letters going out and responses varying wildly, FX pairs like USD/JPY and USD/CAD are primed for swing setups. Expect knee-jerk reactions to each country-specific deal or breakdown.

📊 Tariff Themes Mean Rotation Trades: Commodities tied to export-heavy regions (e.g., Canadian crude, Japanese tech components) may see capital rotation. Look for momentum trades building in ETFs or sector-specific names.

🧠 Risk-on/Risk-off Whiplash: The market is already dealing with Fed rate cut timing and inflation drift. Tariff reactivation adds another macro headwind, so watch for tighter ranges and breakout traps — especially around the July 9 and August 1 key dates.

🇺🇸 Trump = Catalyst King: His policy-by-microphone approach means markets could reverse on a tweet. Keep stops tight, avoid overnight positions unless you love stress, and trade the reaction, not the headline.

Dollar Slips as Trump’s Tariff Clock Ticks and Traders Aren’t Buying the Dip 💵

The dollar’s feeling dizzy. After rallying on strong jobs data Thursday, it slipped Friday like it forgot how momentum works. The culprit? Not just inflation. Not just rate talk. It’s tariffs, taxes, and trillion-dollar debt talk all colliding at once — and traders are noticing.

President Trump’s new $3.4 trillion “tax-and-spend” bill just got the green light, and while stocks took it in stride, the dollar got cold feet. Yes, payrolls came in hot — but the greenback still couldn’t hold its ground.

Why? Because markets are watching two bombs that might go off any second:

The July 9 tariff deadline, where Trump promised to slap up to 70% levies on countries without a trade deal.

The $36.2 trillion U.S. debt pile, which just got a bigger boost thanks to new spending plans.

Basically, traders are wondering — how much longer can this dollar flex before it starts to tear?

📉 Dollar, Meet Gravity

- The dollar index dropped 0.1% to 96.92.

- The euro climbed to $1.178 — its highest in over 3 years.

- The yen and Swiss franc gained ground too. Safe havens, anyone?

Meanwhile, the U.S. currency has dropped more than 6% since April, marking its worst H1 performance since 1973. It’s not just about the dollar falling, it’s why it’s falling. And the reasons are stacking.

United States of America's Effective Tariff Rates from 1900 to 2025 (Source: Yahoo Finance)

🌍 Global Trade Games: Letters, Leverage, and Last-Minute Talks

Trump said countries will start receiving letters Friday outlining their shiny new tariff rates. It’s like Santa’s naughty list, but instead of coal, you get a 60% tax hike.

Some of the moves:

- Japan’s trade chief is flying to Washington, again, to save the deal.

- The EU is scrambling to lock in a “deal in principle” before the buzzer.

- Indonesia just offered near-zero tariffs and a $500M wheat shopping spree.

- China said “fine, two can play this game,” and slapped a 34.9% tariff on EU brandy. Cheers to that.

In short, everyone’s talking, but the clock’s ticking.

🤔 Asia Forex Mentor Insights

The dollar’s short-term strength on jobs data was textbook “buy the rumor, sell the fact.” Smart money sold into the bounce, especially with real yield pressure from Trump’s fiscal blowout and softening Fed bets.

Technically, the DXY is now below key support at 97.00, and a sustained move under 96.80 could open doors to 94.50, a level last seen in early 2022.

Meanwhile, yen strength is becoming a pattern, not a fluke, and EUR/USD is creeping toward the 1.19 breakout zone. Watch for July 9 to act as a volatility trigger, especially in USD/JPY and EUR/USD.

This is one of those weeks where macros matter more than momentum. Rate cut expectations may pause, but if tariffs fly, liquidity will dry, and the dollar won’t be the safe haven it used to be.

MEMES OF THE DAY

When confidence hits 100 but experience is still loading… 💻

One’s catching pips, the other’s catching falling knives 🔪