TOGETHER WITH

Today’s edition is powered by FP Markets, where serious traders go for serious execution. Trade with raw spreads from 0.0 pips, lightning-fast order fills, and deep liquidity across MT4, MT5, and cTrader.

👉 Level up your trades with FP Markets now! 💸

Hey traders, Ezekiel here with a quick pulse check on the markets. Let’s dive into what’s moving, what it means, and how to stay ahead of the curve:

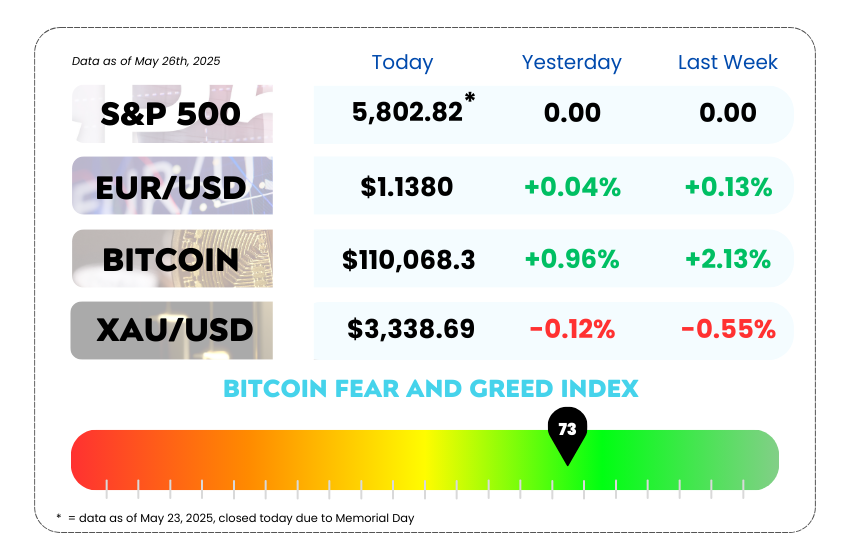

- Today's market mayhem. S&P, EUR/USD, Bitcoin, and XAU/USD today

- Stocks rally as Trump hits pause on EU trade threat

- Yields surge as investors brace for America’s growing debt bomb

- Learn how to avoid fakeouts and master real breakouts with our YouTube video

Stop Trading Like It’s 2015! Trade from 0.0 Pips with FP Markets 🚀

If spreads are eating your trades alive, it’s time to upgrade.

FP Markets gives you a professional-grade setup without the institutional headache, raw spreads from 0.0 pips, ultra-fast execution, and direct access to liquidity through MT4, MT5, and now cTrader.

You get:

- Institutional-level speed with zero markup gimmicks

- Deep liquidity pools to reduce slippage

- The control and tools you need to actually scale

No inflated spreads, no flashy distractions, just raw trading conditions built for real results.

WEEKLY MARKET MAYHEM🔥

For this week's market mayhem, here’s what we got for you today:

Markets Love the Drama… But It’s Getting Old 🌀

Let’s be real, this playbook’s getting predictable. Threat ➝ Panic ➝ Delay ➝ Rally. But here’s the twist: the rebound rallies are losing steam. 📉

Investor mood? Fatigue. The “tariff tango” is starting to feel more like a treadmill, a lot of motion, not much progress. Traders are starting to wonder: even if a deal gets done, what’s the cost to European equities?

Meanwhile, Thyssenkrupp jumped 7% on restructuring buzz, and US Steel surged after Trump hyped up a deal with Japan’s Nippon Steel. No one really knows what that deal includes, but hey, the stocks popped, so who’s asking?

💵 The Dollar’s Not Loving This

Trump’s trade antics aren’t just messing with stocks, the dollar’s slipping too. The US Dollar Index is eyeing its lowest close since July 2023, and traders are slowly dialing down their short positions, but still staying bearish overall. USD just isn’t the cool kid anymore.

US Dollar Index 5-Day Chart as of May 26, 2025 (Source: TradingView)

🔍 Big Things Coming This Week

The macro suspense continues with:

- Nvidia earnings on Wednesday: All eyes on AI’s golden child. A weak outlook could hit growth stocks like a slap.

- Fed’s favorite inflation report on Friday: The PCE index is due, and a surprise there could rattle rate expectations.

- Trade disruption watch: Ports in Europe are clogging up. If the tariff war escalates, expect a spike in global shipping costs.

🤔 Asia Forex Mentor Insights

What to watch: The market is still rewarding hope, but those rebounds are getting smaller. If the back-and-forth continues, traders may start positioning more defensively.

Key takeaway: Don’t get hypnotized by the relief rallies. The real risk might not be the tariffs themselves, it’s the constant uncertainty that erodes confidence, shifts flows, and makes the charts messy.

Stay sharp, stay liquid, and stay flexible. The market’s not done testing your nerves. 💡📊

Trump Yells Tariff Again… and Wall Street Shrugs 💤

While everyone’s watching stocks bounce around, the real panic is brewing in the bond market. Yields are spiking, confidence is cracking, and the cause? Uncle Sam’s wallet is wide open… and leaking fast. 🧾📉

Thanks to Trump’s newly-passed tax bill, loaded with cuts and light on spending discipline, the U.S. deficit is looking more like a financial black hole. And investors? They're starting to flinch.

Long-term Treasury yields are on the move, with the 30-year touching levels not seen since 2007. That’s not just a bump, that’s a warning flare. Bonds, usually the safe haven during chaos, are now the ones causing the chaos.

🏛️ The Debt Party Just Got Louder and Riskier

Trump’s tax bill is promising major cuts to both personal and corporate tax rates. Sounds great on paper, until you see the $4 trillion price tag added to the national debt over the next 10 years. 🧨

Even worse? There’s no aggressive spending cut to balance it out. What’s being proposed is either backloaded (aka: future Congress’ problem) or so vague it’s practically fictional. That’s made traders uneasy, and it’s showing in how fast yields are climbing.

Throw in inflation fears, global instability, and a very meh Treasury auction, and what you get is this: investors demanding higher returns to hold U.S. debt.

🌍 The Global Fire Is Spreading

The bond chaos isn’t just Made in America. Over in Japan, Prime Minister Shigeru Ishiba dropped a financial bombshell on his own economy, warning of fiscal instability. That sent Japanese bond markets into a spiral, and added fuel to fears of weak global demand for U.S. Treasuries.

Translation? If foreign buyers stop showing up, the U.S. has to raise yields even more to get attention. And when bond yields go up… everything else feels it. From mortgage rates to corporate loans to valuations across Wall Street.

📈 The Curve Is Flattening, But Not In A Good Way

Short-term rates are staying pretty chill, since most traders expect the Fed to stay on hold. But long-term yields are stretching higher, signaling that the real fear is further down the road. It’s not just “are rates going up”,it’s “can the U.S. actually afford its future?”

🤔 Asia Forex Mentor Insights

Why this matters for you: Bond market moves are like the rumble before an earthquake, they shake everything from currency strength to equity valuations. When yields rip higher, money starts moving fast. Smart traders aren’t just watching price, they’re watching flows.

Stay nimble: Be alert to sudden shifts in sentiment, especially on longer-term bonds and USD pairs. And keep an eye on how equity markets react, because if yields climb too fast, risk assets will start sweating hard.

Bottom line: The debt story isn't new, but this reaction? It's starting to feel different. The bond market’s shouting… the question is: who’s listening? 🔍📊

MEMES OF THE DAY

The fastest way to turn one bad trade into five 😵💫

Demo profits got him feeling invincible 😎