The purpose of basic technical analysis tools is to signal market changes by providing crucial information that can affect investment decisions.

Brokers possess an arsenal of tools to estimate the conditions before entering a position. Several instruments make this possible, yet most perceive the KDJ indicator as optimal market analysis for short-term stock.

At its core, the KDJ analysis tool is a trend-following indicator. Helping investors discover trends and points of optimal entry points.

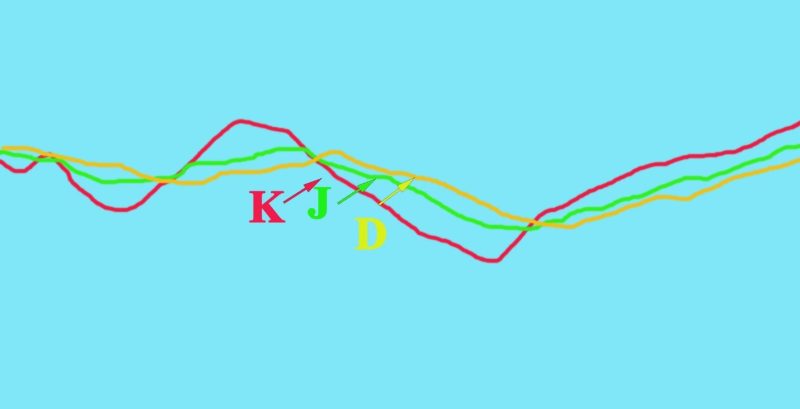

The name of the indicator is not a set of initials. KDJ consists of three lines appropriately designated K, D, and J. Most experienced traders will be familiar with the K and J lines from the stochastic oscillator.

But the extra line called J is something new. The line represents the divergence between the K and D values.

With the KDJ indicator, investors can identify the direction of a trend and its potential. The KDJ indicator calculation uses the lowest, highest, and the closing price.

The captured K, D, and J values are created separately at the point on the correlative of the index, and a perpetual number of analogous points are associated. Market analysts estimate the KDJ indicator by looking at the highest, lowest, and closing prices in a given period.

The alternative name for the indicator is a random index.

Also Read: What Is The TRIX Indicator?

Contents

- What’s The Role Of The J Line?

- What Is A Stochastic Oscillator?

- Trading FX And Crypto With KDJ

- Prevent False Signals By Combining With Other Indicators

- Very Practical Technical Indicator

- Conclusion

- FAQs

What’s The Role Of The J Line?

The KDJ indicator gets constructed from and two levels. The K and D lines are identical to those used in the Stochastic Oscillator. The J line shows the disparity of the value D from the value K. When the lines converge it indicates a trading opportunity.

When using the KDJ indicator, the overbought and oversold levels coincide with periods when the course of the asset can get reversed.

The default setting is 20% and 80% but can be modified if you want to get better sensitivity or reduce fake signals.

What Is A Stochastic Oscillator?

A stochastic indicator is a momentum indicator that functions by analyzing an appropriate closing price of an asset to a range of its prices over a given period. The awareness of the oscillator to market dynamics gets made by modifying that period. It gets used to produce overbought and oversold trading signals.

It is range-bound and is usually somewhere from 0 up to 100. Making for an advantageous indicator for overbought and oversold conditions. Readings over 80 get perceived in the overbought range, and readings under 20 are perceived as oversold.

Still, these are not suggestive of approaching reversal. Powerful trends can sustain overbought or oversold conditions for a long period.

In charting, the indicator is composed of two lines: the first presenting the actual value of the oscillator for each session, and the other showing its three-day simple moving average.

Usually, the price moves in tune with the momentum. When the two lines cross, it signals that a reversal is starting, indicating a large change in momentum.

The disparity between the stochastic oscillator and trending price action gets perceived as a crucial reversal signal. If the bearish trend comes to a new lower low, but the oscillator displays a higher low, it may signal that bears are losing their momentum, and a bullish reversal is gaining inertia.

Trading FX And Crypto With KDJ

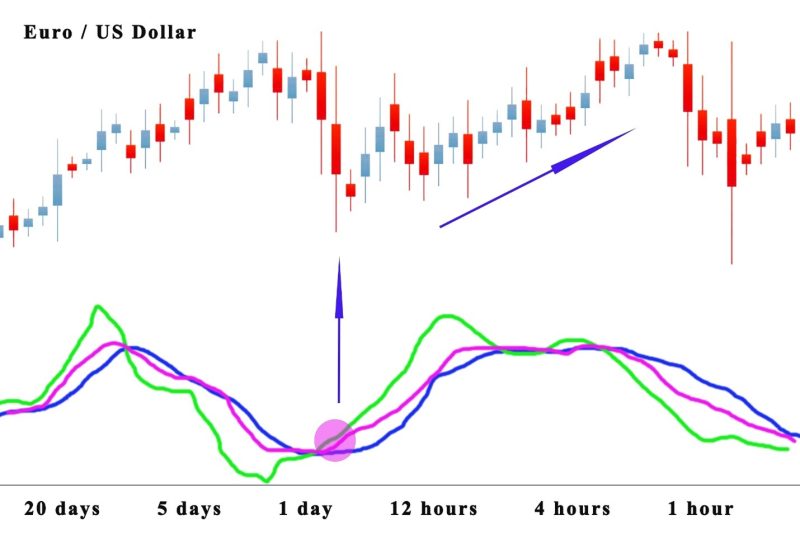

The indicator gets used in all forms of trading without any need for modification. However, you must take into account the nuances of the chosen asset.

The parameters may be the same, but the method you use to interpret the data you receive from the indicator depends on the type of traded asset and the circumstance in which it gets traded.

When a trader observes a potential uptrend, the KDJ indicator is over 80 or even under 100. It doesn’t mean that the asset has to get sold just because the KDJ indicates its overbought level.

Uptrend oscillators can indicate an overbought zone a few times before the price reverses, resulting in a few bad signals. The same applies to the downtrend, of course.

The important consideration is to know that the indicators are provided by the KDJ Stochastic stay the same and can get used in that form with the apparent difference that for forex and cryptocurrency you use to buy and sell while for binary options you can use call and put.

Remember that the info above is not a detailed strategy, and the KDJ indicator is simply an indicator that should get used in combination with other technical analysis tools to help you trade prosperously.

Prevent False Signals By Combining With Other Indicators

Best results get achieved by combining the KDJ with other indicators, most frequently the Average Directional Index (ADX) and Average True Range (ATR).

The former is constantly over the curve and indicates an imminent reversal. The latter gets used to measure the volatility of the market.

It was repeated a million times, don’t fool yourself into thinking that any indicator has the potential of generating precise information. A good combination for KDJ is the Bollinger bands that can show support and resistance levels.

That’s why it’s crucial to diversify not just the investment portfolio, but also the set of technical indicators that get used. Implementing high-risk management when using KDJ to prevent losing money rapidly.

Very Practical Technical Indicator

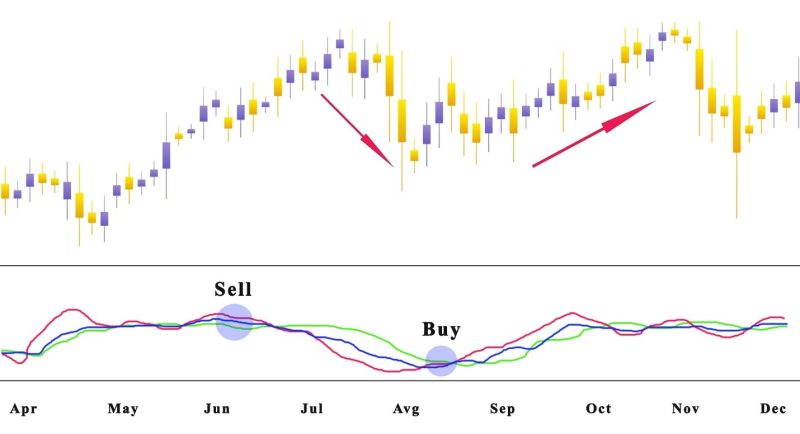

The point of crosses of the KDJ curve is branches out in two formations the golden cross and the death cross. When the golden cross forms it’s an indicator to buy, and the death cross is the sell signal.

Typically, in an uptrend and downtrend, the signal line of the KDJ indicator will form two or more golden crosses and death crosses.

If the stock price goes through consolidation, and under the 50 line, when the J line and the K line simultaneously crack the D line. There is a signal that the stock market is gaining strength and the price declines, then the trend is over.

When the decline comes to a still and starts going upwards, many traders interpret it as a buy signal. This is a form of the KDJ indicator golden cross.

If the stock price climbs consistently in the previous period, and the traded assets price rises when the J line and the K line simultaneously go through the D line. It signals that the stock market is gaining strength.

Turning to a weak position the stock trends price will fall sharply. Most of the stocks should be sold instead of buying stocks. This is a form of the death cross of the KDJ indicator.

Conclusion

The KDJ indicator is an important technical indicator in market trend analysis. It’s a trend-following indicator, and the important points of the indicator are points 20 and 80, which show oversold and overbought zone.

When looking at price patterns formed by the KDJ, it’s important to know that false signals can be produced. That’s why common investment advice is to combine it with another indicator such as the Average True Range (ATR) or the Average Directional Index (ADX).

No indicator will be fully successful, that’s why investors use risk management strategies. The KDJ provides fewer false signals and is a lagging indicator.

The KDJ is a useful tool, and the third line is great for newbie traders that benefit from learning to use stochastics. Traders follow the trend when it is moving up, and trade up, when it is moving down, they trade down.

Also Read: What Is The Supertrend Indicator

FAQs

How do You Read KDJ?

KDJ is a borrowed form of the Stochastic Oscillator Indicator the only characteristic is the extra J line. Values of K and D lines indicate that the asset is overbought or oversold. Indicators of buying and selling are the instances of K crossing D.

What Is KDJ in Tradingview?

KDJ gets used as an indicator in TradingView, one of the best charting platforms on the web.

What are the 3 Basic Stock Indicators?

The best stock indicators are SMA or EMA for trend following, the RSI for momentum, and ATR for volatility.

What Is the Most Accurate Indicator in Trading?

No indicator is always precise and that is true for the KDJ which should always get used in combination.

I really like the way that you have expressed yourself. There is a lot to be admired from this post. You might want to click on

T-Birds Jacket

When seeking the best sites to free download movies in HD, it’s crucial to prioritize legal and reputable platforms to ensure a secure and enjoyable experience. Some reliable options include popular streaming services like Netflix, Amazon Prime Video, and Hulu, which offer a vast library of movies in high definition. Additionally, consider platforms like Vudu, YouTube Movies, and Google Play Movies & TV for renting or purchasing movies legally. Remember to stay away from unauthorized or suspicious websites to safeguard your device and data. As for Delta 8, it’s a noteworthy keyword often associated with cannabis, particularly a type of THC with unique properties. Always ensure legal compliance and safety when exploring related products.

The KDJ indicator, also known as the “Stochastic Oscillator,” is a technical analysis tool used in trading to assess momentum and potential trend reversals. It consists of three lines: %K, %D, and the J line. %K represents the current market rate, %D is the moving average of %K, and the J line helps identify potential crossovers and divergence.

As for the “ai death calculator,” there’s no widely recognized term with this specific phrase in the context of finance or trading. If you have more details or if it refers to something else, please provide additional information for a more accurate response.

The KDJ Indicator, also known as the “KDJ Index,” is a technical analysis tool used in financial markets to assess the momentum and trend strength of an asset. It is an extension of the Stochastic Oscillator, incorporating additional elements such as the %D line and the moving average of the %K line. Traders use the KDJ Indicator to identify potential reversal points, overbought or oversold conditions, and the overall strength of a prevailing trend.

When seeking Dubai Attraction Tickets, ensure to explore various options and packages that cater to your preferences, providing access to the city’s renowned attractions and experiences.

Leather Jacket

Paradise Jacket

The KDJ indicator, also known as the “Stochastic Oscillator,” is a technical analysis tool used in financial markets to assess momentum and trend strength. It consists of three lines: %K, %D, and J. The %K line represents the current market rate as a percentage, %D is a moving average of %K, and J is the difference between %D and %K.

Now, regarding the keyword “What is a Bonsai Tree,” a Bonsai Tree is a miniature tree grown in a container, carefully pruned and shaped to create a small, aesthetically pleasing representation of a full-sized tree. The art of cultivating Bonsai originated in China and was later adopted and refined by the Japanese. Bonsai trees require meticulous care and attention to maintain their miniature size and distinctive shapes, making them a symbol of patience, precision, and the beauty of nature in a confined space.

The KDJ indicator, also known as the Stochastic Oscillator, is a technical analysis tool used in financial markets to assess momentum and identify potential trend reversals. It comprises three lines: %K, %D, and the slow-moving average %J. Much like Spider-Man navigating between buildings, buy miracle smile discount the KDJ indicator helps traders swing between overbought and oversold conditions, providing insights into market strength and potential turning points. By analyzing the interplay of these lines, investors can make informed decisions about entry and exit points in the ever-volatile financial web.

nice

nice

xdces

Very great post. I simply stumbled upon your weblog and wished to mention that I have really enjoyed surfing around your blog posts. In any case I will be subscribing to your feed and I’m hoping you write again soon! New Edition Jacket

Direct to film transfer, also known as digital to dtf transfer, is the process of transferring digital content directly onto film stock, bypassing the need for intermediate steps such as printing onto paper or creating negatives.

Every stitch in Gosling’s <a href=”https://evesuiting.com/product/ryan-gosling-the-fall-guy-bomber-red-jacket/”>The Fall Guy Red Jacket</a> tells a story of adventure and intrigue.

Every stitch in Gosling’s <a href=”https://evesuiting.com/product/ryan-gosling-the-fall-guy-bomber-red-jacket/”>The Fall Guy Red Jacket</a> tells a story of adventure and intrigue.

Every stitch in Gosling’s The Fall Guy Red Jacket tells a story of adventure and intrigue.

Blue light therapy is commonly used to treat acne, as it has been shown to effectively kill the bacteria that contribute to acne breakouts. The blue light therapy penetrates the skin and targets the bacteria known as Propionibacterium acnes (P. acnes), which can help reduce inflammation and improve acne symptoms.

The KDJ indicator, also known as the KDJ line, is a technical analysis tool used in trading to assess market momentum and identify potential trend reversals. It is based on the stochastic oscillator and consists of three lines: the K line, D line, and J line. The KDJ indicator helps traders analyze price movements and make informed decisions about buying or selling assets. Mounjaro UK provides insights and tools for traders to effectively utilize indicators like the KDJ in their trading strategies.

The KDJ indicator, also known as the KDJ line, is a technical analysis tool used in trading to assess market momentum and identify potential trend reversals. It is based on the stochastic oscillator and consists of three lines: the K line, D line, and J line. The KDJ indicator helps traders analyze price movements and make informed decisions about buying or selling assets. Mounjaro UK provides insights and tools for traders to effectively utilize indicators like the KDJ in their trading strategies.

The KDJ indicator, also known as the KDJ line, is a technical analysis tool used in trading to assess market momentum and identify potential trend reversals. It is based on the stochastic oscillator and consists of three lines: the K line, D line, and J line. The KDJ indicator helps traders analyze price movements and make informed decisions about buying or selling assets. Mounjaro UK provides insights and tools for traders to effectively utilize indicators like the KDJ in their trading strategies.

The KDJ indicator, also known as the KDJ line, is a technical analysis tool used in trading to assess market momentum and identify potential trend reversals. It is based on the stochastic oscillator and consists of three lines: the K line, D line, and J line. The KDJ indicator helps traders analyze price movements and make informed decisions about buying or selling assets. Mounjaro UK provides insights and tools for traders to effectively utilize indicators like the KDJ in their trading strategies.

The KDJ indicator, also known as the KDJ line, is a technical analysis tool used in trading to assess market momentum and identify potential trend reversals. It is based on the stochastic oscillator and consists of three lines: the K line, D line, and J line. The KDJ indicator helps traders analyze price movements and make informed decisions about buying or selling assets. Mounjaro UK provides insights and tools for traders to effectively utilize indicators like the KDJ in their trading strategies.

To order Ozempic online UK, one can visit licensed online pharmacies or reputable medical websites offering prescription services. It’s essential to ensure the website is legitimate and follows proper protocols for dispensing prescription medications. After selecting a trustworthy platform, users typically need to fill out a medical questionnaire detailing their health history and current conditions. A qualified healthcare professional will review the information and issue a prescription if deemed appropriate. Once approved, customers can proceed to purchase Ozempic, a medication commonly used to treat type 2 diabetes, with the assurance of receiving genuine and regulated medication delivered conveniently to their doorstep.