- The Purpose of a Cross Currency Swap

- How a Cross Currency Swap Works?

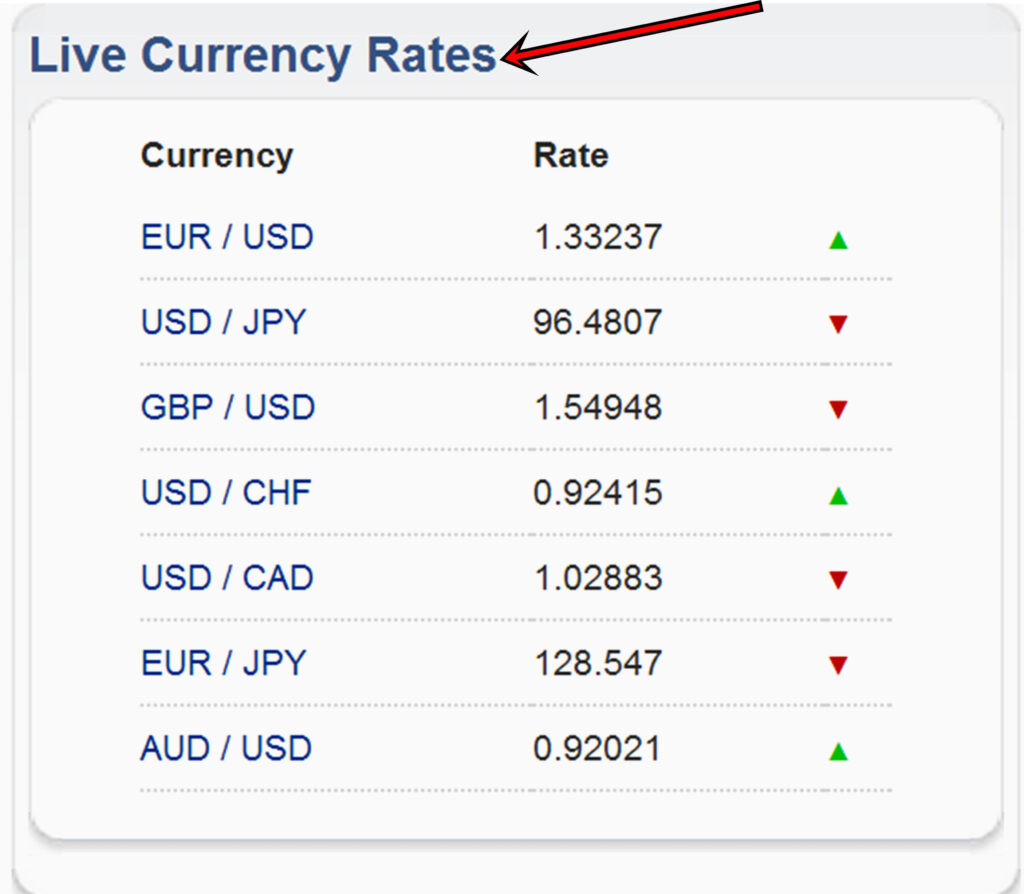

- Currency Swaps and Exchange Rates

- How Cross Currency Swap Differs From FX Swap

- The Differences

- The Role of Swap Bank

- Benefits and Risks of Cross Currency Swap

- Types of Cross Currency Swaps

- How Cross Currency Swap Influences Investments and Funding

Cross currency refers to a currency pair that is traded in foreign exchange, but the trade (neither of the currencies) does not involve the U.S dollar. Although neither of the currencies is the U.S dollar, the dollar is still considered as benchmark for fairness because it is more stable.

On this basis, a person can exchange a sum of money for another currency without been cheated as long as the different currencies are first converted into the dollar before the exchange is done to ensure fairness in the trade.

With this knowledge, understanding what cross currency swap means is a lot easier than before.

Cross currency swap refers to an agreement between two parties to exchange or trade equivalent amount of different currencies with each other.

During a cross currency swap, interest rates are exchanged at regular intervals but the exact or principal values are exchanged only at the start of the trade and at full maturity.

This agreement is also known as over-the-counter (OTC) derivatives. Also, only the current current exchange rate is used as the cross currency basis. They are highly customizable and can include both fixed interest rates and variables.

Also Read: Money Flow Index

The Purpose of a Cross Currency Swap

There are several reasons why financial institutions do a cross currency swap. some of the commonest reasons include:

- Attempt at speculating or influencing the flow of a currency

- Hedge exposure to the risk of exchange rate as a result of currency fluctuations or floating rates

- Attempt at reducing the cost of borrowing in a foreign market

Investors of corporate finance firms do cross currency swaps either to trade for themselves or to trade on behalf of another corporation.

How a Cross Currency Swap Works?

Currency swaps are common today between companies in different countries. They exchange loans amounts in each other's local currency but with a more flexible term than they will get if they had opted to just approach a random foreign country for loan.

Take two companies in Britain and Germany as a case study. A British gas company may initiate a cross currency swap with a German automobile company.

Assuming the British company received 10 million Euros as a principal amount while the German company receives 25 million pounds in return as a principal amount. This shows that the current exchange rate of Euro/Pounds is 2.5. Take note that these are just notional amounts.

This was the rate at which both currencies exchanged at the start of this currency swap. At the maturity of this trade (as agreed on by both parties), they will swap currencies again either at that original rate or at a new exchange rate.

Currency Swaps and Exchange Rates

The agreement between both parties determines how long a currency swap trade will last. Since currencies fluctuate, it is expected that the exchange rates of both currencies involved will never be fixed throughout the entire lifetime of the swap deal.

This is why most financial institutions prefer cross currency swaps; they understand how much they are expected to pay back eventually. If they also foresee that a particular currency will significantly strengthen in the coming years, they can borrow money in that currency since a swap will minimize how much they are expected to repay.

Let's return to our case study of cross currency swaps involving a German company and British company. Even if the pounds strengthen against the Euro, or if it is the other way round, the loan repayment will always be at that initial notional interest rate of 2.5.

Currency fluctuations will not affect their trade (cross currency swaps), the rate stays the same except they both agree on fresh rates before the maturity of their cross currency swap.

How Cross Currency Swap Differs From FX Swap

Fx swaps involves simultaneous borrowing and lending. The agreement is always to borrow one currency and lend another. at the expiration of the trade, these currencies are exchanged with interest rates fixed in most cases.

Although quite similar in a number of ways, there are few difference between foreign exchange (fx) swaps and cross currency swaps. Let's take a look at these differences.

The Differences

One difference between fx swaps and currency swaps is the manner in which the currencies are swapped. For fx swap to happen, both parties involved must have the currency the other party needs.

They come together and initiate the swap on the basis of ‘two legs' or as they call it, near far legs.

The near leg or first leg is the start of the currency swap. It involves the buying or selling of one currency against another currency at a spot rate (the exchange rate at the initial stage).

The second leg or far leg involves reversing this exchange position at the maturity of the swap, but this time at a forward rate. In other words, both parties return the currency they borrowed from each other at an agreed exchange rate (forward rate).

And with fx swap, the risks are further minimized because in cases where one party cannot pay back their loan, the funding currency with the second party becomes the collateral.

Another difference is how interests are paid. With cross currency swaps, each party is expected to periodically pay interest in the desired currency they are borrowing.

Forex swaps may or may not involve an interest rate. If it does, it is most likely not paid periodically.

The Role of Swap Bank

Let's be realistic; it is almost impossible to just wake up, grab some local currencies, and head to the foreign market in search of an American company that needs your local currency in exchange for U.S dollars.

Even if that is possible, it is also very difficult finding institutional investors whose exchange rate makes sense, whose exchange rate risk tolerance and maturity date exactly matches yours, and whose interest rate swaps is favorable for currency swap agreement with you.

To cater to all these needs, there is always an intermediary swap bank. Their goal is to help you find a counterpart investor that matches your requirements, accelerate the exchange of cash flows, and advices accordingly .

Although these swap banks will charge you for their services, they have helped many investors prepare cross currency basis swaps as well as prepare great swap contracts.

You need a swap bank to also help you identify currency swaps with cheaper debt and reasonable repayment dates.

Benefits and Risks of Cross Currency Swap

With a basic knowledge of how currency swap works between two parties, it is clear there are comparative advantage as well as risks.

However, one thing is clear: each investor will weigh both the pros and cons, decide whether or not to proceed with the agreement based on current exchange rates and market risks, and find a suitable corporate finance company or institution with which to form two parties needed for the agreement.

Key Benefits

Borrow at lower rates: When you enter into cross country agreements with companies from other countries, you both can access loans at lower interests rates in two different currencies.

Acts as a great risk management tool: When foreign institutional investors access loans through currency swap agreements, they reduce their exposure to currency fluctuations. This way, operating in a domestic market, with their local currency, funding costs are reduced.

No periodic Interest payment: when currency swap agreements takes effect, you are not expected to pay interest periodically in the different currency of both parties. You are expected to pay only the fixed rate of the principal amount at the maturity of the agreement except you both decide to alter the exchange rate toward the maturity of the derivative contract.

The Risk

Loan repayment default: The major risk involves the other party not being able pay up at maturity date. It is a risk because there is no form of collateral, so you have to expect that what the other party borrows will be paid back. There is no allowance for other market participants in place of them. This only limits you to the exchange interest payments.

Also Read: Currency Risk

Types of Cross Currency Swaps

There are two types of Cross Currency Swaps:

- Fixed-for-fixed Currency Swap: The two parties involved exchange each other's local currencies at a fixed interest rate. This way, even if the interest rate on any of the currencies increases or decreases, no party is affected is affected negatively. The interest rate swap on the principal exchanged funds does not count or influence the terms of this agreement.

- Fixed-for-floating Swaps: In this agreement, one of the two parties involved exchanges the interest cash flows of a fixed rate loan with a floating rate loan of the other party. The purpose of this swap is to reduce the interest rate in a case where the floating rate is lower than the current fixed rate.

How Cross Currency Swap Influences Investments and Funding

Companies are fond of trying to expand and gain financial grounds in other countries. For example, an automobile company in Germany may decide that having a branch in America will further boost their sales and global acceptance. However, they understand that having a branch in that country may not come easy because of difference in currencies.

To hedge potential risks with any currency fluctuation or exchange rate, the management of that automobile company may take advantage of cross currency swap by seeking a swap contract with American companies who are expected to provide back-to-back loans in U.S dollars as a basis for the cash flows.

Investors who are operating businesses on foreign soils often use currency swaps to obtain loans in the local currency of that country because it gives them the advantage of favorable loan rates instead of borrowing from a foreign bank with a floating rate in addition to the principal repayment.