TOGETHER WITH

Today’s edition is brought to you by Plus500 , your trusted platform for secure, hassle-free trading. With tight spreads, advanced trading tools, and zero commissions on stock CFDs, Plus500 empowers you to trade with confidence and precision..

Click here to start trading with Plus500 today! 💸

Hey traders, Ezekiel here with your quick market update. Let’s take a look at what's moving the markets, why it’s important, and how you can stay ahead of the game:

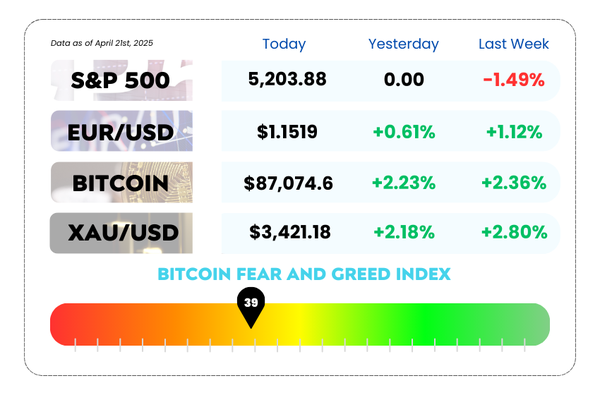

- Today's market mayhem. S&P, EUR/USD, Bitcoin, and XAU/USD today

- Soybean imports buck the trend as China turns its back on US goods

- Bitcoin’s 20% rally sparks optimism as it decouples from US stocks

- The hidden red flag in the “W” pattern: why you need to be cautious

🚀 Elevate Your Trading with Plus500 🚀

Looking for a user-friendly platform to trade CFDs? Plus500 offers:

- Competitive Spreads: Keep your costs low with tight spreads.

- No Commission Fees: Enjoy trading without the extra charges.

- Advanced Tools: Utilize real-time quotes and leverage up to 1:30.

- Secure Withdrawals: Experience fast and secure withdrawal processes.

- Demo Account: Practice risk-free with an unlimited demo account.

Join over 30 million traders worldwide who trust Plus500 for their trading needs. Ready to start? Open your account now and take the first step towards smarter trading.

WEEKLY MARKET MAYHEM

For this week's market mayhem, here’s what we got for you today:

🚨 China Slashes US Commodities Purchases as Trade Tensions Heat Up 🚨

China has been slashing its imports of US commodities, and we’re talking some big cuts here – in some cases, zero purchases. 📉 This is all happening amid growing trade tensions between the US and China, two of the world’s largest economies.

What’s getting hit the hardest?

- Liquefied natural gas (LNG) and wheat imports plummeted to nothing in March.

- Last year, the US supplied 17% of China’s wheat and 5% of its LNG. So, you can imagine how significant this is. 🌾⚡

So why this sudden shift? Well, China slapped retaliatory duties of 10-15% on US energy products in February, and it didn’t stop there. By March, similar duties hit agricultural goods too. And now, with both sides launching 100%+ tariffs on each other’s goods, China’s purchases are likely to drop even more. 🚫

📊 The Full Breakdown

- American cotton imports? Down a staggering 90% year-over-year.

- Corn imports? Just a tiny 800 tons – the lowest since February 2020. 🌽

Soybeans did manage to buck the trend, rising by 12% to 2.44 million tons, as China continues to rely heavily on US supplies until South American harvests hit the market. 🌱

💡 But Not All Bad News for the US

- Crude oil imports went up by 25%, hitting 542,000 tons. However, the US still doesn’t even crack the top 10 in terms of China's biggest suppliers.

- US copper imports? They’re slipping too, with copper scrap down by 50% and concentrate falling by 38%.

🤔 Asia Forex Mentor Insights

This could mean more volatility ahead, especially in commodities. Keep an eye on how these shifts affect the global supply chain, and stay tuned for the next big trade move between these two economic giants. 🌍💥

📰 Asia Forex Mentor and Markets4you Announce Free Live Webinar on Naked Price Action Trading 📰

Ready to cut through the noise and make your technical analysis clearer? Asia Forex Mentor has teamed up with Markets4you to bring you a free live webinar that dives deep into the powerful world of Naked Price Action Chart Reading.

Led by Ezekiel Chew, founder of Asia Forex Mentor and one of the world’s most sought-after trading mentors, this session will show you how to simplify your trading approach by interpreting price movements directly from the charts—no indicators needed.

📅 Date: April 29, 2025

🕖 Time: 7:00 PM (GMT +8)

📍 Location: Online via Zoom

💥 Admission: Absolutely FREE

🔍 What You’ll Learn:

- The core principles of naked price action trading

- How to identify high-probability setups without lagging indicators

- How to read market psychology through price movement

- Actionable techniques to predict market direction with more confidence

Spots are limited — secure yours now before they’re gone!

►►► CLICK HERE TO CLAIM YOUR SPOT NOW ◄◄◄

🚀 Bitcoin Surges 20%, Breaking Free from Tech Stocks and Gaining Momentum 🚀

Bitcoin (BTC) is making waves, surging nearly 20% from its April 7 low, hitting its highest level since March and sparking optimism that it might finally be breaking free from its usual correlation with US tech stocks. 📈

What happened? Well, after a brief dip caused by the US tariff storm (thanks to President Trump’s sweeping trade moves), Bitcoin bounced back, showing a more gold-like behavior. Yep, it’s acting like a safe-haven asset in the midst of global market uncertainty. 🛡️

Here’s the kicker: Bitcoin isn’t just following the tech stock movement anymore. It’s starting to trade independently of them, which is a big deal for crypto fans who’ve been waiting for this decoupling to happen. If this trend holds, Bitcoin could be positioning itself as a store of value, much like gold.

💥 The Decoupling Explained

The market’s recent turbulence, especially the dollar’s decline, has given crypto bulls some relief. It’s been a rough few months, with many waiting for the rally that Trump’s first months in office didn’t spark. But now, Bitcoin is rising on its own terms, and this is what many were hoping for. 🏦

Augustine Fan, partner at SignalPlus, points out that after a year of Bitcoin being a tech stock proxy, the crypto is finally showing signs of decoupling. Bitcoin could be returning to its roots as a digital gold.

📊 Bitcoin Price Update

As of Tuesday morning, Bitcoin was hovering around $90,000—a nice bump from its previous lows. Meanwhile, the dollar bounced back slightly after hitting its lowest level since late 2023, and gold surged past $3,500 an ounce before cooling down a bit. 🏅

The Nasdaq 100, which took a hit recently, is showing signs of recovery too, but Bitcoin is still going strong. 📉💪

BTC/USD Daily Chart as of April 22nd, 2025 (Source: TradingView)

🔮 What’s Next for Bitcoin?

If Bitcoin continues to behave more like gold than a tech stock, this decoupling narrative could gain serious momentum. Richard Galvin, co-founder of DACM, a crypto hedge fund, believes the shift is real.

Also, there’s something else fueling the optimism: US-listed Bitcoin ETFs saw an influx of $381 million on Monday—the largest since January. With Bitcoin breaking past $88,800, we could see it pushing to the $92,000–$94,000 range soon. 🔥

🤔 Asia Forex Mentor Insights

This move could signal a bigger shift for Bitcoin. As it diverges from traditional tech stocks, it might just be gearing up for the next big run. Stay tuned and keep an eye on the charts, Bitcoin might be playing a whole new game! 🌍💥