Hey, traders! Ezekiel here with the latest market insights and pro tips to help you level up your trading game. Here’s what’s on the radar:

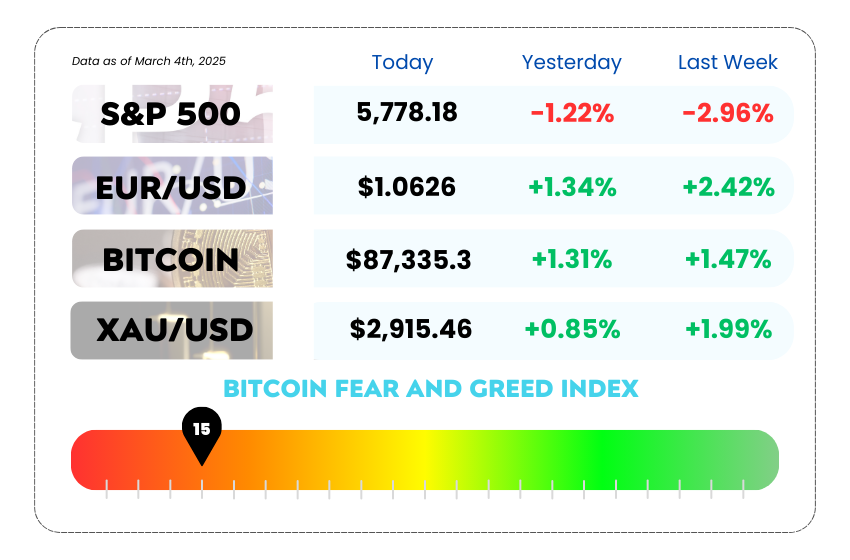

• Today’s market mayhem. S&P, EUR/USD, Bitcoin, and XAU/USD today

• China, Canada, and Mexico strike back as Trump’s tariffs put U.S. farmers on the front lines

• Trump’s trade war is back: stocks plunge, the Dow drops 650+ points, and markets brace for more turmoil

• Unlock the power of Fibonacci, Trendlines, Harmonics, and Elliott Waves to spot high-probability trades with precision

WEEKLY MARKET MAYHEM

For this week’s market mayhem, here’s what we got for you today:

🚜 America’s Farmers Are Back in the Trade War Spotlight… Again 🚜

Déjà vu? Yep. Farmers in the U.S. are once again caught in the crossfire of global trade wars after Trump dropped fresh tariffs, triggering China and Canada to clap back with their own moves.

China wasted no time, immediately slapping new tariffs focused on agriculture (because, of course). Canada joined the party, pointing out how key farm products, like fertilizers, are now tangled up in this mess.

What’s going on? 👇

- Trump’s new tariffs: A 25% tax on all Mexican and Canadian imports (except for Canadian energy, which gets a 10% rate). He also doubled tariffs on China to 20%.

- China retaliates: Tariffs of up to 15% on U.S. farm products like soybeans, wheat, meats, corn, and cotton.

- Canada claps back: PM Justin Trudeau warns it will hurt U.S. farmers, especially when it comes to critical items like fertilizer.

- Mexico joins in: Mexico imposed 25% retaliatory tariffs while President Claudia Sheinbaum called the move unjustified.

US Dollar Index Daily Chart as of January 10th, 2025 (Source: TradingView)

Sound familiar?

This isn't Trump's first trade war. Back in 2018-2019, farmers took such a hit that the government had to bail them out with over $20B. And guess what? The same playbook is unfolding again.

Even Trump's biggest supporters in farm states like Iowa Sen. Chuck Grassley are pleading for exemptions on fertilizer, but so far, no luck.

The Bigger Picture 🌎

Trade experts note that China has been shifting its supply chains in recent years (hello, Brazil 👋), but it still relies on U.S. soybeans and other crops. That means this fight will hurt both sides, and if history repeats itself, Trump might need to roll out another massive bailout for struggling farmers.

Meanwhile, Democrats and global leaders are slamming the move, warning that “there are no winners in a trade war.” But Trump? He told farmers to “Have fun!” 🤔

Trade wars are never just about tariffs—they ripple through global markets, currencies, and economies. Expect volatility in commodity prices, forex fluctuations, and shifts in supply chains. If this standoff escalates, we could see pressure on the U.S. dollar, emerging markets, and agricultural-linked assets. Stay sharp! 📈

📉 Wall Street Takes a Dive as Trump’s Trade War Heats Up 📉

Boom. 650 points gone. The Dow took a nosedive on Tuesday, shedding 1.5% (650+ points), while the S&P 500 dropped 1.2%, officially wiping out all post-election gains. Meanwhile, the Nasdaq, after flirting with green, managed to close just 0.4% lower, barely dodging correction territory.

The culprit? Trump’s new tariffs, a 25% tax on Canada and Mexico, plus a doubling of China duties to 20%, are sending markets into a spiral as investors brace for impact.

🚨 Global Trade Smackdown

- Canada wasted no time, hitting back with tariffs on U.S. imports.

- China played it a bit cooler, announcing 15% duties on U.S. farm products (think chicken, pork, and soybeans) starting March 10. Some analysts think Beijing is leaving the door open for negotiations with Trump.

🎯 Retailers Feeling the Heat

Even big-name brands are sounding the alarm. Target (TGT) warned that tariffs could pressure Q1 profits, despite an earnings beat. Meanwhile, Best Buy (BBY) put out a muted sales forecast, hinting at consumer caution, which sent its stock lower.

Markets hate uncertainty, and this trade war revival is bringing plenty of it. Investors are rotating out of risk assets, and if tensions escalate, expect more volatility in equities, forex, and commodities. The U.S. dollar could see swings as traders digest retaliatory moves from China and Canada. Buckle up! 📊🔥

MEMES OF THE DAY

Plot twist: The brokers were the real players all along! 🎭

Paper hands strike again! 😂📉🚀