TOGETHER WITH

Today's edition is sponsored by TMGM. Looking to earn while you trade? With TMGM’s exclusive Cashback Promo, you can score up to $700 in cashback. just for trading like you normally do.

Start collecting your cashback today!

Hey traders! Ezekiel here, ready to break down the latest market action and keep you ahead of the game. Here’s what’s moving the markets today:

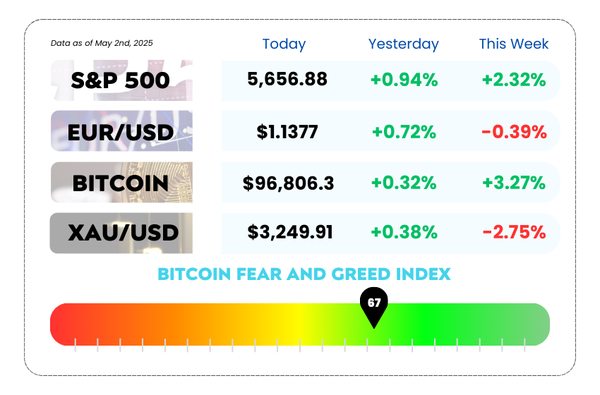

- Today's market mayhem. S&P, EUR/USD, Bitcoin, and XAU/USD today

- All eyes on NFP: Can the dollar make a comeback or nah?

- Markets rebound after Apple fumbles and China flirts with a deal

- Discount & Premium Zones EXPLAINED – Stop Buying at the Top!

💸 Get Paid to Trade: TMGM’s Cashback Deal is Here! 🚀

Turn your trades into real cash with TMGM’s Cashback Promo – earn up to $700 just by doing what you already do best.

Here’s what makes it worth your while:

✅ The more you trade, the more you earn – stack cashback as your volume grows.

✅ Boost your balance – score extra funds without adding a single dollar to your deposit. 🔥

✅ Trade smarter – access tight spreads and powerful tools built for serious traders.

✅ Speed meets precision – enjoy lightning-fast execution on TMGM’s top-tier platforms.

►►► CLICK HERE TO GET YOUR $700 CASHBACK ◄◄◄

👉 Don’t miss out — claim your cashback today!

WEEKLY MARKET MAYHEM

For this week's market mayhem, here’s what we got for you today:

💸 US Dollar's Having a Midlife Crisis Ahead of Jobs Report 💸

The US Dollar Index (DXY) is feeling a little wobbly this Friday—slipping back to 99.75 after trying (and failing) to break that sexy 100-mark. It strutted above 100 like it owned the place… then got promptly shown the door. 😬

Why the sudden weakness?

Blame it on some geopolitical gossip: rumors are swirling that China might restart tariff talks with the Trump administration. No signed deals yet, just whispers. But even whispers are enough to shake up the markets these days.

Meanwhile, over in Eastern Europe, the US inked a mineral deal with Ukraine—but don’t get too excited. It’s more like buying a coffee than investing in a gold mine. No military commitments, and not exactly a game-changer.

🗓 All Eyes on the Nonfarm Payrolls (NFP)

This Friday’s main event? The NFP report for April. Think of it as the UFC main card for traders.

Here’s the market vibe:

- Low-end expectations: 50,000 new jobs

- High-end: 171,000 jobs

A print below 50k? The dollar could fall faster than crypto in a bear market 🫠

But above 171k? That Greenback might get some muscles back 💪

The DXY is at a make-or-break level right now. It’s been on a three-day winning streak, and the NFP report could be the power-up it needs to smash through 100 convincingly. Or…it could be the banana peel that sends it tumbling.

US Dollar Index Daily Chart as of May 2nd, 2025 (Source: TradingView)

📊 Key Levels to Watch

- Resistance #1: 100.22 – the “ex” that gave support back in Sept ‘24

- Big Boy Resistance: 101.90 – that sweet spot from Dec ‘23 and the H&S formation from last summer 🧠

- Support: 97.73 – the “danger zone” if headlines go full doom

- Below that? Say hello to 96.94, 95.25, and 94.56—lows we haven’t seen since 2022. Yikes.

🤔 Asia Forex Mentor Insights

This is a moment of truth for the US Dollar. NFP is more than just a data point, it’s a market mover. If the jobs number impresses, expect dollar bulls to come charging. But if it disappoints? We could be staring down a slide toward multi-year lows. For traders, it’s time to stay sharp, manage risk, and maybe have popcorn ready, because this one’s gonna be spicy.

📈 Stock Futures Pop as Jobs Beat & Trade Talks Tease a Truce 📈

Wall Street’s waking up in a better mood today—because nothing says “we’re back, baby” like strong jobs data and a potential US-China love story (again).

On Friday morning, US stock futures climbed:

- Dow futures +0.8% – aiming for a ninth straight day of wins 💪

- S&P 500 futures +0.9%

- Nasdaq 100 futures +0.8%

That’s a full recovery move after tech titans Apple 🍏 and Amazon 📦 tried to play party poopers with their earnings and tariff talk.

💼 Jobs Data to the Rescue

The US added 177,000 jobs in April—smashing expectations of 138,000. And the unemployment rate? Still chilling at 4.2%. Not bad, considering markets were still wobbling after Trump’s latest “Liberation Day” tariff push (yeah, he named it that).

Bottom line: the labor market’s looking tough, even while markets were throwing tantrums.

Dow Jones Industrial Average Index Daily Chart as of May 2nd, 2025 (Source: TradingView)

🇺🇸🤝🇨🇳 Will They or Won’t They (Again)?

In trade drama 3,465:

China’s Commerce Ministry just dropped a “the door is open” line if the US is willing to back off on reciprocal tariffs. Basically:

“You stop, we’ll talk.”

That little line alone sent futures jumping, as investors sighed in relief that this might not escalate into a full-blown economic cage match. Again.

🍏📉 Tech Got Tariff-Slapped

Despite beating earnings:

- Apple warned of a $900M tariff hit this quarter and trimmed its buyback plan by $10B. Oof. Shares dipped.

- Amazon also beat but served up some weak guidance thanks to—you guessed it—tariffs.

Traders didn’t love it, but the jobs + trade vibes helped markets bounce back quick.

🤔 Asia Forex Mentor Insights

This market bounce is a classic “bad news, good reaction” moment. Tariff fears are real (just ask Apple), but solid job numbers and signs of US-China dialogue gave traders reasons to exhale. The big takeaway? Sentiment still rules.

If talks actually move forward, we could see continued upside—but don’t sleep on the risk of headline-driven reversals. Stay nimble, set tight stop losses, and don’t bet against market psychology.

MEMES OF THE DAY

And it hasn’t drawn a single level of structure 🧠

Hold up, we buying more now ➡️💛🎈