TOGETHER WITH

Today's edition is sponsored by AvaTrade, a trusted name in online forex trading since 2006. Claim an exclusive 20% bonus to elevate your trading experience!

Get started today, boost your account with extra funds, and unlock greater trading opportunities.

Hey, traders! Ezekiel here, ready to share the latest market insights (and more

• Today’s market mayhem. S&P, EUR/USD, Bitcoin, and XAU/USD today

• Coinbase posts record earnings, positioning for Bitcoin’s rise and regulatory changes

• The U.S. targets Iran’s oil exports, tightening supply amid demand concerns

• Learn how to se Williams %R to spot overbought, oversold markets, and time your trades better with our video

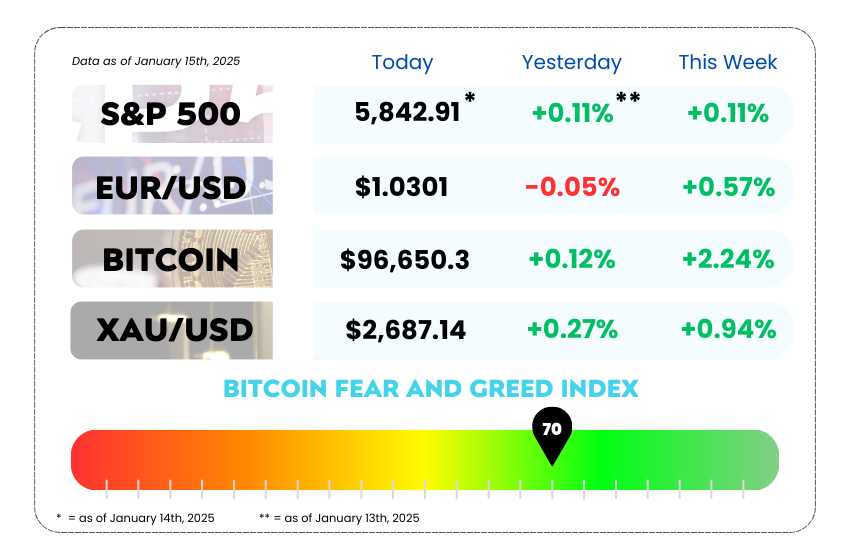

WEEKLY MARKET MAYHEM

For this week’s market mayhem, here’s what we got for you today:

🚀 Coinbase Surprises on Earnings, But Wall Street Yawns 💰

Coinbase (COIN) just posted its strongest earnings since 2021—but instead of celebrating, Wall Street is acting like it’s just another Thursday. 📉 The stock dipped slightly to $295.18 in pre-market trading, despite the crypto exchange blowing past expectations.

So why isn’t Wall Street hyped? Blame the cautious outlook. Coinbase’s forecast for Q1 suggests that higher marketing spend could squeeze profit margins a bit. But some analysts think the company is just playing it safe with its guidance. 👀

💡 The Bigger Picture: Trump, Bitcoin, and a Crypto Revival

Forget the short-term noise—Coinbase is riding some major tailwinds that could shake up the game:

• Bitcoin is booming—higher BTC prices are driving trading activity, and Coinbase raked in $1.556 billion in transaction revenue last quarter, its best haul in three years.

• Regulation is turning bullish—With Trump and a crypto-friendly Congress setting the stage for new rules on stablecoins and token classification, the regulatory landscape might finally start working in crypto’s favor.

• Institutions are diving back in—Coinbase’s institutional trading volume hit $345 billion, proving that big-money investors aren’t sitting this one out.

🎤 Coinbase’s Game Plan for a Trump Crypto Boom

On the earnings call, CEO Brian Armstrong emphasized that Trump’s administration and a crypto-friendly Congress could accelerate the U.S. as a global crypto hub. With stablecoin and market structure legislation on the table, other nations may feel the pressure to follow suit.

Coinbase’s stock dropped after earnings, but that doesn’t tell the full story. The company is riding major trends that could shape the future of crypto. Bitcoin’s price is climbing, big investors are coming back, and a pro-crypto government could bring long-awaited clarity to regulations.

Short-term traders are focused on Coinbase spending more on marketing, but the real opportunity is in how the company is setting itself up for long-term growth. If crypto adoption continues and regulations become clearer, Coinbase could be in the best position to benefit. The market might be unsure now, but in the future, this moment could look like an obvious buying opportunity.

🚀 Power Up Your Trades with AvaTrade’s 20% Bonus! 🚀

Looking to level up your trading? AvaTrade, a trusted name in forex trading since 2006, is giving traders an exclusive 20% deposit bonus to boost their accounts and maximize their potential!

✅ 20% Bonus on Your Deposit – More funds, bigger opportunities

✅ Trusted Broker Since 2006 – Trade with confidence

✅ Seamless Trading Experience – Forex, stocks, crypto, and more

🛢️ Oil Prices Edge Up as US Targets Iran’s Exports 💰

Oil prices are creeping higher after US Treasury Secretary Scott Bessent made it clear that the Trump administration isn’t backing down on Iran’s oil exports. 📢💥

Brent crude rose 1.1% in London trading after Bessent told Fox Business that the US is pushing to cut Iranian oil exports to just 100,000 barrels a day. That’s a big squeeze, considering Iran pumped 3.3 million barrels a day last month, which accounts for 3% of global supply. 😳

🔥 Oil Markets Are Heating Up

This wasn’t the only market-moving headline. Oil traders have been juggling multiple Trump-induced stress points this week:

• Tariffs on key trade partners – New tariffs could hit global growth, which directly affects oil demand

• Russia sanctions on the table – Bessent said he’s ready to tighten the screws on Russian energy if Trump gives the green light

• Ukraine peace talks? – Trump’s push for a resolution could shake up energy markets in unexpected ways

📊 Where’s Oil Headed?

The International Energy Agency (IEA) and US Energy Information Administration (EIA) both dropped their monthly reports, and they’re starting to agree:

• The global oil market is unlikely to see a big surplus this year

• The balance of supply and demand is tightening, meaning any geopolitical shake-up (like a US crackdown on Iran) could push prices even higher

Oil prices are moving because of more than just supply and demand. When the U.S. pushes to cut Iranian exports and hints at more sanctions on Russia, it creates uncertainty that makes traders react. Less oil on the market means prices could rise, but at the same time, trade tariffs and slowing global growth could reduce demand.

Right now, the market is stuck between these two forces. If supply keeps getting squeezed and demand stays steady, prices will go up. But if tariffs slow down the economy, oil demand could take a hit. Smart traders are watching both policy moves and economic signals because oil prices are driven by more than just production numbers.

MEMES OF THE DAY

Patience pays… but I wouldn’t know. 😭

It's not a loss… until you check your portfolio 😂