TOGETHER WITH

Hey traders, Ezekiel here with your latest market rundown. Let’s dive into what’s moving the markets so you stay one step ahead.

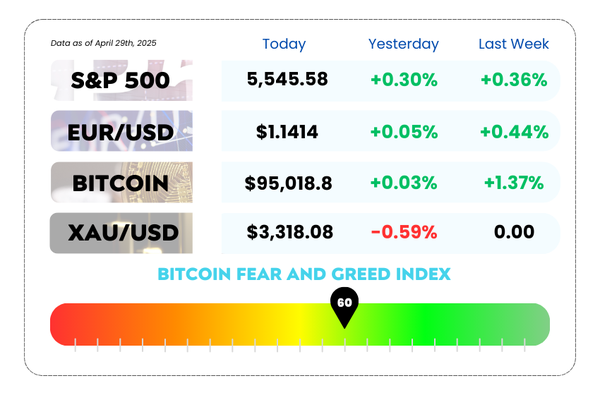

- Today's market mayhem. S&P, EUR/USD, Bitcoin, and XAU/USD today

- EUR/USD slips as dollar hits the gym and trade drama escalates

- Dow climbs, Nasdaq nods, and Wall Street breathes as tariff relief hints drop

- The truth about ATR: How pro use it to place killer stop losses

🚀 Skip the Evaluations. Start Trading Real Capital Instantly. 💸

No delays. No profit targets. No hoops to jump through.

Just instant access to up to $500,000 in trading capital, and real profits you keep.

iFunds is revolutionizing prop trading with a fast, flexible model made for real traders:

💰 Zero evaluations or profit targets

📉 Low commissions and minimal swap fees

⚡ Fast sign-up and instant platform access

Trade forex, crypto, stocks, and indices — all from one sleek, beginner-friendly platform.

Start trading on your terms. Start winning on day one. ✅

WEEKLY MARKET MAYHEM

For this week's market mayhem, here’s what we got for you today:

💸 EUR/USD Slips As Uncle Sam's Dollar Puts On Muscle 💪

EUR/USD dipped down to around 1.1390 during the North American session on Tuesday, and the reason? The US Dollar came out swinging like it just hit leg day. 💥

The Greenback flexed up to 99.35 on the Dollar Index as traders hit pause on risk with the latest round of Will-they-won’t-they from the US-China trade soap opera. 📉🇺🇸🇨🇳

🧊 US-China Trade Drama: Ice Cold Right Now

Things got tense when US Treasury Secretary Scott Bessent told CNBC that “China should be the one to de-escalate.”

Translation: “They sell 5x more to us than we do to them. Ball’s in their court.”

That mic drop moment left investors wondering if talks are even happening — especially since Trump says Xi called him (multiple times, actually)… and China keeps saying “uhh no he didn’t.” ☎️❌

If this was high school, we’d call it mixed signals. In global economics, it’s just Tuesday.

EUR/USD Daily Chart as of April 29th, 2025 (Source: TradingView)

🔍 Data Watch: All Eyes on the Fed’s Homework 📊

Beyond the trade drama, the US Dollar also has a stack of economic report cards coming out this week:

- GDP

- PMI

- ADP jobs report

- Nonfarm Payrolls (NFP)

- PCE inflation numbers

Basically, this week is packed with Fed fuel. What happens here could set the tone for rate moves ahead.

Tuesday’s JOLTS report already missed expectations, only 7.19M job openings vs. 7.5M expected. Not a disaster, but not ideal either. 😬

💹 EUR/USD Outlook: Still Bullish… For Now

Despite the dip, EUR/USD is still riding some bullish vibes:

- 14-week RSI is in beast mode — way overbought at 70+ 💪📈

- 20-week EMA is climbing from 1.0890 like it’s got a mission

🧱 Resistance? 1.1500 is your psychological wall.

🛡️ Support? 1.1276 — July 2023’s high — is where the Euro bulls will defend.

🤔 Asia Forex Mentor Insights

This is a classic case of fundamentals tug-of-war: technicals say “uptrend,” but geopolitics and data surprises could derail the momentum. Keep your eyes on upcoming Fed data, especially PCE and NFP, they’ll either fuel the Dollar’s rally or give the Euro a comeback story.

Patience, discipline, and your edge, that’s the AFM way. 🚀

📈 Dow & Friends Bounce Back As Tariff Drama Hits Pause (Kinda) 📈

It was a rollercoaster Tuesday on Wall Street, but the bulls managed to climb out of the red and end with some W’s 🐂

- S&P 500 and Nasdaq: up about 0.2%

- Dow Jones: added 0.6% and flexed for its longest win streak of 2025 🏆

What gave stocks their second wind? A cocktail of tariff hope, earnings hype, and a sprinkle of “maybe things aren’t that bad.”

🚗 Tariff Relief Incoming?

The White House is throwing automakers a bone 🦴

The Trump admin says it’ll ease double-dipping auto tariffs, meaning US carmakers already paying import duties won’t get smacked with extra steel charges.

That news got traders a little less nervous about a full-blown car-mageddon on the trade front.

Trump’s recent upbeat tone on China helped, too. But… Treasury Sec Scott Bessent is still on the “China needs to fix this” train. 🚂

S&P 500 Daily Chart as of April 29th, 2025 (Source: TradingView)

💸 Earnings: Flood Alert

Corporate earnings reports came in like a tsunami of spreadsheets:

- GM beat Q1 expectations, BUT hit pause on 2025 guidance. Tariffs = big yikes for planning.

- GM earnings call got delayed to Thursday, probably to sync with DC’s next move.

- Spotify and Coca-Cola dropped early reports ☕🥤

- Starbucks is still brewing, results due after market close.

Meanwhile, Amazon got some White House heat 🔥

Rumors flew that they’d show “tariff surcharges” on price tags. WH called it “hostile.” Amazon denied. Stock dipped, then recovered. Drama level = corporate soap opera.

📉 Consumer & Labor Vibes = Not Great

- Consumer Confidence: down for the 5th month in a row, falling to 86 from 92.9.

- Job Openings: dipped in March, chilling at a 4-year low.

Translation: People aren’t feeling too spendy. And companies aren’t hiring like they used to.

🤔 Asia Forex Mentor Insights

This market is riding on tariff tea leaves and corporate storytelling right now. Positive moves on auto tariffs sparked some optimism, but mixed signals (especially from the labor market and consumer confidence data) are making traders twitchy.

💡 Watch for earnings reactions, policy hints, and whether trade talk fluff actually turns into real progress. It’s not just price action, it’s narrative flow + economic signals. That’s where the edge lives.

MEMES OF THE DAY

12 indicators, 0 consistency. Make it make sense. 🤯📉

You can't backtest fear and FOMO. 🚫📈