TOGETHER WITH

Today's edition is sponsored by AvaTrade. If you are looking for a next-level trading experience, AvaTrade's MetaTrader5 has everything you need.

It has advanced charting, ultra-fast execution, and multi-asset trading across forex, stocks, commodities, and crypto! 📊🔥

Hey traders! Ezekiel here with fresh market insights (and more 🔥). Here’s what’s making waves today:

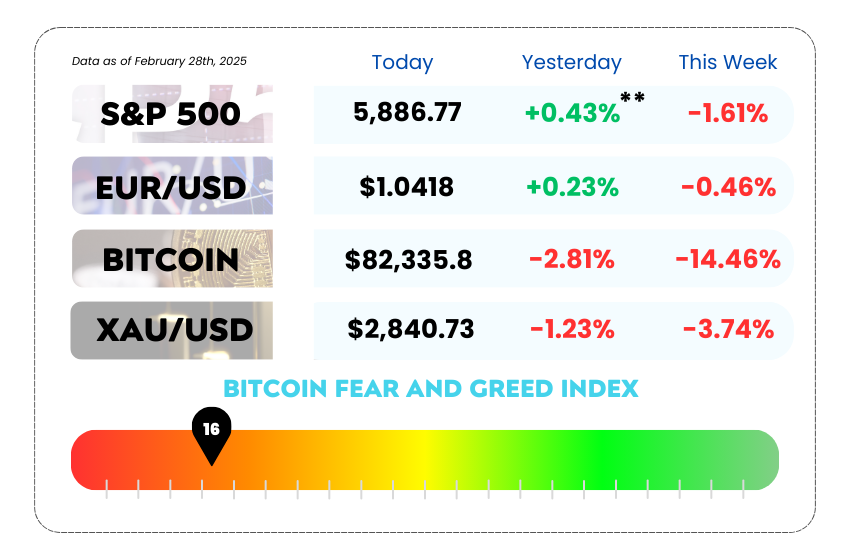

• Today’s market mayhem. S&P, EUR/USD, Bitcoin, and XAU/USD today

• Trump unveils a U.S. Bitcoin reserve, calling it a “Digital Fort Knox.”

• New meme coin surges—hype or pump-and-dump?

• The dollar hits a four-month low as tariffs spark economic concerns

• Learn how the Diamond Top Pattern can signal market trouble and how to trade it wisely

WEEKLY MARKET MAYHEM

For this week’s market mayhem, here’s what we got for you today:

🚀 Trump Unveils Bitcoin Reserve Ahead of Crypto Summit! 🎉

The crypto world just got a major shakeup and it’s coming straight from the White House. Former (and maybe future? 👀) President Donald Trump has just authorized the creation of a strategic Bitcoin reserve 🇺🇸💰, fulfilling a campaign promise to the crypto industry.

And it’s happening right before the highly anticipated “crypto summit” at the White House, where the biggest names in crypto are gathering to rub elbows with lawmakers. 🏛️

A Digital Fort Knox 🏦🔐

Trump’s Bitcoin reserve will be seeded with BTC already owned by the federal government, which was previously seized in criminal or civil asset forfeitures. That means it won’t cost taxpayers a single dime. 💸🙅

💬 Trump’s “crypto czar” David Sacks (yes, that’s his new unofficial title) made it clear: the U.S. is not selling any of the Bitcoin once it’s in the reserve. The plan? HODL for the long haul.

“The reserve is like a digital Fort Knox for the crypto often called ‘digital gold,’” Sacks said on X (formerly Twitter). 📲🐦

The U.S. government is believed to own around 200,000 BTC, but there’s never been a full audit. Well, that’s about to change. Trump’s new executive order calls for a complete review of all federal digital asset holdings.

Buying More Bitcoin? Maybe.

So, will the U.S. buy more BTC to beef up this reserve? Sacks hinted that it’s on the table, saying that Treasury and Commerce officials can explore “budget-neutral” strategies to acquire more—but without adding costs to taxpayers.

Meanwhile, Senator Cynthia Lummis has been cooking up a plan to get the Federal Reserve to buy Bitcoin using 1970s-style gold reserve certificates. (Yes, that would require Congress to sign off. Good luck with that. 👀)

Why all the effort? Lummis says it’s about stabilizing Bitcoin’s role as a long-term strategic asset and how it could work alongside the U.S. dollar in global finance. “We think they are very complementary,” she told Yahoo Finance.

More Than Just Bitcoin? 🤔

Turns out, Trump’s plan isn’t just about Bitcoin. When he first teased the reserve idea last weekend, he mentioned Ethereum (ETH), XRP (XRP), Solana (SOL), and Cardano (ADA). 🚀

On Thursday, Sacks confirmed that Trump also authorized a “U.S. digital asset stockpile” for crypto other than Bitcoin, again, only using assets seized through forfeiture proceedings. But don’t expect Uncle Sam to start buying up altcoins anytime soon.

Crypto Industry Meets the White House 🏛️🤑

This announcement comes at a wild time for crypto. Bitcoin’s price has been on a rollercoaster ride, dropping hard this week in its biggest correction since 2022.

Still, the crypto industry is betting big on Trump and hoping today’s White House Crypto Summit will push things forward. The SEC has already dropped several big lawsuits against crypto companies, and a presidential working group is exploring new legislation to provide more regulatory clarity.

Trump himself will deliver remarks at the summit, which is set to feature some of the biggest names in crypto, including:

🔹 Brian Armstrong (Coinbase CEO)

🔹 Michael Saylor (MicroStrategy’s Bitcoin king)

🔹 Sergey Nazarov (Chainlink Labs CEO)

🔹 JP Richardson (Exodus CEO)

Oh, and in case you forgot, Trump is already deep in the crypto game. Just before his inauguration, his team launched two meme coins: one for himself (TRUMP) and one for Melania Trump (MELANIA), both on Solana. Gotta love the hustle. 💰🎩

1️⃣ Bitcoin as a strategic asset: The U.S. moving to officially recognize Bitcoin as a reserve asset is a huge milestone, one that could reshape how governments handle crypto.

2️⃣ Crypto-friendly policies incoming? The GOP is aligning itself with the crypto industry, and with regulatory uncertainty still hanging over the market, this summit could be a game-changer.

3️⃣ Will other countries follow? If the U.S. embraces Bitcoin as a strategic reserve asset, expect other nations to take notice, especially those already dabbling in crypto like El Salvador.

🔥 Bottom line? The U.S. just signaled that Bitcoin isn’t going anywhere. The big question now: What’s next? 🚀

🚀 Trade Smarter with AvaTrade’s MT5 – Get a 20% Bonus! 💰

Looking for a powerful, all-in-one trading platform?

AvaTrade’s MetaTrader 5 (MT5) is your ultimate trading hub, offering advanced charting, lightning-fast execution, and access to forex, stocks, commodities, and crypto, all in one place! 📈

✅ Multi-Asset Trading – Trade forex, stocks, indices, and crypto seamlessly

✅ Advanced Charting & Tools – Perfect for both beginners & pros

✅ Ultra-Fast Execution – Never miss a trade with real-time market access

✅ Automated Trading – Use Expert Advisors (EAs) to trade while you sleep 😴

🚀 Meme Coin Mania: Millions Made, But Is It All Hype? 🚀

A new crypto meme coin is taking over the market, turning internet jokes into real profits for early investors.

With celebrity influence and social media buzz, its market cap has skyrocketed in days, proving once again that speculation fuels the crypto world. But with no real utility and the risk of sudden crashes, is this just another pump-and-dump? 🤔

📉 Some traders are cashing out big, while others are getting rekt. Should you jump in or stay away?

🔍 Read the full story here.

📉 Dollar Takes a Dive, Is the Bull Run Over or Just Taking a Nap? 💰

The U.S. dollar has hit a four-month low, and the bulls? Well, they’re on a coffee break. ☕ After a 5% drop since Trump’s inauguration, investors are rethinking their dollar bets as trade tariffs fuel concerns over U.S. economic growth. Meanwhile, Europe’s getting a glow-up with fresh German fiscal spending, pulling more capital across the pond. 🇩🇪💶

But not everyone is calling it quits on the greenback just yet. Some believe tariffs could actually help the dollar, and history shows that betting against the buck too early has burned traders before. So, is this a short-term dip or the start of a dollar downturn? Let’s break it down.

🛑 Tariffs vs. The Dollar: Who Wins?

The biggest culprit behind the dollar’s slump? Trade tariffs. 🎯 Investors are worried they’ll slow the U.S. economy by raising costs, disrupting supply chains, and shrinking trade volumes.

But here’s the plot twist: tariffs could also support the dollar by making foreign goods more expensive, reducing demand for other currencies. 💡 Some analysts argue that while the economy might take a hit, the dollar could still come out stronger in the long run.

“I still think the dollar is king,” said Amundi’s Paresh Upadhyaya. And history agrees—the dollar has bounced back before.

US Dollar Index Daily Chart as of March 7th, 2024 (Source: TradingView)

📊 Betting Against the Dollar? Might Want to Think Twice.

Shorting the dollar has been a dangerous game in recent years. The last two times it dipped 5% from a near-term peak (Oct-Dec 2023 & Apr-Sep 2024), it snapped back within months. Traders who bet against it too early got rekt. 😵💸

With Trump ramping up tariffs on Europe, Mexico, and China, some believe the dollar still has room to rebound. ING strategist Francesco Pesole expects the euro to drop back to $1.02 by year-end, down from its current $1.08 high. 📉

On the flip side, others argue the dollar has already priced in most of the upside, and any further trade war escalation could tilt the scales. UBS strategist Vassili Serebriakov puts it bluntly: “It's hard to be a dollar bear with tariffs still on the table.”

Dollar slumping, but history says it bounces back. Betting against it too early? Risky move. Also, tariffs might hurt the economy but could also support the dollar. It’s a double-edged sword.

Furthermore, market watching Europe’s next move. Euro strength is shaky, could tumble later this year. For now, the dollar’s taking a breather, but is it resting or ready for a comeback? Only time will tell. ⏳💵

MEMES OF THE DAY

Wait… it actually worked?! 🤯

Same struggle, different charts 📊😂