Traddoo Review

Prop trading firms like Traddoo are reshaping the financial landscape by offering unique trading opportunities. Operating in over 180 countries, Traddoo enables traders to potentially earn up to $400,000. This global reach and significant earning potential mark Traddoo as a notable player in the proprietary trading sector.

As a Forex expert who has traded with the prop firm, I’m set to provide an in-depth review of Traddoo. My insights, coupled with customer feedback, will offer a comprehensive view of the firm. This review will highlight the advantages and platforms offered by Traddoo, dissect their evaluation process, and detail their distinctive trading features. It will also address potential limitations, providing a balanced perspective for traders and investors considering Traddoo for their trading endeavors.

Also Read: Prop Trading: What Is It & How Does It Work?

What is Traddoo?

Traddoo is a U.S.-registered proprietary trading firm, that adheres to local jurisdictional regulations. This firm distinguishes itself by offering two primary account types for traders: the 1-phase challenge and the 2-phase challenge. With an accessible minimum deposit of just $99, it opens doors for a wide range of traders. The profit-sharing structure varies between an 80/20 split and a 75/25 split, depending on the account type and balance maintained by the trader.

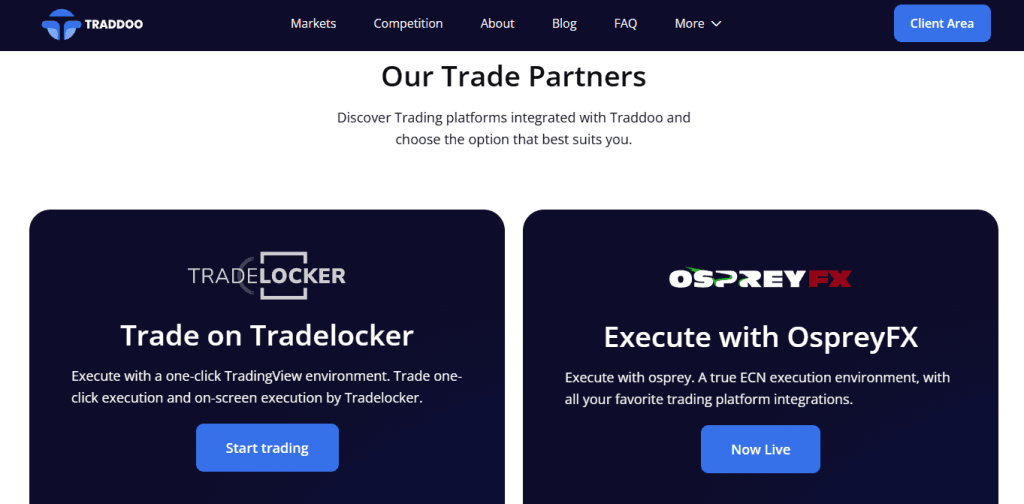

The firm operates primarily through the well-known trading platforms, MetaTrader 4 and MetaTrader 5, ensuring a familiar and efficient trading environment. Traddoo stands out in the market by offering an extensive range of over 100 assets, including currencies, cryptocurrencies, stocks, indices, metals, and CFDs (Contract for Difference). The leverage provided by Traddoo is tailored to the selected financial instrument, with the maximum leverage capped at 1:30.

In terms of trading strategies, Traddoo is versatile. It permits various approaches such as trading news, scalping, and hedging, and also supports the use of trading advisors. However, it’s important to note that weekend trading is not available with Traddoo.

The firm collaborates with Eightcap, a broker known for providing raw spread trading accounts. These raw spread accounts connect traders directly to the interbank market, offering a more transparent trading experience. While Traddoo itself doesn’t impose trading fees, Traddoo clients are responsible for covering the spreads and any broker fees charged by Eightcap.

Benefits of Trading with Traddoo

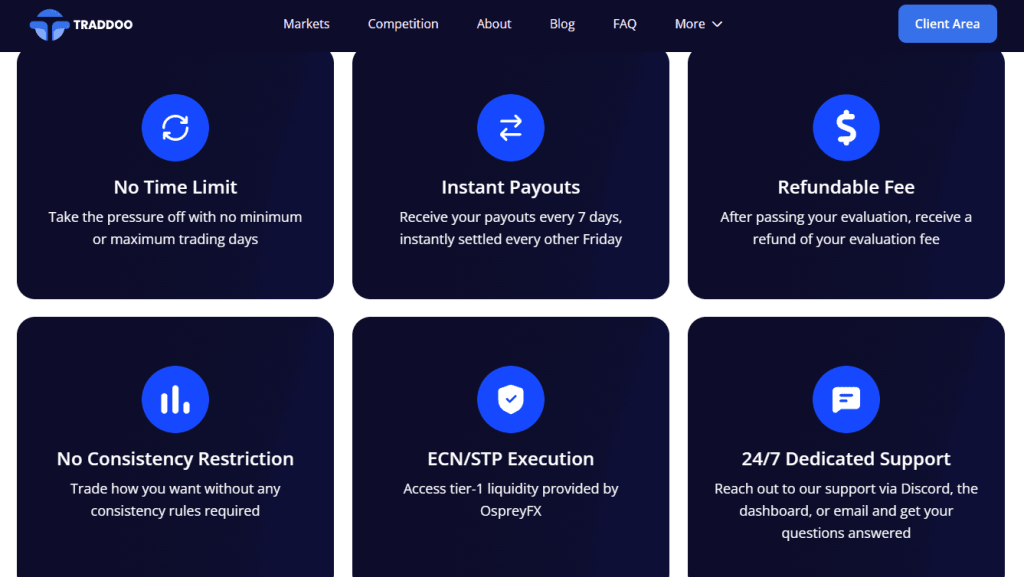

After engaging with the Traddoo Funding Program, I’ve identified several benefits that make it a standout choice for traders. One of the most appealing aspects is the instant payouts. As a trader, receiving payouts every 14 days, specifically on alternate Fridays, is not just convenient but also provides a sense of financial stability and flexibility. This regular payout schedule allows traders like myself to enjoy and reinvest our earnings promptly.

Another significant advantage I’ve noticed with Traddoo is the freedom in trading frequency. The program doesn’t enforce any minimum or maximum trading day requirements. This flexibility is crucial as it allows traders to operate at their own pace, focusing on making profitable trades rather than meeting arbitrary quotas. Such an approach is beneficial for those who value strategic decision-making and patience in trading.

Furthermore, Traddoo’s recognition of diverse trading styles and strategies is a key benefit. The absence of consistency rules means traders are free to trade according to their individual styles without any restrictions on trading patterns. This flexibility is particularly valuable as it enables traders to leverage their unique strengths and strategies to maximize their trading potential.

Lastly, the refund of the evaluation fee upon successful completion of the evaluation phase is a thoughtful feature. This policy effectively removes the financial burden associated with starting the Traddoo Funding Program, making it more accessible. It’s an encouraging aspect for traders like me who are looking to embark on a funded trading journey without incurring additional costs.

Traddoo Pros and Cons

Pros

- User-friendly interface with a low entry barrier and two account types

- No additional fees and a fair profit split

- Freedom in trading days, styles, and strategies

- Varied financial instruments and moderate leverage

- Easy withdrawals through popular methods

- Optional removal of trading restrictions for a fee

- 24/7 technical support availability

- Upcoming instant funding feature

Cons

- Restricted access for OFAC blacklist countries

- Limited customer support options

- Absence of structured educational content

Difficulties Met by the Traders Who Participated in the Brokers Challenge

Adhering to Strict Risk Management Rules

Traders often struggle with the stringent risk management rules set by brokers in challenges. These rules, like mandatory stop-loss orders and limits on maximum daily loss, can be difficult to navigate, especially for those accustomed to a more flexible trading style.

How to Overcome the Difficulty

To overcome this challenge, traders should focus on developing a disciplined trading strategy. This involves understanding and respecting the set rules, and possibly practicing with a demo account to get used to these constraints. Educating oneself on effective risk management techniques is also crucial.

Consistency in Profitability

Achieving consistent profits under the pressure of a challenge is a common hurdle. The need to demonstrate profitability within a set timeframe can lead to rushed decisions or deviation from one’s usual trading strategy.

How to Overcome the Difficulty

Traders can overcome this by maintaining a steady, well-planned approach to trading. It’s important to stick to proven strategies rather than chasing quick wins. Setting realistic profit targets and being patient is key to achieving consistency.

Limited Trading Instruments

Some challenges offer a limited range of trading instruments, which can be a roadblock for traders who specialize in markets or assets not included in the challenge.

How to Overcome the Difficulty

To adapt, traders should broaden their expertise to include a wider range of instruments. This might involve studying different markets and practicing trades in unfamiliar territories to gain a better understanding and flexibility.

Traddoo Customer Reviews

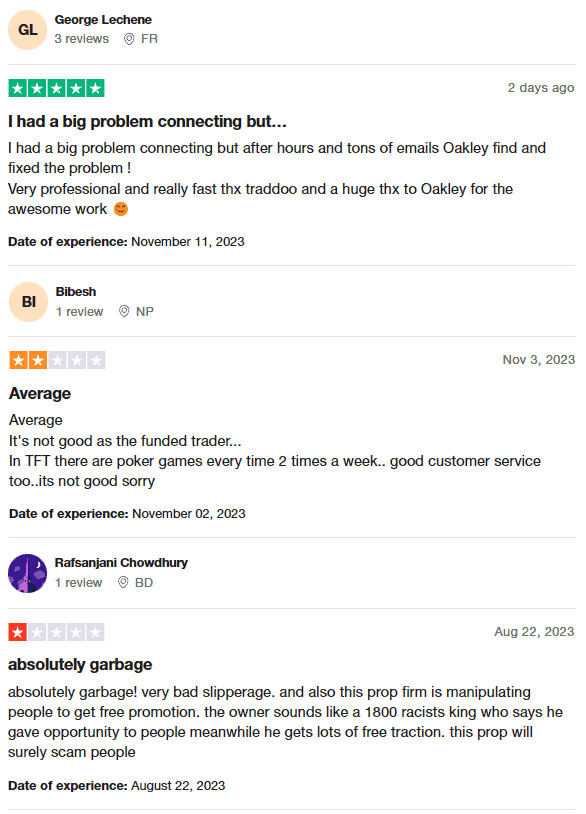

Traddoo, a proprietary trading firm, currently holds a 3.5-star rating on Trustpilot, reflecting a mix of customer experiences. Some users have praised the company’s professional and responsive technical support, highlighting instances where issues were resolved promptly after extensive communication.

However, others have expressed dissatisfaction, citing average performance compared to other funded trader programs and mentioning a lack of engaging activities like those found in competing services.

A few reviews have raised concerns about slippage and promotional tactics, with some strong criticism regarding the firm’s overall operation and management. This diverse range of feedback illustrates the varied experiences traders have had with Traddoo.

Traddoo Fees and Commissions

In my experience with Traddoo, their fee and commission structure is in line with typical proprietary trading firm practices. They charge initial fees to their partners, along with fees for additional options. Instead of a deposit, sometimes there’s a subscription fee. A key point to remember is that these prop firms don’t impose trading fees. This is because they don’t bring their clients’ trades to the interbank market; that’s the domain of brokers like Eightcap, Traddoo’s partner. Therefore, only the brokers apply spreads and fees.

An important aspect to consider is that the spreads or trading fees differ for traders who work directly with brokers versus those who trade through prop firms. The reason is that prop traders, like Traddoo, have their own agreements with brokers, often resulting in more favorable conditions for their clients. For example, in the Traddoo 1-phase challenge, the minimum spread is just $1, and there’s no withdrawal commission. The same goes for the 2-phase challenge. This structure makes Traddoo an attractive option for traders looking for a cost-effective trading platform.

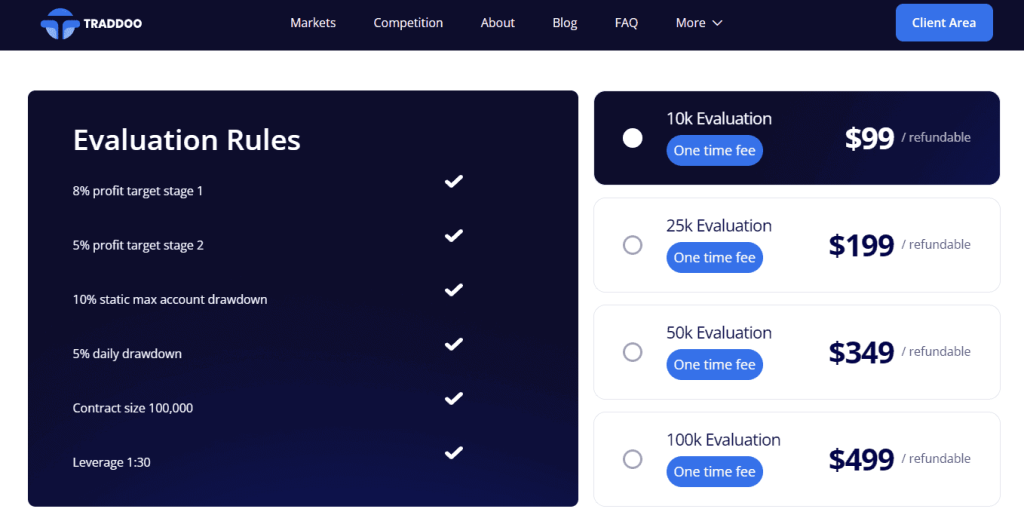

Account Types

Based on my testing and experience, Traddoo offers two main account types, each tailored to different trading styles and goals. Here’s a breakdown of these account types:

1-Phase Challenge

- Minimum Deposit: $99

- Balance Range: $10,000 – $400,000

- Profit Target: 10% during the challenge

- Profit Split:

- 75% for balances of $10,000 and $25,000

- 80% for higher balance amounts

2-Phase Challenge

- Minimum Deposit: $99

- Balance Range: $10,000 – $400,000

- Profit Targets:

- 10% in the first phase

- 5% in the second phase

- Profit Split: 80% across all balance amounts

An important aspect to note is that traders have the option to hold multiple accounts. However, the initial fee for each new account is paid separately, and undergoing the challenge phase is mandatory for each new account. This structured approach allows traders to diversify their strategies across different accounts while adhering to Traddoo’s guidelines.

How to Open Your Account

- Visit the Traddoo website and click on the “Get Funded” button.

- For the 2-phase challenge, you’ll see the accounts directly; for the 1-phase challenge, click “Programs” and select 1-Phase Evaluation.

- Review the conditions of your chosen account, choose a balance option, and select “Get Started MT4” or “Get Started MT5” for your trading platform.

- If needed, add extra options by ticking their boxes; these will add to your initial fee.

- In the shopping cart, verify your account conditions and note the preferred payment method section.

- Fill in your personal details: first and last names, company name (if applicable), country, address, phone number, and email.

- Optionally, leave a comment for the manager in the designated area.

- Choose a payment option, such as a bank card, crypto wallet, or online transfer, and input the necessary data.

- Agree to the terms of service, tick the box, and click on “Place Order”.

- Follow the on-screen instructions in the payment system to complete your transaction.

- Verify your identity by uploading identification documents and await verification for full access to your account and trading platform.

Traddoo Customer Support

Based on my personal experience, the role of technical (client) support at Traddoo cannot be overstated. Traders, including myself, often encounter situations that require external assistance, such as technical glitches or queries about trading platforms. Moreover, the process to request withdrawals from Traddoo is facilitated through their technical support, making their efficiency and responsiveness crucial.

Traddoo stands out for offering 24/7 professional assistance. This round-the-clock availability means that, regardless of the time or day, there’s always a specialist ready to help. This includes weekends and nighttime, ensuring that traders are never left without support when they need it most. The available communication channels are email, live chat, and Discord, providing multiple avenues for contacting their support team. This constant availability and variety of communication options significantly enhance the trading experience with Traddoo.

Advantages and Disadvantages of Traddoo Customer Support

Contact Table

Security for Investors

Withdrawal Options and Fees

As a trader with Traddoo, once you’ve registered, paid the initial fee, and successfully completed your challenge, you’re set to start real trading. This is where your trading skills and strategies turn into potential income. The profit split arrangement with Traddoo is generally 80/20. However, for 1-phase challenge accounts with balances ranging from $10,000 to $25,000, the trader’s share of the profit is 75%.

Regarding withdrawals, Traddoo’s policy allows traders to submit withdrawal requests once every 30 days. This means you can’t withdraw funds more frequently than this one-month interval. For withdrawals, there’s a range of options available. These include Visa or MasterCard bank cards, the Coinbase crypto wallet, PayPal, and other online wallets like Payoneer, Revolut, and Wise. To initiate a withdrawal, you need to contact Traddoo’s technical support via email. Typically, the request is processed within a few days, making it a relatively swift procedure.

What Makes Traddoo Different from Other Prop Firms

Traddoo sets itself apart from other proprietary trading firms primarily through its unique funding program structure. Unlike many other firms that offer a multitude of complex program options, Traddoo simplifies this by providing two clear-cut challenge phases – the 1-phase and 2-phase challenges. This streamlined approach makes it easier for traders, especially those new to prop trading, to understand and choose a program that best suits their trading style and goals.

Another distinct feature of Traddoo is its favorable profit split, which is notably competitive in the industry. For balances between $10,000 to $25,000 in the 1-phase challenge, the profit split stands at 75% in favor of the trader, and it goes up to 80% for other amounts. This generous profit-sharing model is a significant draw for traders looking to maximize their earnings, setting Traddoo apart from many of its competitors who might offer less advantageous terms.

Furthermore, Traddoo’s commitment to flexibility and trader autonomy is evident in its policy of not imposing mandatory trading days or specific trading styles. This allows traders the freedom to trade according to their own strategies and pace, a liberty that is not always available with other prop firms. This degree of flexibility, combined with the firm’s supportive infrastructure like 24/7 technical support, positions Traddoo as a forward-thinking and trader-centric prop trading firm.

How Can Asia Forex Mentor Help You Pass Traddoo’s Evaluation?

As the founder of Asia Forex Mentor, I’ve seen firsthand how our AFM Proprietary One Core Program can be instrumental in helping traders pass Traddoo’s evaluation process. Since establishing Asia Forex Mentor in 2008 in Singapore, I began by teaching forex trading to a small group of friends. This modest start soon evolved into a thriving community as I refined my teaching methods and approach.

The AFM Proprietary One Core Program is the culmination of all my experience and expertise. It’s designed to help students develop a robust trading system, perform accurate forex market analysis, and manage their trading accounts effectively. This course is crucial for forex traders who seek to deepen their understanding of the market dynamics.

With 26 comprehensive lessons and over 60 subtopics, each accompanied by high-quality online videos, the program provides an extensive learning experience. I’ve included my own hand-picked examples and interpretations in every lesson to ensure that complex concepts are broken down into understandable segments. This beginner-friendly program is not just about learning the basics; it’s about applying these principles in a low-risk manner, which is essential for passing evaluations like those set by Traddoo. My aim is to empower traders with the knowledge and skills required to succeed in the challenging world of forex trading.

Our Journey at Asia Forex Mentor

Over my years at Asia Forex Mentor, I’ve had the opportunity to influence and guide a diverse group of traders. My students range from retail and bank traders to professionals at trading institutions and investment firms. Witnessing many who started as novices grow into full-time forex traders, and some ascending to roles like fund managers, has been a rewarding experience.

In the One Core Program at Asia Forex Mentor, I’ve distilled my learnings and insights into a comprehensive approach to trading. The program culminates with in-depth discussions on backtesting and trading psychology, where I share personal insights on maintaining trading diaries and the crucial steps to succeed in forex trading. The course introduces the ‘set-and-forget’ strategy, an exclusive auto stop-loss tool, and dives into our free trade concept. It also clarifies the distinctions between large and small stop loss levels, providing a thorough understanding of these concepts.

For those ready to embark on this journey, the One Core Program offers a seven-day free trial. Priced at a one-time fee of $997, the course is also available at a direct price of $940 for those eager to bypass the trial and dive straight into learning. This opportunity is a gateway to extensive forex trading knowledge, suited for both beginners and experienced traders.

Conclusion: Traddoo Review

In conclusion, my review of Traddoo reveals a proprietary trading firm that offers distinctive advantages, yet has aspects that potential users should be aware of. Traddoo’s strengths lie in its accessible account options, fair profit splits, and the flexibility it offers traders in terms of trading styles and pace. The firm’s commitment to providing round-the-clock technical support and its diverse range of financial instruments are notable benefits that cater to a wide spectrum of traders.

However, it’s important to approach Traddoo with a balanced perspective. The absence of a call center for customer support might be a drawback for those who prefer direct, verbal communication. Additionally, the fact that Traddoo does not provide direct license or regulation data may be a concern for some investors, emphasizing the need for due diligence.

Also Read: Glow Node Review 2023

Traddoo Review FAQs

Is Traddoo suitable for beginner traders?

Yes, Traddoo’s straightforward account options and supportive technical team make it a viable option for beginners.

Are there any hidden fees with Traddoo?

No, Traddoo is transparent about its fees, with clear information on profit splits and account options.

Can traders use their own strategies with Traddoo?

Absolutely, Traddoo offers the freedom to trade using personal strategies and styles, without restrictive rules.