FXORO Review

Forex trading has become one of the cornerstones of the global financial markets, offering a plethora of opportunities for investors and traders. At the heart of this dynamic market lies the critical role of Forex brokers. These brokers not only provide access to the Forex market but also determine the quality of your trading experience. Therefore, choosing the right Forex broker is paramount for both novice and seasoned traders. It can be the difference between success and failure in the volatile world of Forex trading.

In the realm of Forex brokers, FXORO has emerged as a noteworthy contender. This broker is known for offering access to a wide range of financial instruments. Among these are hundreds of contracts for difference (CFDs) on diverse asset groups including currency pairs, cryptocurrencies, stocks, indices, commodities, and exchange-traded funds (ETFs). What sets FXORO apart is its unique offering that allows clients to invest in physical shares of American companies, a feature not commonly found in typical Forex brokers.

Our comprehensive review of FXORO aims to delve deep into its features and offerings. We'll explore the various account options, deposit and withdrawal processes, commission structures, and more. This evaluation is not just based on expert analysis but also includes real experiences of traders who have used FXORO. Our goal is to provide you with an unbiased and thorough perspective, helping you decide if FXORO fits your Forex trading needs. Stay tuned as we uncover what makes FXORO stand out in the competitive world of Forex brokerage.

What is FXORO?

FXORO is a well-known brokerage firm specializing in Forex and CFD trading. The firm offers traders a diverse range of trading instruments across multiple asset classes. These include Forex, CFDs, Shares, Commodities, Stocks, Indices, Cryptocurrencies, and Exchange-Traded Funds (ETFs). This variety ensures that traders of all preferences have access to a wide array of trading options.

The company is headquartered in Cyprus and operates under the strict oversight of the Cyprus Securities and Exchange Commission (CySEC), a respected European regulatory authority. This regulation ensures a high standard of safety and transparency for its clients. Furthermore, FXORO also has a presence in Seychelles and is authorized by the Financial Services Authority (FSA), adding another layer of credibility to its operations. This dual regulation underlines FXORO's commitment to adhering to international financial standards.

Benefits of Trading with FXORO

After trading with FXORO, I've identified several key benefits that make it an appealing choice for traders. First and foremost, FXORO offers access to a wide range of trading instruments, including CFDs on currency pairs, stocks, indices, cryptocurrencies, commodities, and ETFs. This diversity allows traders like me to explore various markets and diversify our portfolios effectively.

Another significant advantage is the broker's competitive spreads and fees. Particularly in floating accounts, the spreads start from as low as 1.2 pips, which is quite advantageous for active traders. Additionally, FXORO's policy of not charging commissions on the first three withdrawals each month is a notable cost-saving feature, especially for frequent traders.

The use of the MetaTrader 4 platform is another benefit. Known for its user-friendliness and robust features, MT4 caters well to both beginners and experienced traders. Its array of technical and fundamental analysis tools aids in making more informed trading decisions. Moreover, FXORO's customer support, available 24/5 through various channels, has been responsive and helpful in my experience, providing assistance whenever needed.

FXORO Regulation and Safety

As someone who has traded with FXORO, I can confidently say that understanding its regulation and safety is crucial for any trader. FXORO is a legitimate and regulated broker, demonstrating its commitment to adhering to the necessary regulations for offering Forex trading services. It's important for traders to know that a broker's regulatory status is a significant indicator of its reliability and trustworthiness.

The broker is owned by MCA Intelifunds Ltd, which is registered in Cyprus. This entity is regulated by the Cyprus Securities and Exchange Commission (CySEC), a respected European regulatory body. Additionally, FXORO holds authorization from the Financial Services Authority (FSA) in Seychelles. This dual regulation is a reassuring sign of the broker's dedication to maintaining high compliance standards in the financial trading industry.

However, traders should be aware that FXORO also holds an offshore license. This means that the regulatory environment and the protections offered may differ when trading in various jurisdictions. It's essential to understand these differences before engaging in trading activities. Being informed about the regulatory landscape helps in making more secure and informed trading decisions, especially when navigating the complexities of international Forex trading.

FXORO Pros and Cons

Pros

- European regulation

- Favorable trading terms

- Variety of trading instruments

- Access to the MT4 platform

- Comprehensive analysis tools on the platform

- Customizable MT4 with plugins

- Three free withdrawals monthly

Cons

- Limited to CFDs

- No round-the-clock customer support

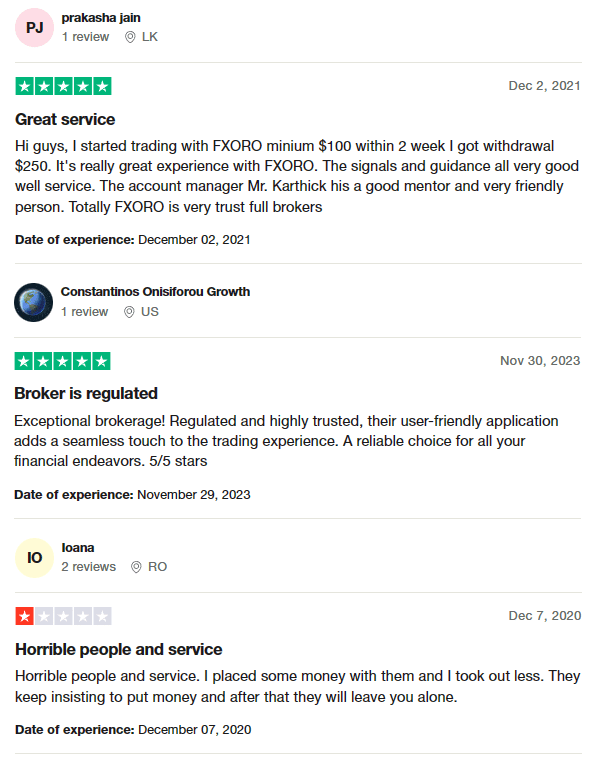

FXORO Customer Reviews

FXORO's customer feedback presents a mixed picture. Some customers have had positive experiences, highlighting successful withdrawals, efficient service, and commendable guidance from account managers like Mr. Karthick. These users appreciate the broker's trustworthiness and the user-friendly nature of its application. On the other hand, there are negative reviews where customers express dissatisfaction, citing issues with service quality and financial losses. Such feedback often mentions pressure to invest more funds and a lack of support post-investment. This range of experiences suggests that while some traders find value in FXORO's offerings, others have encountered challenges in their trading journey with the broker.

FXORO Spreads, Fees, and Commissions

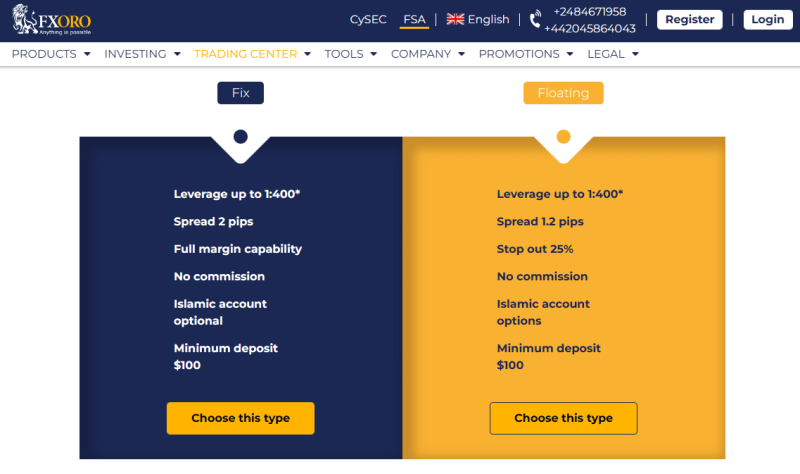

In my experience trading with FXORO, their approach to spreads, fees, and commissions is quite straightforward and competitive. For traders using either fixed or floating accounts, the good news is there are no trading commissions. The spread on these accounts varies: for fixed accounts, it's set at 2 points, while for floating accounts, it begins at a more dynamic 1.2 points.

The scenario changes a bit with the ECN account. Here, while you benefit from an extremely low spread starting from 0 points, there is a commission of $6 per lot. This structure is pretty advantageous, especially for those who prefer the ECN model for its direct market access and typically faster execution.

In terms of average spreads, FXORO offers 1.2 pips for the EUR/USD pair in floating spread accounts, which is quite competitive in the Forex market. It's important to note that FXORO primarily charges fees through spreads and commissions (specifically for ECN accounts). Additionally, you might encounter overnight/swap costs. There can also be additional fees during trading activities, so it's crucial to be mindful of these when you're planning your trading strategy with FXORO.

Account Types

In my experience testing the trading account types at FXORO, I found two distinct options of trading accounts, each catering to different trading styles and needs. Here's a clear overview:

Fix Account

- Offers leverage up to 1:400.

- Features a fixed spread of 2 pips.

- Allows full margin capability, enhancing trading potential.

- No commission on trades.

- Option to convert to an Islamic account.

- Requires a minimum deposit of $100.

Floating Account

- Also provides leverage up to 1:400.

- Comes with a floating spread starting from 1.2 pips.

- Includes a stop-out level set at 25%.

- Commission-free trading.

- Islamic account option available.

- Minimum deposit requirement is $100.

Both these accounts are designed to meet varied trading requirements, whether you prefer a stable spread environment or flexible spread conditions. The absence of commission in both accounts is a notable advantage, making FXORO a cost-effective choice for traders.

How to Open Your Account

- Visit FXORO's official website to begin the account opening process.

- On the website, select your preferred language from the top menu.

- Click on the “Register” button to initiate registration.

- Fill in your first and last names, country of residence, email address, and contact phone number.

- Select your desired account type from the available options.

- Agree to FXORO's terms of cooperation by ticking the relevant boxes.

- Complete the captcha verification and click “Join” to proceed.

- Use your email as your login; the system will generate a password which you can change later.

- Check your email for the login details, including access to the MT4 trading platform.

- Follow on-screen instructions to verify your identity with photos or scans of required documents.

- After successful verification, a deposit prompt will appear to guide you through funding your account.

- Download the MT4 trading platform either from FXORO's website or the official MetaTrader portal.

- Once logged into MT4, start trading according to the conditions set by your chosen account type.

FXORO Trading Platforms

Based on my experience, FXORO offers its clients the opportunity to trade on the MetaTrader 4 (MT4) platform, which is widely recognized for its simplicity and functionality. MT4 is known for being one of the most user-friendly and convenient trading platforms available in the market. Its intuitive interface and range of features cater to both novice and experienced traders, making it a preferred choice for a broad spectrum of FXORO clients. Whether you're looking at basic trading or advanced strategic operations, MT4's versatile environment adapts to your needs, ensuring a seamless trading experience.

What Can You Trade on FXORO

During my trading experience with FXORO, I explored a diverse range of trading instruments that the platform offers. FXORO allows trading in Contracts for Difference (CFDs) on various asset classes. This includes popular currency pairs, which are a staple for Forex traders. Additionally, the platform caters to the modern trader's interest in the digital economy with CFDs on cryptocurrencies.

Moreover, FXORO provides opportunities to trade CFDs on traditional stocks and indices, appealing to those who are interested in the stock market. For traders looking to diversify their portfolio, the platform also offers CFDs on various commodities. Furthermore, for those interested in a broader market scope, FXORO includes exchange-traded funds (ETFs) in its trading instruments. This range of options ensures that traders with different preferences and strategies can find suitable trading opportunities on FXORO.

FXORO Customer Support

FXORO's customer support is comprehensive and accessible, operating 24/5. They offer multiple channels for assistance including live chat, email, phone lines, and even social media platforms. This variety ensures that you can reach out for help in a way that's most convenient for you, whether it's a quick chat or a more detailed email.

The support team at FXORO is not just about addressing basic queries; they include trading experts who provide valuable insights. These experts are equipped to assist with technical support, analysis recommendations, and respond to general inquiries and operational issues. This level of expertise in customer service is particularly beneficial for traders who might need guidance in various aspects of their trading journey.

Advantages and Disadvantages of FXORO Customer Support

Withdrawal Options and Fees

As a trader who has used FXORO, I've learned that understanding their withdrawal options and fees is crucial. Initially, it's important to note that if you're using a demo account, you're trading with virtual funds, which means you cannot withdraw any real profits. It's only after registering a real account and making a deposit that you gain the ability to withdraw your earnings, provided you have a positive balance from successful trades.

Withdrawals at FXORO are conducted through the user account on the broker's official website. As a trader, you have various channels at your disposal for withdrawals, including Visa and MasterCard cards, Skrill, Neteller, Wire2pay, and bank transfer. Submitting a withdrawal request can be done anytime, and the first three requests each month are free of any commission fees. However, from the fourth withdrawal within the same month, a fee of $10 or its equivalent in another currency is charged.

One key point to remember is that third parties, like banks or e-wallets, involved in the withdrawal process may impose their own fees. Thankfully, FXORO's prompt technical support is always on hand to assist with any queries related to fund withdrawals, making the process smoother and more transparent.

FXORO Vs Other Brokers

#1. FXORO vs AvaTrade

FXORO offers a range of CFDs and allows investments in physical shares of American companies, with a focus on no commission for the first three withdrawals each month. On the other hand, AvaTrade, established in 2006, boasts a larger customer base from over 150 countries and offers a wider range of financial instruments. Heavily regulated, it provides a comprehensive trading experience with its global presence.

Verdict: AvaTrade may be better for those seeking a more extensive range of trading instruments and a globally recognized platform. FXORO is suitable for traders prioritizing lower withdrawal fees and specific CFD trading options.

#2. FXORO vs RoboForex

FXORO offers straightforward trading options with a focus on CFDs and no commission for initial withdrawals. Meanwhile, RoboForex, operating since 2009, stands out with its diverse 12,000 trading options across eight asset classes and a wide selection of trading platforms. It caters to various traders' styles and volumes.

Verdict: RoboForex is likely a better choice for traders seeking diversity in trading options and platforms. FXORO is more suited for those who prefer a more focused range of trading instruments and simpler platform options.

#3. FXORO vs Exness

FXORO provides CFDs across various asset classes and physical shares trading, with a focus on initial withdrawal benefits. In contrast, Exness, starting in 2008, offers a significant monthly trading volume and an extensive range of CFDs including over 120 currency pairings, with the unique feature of infinite leverage on small deposits.

Verdict: Exness might be more advantageous for traders looking for a wide range of currency pairings and the unique offering of infinite leverage. FXORO, on the other hand, is ideal for those interested in a mix of CFDs and physical shares trading with fewer complexities.

Also Read: AvaTrade Review 2024 – Expert Trader Insights

Conclusion: FXORO Review

In conclusion, FXORO presents itself as a solid choice for traders, particularly those focused on CFD trading across various asset classes and interested in investing in physical shares of American companies. The platform's strengths lie in its user-friendly MetaTrader 4 interface, diverse trading instruments, and the advantage of commission-free first three withdrawals each month. These features make FXORO an attractive option for both novice and experienced traders.

However, it's important to approach FXORO with an awareness of its limitations. The broker currently has mixed customer experiences. Additionally, the lack of 24/7 customer support might be a constraint for some traders. Potential clients should weigh these aspects against the broker's advantages to make an informed decision.

Also Read: Scandinavian Capital Markets Review 2024 – Expert Trader Insights

FXORO Review: FAQs

What types of accounts does FXORO offer?

FXORO offers two main types of accounts: the ‘Fix' account with a stable spread of 2 pips and the ‘Floating' account with a spread starting at 1.2 pips. Both accounts provide leverage up to 1:400 and a minimum deposit of $100.

Does FXORO charge for withdrawals?

FXORO does not charge a commission for the first three withdrawals per month. However, from the fourth withdrawal within a month, a fee of $10 or its equivalent in another currency is charged.

Can I trade cryptocurrencies with FXORO?

Yes, FXORO offers trading in CFDs on cryptocurrencies, along with other asset classes like currency pairs, stocks, indices, commodities, and ETFs.

OPEN AN ACCOUNT NOW WITH FXORO AND GET YOUR BONUS