Glow Node Review

Proprietary trading firms provide traders with a unique opportunity. These firms supply funding and resources to traders, allowing them to make trades without putting their own money at risk. One such firm that was formed to fill a market void is Glow Node. They provide traders with the opportunity to manage large sums of money, with the goal of making everyone prosperous.

The emphasis of Glow Node is on collaboration and education. They provide premium funding programs to traders all over the world. Traders can work with capital of up to $1,000,000 at the firm. Even better, traders can keep up to 90% of the gains. Forex, commodities, indices, and cryptocurrencies are all available for trading.

As an experienced trader, I'll delve into what makes Glow Node unique. This evaluation will be based on both my observations and consumer feedback. We'll go over the benefits, platforms, and how Glow Node rates traders. We'll also discuss any constraints, which will help you decide if this firm is a good fit for your trading objectives.

Also Read: Prop Trading: What Is It & How Does It Work?

What is Glow Node?

Glow Node is a proprietary trading firm established in April 2022. It is co-founded by CEOs Sam Bradbury and Ryan Beasley. The firm operates from its base in London, UK, and targets a global audience of traders.

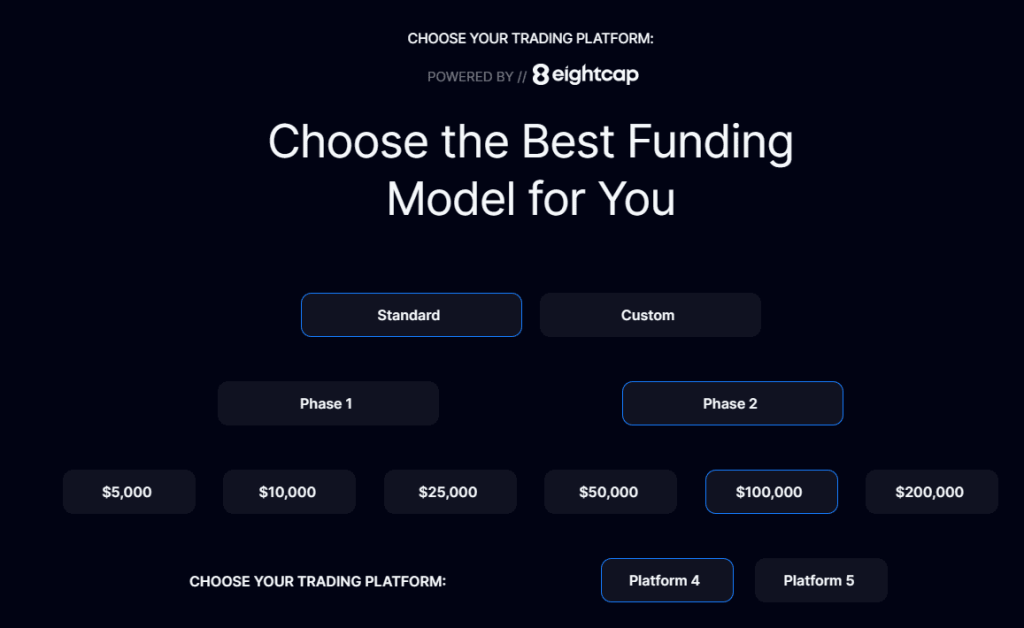

This prop trading firm features three different funding programs: one-step, two-step, and instant funding. Each of these programs includes a unique scaling plan. Traders have the opportunity to access up to $1,000,000 in capital for trading.

Traders can operate on MetaTrader 4 or MetaTrader 5, with Eightcap serving as the broker. These platforms are popular and widely used, making them ideal for traders of all levels.

Glow Node presents three types of accounts for traders: a 2 Phase Evaluation account, a 1 Phase Evaluation account, and an Instant Funding account. All these accounts offer scalable benefits. The firm starts with an 80% profit split, which can go up to 90% as you scale.

Financial incentives are in place for profitable trading. If you make a 10% profit within three months, your balance receives a 30% boost. The initial trading capital ranges from $10,000 to $200,000, and scaling can go up to $1,000,000.

Finally, Glow Node has a fee structure that varies depending on the account type and initial balance. The minimum fee starts at $99 and is refundable if you trade successfully.

Advantages and Disadvantages of Trading with Glow Node

Benefits of Trading with Glow Node

After trading with Glow Node, it's evident that the range of account settings is one of the key advantages. Whether you're a novice or a seasoned trader, there's an account to suit your trading style and risk tolerance. Because of this amount of customisation, Glow Node is a versatile alternative for traders of all skill levels.

Another enticing advantage is the ability to trade. Because the firm does not establish a profit target, you can trade at your own pace. The ability to utilize any trading technique is advantageous for people who do not want to be restricted to specific trading goals or styles.

The various markets and leverage possibilities are also significant. Traders can use leverage of up to 1:30 to invest in a variety of asset classes, including currencies and cryptocurrencies. This gives up a whole new universe of trading possibilities.

The profit split is very generous. The firm offers one of the most attractive profit-sharing schemes in the market, starting at 80% and ramping up to 90% as your balance grows.

Glow Node Pros and Cons

Pros

- No Time Limits

- Large Trader Community

- High-Profit Splits

- Back Testing Tools

- 24/7 Cryptocurrency Trading

- News Trading Allowed

- Diverse Trading Assets

Cons

- Challenge Fee Retained

- Higher Funding Fees

Difficulties Met by the Traders Who Participated in the Brokers Challenge

Maximum Daily Loss Limit

One challenge traders face in the Broker's Challenge is adhering to the maximum daily loss limit, which is capped at 5% for all account sizes. Exceeding this limit can lead to account violation, creating a roadblock for traders aiming for consistent profitability.

How to Overcome the Difficulty

To navigate this constraint, traders should implement a solid risk management strategy. This includes setting up stop-loss levels for each trade and continually monitoring trade performance. A disciplined approach will help you stay within the 5% daily loss limit and protect your account.

No Martingale Allowed

The Broker's Challenge prohibits the use of martingale strategies. Traders who are accustomed to this approach may find it difficult to adapt, as martingale involves doubling down on losing trades to recover losses.

How to Overcome the Difficulty

Traders should focus on adopting alternative trading strategies that are not based on the martingale system. This can include methods that prioritize risk management and diversification. Experiment with different approaches in a demo account to find what works best for you, and then apply it in the live Broker's Challenge.

Third-Party Copy Trading Risk

Using third-party copy trading services can be risky in the Broker's Challenge. If multiple traders are using the same service, they'll be employing identical trading strategies. This can lead to problems like exceeding the maximum capital allocation rule, causing potential account denial or withdrawal complications.

How to Overcome the Difficulty

If you're keen on using copy trading services, thorough research is essential. Check that the service you're considering complies with the Broker's maximum capital allocation rules. Understanding these details can save you from the risk of account denial and make your trading journey smoother.

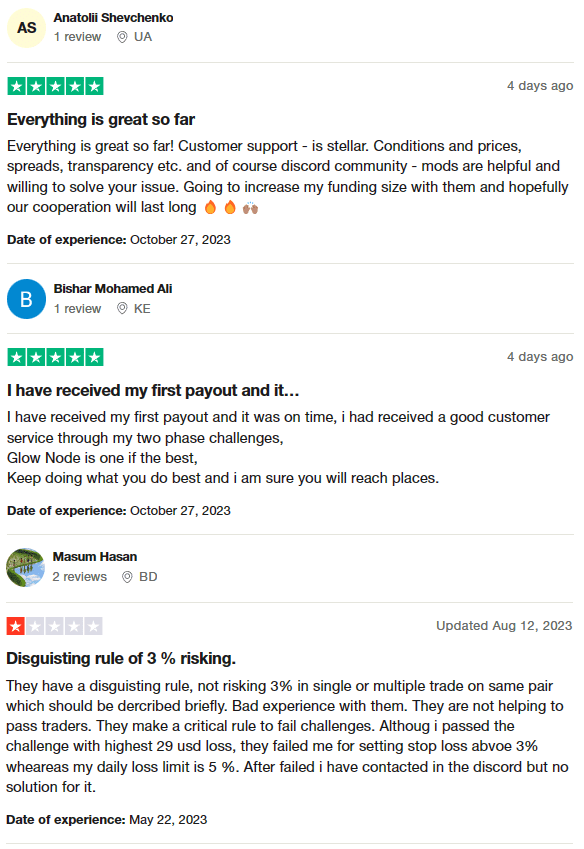

Glow Node Customer Reviews

Glow Node currently holds a 4.7-star rating on Trustpilot, indicating a generally positive reception from its user base. Customers often praise the firm for its stellar customer support and transparent trading conditions. The Discord community also receives commendation for its helpful moderators.

However, there are criticisms concerning complex trading rules, particularly around the 3% risk limit on trades. These rules have led to challenges in account evaluations for some traders. Overall, the majority of reviews highlight timely payouts and a positive experience with the two-phase challenges.

Glow Node Fees and Commissions

At Glow Node, the fee structure is pretty straightforward, and tailored to keep traders focused on making profitable trades rather than worrying about hidden costs. In the prop trading world, firms like Glow Node mainly make money from initial fees and a slice of the traders' profits. In Glow Node's case, they take a 10%-20% cut from your profits, in addition to what they earn from initial fees if a trader fails the challenge.

There are no hidden fees, but do note that trading currency pairs will incur a $3.5 fee per lot. While withdrawals are free from Glow Node's side, your bank or e-wallet might charge you. As for trading costs like spreads, those are managed by Eightcap, Glow Node's broker partner. A noteworthy point is that you'll likely get more favorable trading conditions with Glow Node than you would if you went directly to Eightcap.

Account Types

After testing the various account types offered by Glow Node, I can say that they've designed their accounts to cater to a broad range of trader needs. Here's a quick rundown of the accounts available:

- 2 Phase Evaluation: This requires a minimum deposit of $99 and offers a maximum balance of $200,000. It has an 8% and 5% profit target for each phase, along with a daily drawdown of up to 5% and a total drawdown of up to 10%.

- 1 Phase Evaluation: For this account, you'll need a minimum deposit of $149 and can have a maximum balance of $100,000. It comes with a 10% profit target, a daily drawdown limit of up to 4%, and a total drawdown cap of up to 8%.

- Instant Funding: The minimum deposit here is $450, and the maximum balance stands at $100,000. Unlike the evaluation accounts, this one doesn't have a challenge or a daily drawdown. It only has a total drawdown limit of up to 5%.

How to Open Your Account

- Visit Glow Node's official website.

- Click on the “Dashboard” button located in the upper right corner.

- Input your email address in the provided field.

- If you're an existing user, click “Sign In”. New users should click “Register”.

- For new users, complete the registration by entering your first and last names.

- Check your email for a login link.

- Click the received link in your email.

- You'll be automatically redirected to your user account dashboard.

Glow Node Customer Support

Based on my experience, technical support is crucial for smooth trading, especially in a prop firm like Glow Node. Whether it's urgent queries or common questions, timely support can make a big difference. Glow Node offers live chat and Discord channel support, accessible from 7:00 to 22:00 GMT daily. While these options are efficient for immediate help, they also provide an email support channel. However, I found email to be less efficient compared to the instant solutions offered by live chat and Discord.

Advantages and Disadvantages of Glow Node Customer Support

Contact Table

Security for Investors

Withdrawal Options and Fees

At the challenge phase, traders don't make money as transactions aren't taken to the interbank market. It's only a test run. During the funding phase, traders earn a significant profit share, ranging from 80% to 90%.

Withdrawal applications can be made 30 days after your first live transaction. The minimum amount you can withdraw is $50. Submitting the withdrawal application is a straightforward process within your user account and is usually processed in a few days.

Withdrawal frequency is limited to once every 14 days. As for withdrawal methods, you have the option of using bank cards or e-wallets. No hidden fees are involved, making the process transparent and easy.

What Makes Glow Node Different from Other Prop Firms

One of the standout features of Glow Node is its variety of funding programs: one-phase evaluation, two-phase evaluation, and instant funding. This flexibility allows traders to choose a program that suits their trading style and comfort level. Unlike other prop firms, Glow Node places almost no restrictions on your trading style; you're free to trade during news events, hold trades overnight, and even trade over the weekends.

The two-phase evaluation program at Glow Node is unique in its structure. It requires traders to hit an 8% profit target in the first phase and a 5% profit target in the second phase. While the program does have a maximum loss rule of 10% and a daily loss rule of 5%, what makes it different is that there are no minimum or maximum trading day requirements. This allows traders to work at their own pace, which can be a significant advantage. Also, the two-phase evaluation comes with a scaling plan, offering more room for growth.

Overall, compared to other industry-leading prop firms, Glow Node has more relaxed trading rules, making it a flexible and attractive option for traders.

How Can Asia Forex Mentor Help You Pass Glow Node's Evaluation?

At Asia Forex Mentor, my mission has been to empower traders ever since the company's inception in 2008. Starting off by teaching a small circle of friends how to navigate the forex market, we've grown into a flourishing community.

Now, trading firms and banks even invite me to train their teams. What makes our approach uniquely effective is our AFM Proprietary One Core Program. This comprehensive program gives you the tools you need to succeed, especially if you're aiming to pass Glow Node's evaluation.

The One Core Program is structured to cover every aspect of trading. It teaches you to create a robust trading system, accurately analyze forex markets, and manage your trading account with consistent results.

The course is extensive, with 26 main lessons that further break down into over 60 subtopics. Each subtopic is supported by high-quality online videos and includes examples and insights that I've personally selected.

Designed to be both beginner-friendly and low-risk, this program gives you a solid foundation that can significantly increase your chances of passing Glow Node's evaluation process.

Our Journey at Asia Forex Mentor

At Asia Forex Mentor, I've had the incredible opportunity to mentor a diverse range of traders, from beginners to professionals, and from bank traders to fund managers. It's truly rewarding to see how many of my students have gone from novices to becoming full-time traders or even landing prestigious roles in the finance industry.

The One Core Program encapsulates the wisdom and strategies I've honed over the years. It offers a 360-degree view of trading, covering everything from detailed backtesting to the psychological aspects of trading. Students can benefit from unique features like the ‘set-and-forget' strategy, an exclusive auto stop-loss tool, and a deep dive into the free trade concept. I also offer clarity on the intricacies of different stop-loss levels.

For those who are intrigued and want to experience the program, there's a seven-day free trial available. If you're committed to fast-tracking your trading journey, the course is available at a special one-time fee of $940, bypassing the trial. Normally, the program costs $997, but I wanted to provide an accessible entry point for those eager to begin.

Also Read: Leeloo Trading Review 2024

Conclusion: Glow Node Review

Glow Node distinguishes out for its diverse funding packages and adaptable trading rules. Customers have commended the company's customer service and speedy payout method. The firm provides an interesting platform for both new and seasoned traders to thrive.

It is important to remember, however, that the firm has some limitations. There are several trading restrictions and no customer service call center. Furthermore, while it works with a licensed broker, Glow Node does not give license or regulation data.

Before making a decision, make certain that you have thoroughly weighed the benefits and negatives. While Glow Node has a lot to offer, you should consider whether it matches your trading goals and risk tolerance.

Glow Node Review FAQs

What types of funding programs does Glow Node offer?

Glow Node offers one-phase and two-phase evaluation programs, as well as an instant funding program.

Is customer support available round the clock?

No, customer support via live chat and Discord is available from 7:00 to 22:00 GMT.

Are there any trading restrictions?

Yes, there are some trading restrictions like a 5% daily loss limit and no use of martingale strategies.