Contents

- How to Use the Aroon Indicator?

- Aroon Up and Aroon Down are the Key Parameters

- Aroon Indicator Formula

- Applying the Aroon Oscillator

- Interpreting the Oscillator

- Aroon Indicator vs Directional Movement Index (DMI)

- Pros and Cons as a Technical Indicators

- Conclusion

- FAQs

How to Use the Aroon Indicator?

Developed by Tushar Chande back in the 90’ of the previous century, the Aroon technical indicator is used to recognize changes in the market trend. More specifically in the price of an asset, but also the potential of the trend.

The Aroon indicator estimates the period between high and lows. The concept is that a powerful uptrend will display a new high, and a strong downtrend will reveal new lows.

Day trading strategies are often based on the Aroon indicator because of its capacity for fast profits in the markets. It is one of the rare technical indicators that can help traders identify trend and have continued success with their trading strategy.

Every experienced day trader has noticed that the price of an asset usually gravitates in a range, where the price moves impulsively. In trading hours, the price moves up or down for a small percentage of the time.

Also read: ATR Indicator

Aroon Up and Aroon Down are the Key Parameters

The Aroon indicator formula was created to predict when the price action of an asset is transitioning from a range-bound state to a trending state, that way creating a long or short position. It can also show if the price action of a security is going to stop trending and start consolidating.

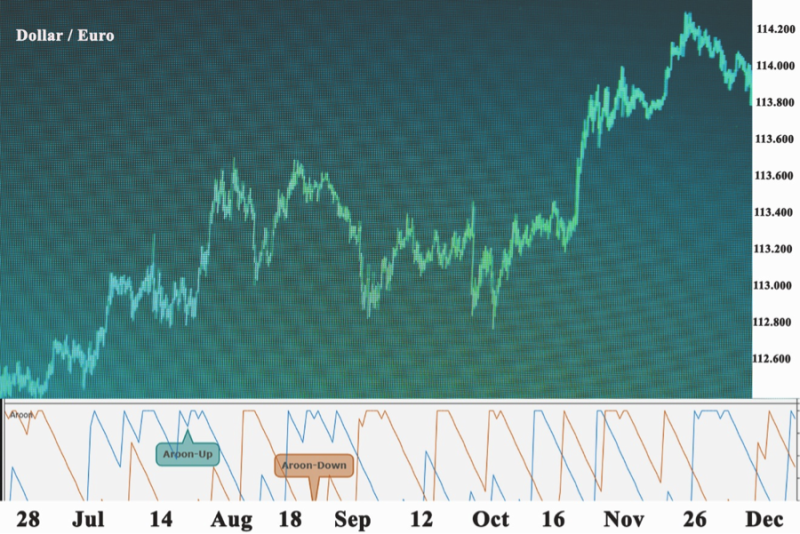

Visually the Aroon indicator is displayed on daily charts, as an up line that estimates the uptrend. And a down line does the opposite.

The indicator is usually based on 25 periods, it is expressed in terms of 0 to 100. Practically when the Aroon-Up indicator is over 50 prices it has made a new high in the past 12.5 periods.

The same applies to the Aroon-Down indicator. When it is over 50 it means a new low was posted within the last 12.5 periods. Reading close to 100 indicates a powerful trend.

Aroon Indicator Formula

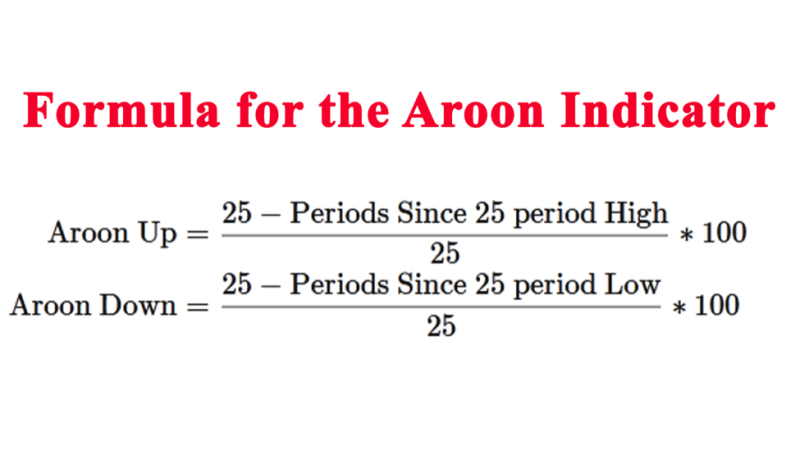

The Aroon Up or Down regulates the extend of time since the last high or low for the ongoing period. The Up or Down values are communicated in percentages and range from 0 to 100.

The nearer the line is to 100%, the more powerful the trend is. An Aroon Up close to 90% is showing a strong uptrend. Interestingly this can be also done with a low Aroon Down Line to give us trust in the trend. Seeing Aroon Down close to 100% indicates that low happened not long ago.

If you want to calculate the present Aroon Up value, you need to determine the point in time when the price was highest in the last 20 days. If that was two days ago, then we can use the following equation to find the Aroon Up:

Aroon Up = (20 – 2) * 100/20 = 90

If earlier the high were 15 days, the value would be 25. The closer the 20-day high is to now, the value of Aroon Up will be greater. This can be understood as an uptrend if there is also a low Aroon Down value to authenticate it.

Applying the Aroon Oscillator

Brokers can use the Aroon technical indicator for:

- Recognizing new trends.

- Anticipate market reversals.

- Measuring the strength of the trends.

- Identifying consolidations.

The basic interpretation of the Aroon readings:

- Reading near the 100 level signals a strong bullish/bearish trend.

- Reading near to the 0 level signals a weak bullish/bearish trend.

Interpreting the Oscillator

Three levels are crucial in explaining the Aroon indicators. The readings are 0, 50, and 100. The basic interpretation is that the market is bullish if Aroon-Up is over 50 and Aroon-Down is under 50.

This setup indicates new daily highs are more likely than new daily lows. The opposite is true for a downtrend.

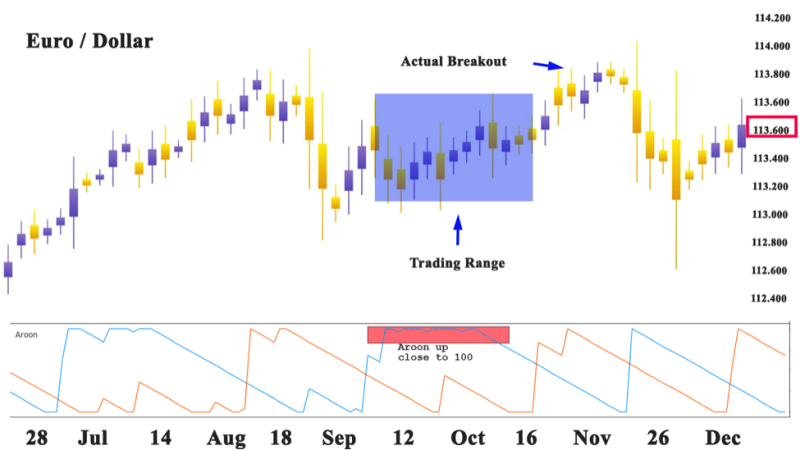

Recognizing Consolidation

Two signs indicate consolidation is emerging. The first is when both the Aroon-Up and the Aroon-Down are under 50. The next if both Aroon-Up and Aroon-Down are parallelly going lower. When both readings are under 50 it signals consolidation.

Reading under 50 for both indicators signals no new highs or lows have been spotted over 13 days When the lines together move in parallel, it signals a trading range has formed.

Indicating a New Trend

A new trend occurs in three phases. The first signal is when the Aroon-Up goes above the Aroon-Down. These signals that new highs are more frequent than new lows.

The following sign is when the Aroon-Up goes over 50 and the Aroon-Down under 50. The final sign is when the Aroon-Up comes to 100, while the Aroon-Down stays under 30.

Limitations of the Aroon Indicator

The downside of the indicator is that during turbulent market action the indicator provides weak trading signals. Sometimes it shows a valid signal, but too late to be implemented in the trade market. The Aroon indicator is accurate when combined with other technical indicators.

Aroon Indicator vs Directional Movement Index (DMI)

At face value, the Aroon indicator is indistinguishable from the Directional Movement Index (DMI) Wilder. Both use up and down lines to reveal the direction of a trend. The difference is that the Aroon indicator formulas are focused on the amount of time between highs and lows.

The DMI measures the price difference between current highs/lows and prior highs/lows. The crucial factor in the DMI is the price, not time.

Also read: Average Directional Movement Index

Pros and Cons as a Technical Indicators

Advantages:

- Indicates changes in trends. Line crossovers can indicate a rise or loss in momentum to the traders.

- Easy to understand. Interpreting the lines is easy and does not require sophisticated mathematical formulations.

- Flexibility in choosing the interval. Traders can alter the length of the period for measuring the Aroon Lines based on how frequently they trade.

Disadvantages:

- Lagging indicator. The Aroon lines are based on historical prices. They form slower compared to the underlying trend.

- Should be used in combination with other indicators. Used alone the signals created are not precise, and it is preferred to use them in tandem with other indicators.

- Influenced more by time than price movements. It depends only on how long ago the last high/low was observed, the indicator does not provide information on the immensity of change that can happen.

Conclusion

The Aroon indicator is easy to learn and utilize in technical analysis, even for beginners that are just starting to trade. To understand the trade signals and data correctly it is advisable to test your strategies using the indicator.

It is an unusual indicator that allows you to see the strength of a trend and use that insight to exploit the trend until a buy or sell climax is reached.

You get a momentum oscillator that can easily be a top 3 technical indicators in your trading toolbox. The Aroon is a successful tool for locating changes in the trend direction and the power of the trend.

A solid trading platform will offer the Aroon oscillator formula to monitor the existing trend and high and low prices. Aroon indicator strategies can validate the strong trend when the Aroon crossover happens. It can reveal a weak trend and price consolidation by anticipating a bull market and a bear market.

FAQs

What Does Aroon Indicator Mean?

The Aroon Indicator is a technical momentum oscillator that enables traders to recognize if a security is trending, the direction the power of the trend. Because it focuses on the price relative to the time, it can also be used to spot emerging trends and reversals.

The concept behind the indicator is that when trends price tends to make new highs or lows regularly, and by tracking that we can determine the strength of a trend, and when trends are beginning or ending.

Is Aroon Indicator Accurate?

Traders use it to follow stock price trends. It is a reliable and accurate indicator.

What Is Aroon Oscillator Indicator?

Aroon Oscillator is perceived as an extension of the Aroon Indicator and estimates the strength of a trend. It verifies the possibility the trends that are building up in the Aroon Lines can be used to interpret if a valid trend is emerging. The Oscillator is the difference between Aroon Up and Aroon Down.

How do You Trade with Aroon Indicator?

There are two lines in the indicator the Aroon Up, and Aroon Down. The Up-line signals bullish strength and momentum, and the Down line is for bearish strength and momentum. The lines are plotted on a histogram with a range of 0 to 100, with 100 the strongest indication of trend.

Traders use the indicator to observe crossovers. When the Up-line crosses higher it is a signal of a bullish trend and when the Down line goes higher it is an indicator of a bearish trend. When both lines are under 50 it is a sign of consolidation.

Appreciate the clear breakdown of the Aroon Indicator and its role in identifying market trends. The practical insights into interpreting Aroon Up and Aroon Down values make it easier to gauge trend strength.

Landscaping Services in Fresno CA

MY PERSONAL EXPERIENCE ON LOST CRYPTO RECOVERY!

I read so many stories about bitcoin loss to scams. I will like to start by saying the agencies responsible for bitcoin security has really done nothing to help locate stolen or lost coins. In my situation my MacBook was hacked by someone that had access to my emails, i immediately contacted blockchain and they only wasted my time, after which i worked towards getting help else where, i was referred to consult a bitcoin expert who helped track and retrieved my 3.3 btc, for an agreed fee. I was more than grateful, Thankful i didn’t fall victim and would like to recommend ( MORRIS GRAY 830 @ G maiL . COM )…!!!

Good day Audience, I want to use this great medium to announce this information to the public about Mr MORRIS GRAY. few months back, I was seeking an online BTC investment plan when I got scammed for about $172,000. I was so down and didn’t know what to do until I came across a timeline about Mr MORRIS GRAY. so I reached out to him and to my greatest surprise, they were able to recover all the funds which I had previously lost to the Devils. I am so glad to share this wonderful news with you all because it cost me nothing to announce a good and reliable Hacker as Mr MORRIS GRAY, His direct email is Morris Gray 830 at gmail dot com, WhatsApp: +1 607 : 698 : 0239…..!!!

This is a WARNING not to do any business with this company.You will be asked to pay for bogus “taxes” in order to withdraw which were not mentioned before. And even if you do pay, You still can’t. If you are in this mess or similar one get help by contacting Marketpeace .n et Their service was so easy to work with and we recouped all my losses till the last penny.

almost lost my investment capital and profits trading online, they wouldn’t process my withdrawal request . All efforts to reach out to their customer support desk had declined, I found it very hard to move on. God so kind I followed a broadcast that teaches on how scammed victims can recover their fund through the help of Gavin ray a recovery specialist, I contacted his email provided for consultation, I got feedback after some hours and I was asked to provide all legal details concerning my investment, I did exactly what they instructed me to do without delay, to my greatest surprise I was able to recover my money back including my profit which my capital generated. I said I will not hold this to myself but share it to the public so that all scammed victims can get their funds back. Contact his mail: gavinray78 @ gmail com or WhatsApp + 1 352 322 2096.