NAGA Review

Forex brokers play a crucial role in the financial markets, acting as intermediaries between retail traders and the vast world of foreign exchange trading. Selecting the right Forex broker is paramount, as it can significantly affect your trading experience and performance. The right broker not only provides access to the markets but also offers the tools, education, and support needed to navigate the complexities of Forex trading successfully.

NAGA stands out in the crowded Forex broker landscape by offering a comprehensive trading platform that caters to traders of all levels. With over 1,000 trading instruments, including stocks, forex, indices, and oil, NAGA integrates modern technologies and innovative solutions like copy trading. This approach positions it as a formidable competitor against traditional financial institutions, offering a unique blend of traditional and cutting-edge trading options.

In our forthcoming review, we delve into the intricacies of NAGA, highlighting what sets it apart from the competition. We cover essential aspects such as account options, deposit and withdrawal processes, and commission structures. By combining expert analysis with real trader experiences, our goal is to provide a balanced view that equips you with the knowledge to decide if NAGA is the ideal broker for your trading needs. Stay tuned for an in-depth exploration of NAGA’s offerings and how it compares to other brokers in the market.

What is NAGA?

NAGA is a well-known brand under The NAGA Group AG, established in 2015. As a German FinTech company, it proudly stands on the Frankfurt Stock Exchange, showcasing its credibility and growth in the financial sector. This background underlines NAGA’s solid foundation and innovative approach in the competitive landscape of financial services.

The company is at the forefront of integrating modern technologies and innovative solutions. By doing so, NAGA distinguishes itself from traditional financial institutions, such as banks and other brokers. This strategic approach aims to offer superior services and tools for traders and investors navigating the investment market.

With a solid global community of over 1 million active traders and passive investors, NAGA commands a significant presence in the brokerage services market. This milestone is a testament to the trust and efficiency NAGA provides to its clientele, ensuring a seamless and advanced trading experience. The numbers speak volumes about NAGA’s ability to meet the needs of a diverse and growing community of investors and traders worldwide.

Benefits of Trading with NAGA

Trading with NAGA has offered me a comprehensive and versatile trading experience, underscored by a suite of benefits that cater to both novice and experienced traders. One of the standout features is the platform’s extensive range of trading instruments. With access to over 1,000 options including forex, stocks, indices, and cryptocurrencies, I found it incredibly easy to diversify my portfolio and explore various market opportunities.

The integration of social trading is another significant advantage, enabling me to follow and replicate the strategies of successful traders. This feature not only enhanced my trading decisions but also provided a valuable learning opportunity by observing real-time trades and strategies. It’s a unique blend of community and trading that I haven’t found to this extent on other platforms.

Moreover, trading on NAGA is underpinned by modern technology and a user-friendly interface, making the execution of trades both seamless and efficient. The platform’s commitment to security, evidenced by segregated client funds and protection against negative balance, gave me peace of mind knowing my investments were safeguarded.

NAGA Regulation and Safety

Trading with NAGA has been a noteworthy experience, given its background as part of The NAGA Group AG, a German FinTech powerhouse publicly listed on the Frankfurt Stock Exchange. This affiliation not only adds a layer of trust but also positions NAGA within a network of companies dedicated to financial innovation and security. My insights are drawn from firsthand trading activities with NAGA, reflecting its operational integrity and market presence.

One significant advantage I’ve observed is the rigorous approach to client fund security. NAGA ensures that clients’ funds are held in segregated accounts, distinctly separate from the broker’s capital. This practice is crucial for safeguarding traders’ money, offering an added layer of financial safety and peace of mind during trading activities.

Another noteworthy benefit is the protection from negative balance, a feature that guards traders against owing more than their account balance. This protective measure is especially beneficial in volatile markets, where sudden price swings can otherwise lead to significant losses.

In instances of disputes or disagreements with the broker, the process to file a complaint with the regulator is straightforward and transparent. This accessibility to recourse reinforces the accountability and reliability of NAGA as a trading platform, ensuring traders have a channel for addressing concerns.

NAGA Pros and Cons

Pros

- Listed for reliability on the Frankfurt Stock Exchange

- A multitude of trading choices

- Social trading for earning passively

- Cutting-edge trading technology

- More than 1 million active traders

- Separate client funds ensure security

Cons

- High spreads on standard accounts

- Absence of welcome bonuses

- Limited options for deposit and withdrawal

- Lack of cent accounts

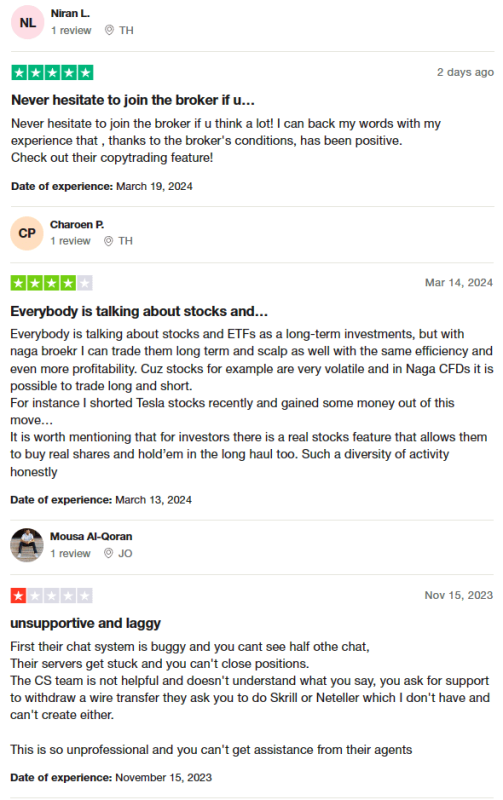

NAGA Customer Reviews

NAGA reviews from different customers present a mixed yet leaning positive view. Users appreciate the broker’s versatile trading options, highlighting the copytrading feature and the flexibility to engage in both long-term investments and scalping, particularly with volatile stocks and ETFs. The ability to trade CFDs on both long and short positions, alongside the option to purchase real shares for long-term holding, is frequently praised for adding depth to trading strategies. However, some customers have reported technical issues with the chat system and server stability, which can impede trading activities and customer service interactions. Issues with the customer support team’s responsiveness and understanding have also been noted, particularly concerning withdrawal processes. Overall, while NAGA Broker is lauded for its trading features and investment opportunities, there’s room for improvement in technical stability and customer support.

NAGA Spreads, Fees, and Commissions

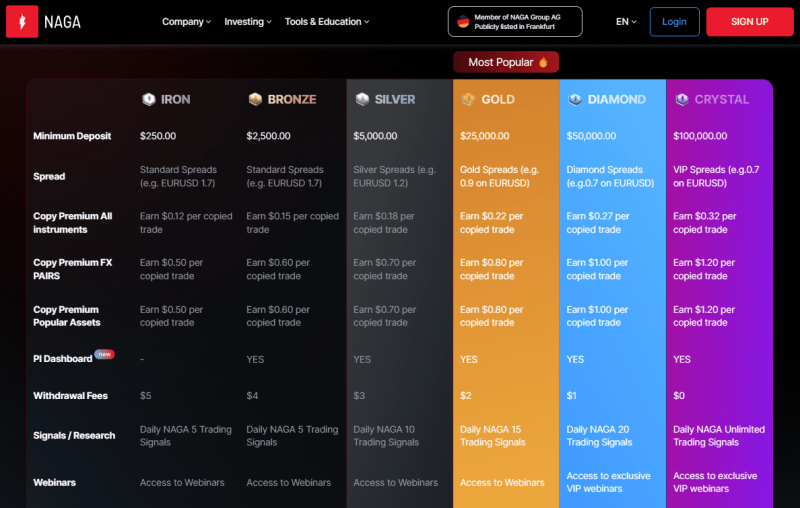

When I explored NAGA for trading, I noticed they apply a floating spread as their main trading fee. This means the spread varies based on market conditions, which is pretty standard in the industry. Interestingly, they don’t charge a commission per lot across all account types, which simplifies the cost structure for traders like me.

However, when it comes to withdrawals, NAGA does introduce a fee, ranging from $0 to $5 per transaction. This non-trading withdrawal commission is something to keep in mind, especially if you plan to move money in and out frequently. It’s worth noting that the broker doesn’t specify the fees charged by payment systems, such as Visa or wire transfers, for withdrawing funds from their platform. This lack of transparency means you might encounter additional costs from your payment provider when you withdraw your funds.

Additionally, NAGA implements a swap fee. This is a commission charged for holding a position overnight, a common practice in the trading world. It’s an essential factor to consider for traders who tend to hold positions for more than a day.

Account Types

In my journey through NAGA’s trading platform, I discovered a variety of account types designed to cater to different trader needs and investment levels. Here’s a structured overview:

- Iron Trader: This entry-level account requires a minimum deposit of $250, featuring floating spreads starting from 1.7 pips. It’s a good starting point for newcomers to the platform.

- Bronze Trader: With a step up, this account demands a minimum deposit of $2,500 and offers spreads from 1.7 pips. Additional benefits include daily trading signals and access to webinars, enhancing the trading experience.

- Silver Trader: For those looking to invest more, a $5,000 deposit is required. This account offers tighter spreads from 1.2 pips, suited for traders seeking more favorable trading conditions.

- Gold Trader: Aimed at professionals willing to invest $25,000 or more, this account provides floating spreads from 0.9 pips. A standout feature is the instant withdrawals to the NAGA CARD, offering quick access to funds.

- Diamond Trader: This professional account requires a $50,000 minimum deposit and offers spreads from 0.7 pips. Like the Gold Trader account, it also facilitates instant money transfers to a NAGA card, catering to high-volume traders.

- Crystal Trader: The premium account type for elite traders, requiring a $100,000 deposit. It boasts precise spreads from 0.7 pips and offers the highest margin trading opportunities. Additional perks include free NAGA CARD registration, trading signals, and participation in company webinars, making it the ultimate choice for serious investors.

Each of these accounts is tailored to fit different trading styles and investment capacities, ensuring traders can find a match that best suits their trading goals and strategies on NAGA.

How to Open Your Account

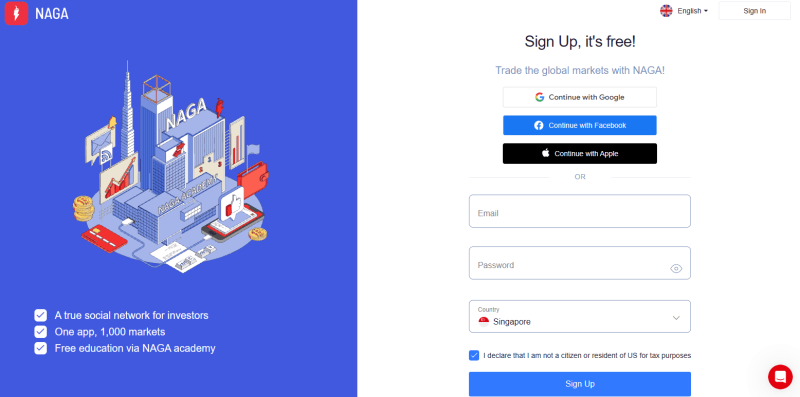

- The user starts by visiting NAGA’s official website and selecting the “Sign Up” or “Start Trading” option.

- They then proceed to complete the registration form, providing their full name, email, and phone number.

- The next step involves creating a username and password for the new account.

- To verify the account, the user must confirm both their phone number and email.

- An alternative registration method allows the user to sign up using their Google or Facebook accounts.

- The user is required to complete any additional verification steps as mandated by NAGA.

- Choosing an account type comes next, with the decision based on the user’s trading preferences and experience level.

- Finally, the user makes their first deposit, adhering to the minimum amount specified, thus enabling them to start trading with NAGA.

NAGA Trading Platforms

Based on my experience, NAGA provides traders with access to two of the most renowned trading platforms: MetaTrader 4 (MT4) and MetaTrader 5 (MT5). Both platforms are highly acclaimed for their robust features, which cater to the needs of both novice and experienced traders.

MetaTrader 4 is widely recognized for its user-friendly interface, making it an excellent choice for those new to trading. It offers a variety of technical analysis tools and supports automated trading through the use of Expert Advisors (EAs). The platform’s reliability and simplicity have made it a staple in the trading community.

MetaTrader 5, on the other hand, expands on the capabilities of MT4, providing more advanced charting tools, additional timeframes, and improved order management features. It is particularly suited for traders looking for depth in their analysis and execution, with access to more markets and instruments. MT5’s sophisticated environment supports a broader range of trading strategies, making it a preferred option for advanced traders.

Utilizing these platforms through NAGA has allowed me to experience the versatility and depth needed to navigate the markets effectively. Whether you’re starting out or looking to leverage complex strategies, NAGA’s integration of MT4 and MT5 caters to a wide spectrum of trading preferences and requirements.

What Can You Trade on NAGA

During my time trading with NAGA, I’ve had the opportunity to explore a diverse range of trading instruments. The platform offers CFDs (Contracts for Difference) on a variety of assets, including Forex, Stocks, Futures, Indices, Cryptocurrencies, Commodities, ETFs, and also provides access to real stocks. This diversity allows traders to spread their investments across different markets, optimizing their risk and potential returns.

Trading Forex pairs is a standout feature, offering access to major, minor, and exotic currencies. The platform’s ability to trade CFDs on stocks from major companies around the world, futures contracts, and various indices allows for a broad market reach. Additionally, the inclusion of cryptocurrencies and commodities adds depth to the trading experience, catering to those interested in digital currencies and traditional commodities like gold and oil.

Moreover, NAGA‘s provision to trade ETFs (Exchange-Traded Funds) and real stocks offers an additional layer of investment opportunities, appealing to both short-term traders and long-term investors. This comprehensive array of instruments has made my trading experience with NAGA both versatile and rewarding, providing the tools necessary to navigate the complexities of global markets.

NAGA Customer Support

Based on my experience, NAGA offers several convenient ways to reach out to their customer support team, ensuring that help is always readily available for their client’s needs and trading decisions. The methods include making a call to international numbers listed in the “Contact Us” section, sending an email, and using the online-chat feature on the website. This variety ensures that traders can choose the communication channel that best suits their preferences or needs.

I found the ability to contact NAGA’s technical support both through my personal account and directly on the website particularly useful. It meant that whether I was logged in and trading or just browsing their site for information, assistance was always a few clicks away. This level of accessibility significantly enhanced my trading experience, providing peace of mind that support is accessible whenever I might need it.

Advantages and Disadvantages of NAGA Customer Support

Withdrawal Options and Fees

From my experience with NAGA, I found their withdrawal process to be quite efficient. All withdrawal requests I made were completed within 24 working hours, which is fairly quick. The platform sets a minimum transaction amount for withdrawals at 50 EUR/USD/GBP and PLN, making it accessible for small to medium-sized traders.

The availability of withdrawal methods is tailored to the client’s country of residence, which I found convenient. I had the option to withdraw funds to my NAGA CARD, as well as through other popular methods like VISA, VISA Electron, MasterCard, Maestro, Neteller, and Skrill. This variety ensured that I could choose the most convenient option for me.

However, it’s important to note that withdrawals are primarily made in EUR and USD, which might be a limitation for some. Additionally, NAGA charges a withdrawal fee ranging from 0 to 5 EUR/USD (or the equivalent in other currencies) for each transaction. While not excessive, this fee should be considered when planning your withdrawals to avoid any surprises.

NAGA Vs Other Brokers

#1. NAGA vs AvaTrade

NAGA differentiates itself by offering a wide array of trading instruments including stocks, forex, and cryptocurrencies, along with innovative features like social trading. It’s known for its modern technology and has a significant user base. AvaTrade, established in 2006, has a strong focus on providing a comprehensive trading experience with over 1,250 financial instruments and is heavily regulated, offering a high degree of security to its users.

Verdict: AvaTrade may be better for those valuing a long-established broker with a wide range of instruments and regulatory security. However, for traders interested in social trading and a modern platform, NAGA offers a compelling proposition.

#2. NAGA vs RoboForex

NAGA offers a broad spectrum of trading options and emphasizes modern technologies and social trading. RoboForex, with its inception in 2009, focuses on delivering superb trading conditions through cutting-edge technologies. It provides a vast selection of more than 12,000 trading options across eight asset classes, and a variety of platforms including MetaTrader, cTrader, and RTrader.

Verdict: RoboForex edges out for traders seeking a wide variety of trading platforms and an expansive range of instruments. However, for those prioritizing social trading and a unified platform experience, NAGA remains a strong contender.

#3. NAGA vs Exness

NAGA stands out with its social trading feature and a user-friendly platform for trading a wide range of instruments. Exness specializes in forex and CFDs offering, with its high monthly trading volume indicating robust activity. It provides beneficial trading conditions such as low commissions, instant order execution, and offers the unique feature of unlimited leverage on small deposits.

Verdict: Exness may be preferable for forex traders seeking low commissions and the flexibility of unlimited leverage, especially beneficial for those with smaller deposits. For traders looking for a broader range of instruments and the added value of social trading, NAGA presents a compelling choice.

Also Read: AvaTrade Review 2024- Expert Trader Insights

Conclusion: NAGA Review

Based on my insights and user feedback, NAGA emerges as a forward-thinking broker that caters to the needs of modern traders. With its robust offering of over 1,000 trading instruments, including a strong focus on social trading, it provides a unique platform for both new and experienced traders. The integration of modern technologies and a user-friendly interface enhances the trading experience, making it accessible and engaging.

NAGA is also commendable for its security measures, including segregated client funds and protection from negative balance, which offer traders an added layer of financial safety. Its affiliation with The NAGA Group AG, listed on the Frankfurt Stock Exchange, adds to its credibility and reliability as a brokerage.

However, other traders should be aware of the platform’s drawbacks, such as the high spreads on standard accounts and limited withdrawal and deposit methods. Additionally, customer support challenges, like delayed responses during peak times and unavailability on weekends, could impact the trading experience.

Also Read: Skilling Review 2024 – Expert Trader Insights

NAGA Review: FAQs

What is NAGA?

NAGA is a dynamic online trading platform offering access to a wide range of financial instruments, including forex, stocks, indices, and cryptocurrencies. It integrates modern technologies and innovative solutions, such as social trading, making it suitable for both new and experienced traders.

How does NAGA ensure the security of my funds?

NAGA ensures the security of client funds through segregated accounts, which means traders’ funds are kept separate from the company’s operating funds. Additionally, it offers protection from negative balance, safeguarding users from losing more than their account balance.

Can I trade cryptocurrencies on NAGA?

Yes, NAGA provides the option to trade a variety of cryptocurrencies as part of its extensive offering of over 1,000 trading instruments. This allows traders to diversify their portfolio by including digital currencies.

OPEN AN ACCOUNT NOW WITH NAGA AND GET YOUR BONUS