TOGETHER WITH

Today’s edition is sponsored by Octa. Looking for a broker that actually gets traders? Octa has your back. With over 14 years in the game, they’ve built a solid rep for reliability, tight spreads, fast execution, and user-friendly platforms.

👉 Check them out here and see why millions of traders ride with Octa.

What’s up traders, Ezekiel here with your fast market scoop. Let’s break down what’s moving the markets, why it’s important, and how you can stay ahead of the game:

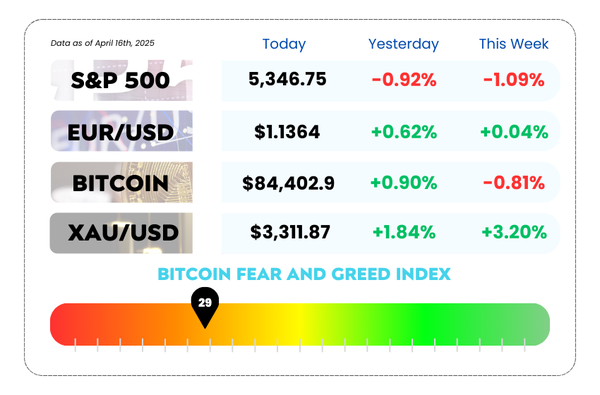

- Today's market mayhem. S&P, EUR/USD, Bitcoin, and XAU/USD today

- Chip ban drama? Say less, dollar gets smacked by trade war fears

- Nvidia gets nuked, $5.5B hit from surprise China chip ban

- Bullish ABCD pattern EXPLAINED: Spot fake moves like a pro with our video

💰 Boost Your Trading Power with Octa's 50% Deposit Bonus! 💰

Ready to level up your trading? Octa’s giving you a 50% bonus on every deposit — instantly.

Deposit $100 → Trade with $150

Deposit $500 → Trade with $750

Yes, it works on future deposits too! 🙌

FP Markets delivers a powerful forex trading experience tailored for both beginners and pros. Here's what makes them stand out:

✅ Easy setup — just $50 to get started

✅ Bonus activates instantly

✅ Withdrawable once you hit simple trading volume

(Bonus ÷ 2 in standard lots — that’s it!)

👉 Higher-tier users get even easier withdrawal conditions.

WEEKLY MARKET MAYHEM

For this week's market mayhem, here’s what we got for you today:

💸 The Dollar’s Losing Streak Is Back — And Trade War Drama Is the Villain 💸

The US dollar just got kicked in the assets again 😬

After a brief little glow-up earlier this week, the greenback is back on the struggle bus, hitting a fresh 6-month low. It’s now down against every major currency in the Group-of-10 squad — yup, even your grandma’s favorite: the Swiss franc 🇨🇭

So what’s going on?

👀 Blame it on the trade war jitters.

The US cracked down (again) on Nvidia’s chip exports to China, and Wall Street immediately freaked out. Cue the “risk-off” energy. Investors started pulling out of US assets faster than you can say “tariff tantrum.”

👉 China basically said, “We’re not even talking unless you clean up your act,” which didn’t help either.

Meanwhile…

The euro, yen, and Swiss franc strutted in like safe-haven hotties.

Volatility demand spiked — because when there’s chaos, someone’s always buying popcorn 🍿

The Bloomberg Dollar Spot Index dropped 0.6%, its biggest slide in weeks.

And if you’re thinking this is just a blip… think again.

The dollar is down 3% already in April, on pace for its worst month since 2022. Big brains like Jefferies’ chief economist are calling it:

“The strong dollar era has peaked.”

US Dollar Index Daily Chart as of April 16th, 2025 (Source: TradingView)

💰 Gold is the new black

With central banks slowly ghosting the dollar (👻), many are pivoting to gold like it’s the safe, shiny ex that never lets you down. Jefferies says it’s their “favorite version of a weaker dollar.”

Oh, and Treasuries? Also not vibing.

US Treasuries just had their worst selloff in 20+ years. Yikes.

There’s growing fear that big foreign holders (hi China 👋) are trimming down their US bond stashes.

Even the options market’s catching the drift — traders are paying extra to hedge against dollar weakness for the first time in 5 years.

And fund managers? The most dollar-bearish they’ve been since 2006. That’s pre-iPhone era bearish.

🤔 Asia Forex Mentor Insights

This is more than just dollar dips and China drama. It’s a global rebalancing of confidence — and forex traders are riding the wave 🌊

Safe havens are in, and risk assets tied to the US? Looking shakier than ever.

👉 Watch the euro, yen, and gold — they’re where the smart money’s flowing.

👉 And remember: in the FX game, sentiment shifts fast. Stay alert, stay nimble.

💥 Nvidia Just Got Smacked With a $5.5B Surprise 💥

You know that feeling when you’re about to cash in big… and then your wallet catches fire?

That’s basically what happened to Nvidia this week 🔥💸

The AI chip king saw its stock tumble 6% after revealing it’s about to take a $5.5 BILLION hit thanks to a surprise export ban on its made-for-China H20 chips.

Yeah — not a bug, that’s the actual number 🤯

🧨 What happened?

Late Tuesday night, Nvidia dropped a bomb in an SEC filing:

The US government told them they now need a special license to export H20 chips to China.

Spoiler alert: Those licenses basically don’t exist.

Like, zero have ever been granted. Not one. Because of fears the chips might be used to build AI supercomputers 🧠💻 (aka digital Skynet).

And while everyone assumed the US had backed off these bans after Nvidia’s CEO had dinner with Trump at Mar-a-Lago 🍽️… surprise! The feds hit “reverse” on that handshake.

NVIDIA Corporation Stock Daily Chart as of April 16th, 2025 (Source: TradingView)

😬 Why it’s such a mess

Nvidia already built the chips.

This isn’t about canceling future orders — they’ve got billions in inventory that’s now basically paperweights.

- Jefferies thinks the real damage could be closer to $10B in lost revenue 😳

- Bernstein is calling it out too: “The ban makes no sense. Chinese competitors already make worse chips.”

- Even Wall Street’s stunned. Most thought the Biden admin was chilling out on H20 controls. Nope.

To make things even more awkward, Nvidia had just promised to spend $500B building AI infrastructure in the US over the next four years. Timing? Impeccable 🙃

🤔 Asia Forex Mentor Insights

This isn’t just about Nvidia — it’s a major plot twist in the global AI arms race.

The US wants to keep China from training top-tier AI. China wants to go full-send on domestic innovation. And Nvidia? Caught right in the middle.

Here’s what we’re watching:

👉 If these chip bans stick, expect Huawei and other Chinese firms to rise FAST

👉 Nvidia could pivot hard to domestic expansion and non-China sales

👉 And in the FX world? This fuels more volatility and safe-haven inflows — think yen, Swiss franc, and gold plays 💰

The bigger question: How far will the US go to kneecap China’s AI future? And how many Nvidia chips get left out in the cold?

MEMES OF THE DAY

Please, just one bounce… 🕯️📈🔮

“Fed surprise rate hike… effective immediately.” 😳📉