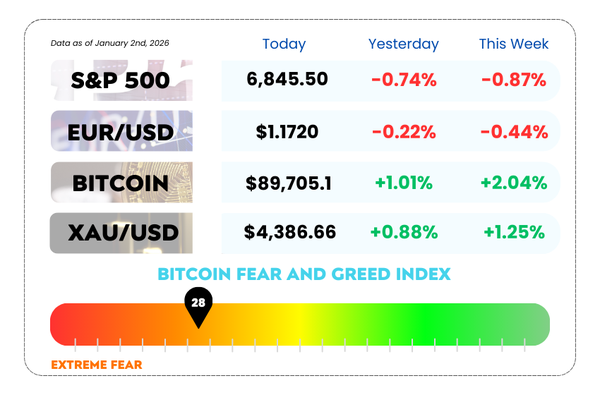

- Today's market mayhem. S&P, EUR/USD, Bitcoin, and XAU/USD today

- EUR/USD pulls back, but the bigger trend isn't broken yet

- Gold holds near records as silver jumps to start the new year

- Stop chasing breakouts and learn how smart traders use volatility to time precise entries in our video

One Night That Can Reset How You Trade in 2026

Most trading events focus on systems, shortcuts, or bold promises.

AFM Trading Summit Live 2026 takes a different approach.

This session isn’t about guaranteed outcomes or secret techniques. It’s designed to give traders one structured evening to step back from day-to-day execution and look at how experienced professionals think about the market at the start of a new year.

If you've been active in the markets but feel like:

- Your effort isn't translating into consistent progress

- You're adjusting entries and indicators, but not your overall reasoning

- Your strategy feels busy rather than clear

This summit may be useful.

On January 29, 2026, traders from the world will join a live session focused on:

- Structured market reasoning

- Risk awareness before opportunity

- Building a practical framework for 2026

A Free Pass is available, which includes live access, community discussion, a 24-hour replay, and the AFM Starter Kit PDF

It’s not positioned as a breakthrough or a shortcut.

Rather, it’s a chance to reset perspective, refine thinking, and start the year with a clearer plan.

WEEKLY MARKET MAYHEM🔥

For this week's market mayhem, here’s what we got for you today:

📉 EUR/USD Slips After Weak Eurozone Factory Data Rattles the Euro

EUR/USD is backing off 👀

And no, it’s not because traders are still waking up from New Year’s brunch ☕

After flirting with 1.1800 in late December, the pair has slid back toward the 1.1730 zone, as soft Eurozone manufacturing data took the wind out of the Euro’s sails 🇪🇺📉. Even in a calm holiday session, weak data still knows how to make noise.

What’s dragging the Euro lower

Manufacturing numbers across the Eurozone, especially Germany, came in underwhelming, reinforcing one uncomfortable truth, factories are contributing less and less to growth. That was enough to invite sellers back in, even though the broader market mood remains relatively quiet.

Zooming out a bit 🔍, the bigger picture is still interesting. EUR/USD isn’t far from its three month highs near 1.1808, reached just before Christmas.

Meanwhile, the US Dollar has had a rough year, down roughly 14% against the Euro, pressured by policy uncertainty, slowing US growth signals, and diverging paths between the European Central Bank and the Federal Reserve.

EUR/USD Daily Chart as of January 2nd, 2026 (Source: TradingView)

What traders are watching now 👇

All eyes are turning to the upcoming US S&P Manufacturing PMI. A surprise there could give the Dollar a short term boost, or confirm that momentum is still leaking out of the US economy 🧠💵.

Technically speaking 🧮

The short term tone remains bearish. EUR/USD has slipped below its mid November trendline support, the RSI is struggling to reclaim the 50 level, and MACD is still below zero, even though downside pressure looks like it’s losing some bite.

For sellers, the 1.1700 area is the line in the sand. A clean break could open the door toward 1.1680, and even 1.1615 if momentum builds. On the flip side, rebounds have stalled near 1.1764, with tougher resistance waiting around 1.1785, and again above 1.1800.

🤔 Asia Forex Mentor Insights

Short term weakness doesn’t erase the bigger trend. As long as EUR/USD holds above the mid 1.16s, this pullback looks more like a breather than a breakdown. Traders should stay flexible, watch incoming US data closely, and remember, low liquidity sessions can exaggerate moves faster than expected ⚠️

🏆 Gold and Silver Kick Off 2026 Strong After a Monster Year ✨

Gold and silver are starting 2026 on the front foot ✨

And yes, the rally hangover from last year hasn’t kicked in yet.

As the new trading year opened, gold hovered near $4,375 an ounce, while silver jumped more than 2%, extending what was their strongest annual performance since 1979 🏆. Not a bad way to kick off January.

Why metals are still shining 🌟

The bullish case hasn’t changed much. Traders continue to bet on lower US interest rates, a softer US dollar, and steady demand for safety as global uncertainty sticks around. Gold, in particular, thrived last year thanks to central bank buying, easing policy from the Federal Reserve, and ongoing geopolitical tension.

But there’s a short term speed bump 👀

Despite the strong start, some traders are cautious. Broad index rebalancing is coming up, and after such a massive rally, passive funds may need to trim positions to align with new weightings. Thin post holiday liquidity could make any move feel bigger than it should, especially in silver.

Still, big banks remain optimistic. Goldman Sachs Group Inc. recently pointed to a base case that sees gold climbing toward $4,900 an ounce, assuming rate cuts continue and US monetary leadership evolves further.

Quick market snapshot 📊

Gold was up about 1.3% in Asian trading, while silver surged 2.5%. The Bloomberg Dollar Spot Index edged lower, adding a little extra fuel to the metals move. Platinum and palladium joined the party too.

One thing to keep in mind, trading conditions may stay thin, with major markets like Japan and China still on holiday, meaning price swings could be sharper than usual ⚠️.

🤔 Asia Forex Mentor Insights

The long term trend for precious metals remains firmly bullish, but short term volatility is part of the game after such an explosive run. If prices cool off on rebalancing flows, it may offer better risk entry zones, rather than signal the end of the rally. Patience and position sizing matter more than chasing headlines in low liquidity markets.