Hey traders, Ezekiel here — let’s dive into today’s market action and uncover the setups that could power your next big trade. ⚡

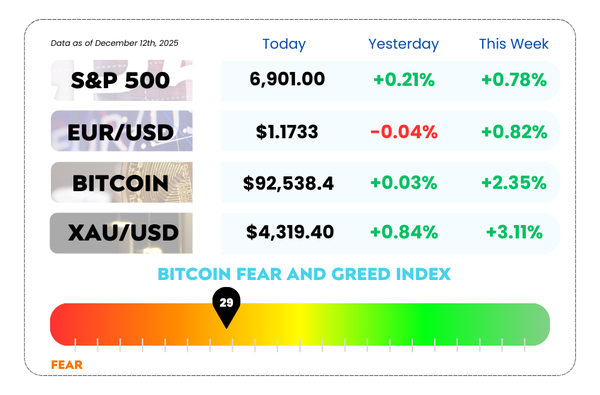

- Today's market mayhem. S&P, EUR/USD, Bitcoin, and XAU/USD today

- Gold breaks above $4,250 as Fed rate cut weakens USD: What’s next for XAU/USD?

- Bitcoin slips below $90K as Fed’s rate cut doesn’t lift crypto

- Learn the exact VWAP strategy that reveals institutional zones and helps you time high-precision trades with confidence with our video

🏆 AFM Awards 2025 — Voting Is Live! 🏆

The first-ever AFM Awards are officially underway, and your vote counts. This is your opportunity to celebrate and recognize the individuals and brands that have demonstrated excellence, innovation, and leadership in the forex industry.

⏰ The clock is ticking! Only a few days left to cast your vote for your favorite nominees. Don’t miss your chance to have a say in who takes home the title and becomes part of AFM history.

🗳 Vote now — voting closes on December 15, 2025!

WEEKLY MARKET MAYHEM🔥

For this week's market mayhem, here’s what we got for you today:

🚨 Gold Price Soars: XAU/USD Surpasses $4,250 as the Fed’s Rate Cut Weakens USD

Gold is shining brighter than ever, climbing to a fresh seven-week high of $4,275 in early Friday trading across Asia.

This surge comes right after the Federal Reserve's rate cut, which is dragging down the strength of the US Dollar. 📉 But here’s the twist – Ukraine peace talks could limit Gold's rally, keeping the precious metal on edge. 🤔

XAU/USD Daily Chart as of December 12th, 2025 (Source: TradingView)

🔑 Key Factors Driving Gold Up:

The Fed’s rate cut of 25 basis points on Wednesday has significantly weakened the USD, boosting Gold’s appeal as a safe haven.

Weaker-than-expected US job numbers (applications for unemployment benefits rose the most in nearly 4.5 years) are further pressuring the USD, adding momentum to Gold’s rise. 📊

With interest rates now hovering between 3.50% and 3.75%, the Fed is signaling they might pause further cuts, keeping Gold in play. 📈

🌍 But… Is Peace on the Horizon?

Ukraine’s potential peace deal might dampen Gold's appeal. As President Zelensky speaks with US officials about a security framework to end the war, the uncertainty Gold thrives on may start to fade. 🕊️

🤔 Asia Forex Mentor Insights

Gold continues to ride high, but as geopolitical tensions ease, the upside might be capped. Traders should stay alert to both US policy shifts and international developments shaping this precious metal’s future.

📉 Bitcoin Dips Below $90K as Dollar Weakens After Fed Rate Cut

Bitcoin is back below $90,000, slipping to $89,400 after a brief rally above $94,000 following the Federal Reserve’s rate cut.

This marks a continuation of the bearish trend in crypto despite the dollar weakening and other markets reacting as expected to the Fed’s move. The U.S. Dollar (DXY) has fallen to a seven-week low, in line with the usual reaction to an easier monetary policy.

Alongside the dollar’s decline, precious metals prices surged, with silver hitting a record high of $64 per ounce, and the 10-year Treasury yield dipping slightly to 4.12% from 4.20%.

Despite these positive movements in traditional markets, crypto hasn’t been able to join the rally.

Bitcoin and Ethereum are both in the red, with Bitcoin down 3% over the last 24 hours, while Ether has slid 5.5%. XRP and Solana also dropped around 4%, indicating a broader bearish sentiment in the digital asset space.

BTC/USD Daily Chart as of December 12th, 2025 (Source: TradingView)

The gloomy mood in crypto may have been worsened by the disappointing earnings report from Oracle, which led to a 14% drop in Oracle’s stock. This dragged down other tech giants like Nvidia, AMD, and Broadcom, contributing to a 1.2% drop in the Nasdaq.

Bitcoin mining stocks, many of which have pivoted to AI infrastructure, are also feeling the heat. Companies like Hut 8, Iren, and Cipher are down by around 5% to 6%, with Riot Platforms also facing similar losses.

Additionally, Strategy, a major Bitcoin treasury player, dropped 6.4%, and Coinbase saw a 5% decline. Even Robinhood, which has struggled with declining crypto trading volumes, saw a 8.3% dip after releasing a November update showing weak numbers in the crypto trading space.

🤔 Asia Forex Mentor Insights

Despite the Fed’s rate cut triggering the usual market reactions, crypto is still stuck in a bearish phase.

With major players like Bitcoin and Ether continuing their slide, the focus now turns to whether traditional markets and further economic developments can help lift crypto, or if it will remain in its current slump.