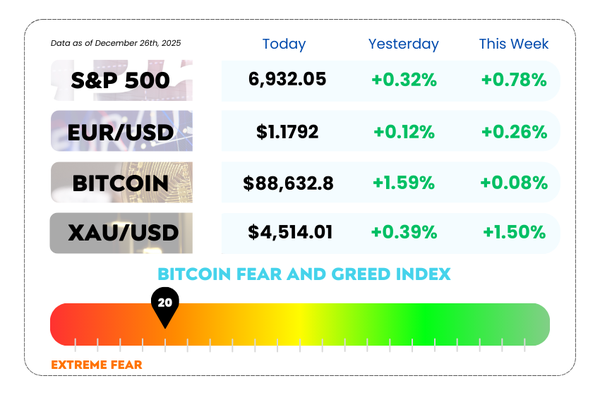

- Today's market mayhem. S&P, EUR/USD, Bitcoin, and XAU/USD today

- US Dollar struggles amid economic growth and Trump's comments

- Hong Kong to launch virtual asset dealer rules in 2026

- Learn how SMT Divergence exposes smart money moves and helps you avoid fake breakouts with our video

2026 Belongs to the Traders Who Prepare — Not React

Most traders head into a new year with no real roadmap.

They watch the market, react emotionally, and hope things improve. But hope isn’t a strategy — and reaction isn’t a plan. The traders who actually grow in 2026 will be the ones who step into the year prepared, structured, and clear on how they’ll respond to different market conditions.

That’s exactly what AFM Trading Summit Live 2026 is designed to deliver.

This event is going to be a reset point for your entire approach. You’ll learn how experienced traders think, plan, and execute across Forex, Crypto, and Stocks, so you’re no longer guessing or chasing moves after they happen.

If you’re serious about turning 2026 into a year of consistency, confidence, and smarter decision-making, this summit gives you the framework to do exactly that.

For those who want to go even deeper, there’s an opportunity inside the event that takes preparation to the next level. 👇

WEEKLY MARKET MAYHEM🔥

For this week's market mayhem, here’s what we got for you today:

🌐EUR/USD Holding Steady Near 1.1800: The Calm Before the Holiday Storm

EUR/USD is holding firm at 1.1800 on Wednesday, up 0.10% for the day. It hit its highest level since late September earlier today, but for now, it's consolidating in a low-liquidity environment as everyone gets ready to shut down for the holidays. 🎄

The US Dollar is under pressure, despite strong US GDP numbers. The Bureau of Economic Analysis revealed that the US economy expanded at an annualized rate of 4.3% in Q3, topping market expectations. But even this impressive figure couldn't lift the Greenback for long. Why? Because investors are feeling that this growth is lacking momentum in the labor market. 🧐

The USD Struggles Amid Policy Talk 💬

Then there’s President Trump stirring the pot by openly criticizing monetary policy and pushing for lower interest rates, even when things are looking good in the markets. Not exactly the kind of support the Federal Reserve needs, right? This has sparked concerns about the Fed’s independence and further weighed down the dollar.

Meanwhile, the US Dollar Index (DXY), which tracks the Greenback against a basket of other major currencies, has been trading near a multi-week low. It’s clear that Trump's comments and the Fed’s direction are affecting how investors are playing their cards. 🃏

EUR/USD Daily Chart as of December 26th, 2025 (Source: TradingView)

Policy Divergence Fuels EUR/USD Consolidation 📊

Monetary policy expectations continue to guide the markets, and right now, investors are betting on rate cuts by the Fed in 2026. In fact, the CME FedWatch tool shows a high chance of cumulative cuts next year, which is more accommodative than what the Fed’s projections suggest.

On the other hand, the European Central Bank (ECB) left its key interest rates unchanged and ECB President Christine Lagarde said they’re in a good position, with all options still on the table. 💶 Markets aren’t expecting a rate cut from the ECB anytime soon, which could give the Euro a bit of a breather against the dollar.

What’s Next for EUR/USD? 🤷♂️

The year-end environment coupled with more accommodative US monetary policy expectations and a cautious ECB stance suggests that EUR/USD will likely remain in consolidation mode around 1.1800. For now, it seems like we’re in the calm before the storm.

🤔 Asia Forex Mentor Insights

All eyes are on the 2026 Fed rate cuts now, with EUR/USD staying relatively stable. As the US Dollar faces a tough time with internal pressure from Trump and external factors like labor market weakness, the Euro is holding its ground.

The ECB's cautiousness is likely to keep the Euro supported for the time being, but don’t expect any dramatic moves until after the holiday season. 🎁

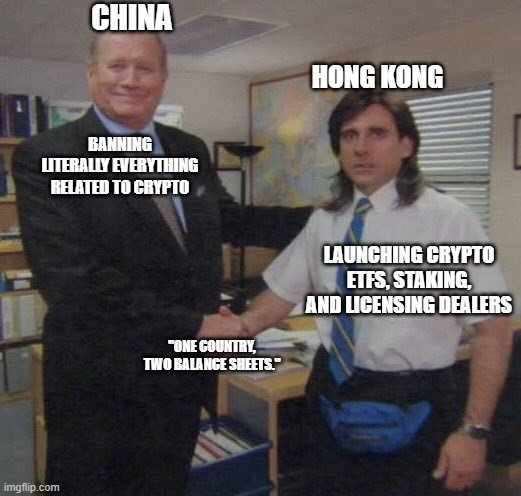

🏙️Hong Kong Gears Up for 2026 Crypto Legislation 💰

Hong Kong’s on a mission to make its mark in the crypto world by bringing in some serious regulation. The city’s regulators are targeting 2026 for launching rules to govern virtual asset dealers and custodians, hoping to carve out a crypto hub that's all its own in Asia. 🇭🇰💎

What’s Happening in Hong Kong? 🤔

After two months of public consultation (190+ responses!), Hong Kong’s Financial Services and the Treasury Bureau (FSTB) and Securities and Futures Commission (SFC) are working on proposals that’ll make a licensing framework for virtual asset dealers and custodians a reality. 💼

- Anti-Money Laundering & Counter-Terrorism rules are being applied to virtual assets, pretty much like the ones for securities trading. 👀

- Their goal? To make Hong Kong the crypto hub of Asia, leaving places like Singapore in the dust.

Hong Kong’s Stance vs China’s Crackdown 🛑

This is a huge move considering China’s crackdown on cryptocurrencies. Hong Kong is all in, with policies that encourage crypto growth, while China continues tightening the noose. 🔒

Earlier this year, Hong Kong's SFC

- Launched new licensing regimes for the over-the-counter-trading 🔄️

- Approved staking services for licenses exchanges 📈

- Even let crypto ETFs hit the market in 2024!📊

Looking Ahead: The 2026 Plan 📅

The new rules

- Custodian regulations focused on securing private keys 🔑

- Dealer rules that line up with securities intermediaries 🚀

- A broader ASPIRe roadmap to make the market more accessible and regulated 🛣️

And guess what? The SFC is also looking to extend their oversight to virtual asset advisers and managers too. Expect the same rules as securities advisory services – same business, same risks, same rules.

🤔 Asia Forex Mentor Insights

Hong Kong’s making some serious moves, and 2026 could be a game-changer for the city’s crypto space.

With a regulatory framework on the way, crypto firms might find a welcoming home in Hong Kong, especially as China pulls back. Investors should keep an eye on this as it could impact Asia's crypto landscape in the years to come! 📈👀