TOGETHER WITH

What’s up traders, Ezekiel here with your quick market rundown. Let’s dive into what’s shaking up the markets, why it matters, and how you can stay one step ahead:

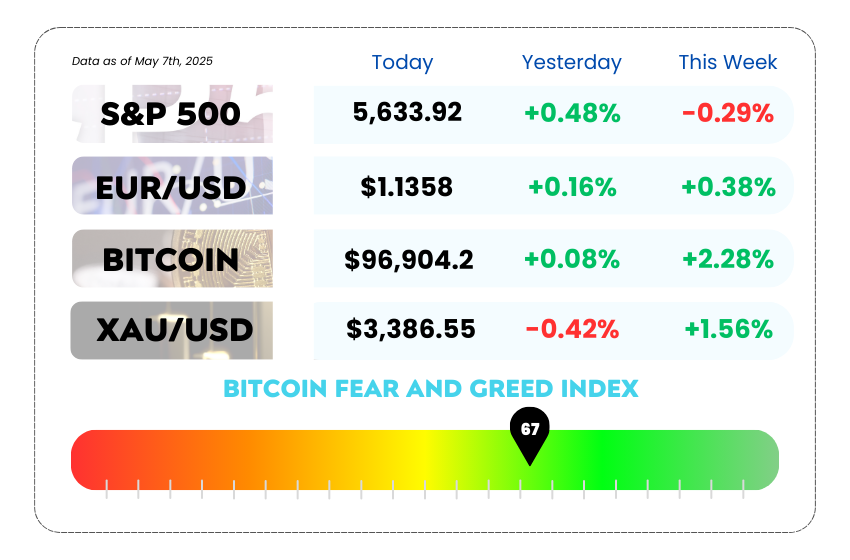

• Today’s market mayhem. S&P, EUR/USD, Bitcoin, and XAU/USD today

• Futures climb as US & China pretend to be friends again (for now)

• Bitcoin rallies as world dances between diplomacy and doom

• Master market structure and spot perfect setups with our video

💥 Power Up Your Trading with Octa’s 50% Deposit Bonus! 💥

Looking to boost your trading firepower? Octa’s giving you a 50% bonus on every deposit — instantly. No strings, no waiting.

Here’s the deal:

- 💰 Get 50% extra added to every deposit

- ⚡ Bonus activates immediately — you're ready to trade

- 📉 Start trading with as little as $50

- 📊 Bonus fuels your trading, giving you more room to move

- 🔓 Withdraw the bonus once you hit simple trading volume

Unlocking your bonus is easy:

Just trade standard lots equal to Bonus ÷ 2

(e.g. $200 bonus → trade 100 standard lots → withdraw it)

🎯 Pro tip: Higher-tier users unlock even easier withdrawal rules.

WEEKLY MARKET MAYHEM

For this week’s market mayhem, here’s what we got for you today:

📈 Futures Up, Hopes (Kinda) Up, and Everyone's Waiting on Jerome 😬

US stock futures got a lil' bump this morning as Wall Street tried to make sense of two big things:

👉 US-China trade talks are back on the calendar

👉 The Fed's got a big rate decision dropping at 2PM ET

Here's how the scoreboard looks:

- 🧓 Dow futures up 0.6%

- 🧑 S&P 500 up 0.5%

- 🤖 Nasdaq 100 also up 0.5%

This comes after a rough two-day slide, so markets are basically going, “Phew, finally some green.”

S&P 500 Index Daily Chart as of May 7th, 2025 (Source: TradingView)

Trade tea time 🫖

For the first time since Trump slapped a whopping 145% tariff on Chinese imports in April, top US and Chinese officials are finally meeting again, and it’s going down this weekend in Geneva.

But don’t get too hyped… most analysts think we’ll get talks, not results. And judging by Trump’s latest vibes (telling other countries it’s a “take it or leave it” deal), this probably isn’t ending with everyone holding hands and singing trade kumbaya.

Now all eyes on Papa Powell 👀

The Fed’s interest rate decision hits later today, and the market’s already 96% sure they’ll hold rates steady. The real juice? What Powell says next. With tariffs on beast mode and inflation still playing games, traders want to know if the Fed is staying chill or getting twitchy.

In the earnings corner…

- 🧞♂️ Disney beat estimates and raised its outlook, mostly thanks to parks bouncing back and streaming staying strong. Mickey’s feeling bullish.

- 💉 Novo Nordisk lowered its 2025 forecast, but weirdly, the stock went up, investors are betting a copycat ban could boost its blockbuster weight-loss drug Wegovy.

Markets are floating on hope, not certainty. The trade talks might not bring magic, but they’re keeping the mood optimistic for now. And with the Fed expected to hold steady, the real action will be in the tone, if Powell even hints at concern, expect volatility. For forex traders, this is the kind of crossfire that opens doors… if you know where to look.

🚀 Bitcoin Pumps While the World Holds Its Breath (Again) 🚀

Bitcoin’s acting like the main character again — shooting up over 3% to cross $97,500 in Asia trading, as traders start placing bets that “risk-on” is back in style.

What lit the fuse this time? A perfect cocktail of:

- 🌏 US-China trade talks getting rescheduled for this weekend in Switzerland

- 💣 Geopolitical fireworks between India and Pakistan

- 📈 A soft “go” on risk from global equities, gold pulling back, and the dollar flexing slightly

Yep, that’s all it took for crypto bulls to say: “Saddle up.”

Ethereum tagged along too, climbing more than 4% before cooling off. It's a classic crypto move: ignore the smoke, follow the money.

BTC/USD 5-Day Chart as of May 7th, 2025 (Source: TradingView)

🧨 Risk? What Risk?

The world’s two biggest economies might be inching toward diplomacy, but across the map, India and Pakistan were exchanging missiles and headlines. And yet? Markets didn’t flinch.

It’s like traders are putting on blinders and saying, “Wake me up when something breaks.” The conflict barely made a dent in Bitcoin or equities — not the usual response when jets start falling out of the sky.

This says a lot about today’s mood: investors are hungry for momentum. Even the Fed’s upcoming decision later today, with rates expected to stay unchanged — has been reduced to background noise for now.

📊 Smart Money's Playing the Upside

Behind the scenes, options traders are loading up on $100K call options for BTC. That’s not just hopium, that’s real capital betting on a breakout if global vibes stay risk-on.

One big brokerage even flagged a spike in demand for “topside exposure”, meaning traders want to ride the rocket if it launches. The mood? Less fear, more FOMO.

Bitcoin is wearing its “macro asset” suit again, moving in sync with global equities and sentiment, not just crypto-native catalysts. That’s a shift worth watching. When crypto trades like a high-beta bet on global stability, it becomes a sharper tool in the forex and macro trader's kit. But remember: markets are optimistic… not immune. One surprise headline and this whole mood can flip like a switch.

MEMES OF THE DAY

Your chart isn’t a Christmas tree… 🎄📉

When the charts are giving A+ setup vibes… but NFP’s lurking like a jump scare 👻