TOGETHER WITH

Today’s edition is powered by FP Markets, your trusted broker for raw spreads from 0.0 pips and top-tier execution on MT4 & MT5. Get tight pricing, fast trades, and deep liquidity for confident, controlled trading.

👉 Start trading with FP Markets now! 💸

What’s up traders, Ezekiel here with a fast market check-in. Let’s break down what’s shaking the markets, why it matters, and how you can stay one step ahead:

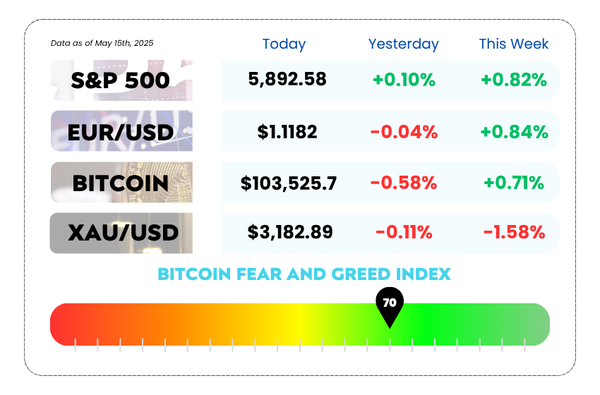

- Today's market mayhem. S&P, EUR/USD, Bitcoin, and XAU/USD today

- Nvidia's stock pops as Saudi Arabia drops billions on AI chips

- EUR/USD plays hard to get, clings close to 1.1200

- Master trade timing with Multiple Timeframe Analysis with our YouTube video

🚀 Cut the Noise. Trade Raw with FP Markets on MT4 & MT5 🚀

Tired of spreads chewing through your gains?

Step into serious trading conditions with FP Markets, where execution is fast, spreads are razor-thin (as low as 0.0 pips), and the focus is all on performance.

🔹 Ultra-tight spreads

🔹 Blazing-fast order execution

🔹 Institutional-grade liquidity

Level up your trading edge today.

WEEKLY MARKET MAYHEM

For this week's market mayhem, here’s what we got for you today:

🎯 Nvidia Stock Jumps as Saudi Arabia Splashes Billions on AI Chips 🎯

Nvidia ($NVDA) shares are on a rocket ride, climbing over 4% Wednesday, part of a sizzling 15% rally in just 5 days. Talk about making a srong comeback🔥.

Here’s what went down:

Saudi Arabia opened its wallet wider than a Dubai mall shopper 🤑, securing Nvidia chips worth roughly $7 billion for its shiny new AI venture, Humain. This isn’t just any shopping spree, folks, Humain is backed by the Kingdom’s mega-rich $925 billion Public Investment Fund, led personally by Crown Prince MBS himself.

The initial deal includes a monster-sized Grace Blackwell supercomputer sporting 18,000 advanced GB300 chips. That's enough computing power to make Siri blush 🤖.

NVIDIA Corporation (NASDAQ) Daily Chart as of May 14th, 2025 (Source: TradingView)

But wait, there’s more…

- AMD ($AMD) and Qualcomm ($QCOM) didn’t miss the party—they announced billion-dollar deals of their own, with AMD's piece of the pie hitting a hefty $10 billion. Cha-ching! 💸

- Even Super Micro Computer ($SMCI) cashed in, scoring a sweet $20 billion contract with Saudi-based DataVolt. Their stock? Up over 30% in two days. Talk about being in the right place at the right time 📈.

Wall Street’s got its pom-poms out, cheering these deals as proof that the AI spending spree isn’t slowing down anytime soon. Translation: Investors worried about peak AI spending, breathe easy (for now 😉).

And there's some juicy geopolitical drama, too:

- President Trump’s administration just hinted it might reverse Biden-era export restrictions, making it easier for Nvidia to flood global markets (except China) with its chips. Nvidia execs probably popping bottles right now 🍾.

- Meanwhile, the U.S. Commerce Department threw some shade at Huawei, warning that using their Ascend chips, considered rivals to Nvidia, might now violate export controls. This could give Nvidia another edge, especially outside China.

🤔 Asia Forex Mentor Insights

Big tech is doubling down on AI infrastructure spending, but watch the geopolitical landscape carefully. Easing restrictions might boost Nvidia short-term, but trade tensions with China could spark a wild ride ahead.

Until next time, stay sharp and trade smarter!

📢 Upcoming Webinar: “Risk Management and Position Sizing” with Ezekiel Chew 📢

Join Octa in partnership with Asia Forex Mentor for an exclusive webinar on May 22, 2025, at 7:00 PM (GMT+8), featuring renowned trading coach Ezekiel Chew.

Discover what really separates top traders from the rest:

✅ Why strategy alone won’t make you profitable

✅ What to add to your system to tilt the odds in your favor

✅ How to rise into the top 10% of consistently successful traders

📅 Date: May 22, 2025

🕖 Time: 7:00 PM (GMT +8)

💥 Admission: Absolutely FREE

🎁 Bonus: Special exclusive rewards for live attendees only!

📍 Save your seat now — this is one session you don’t want to miss!

📌 EUR/USD Sits Tight as Traders Play “Wait-and-See” 📌

EUR/USD hit snooze 💤 on Wednesday, lounging comfortably near the 1.1200 mark after initially teasing traders with a brief spike. Markets are basically scrolling Instagram, waiting for something juicy to happen.

Here's why things got slow-mo 👇:

- Europe dropped its inflation numbers—and guess what? Absolutely no surprises. German HICP inflation was as exciting as reheated pizza, exactly as expected.

- Over in the U.S., traders are chewing on Tuesday’s CPI inflation report, while gearing up for Thursday’s potentially market-moving Producer Price Index (PPI). Markets anticipate Core PPI will dip slightly to 3.1% YoY from 3.3%. Good news? Sorta, but now traders are side-eyeing incoming tariff impacts that could shake things up starting May.

EUR/USD Daily Chart as of May 15th, 2025 (Source: TradingView)

So far, the bulls can't quite muster the strength 💪 to push EUR/USD decisively above 1.1200. Still, the good news for the Euro bulls: the pair's comfortably chilling above the 50-day EMA near 1.1070, giving traders some breathing room.

Technical nerds 🤓 are whispering about oscillators, those indicators that traders love more than free coffee, rolling up from oversold territory. Translation: we might be gearing up for a potential bullish surprise 📈.

🤔 Asia Forex Mentor Insights

Markets hate uncertainty, and right now, EUR/USD is stuck in neutral until U.S. inflation data clears things up. Keep an eye on Thursday’s PPI, this could finally jolt EUR/USD awake from its nap.

Until then, trade smart and stay caffeinated ☕️😎!

MEMES OF THE DAY

The ultimate trader fantasy… until reality margin calls 💀📉

Bill has scars. Bill has learned. #BeLikeBill 💪