TOGETHER WITH

What’s up traders, Ezekiel here and it's time for your fast-track market update. 🚀 Let’s break down what’s moving the markets, why it matters, and how you can stay ahead of the game:

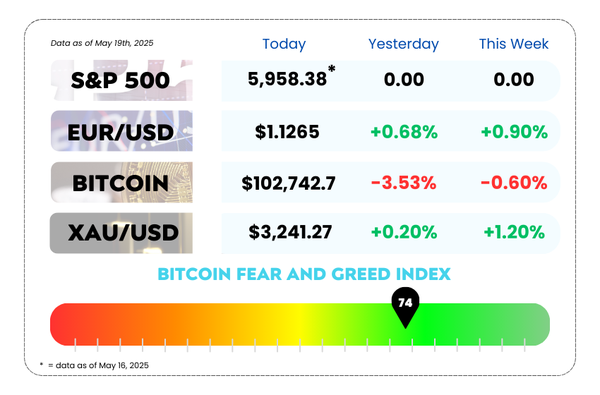

- Today's market mayhem. S&P, EUR/USD, Bitcoin, and XAU/USD today

- EUR/USD climbs as Uncle Sam’s credit score takes a hit

- Bitcoin did a backflip at $106K and took $600M in trades down with it

- Fix your pullback entries and turn losses into wins by watching our featured YouTube video!

🚀 Supercharge Your Trading with Octa’s 50% Deposit Boost! 🚀

Ready to level up your trades? Octa’s giving you an instant 50% bonus every time you deposit — more capital, more potential, zero delays.

Here’s how it works:

🔹 50% bonus instantly added to every deposit

🔹 No wait time — your funds are ready to go

🔹 Start trading from just $50

🔹 Use the bonus to give your trades more breathing room

🔹 Want to withdraw the bonus? Just meet a simple volume target

✅ Withdrawal rule:

Trade standard lots equal to your Bonus ÷ 2

(Example: $200 bonus → trade 100 lots → bonus is yours)

🔥 Insider tip: If you're a higher-tier user, the bonus withdrawal gets even easier.

WEEKLY MARKET MAYHEM🔥

For this week's market mayhem, here’s what we got for you today:

🚨 EUR/USD Rips Higher While the Dollar Gets Dunked On 🚨

The Greenback got slapped and the Euro said, “Merci, I’ll take that.” 🇪🇺💸

At the start of the week, EUR/USD shot up to 1.1270 — its highest level in a while — as traders reacted to a U.S. credit downgrade that rattled dollar bulls and left investors scrambling for alternatives.

🔍 Technically Speaking…

This wasn’t just a vibes-based rally.

- The pair held strong above the 20-day EMA (~1.1214) like a champ.

- The 14-period RSI bounced back above 50, after nearly touching 40. Translation? Momentum is turning bullish, and the bulls have their eyes on bigger gains.

EUR/USD 5-Day Chart as of May 19th, 2025 (Source: TradingView)

🌍 Geopolitics in the Mix

Also in the background: the U.S. and China are flirting with a trade deal again. Over the weekend, Trump hinted at a potential visit to China for direct talks with Xi.

That kind of optimism could lend the dollar a little support, but for now, it’s stuck in the corner licking its wounds.

🤔 Asia Forex Mentor Insights

Short-term bias on EUR/USD is bullish, with price action comfortably above the 20-day EMA and momentum indicators showing strength. If the pair breaks 1.1270 convincingly, the next level to watch is 1.1425. Support rests around 1.1000, a key psychological zone.

Keep an eye on yield movement and U.S. fiscal headlines. They’re calling the shots more than central banks right now.

📣 Don't Miss This! Live Webinar with Ezekiel Chew on Risk Management & Position Sizing 📣

Join Octa and Asia Forex Mentor for a powerful session on May 22, 2025 at 7:00 PM (GMT+8) featuring top trading mentor Ezekiel Chew.

Ready to learn what really sets pro traders apart? In this exclusive event, you’ll uncover:

✅ Why having a strategy isn’t enough to succeed

✅ What elements truly stack the odds in your favor

✅ The mindset shifts elite traders rely on

✅ How to level up into the top 10% of consistently profitable traders

🗓️ Date: May 22, 2025

⏰ Time: 7:00 PM (GMT +8)

💸 Cost: 100% FREE

🎁 Bonus: Live attendees will receive special, exclusive rewards!

📌 Reserve your spot now! Seats are limited and this one’s too valuable to miss!

⚠️ Bitcoin Just Played Everyone: Bulls, Bears, You, Me, Grandma… No One Was Safe ⚠️

Bitcoin pulled a fast one this weekend, shot up to $106K like a rocket, then nosedived back to $103K, leaving both bulls and bears wondering what just happened.

If you blinked, you missed it

.

It started around Sunday night, when BTC ripped $2.5K higher in under an hour. No news, no tweets from Elon, just a good old-fashioned liquidity trap. Traders got sucked in, and the market did what it does best: punished absolutely everyone. 😵💫

🤯 Liquidation Bloodbath

As the dust settled, over $600 million in crypto derivatives got liquidated. That’s not a typo.

- Longs? Obliterated.

- Shorts? Same.

- Solana, DOGE, XRP? Down bad — more than 4% in 24 hours.

- The broader crypto index (CD20)? Down 2%.

This wasn’t your average weekend dip. It was thin liquidity meets algo mayhem meets panic buyers, all wrapped into a beautiful little short squeeze package, followed by instant regret. 🫠

BTC/USD 5-Day Chart as of May 19th, 2025 (Source: TradingView)

⚠️ Bigger Picture: Why It Matters

This rollercoaster ride comes after a week full of macro messiness:

- Moody’s downgraded the U.S. credit outlook on Friday (yikes)

- Inflation fears are bubbling up again

- 30-year Treasury yields punched above 5% for the first time in forever

While institutions have been tiptoeing back into crypto thanks to spot ETF momentum, these kinds of whipsaws are a reminder that volatility never sleeps. Bitcoin might be flat on the week, but failing to hold that $106K level could hint at strong resistance ahead 👀

Also, whispers in the market say traders are bracing for more action as the U.S. scrambles to finalize spending plans, and it could lead to even more wild swings in the days ahead.

🤔 Asia Forex Mentor Insights

Weekend markets are like the Wild West, fewer players, thinner liquidity, and prime time for algorithmic cowboys. 🤠 This latest BTC whiplash shows why risk management matters, especially when the market’s trying to decide if it’s going to the moon or straight back to Earth.

Stay sharp, don’t overleverage, and watch those key levels, especially as macro winds keep shifting. This ain’t your average Sunday scroll anymore.

MEMES OF THE DAY

Diversified? More like terrified 🥴

The chart has more layers than your trust issues 😩