TOGETHER WITH

Hey traders, Ezekiel here. Time for a rapid-fire market rundown. What’s shifting the charts, why it counts, and how to trade it smart? Let's dive in.

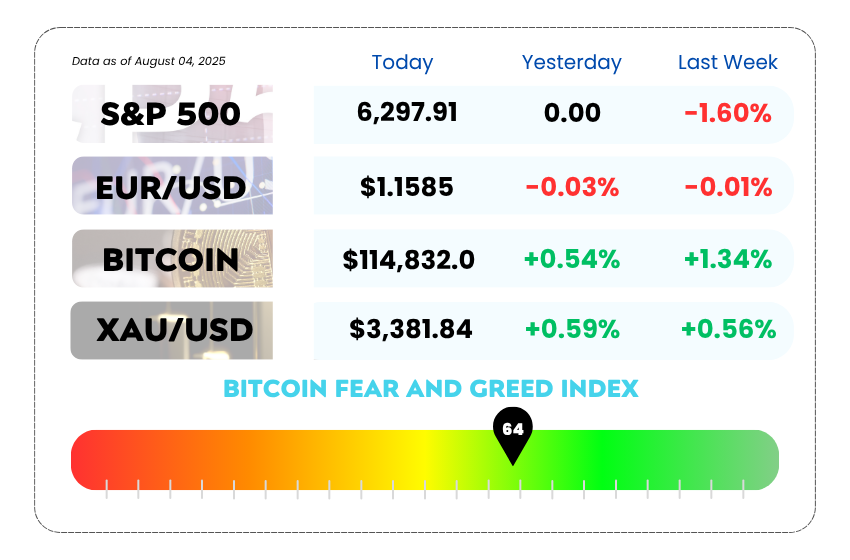

- Today's market mayhem. S&P, EUR/USD, Bitcoin, and XAU/USD today

- Jobs shock fuels hopes of September interest rate cut

- India, China pushed to cut oil ties with Russia and Iran

- Learn the real structure behind chart reversals with our YouTube video

Why Trade Small? Boost Your Margin with Octa 🚀

What if every dollar you deposited came with a twin? That’s exactly what Octa’s doing, giving traders a 50% Deposit Bonus so your capital hits harder, right from the start.

Whether you’re just getting started or scaling up your next setup, Octa’s bonus fuels your margin without messing with your risk profile.

Here’s why traders are jumping on it:

🚀 50% more capital to support bigger positions

🎯 Use it right away — no waiting, no gimmicks

📊 Simple unlock rule: trade bonus ÷ 2 in standard lots

🛡️ Extra margin = better risk cushion

🌟 Elite perks for higher-tier users (yes, better withdrawal terms too)

WEEKLY MARKET MAYHEM🔥

For this week's market mayhem, here’s what we got for you today:

Futures Bounce Back, But Traders Aren’t Celebrating Just Yet 📈

Wall Street’s getting back on its feet — but not without bruises.

After getting slammed last week with the worst losses in months, U.S. stock futures are finally seeing green. The S&P 500 climbed 0.6%, Nasdaq 100 added 0.7%, and the Dow ticked up 0.5% in early trading. It’s a decent rebound, but let’s not pop the champagne yet.

The mood? Think “Monday after a hangover” — cautious, quiet, and trying to figure out what just happened.

Last week was not the vibe

Markets just came off a brutal week:

- S&P 500 dropped 2.4%

- Dow Jones fell 2.9%

- Nasdaq slipped 2.2%

All it took was one weak jobs report to send the bulls running. July’s employment data missed the mark hard, and prior months were revised lower too, flipping the script on what was supposed to be a resilient labor market.

President Trump? He did what he does best, fired the head of the BLS and went on the offensive.

S&P 500 Daily Chart as of August 4th, 2025 (Source: TradingView)

Traders are Watching the Fed 👀

Powell and the Fed kept rates steady last week, but now that the job numbers look ugly, markets are betting big on a cut in September, nearly 90% probability.

The guessing game continues. And while Trump’s beef with Powell keeps simmering, it’s clear that traders are hungry for rate cuts.

Don’t Forget the tariffs 📦

Another curveball: Trump’s new round of tariffs are coming into full force this week — ranging from 10% to 41%. These aren’t just paper threats anymore. They're starting to hit real costs, stoking inflation fears and shaking up global trade nerves again.

Meanwhile… Tesla gives Elon a $29B reason to smile 😏

TSLA stock rose 2% pre-market on reports that Elon Musk is cashing in, unlocking 96 million Tesla shares worth $29 billion under his massive pay package.

Even in chaotic markets, the Musk money machine keeps printing.

🤔 Asia Forex Mentor Insights

This bounce might look like a comeback, but don’t get trapped by the green just yet. The fundamentals are weakening, policy uncertainty is rising, and volatility’s creeping back in.

Watch the S&P key support levels and use caution before chasing momentum. Any signs of dovish Fed moves this week will be your entry signal, not headlines alone.

Trump’s Global Trade Chess Game Gets Messy (And Magnetized) 🌏

If this week’s global trade headlines feel like a season finale, that’s because they are. And President Trump? He’s writing and starring in the script.

The plot: Trump is turning up the pressure on India and China, demanding they quit buying oil from Russia and Iran. In return, both countries basically replied, “We’ll think about it… but not really.” 🇮🇳🇨🇳

China called it a “nonstarter,” especially with energy security at stake. India said “Support local,” but didn’t commit to backing away from Russian crude.

So what’s really going on?

Trump’s wrapping the globe in tariffs, pressure, and power moves — trying to force hands ahead of his self-imposed trade deadline. And it’s not just oil.

🧲 Enter: Rare Earths and Magnets

While the oil headlines grabbed attention, there’s another piece of the puzzle in play — rare earth elements, a.k.a. the stuff inside magnets, missiles, and iPhones.

Trump’s trade team says talks with China are “halfway there” on securing rare earth supply. Why it matters? China’s still the world’s biggest rare earth exporter. If things go sideways, your favorite gadgets (and defense tech) could feel the squeeze.

Meanwhile, new tariff bombs are already falling:

- 🔧 50% tariffs on semi-finished copper

- 🇧🇷 50% on goods from Brazil (but orange juice and plane parts got a hall pass)

- 🍁 Canada gets slapped with 35%

- ✂️ No more duty-free gifts under $800 from abroad — tariffs start Aug 29

And that’s just the highlight reel. Trump also cut side deals with South Korea, Mexico, and the EU, all with just enough sweeteners to say it’s “fair.”

But behind the drama lies a question: Is this a calculated rebalancing… or economic whack-a-mole?

🤔 Asia Forex Mentor Insights

The U.S. dollar may get whiplash from this one. As Trump wields tariffs like a weapon and squeezes oil flows, expect volatility around commodity currencies, oil-sensitive pairs, and especially the USD/INR and USD/CNH. Rare earths might not move charts tomorrow, but they will shape the geopolitical energy war traders should watch now.

MEMES OF THE DAY

Me explaining to myself why taking profits was the right move 🤡

Every group chat has that one trader 😂