TOGETHER WITH

Today’s edition is powered by FP Markets, the go-to platform for traders who mean business. With raw spreads from 0.0 pips, lightning-fast execution, and institutional-grade liquidity across MT4, MT5, and cTrader, this is where real trading happens.

💸 Take your strategy to the next level with FP Markets.

What’s up, traders? Ezekiel here. Let’s break down the latest market action and how to stay one step ahead.

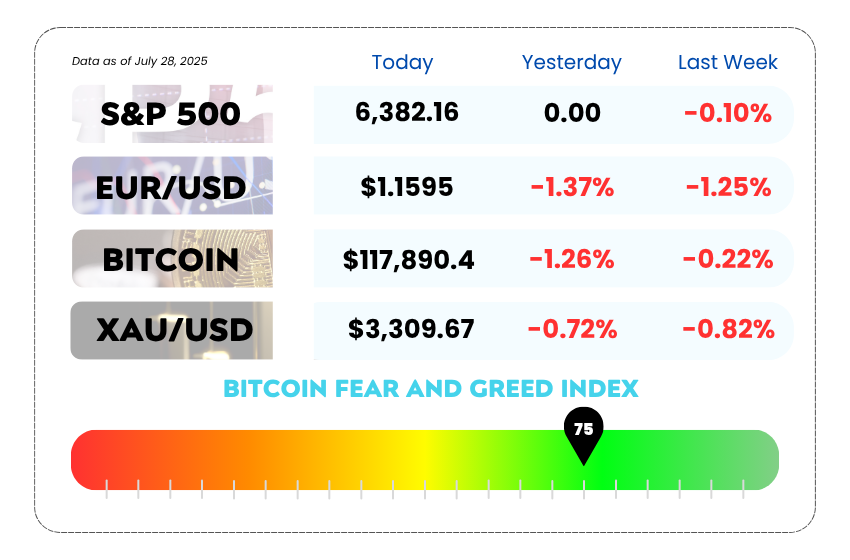

- Today's market mayhem. S&P, EUR/USD, Bitcoin, and XAU/USD today

- Brent rebounds toward $70 after Trump targets Putin and signs energy deal

- S&P 500 logs 5th straight record as Wall Street rides earnings wave

- Trade with precision using real support and resistance tips with our YouTube video

Your Strategy Deserves Better Than Lag and Markup ⚡️

If you're still battling wide spreads, delayed fills, or mystery slippage, you're leaving profits on the table.

Enter FP Markets: the broker built for traders who demand speed, clarity, and raw market access.

With spreads starting at 0.0 pips and infrastructure that rivals institutional desks, FP Markets isn’t just keeping up, it’s setting the pace.

✨ MT4, MT5, or cTrader — the power’s in your hands

🚀 Trade news, scalps, or swing — the execution won’t blink

🔍 Zero fluff, all function — just pure price action in motion

👉 If precision matters to your trading, you know where to go.

WEEKLY MARKET MAYHEM🔥

For this week's market mayhem, here’s what we got for you today:

Oil Prices Pop as Trump Pokes Putin and Lands a Trade Win ⛽

Crude oil just caught a bid, and it wasn’t just because traders needed a Monday pick-me-up. Nope. This spike had everything: Trump, tariffs, Russia, and a sprinkle of EU money.

Let’s break it down.

Brent crude is hovering near $70, climbing off Friday’s dip, and it’s got some heavyweight reasons behind the move. First, Trump dropped a double-whammy:

- He shortened Russia’s ceasefire deadline for the Ukraine war and called out Putin for stalling. The threat? A nasty 100% secondary tariff if Moscow doesn’t hit pause soon.

- He also claimed the EU agreed to buy $750 billion worth of U.S. energy products. The fine print may still be fuzzy — even von der Leyen seemed surprised — but the market liked the sound of it.

Meanwhile, the OPEC+ crew is back at the table, getting ready to decide if they’ll pump more barrels in September. Traders are betting on another production hike, but if demand doesn’t keep up, it could tip the market into oversupply mode later this year.

Also on the radar: U.S. and China trade talks resumed, and rumors suggest the tariff truce might get an extension. That could ease demand fears… at least temporarily.

For now, oil traders are riding the wave of geopolitical spice and policy posturing, and markets are reacting like it’s episode one of a new season of Game of Crude.

🤔 Asia Forex Mentor Insights

When headlines drive price, fundamentals can take a back seat. Crude’s rebound is a classic case of sentiment-over-structure, meaning short-term plays might be hot, but longer-term traders should still factor in oversupply risk and weakening demand forecasts. Trade the volatility, but don’t get trapped by the hype.

S&P Hits 5 Straight Records as Markets Ride the FOMO Wave 📈

It’s been a week of straight Ws for U.S. stocks, and Wall Street’s not even pretending to be humble about it.

The S&P 500 just closed at a record high for the fifth day in a row, while the Nasdaq also set a fresh all-time peak. What’s fueling the party? A cocktail of earnings hype, trade optimism, and a healthy dose of FOMO.

Even Trump’s Powell drama couldn’t ruin the mood this time.

Big Earnings, Bigger Expectations

Tech earnings came in hot, and investors are loving it. The Nasdaq got a boost as Big Tech stocks like Meta, Apple, Microsoft, and Amazon line up for a heavyweight earnings week. Meanwhile, the Dow and S&P both clocked in over 1% weekly gains, riding high on strong corporate results and trade headlines.

But not everyone’s buying the hype. Some investors are whispering the magic word: bubble. Or at least, they’re wondering if FOMO is driving the rally more than actual fundamentals.

Trade Deals, Deadlines, and Powell Peace Talks

Adding fuel to the rally, the U.S. and Japan sealed a new trade pact, and there’s buzz that a U.S.-EU deal could be close too. That’s helping investors look past the looming August 1 deadline, when countries that haven’t struck a deal could face “reciprocal” tariff hikes.

But not all is rosy. The U.S.–Japan deal is already facing friction, especially over who gets what slice of a proposed $550B investment fund. Classic global money drama.

And in a surprise twist that calmed market nerves, Trump decided not to fire Jerome Powell. He did visit the Fed HQ to check out its $2.5 billion renovation, and called it too pricey, but he left Powell’s job alone… for now.

🤔 Asia Forex Mentor Insights

Traders, watch the momentum here. Markets are pricing in earnings optimism and reduced Fed risk, but the Aug. 1 trade deadline could still spark volatility. Keep your eyes on Big Tech earnings and U.S. jobs data, both will be key catalysts.

If you’re trading indices or USD pairs, expect sharp moves around the Fed meeting and Powell’s next move (or tweet). Tighten your risk, and let the charts do the talking. 📊🔥

MEMES OF THE DAY

Risk management lesson unlocked… the hard way…

Confirmations? Nah, vibes felt bullish. 🚨