TOGETHER WITH

Today’s edition is brought to you by iFunds, the prop firm that skips the fluff and hands you real capital from day one. No drawn-out evaluations, just pure trading power in your hands.

👉 Get instantly funded with up to $500K.

Hey traders, Ezekiel here. Let’s dig into today’s market movers and what they mean for your next trade.

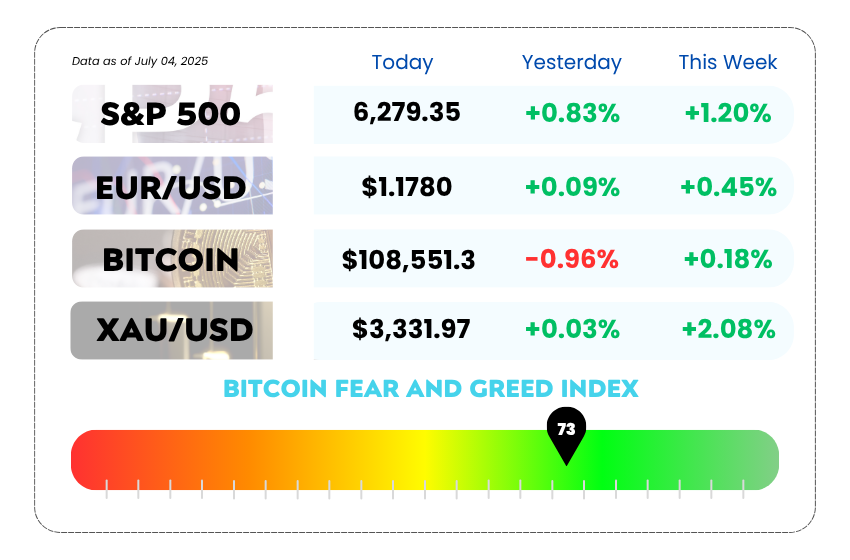

- Today's market mayhem. S&P, EUR/USD, Bitcoin, and XAU/USD today

- GM drives through profit drop with China bounce and strong U.S. sales

- Euro climbs above 1.17 as dollar weakens and tariff risks grow

- Master the change of character entry strategy like a pro with our YouTube video

Skip the Demo. Trade Real. Get Paid. 🔥

Today’s prop trading world is full of hoops, but iFunds is flipping the script. No more grinding through endless demos or jumping through evaluation tests.

With iFunds, you start live with $2,500 real capital from day one, and scale up to $500K+ in just four simple steps.

✅ No daily drawdown

✅ No required trading days

✅ Use any strategy — bots, swing, news, you name it

✅ Fast 24-hour payouts

Here’s what traders are loving:

- Instant access to up to $500K

- No evaluation phases or performance pressure

- Withdraw profits anytime — no strings attached

- Works with scalping, swing trading, bots — however you trade

- Clean fee structure that doesn’t eat your wins

If you're tired of “prove yourself first” models, this might be your shortcut.

WEEKLY MARKET MAYHEM🔥

For this week's market mayhem, here’s what we got for you today:

GM’s Profits Take a $1.1B Hit, Courtesy of Trump’s Tariff Storm 🏭

Trump’s trade war just took a billion-dollar bite out of Detroit.

General Motors just posted a 32% drop in core profit for Q2, and the biggest villain? Tariffs.

The largest U.S. automaker blamed $1.1 billion in trade headwinds for the dent in its earnings, warning that things could get even rougher in Q3. Despite that, GM stuck to its guidance, forecasting full-year adjusted profits between $10B and $12.5B, down from earlier highs, but still in the game.

🔻 Revenue? Down 2% to $47B

📉 EPS? Dropped to $2.53 (vs. $3.06 last year)

💸 Tariff impact so far? $1.1B

💣 Expected full-year tariff damage? $4B–$5B

GM says it can cushion about 30% of that blow, but that still leaves billions at risk.

And Wall Street noticed, shares slipped 3% in premarket trading.

But here’s the twist…

Under the hood, GM’s engine is still running strong. U.S. sales climbed 7%, pickup trucks and SUVs are holding premium pricing, and GM flipped its China ops back to profit after bleeding red last year.

So yes, Trump’s tariffs are hitting hard, but GM isn’t exactly stalling. It’s more like driving with the parking brake halfway on.

General Motors Company Stock Daily Chart as of July 22nd, 2025 (Source: TradingView)

🤔 Asia Forex Mentor Insights

For traders eyeing the auto sector: watch GM’s margin compression and forward guidance carefully. If the trade war escalates, GM's price could reflect more downside despite its operational resilience. Keep an eye on volume spikes near support zones around key quarterly earnings levels.

And if Trump doubles down on tariffs this election cycle, this won’t be the last earnings casualty.

Euro Flexes as Dollar Fumbles and Trade Tensions Rise 🇪🇺

The EUR/USD pair is strutting higher, and for once, it’s not because of some wild ECB move or dovish whisper. This time, it’s all about a weak US dollar, shaky trade talks, and just a dash of optimism from Europe.

📈 The euro climbed back above 1.1700, breaking out of its July slump and testing multi-day highs. That’s a solid bounce from the 1.1675 level traders were watching like hawks.

Why the sudden strength? Two words: Trade drama.

With the August 1 US tariff deadline looming, investors are watching the slow-motion negotiation saga between the EU and US unfold… and it’s not exactly inspiring confidence. Brussels is already talking about retaliatory measures, including potential smackdowns on US services, in response to Trump’s latest round of “America First” import taxes.

Meanwhile, the ECB’s latest lending survey showed that demand for mortgages and business credit is rising across the eurozone. Apparently, European consumers didn’t get the memo about trade panic and are still borrowing like it’s 2021.

Add all that to the mix and you’ve got a euro finding its groove again, with technicals flashing green. The breakout above a bearish channel formed earlier this month is now confirmed, and bullish indicators like RSI and MACD are backing the move.

EUR/USD Daily Chart as of July 22nd, 2025 (Source: TradingView)

But let’s not pop champagne just yet.

Traders are still cautiously eyeing resistance at 1.1720, 1.1750, and 1.1790, if the pair can smash through that trio, then maybe it’s time to start dreaming about 1.1800 again. Until then, it’s a tightrope walk with a downside risk at 1.1655 if the rally stalls.

And don’t forget: Fed Chair Jerome Powell speaks later today. He’s unlikely to talk monetary policy due to the Fed’s blackout period, but anything even vaguely spicy could shake things up.

🤔 Asia Forex Mentor Insights

The euro’s strength is both a technical bounce and a macro play. With the dollar under pressure from political noise and delayed rate decisions, traders are rotating into EUR on short-term strength. Keep an eye on Powell’s tone and tariff headlines for the next catalyst. If 1.1720 breaks clean, bulls might get a shot at 1.18 before the Fed even blinks.

MEMES OF THE DAY

It’s not me, it’s the pair. Definitely the pair.

Logic: 0, Impulse: 100 🧠