TOGETHER WITH

Today’s newsletter is powered by Markets4you, where your deposit goes twice as far. Their 100% Deposit Bonus gives you instant extra firepower, so you can trade bigger without stretching your wallet.

👉 Boost your strategy with double the capital, only at Markets4you.

Hey traders, Ezekiel here. Ready to break down what’s moving the markets so you stay one step ahead? Let’s dive right in.

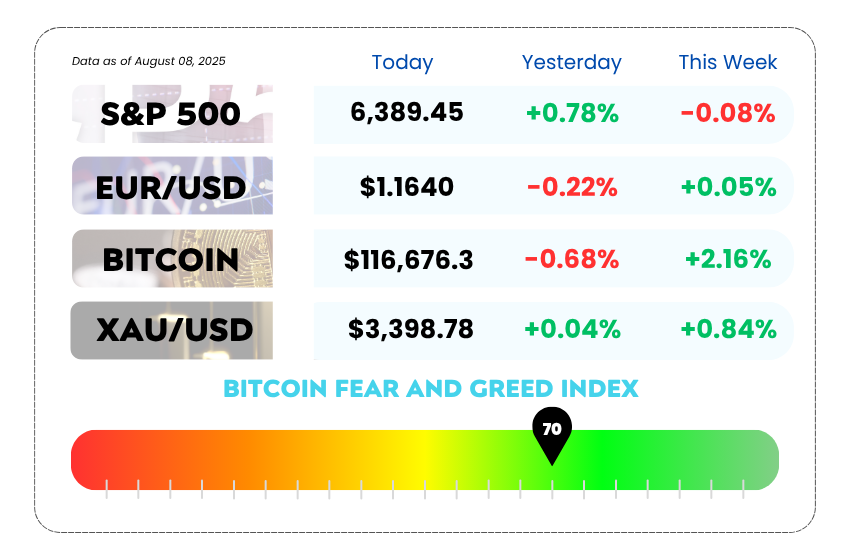

- Today's market mayhem. S&P, EUR/USD, Bitcoin, and XAU/USD today

- Tape maker sticks the landing with strong earnings and soft tariff blow

- Retail strength keeps markets calm despite Netflix dip

- Master the power of Bollinger Bands for perfect entry timing with our YouTube video

Turn Every Dollar Into Two — Exclusive 100% Bonus Deal Just Dropped! 💸

Ready to double your trading power instantly? As part of our limited-time partnership with Markets4you, the AFM community gets access to a 100% Deposit Bonus, no strings, just twice the capital to trade with.

✅ Deposit $100, trade with $200.

✅ Bonus hits your account instantly.

✅ No delays, no drama — just more firepower on the charts.

How to claim your bonus:

- Fund your Markets4you account

- Choose your bonus level

- Get 100% extra as trading credit — immediately

Why traders trust Markets4you:

🔐 Ultra-tight spreads, high leverage

⚡ Fast deposits & withdrawals

🕌 Swap-free accounts

🔄 Proprietary liquidity aggregator

📈 Over 150+ instruments to trade

WEEKLY MARKET MAYHEM🔥

For this week's market mayhem, here’s what we got for you today:

3M’s Tariff Troubles Shrink as U.S.–China Tensions Thaw 📦

Looks like 3M’s dodging more bullets than expected in 2025.

The tape-and-tech titan just raised its full-year profit forecast, saying the hit from tariffs won’t sting as badly as feared. The cherry on top? Investors liked what they heard, shares jumped nearly 4% in premarket trading.

Here’s the simplified breakdown:

3M now sees adjusted earnings landing between $7.75 and $8 per share, up from its previous $7.60–$7.90 range. The expected damage from tariffs in 2025? Just $0.10 per share — way better than the old estimate of up to $0.40.

So, what changed?

🇨🇳 A new trade deal between the U.S. and China.

After months of tension (and Trump threats), both sides inked an agreement in June. The new terms include a 10% baseline tariff on all Chinese imports, plus a 20% rate on goods linked to fentanyl accusations, and a continuation of the older 25% duties.

For 3M — which makes about 10% of its revenue from China, this update is a big deal. Back in April, the company warned that it could take an $850M annual tariff punch. With exemptions and friendlier terms now in play, the outlook’s a lot rosier.

📈 The Q2 numbers back up the optimism too:

- Adjusted EPS: $2.16 vs Wall Street’s $2.01 forecast

- Revenue: $6.16B, beating estimates of $6.11B

- Operating margin: 24.5%, up nearly 3 percentage points YoY

Oh, and it’s not just 3M feeling better. Even Johnson & Johnson sliced their tariff hit in half to $200 million.

The bottom line?

With fewer trade war headwinds and a renewed product push, 3M is pivoting from “damage control” mode to “growth playbook” mode.

🤔 Asia Forex Mentor Insights

Traders, this easing of U.S.–China tensions may not just be good for 3M, it’s a broader signal that the macro trade war pressure is cooling, and that’s a bullish shift for industrials and exporters. Keep an eye on correlated plays in commodities, CNH pairs, and multinationals tied to East Asia. We’re not out of the woods yet, but the fog’s starting to clear.

Wall Street Hits the Brakes But Not the Panic Button 🛑📈

After sprinting to new all-time highs this week, U.S. stock futures are now catching their breath, with the Dow, S&P 500, and Nasdaq 100 all hovering around the flatline on Friday. No fireworks, no crash,just a calm after the climb.

So, what’s holding the rally steady?

While the economy flexed with strong retail sales and cooler jobless claims, giving traders confidence that tariffs aren’t spooking consumers, Netflix didn’t bring the chill. The streaming giant beat profits and revenue but still dipped 1% premarket because Wall Street wanted more guidance sauce on top of its lofty valuation.

Translation: Beat the earnings, but don’t forget the hype.

Still, earnings season isn’t done. 3M, American Express, and Charles Schwab step up to the mic today. And so far, Corporate America seems to be holding its own.

Oh, and Trump? He took a swing at Fed Chair Jerome Powell this week over renovation spending at the Fed HQ, but honestly, no one’s biting.

Powell fired back with a letter, but all eyes are already on who replaces him next year. Whoever it is will need to juggle rate policy, inflation optics, and presidential approval, all while keeping the economy steady.

🤔 Asia Forex Mentor Insights

Markets are pausing at the peak, but don’t mistake this for weakness.

Technical traders should watch for consolidation signals near key resistance zones across major indices.

If Friday’s earnings keep the sentiment stable, expect range-bound setups or possible breakout plays heading into next week. Be alert for potential pullbacks on Netflix-type disappointments, but overall, the trend is still your friend.

MEMES OF THE DAY

Just waiting for the “real breakout” since 2021 💎

Blows account first, reads headlines second, classic combo. 📆