TOGETHER WITH

Today’s edition is brought to you by Bitunix, the fast-growing crypto derivatives exchange built for traders who demand speed, precision, and reliability. 🚀

Trade smarter with deep liquidity, lightning execution, and up to 125x leverage, all in one seamless platform.

Hey traders, Ezekiel here. Let’s break down today’s market moves and spot the setups that could fuel your next big win. ⚡

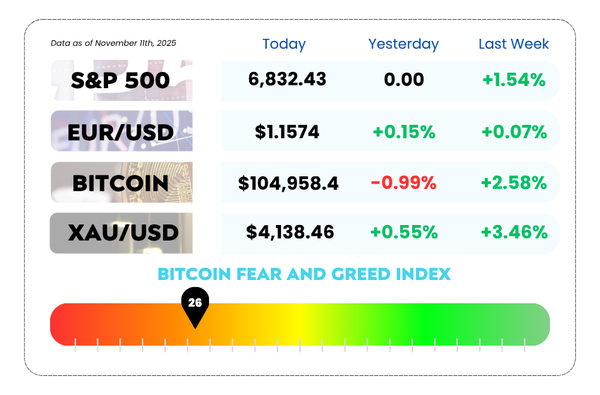

- Today's market mayhem. S&P, EUR/USD, Bitcoin, and XAU/USD today

- Risk-adjusted returns show USD strategies quietly outperforming global markets

- Dow, S&P 500, and Nasdaq drift lower as traders balance optimism with caution

- Master the 3 Stochastic Oscillator setups that turn confusion into clarity with our video

Bitunix x Asia Forex Mentor Mega Promo — Earn Up to 400 USDT Futures Bonus! 🎁

It’s raining rewards this November! 🌧️💰 From Nov 11 – Nov 30, 2025, traders who register during the campaign can stack exclusive Bitunix Futures Bonuses worth up to 400 USDT — just by depositing and trading.

Here’s how to grab your bonus:

⚠️ Note: Deposit bonuses are only for users who register during the campaign period.

But wait — there’s more. 👀

Even if you miss the deposit slots, you can still win extra futures bonuses starting from 15 USDT when you hit ≥ 50 K USDT trading volume, and trade your way up to an iPhone 17 Pro Max when you hit ≥ 25 M USDT volume. 📱💎

Each user can only receive one reward, so aim high — your highest trading volume will determine your prize.

🔥 Trade smart, trade big, and make November your bonus month!

WEEKLY MARKET MAYHEM🔥

For this week's market mayhem, here’s what we got for you today:

The Dollar’s Back, Baby — and It’s Outshining Global Stocks 💸

Forget the “Sell America” talk — the US dollar is quietly staging a comeback and reminding everyone why it’s still the world’s favorite flex.

After a year of mixed signals and global market chaos, a classic strategy — the dollar carry trade — is looking like the smoother ride compared to chasing overheated stock rallies.

🧩 What’s Happening

The play is simple:

Borrow in low-yielding currencies like the Japanese yen or Swiss franc, move that cash into higher-yielding dollar assets, and pocket the spread.

According to Bloomberg’s data, this old-school move is now beating the risk-adjusted returns of major stock markets like Europe and China, as well as government bonds.

In plain English: carry traders are making more money with fewer mood swings. 😎

📊 Why the Dollar’s Looking Fresh Again

- Volatility’s down — the greenback’s been chilling, with calmer price action in the $9.6 trillion-a-day FX market.

- Fed expectations — traders aren’t seeing super-aggressive rate cuts yet, so short-term yields still favor the dollar.

- Global stock fatigue — after a massive AI-fueled rally, investors are realizing some stock markets look like energy drinks wearing off.

Even with the dollar down nearly 7% for the year, it’s bounced back around 3% from September lows — powered by that carry trade juice.

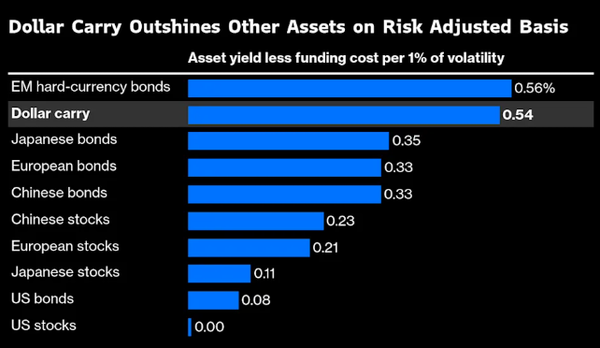

Comparison of Dollar Carry to Other Assests on Risk Adjusted Basis (Source: Bloomberg)

📉 Stocks Are Sweating

While everyone was chasing stocks to the moon, risk-adjusted returns quietly turned… meh.

Bloomberg’s math shows:

- US stocks now offer no real return once adjusted for volatility and borrowing costs.

- Chinese equities bring roughly 0.23% return per unit of volatility.

- Meanwhile, the dollar carry trade? About 0.54% — with way less risk.

So yeah, carry traders are winning the “sleep better at night” game. 😴

⚠️ What Could Go Wrong

If the Fed suddenly cuts rates faster than markets expect, that carry edge could vanish real quick.

But until then, the dollar remains the boss of global carry trades, and capital flows could keep tilting back toward USD assets — reshaping portfolios from New York to Singapore.

🤔 Asia Forex Mentor Insights

The comeback of the dollar carry trade signals a shift in global capital behavior — traders are starting to prefer yield and safety over hype-driven stock bets. For forex pros, it’s a reminder that macro calm can be more profitable than market excitement.

When volatility drops, the carry kings rise. 👑

AI Euphoria Meets Political Reality, and Wall Street Hits Pause 🧠

After an electric start to the week, US markets took a breather on Tuesday. The Dow, S&P 500, and Nasdaq all edged lower as traders digested two competing storylines: AI dreams versus political drama.

💻 AI Gets a Reality Check

Wall Street’s latest darling, AI infrastructure firm CoreWeave, took a hit after trimming its full-year revenue forecast. The stock fell more than 8% in premarket trading, reminding everyone that even the AI boom can have lag days.

Adding to the plot twist, SoftBank dumped its entire Nvidia stake. Why? To fund its own big AI bets. It’s a bold move that shows confidence in the tech’s long game, but it also made investors pause and wonder if we’re at a short-term AI saturation point.

🏛️ Washington Adds to the Whiplash

Markets had been partying on optimism that the 41-day US government shutdown might finally wrap up soon.

The Senate passed a funding bill, pushing it to the House for a vote. President Trump signaled support, even though the deal left out certain Democratic subsidy demands.

That flicker of political progress was enough to fuel Monday’s rally, but Tuesday brought traders back to earth — optimism can’t outrun uncertainty forever.

📊 What’s Next

With earnings season slowing, investors are turning their eyes to a few key names:

- Sony reports Tuesday

- Disney and Cisco step up later this week

These results will help test whether the market’s still driven by fundamentals, or if we’re living in an AI-fueled fever dream.

🤔 Asia Forex Mentor Insights

Wall Street’s mixed signals show what happens when hype meets hesitation. Traders are torn between chasing growth stories like AI and waiting for macro calm from Washington.

For forex traders, that means volatility pockets — quick moves, short windows, and chances to ride sentiment shifts. When optimism fades, safe-haven currencies tend to whisper opportunity. 🕵️♂️

MEMES OF THE DAY