TOGETHER WITH

What’s going on traders, Ezekiel here to analyze today’s market movement and the signals you should be paying attention to.

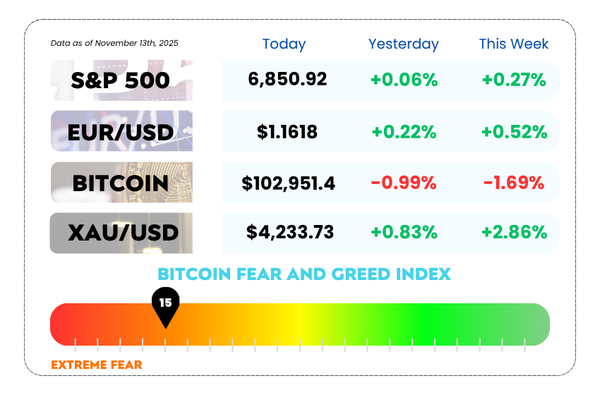

- Today's market mayhem. S&P, EUR/USD, Bitcoin, and XAU/USD today

- USD slumps toward 99.00 as markets go full risk-on mode

- Shutdown cost the US economy billions, with some losses gone for good

- Master the 5 Golden Price Action Setups used by pros with our video

Your Next Go-To Crypto Exchange Might Be WEEX

If you’re hunting for a platform built for actual traders (not meme-chasers), WEEX has earned its spot on the shortlist. Since 2018, it has grown to 7 million+ users across 200+ countries, consistently placing among the Top 5 CEXs on CoinGecko and Top 12 on CoinMarketCap — and the momentum isn’t slowing.

Here’s why traders keep making the switch 👇

💧 Deep, Organic Liquidity

WEEX’s massive global user base fuels one of the cleanest order books in crypto — think tight spreads, faster fills, and smoother execution across major pairs and top altcoins.

👥 Trade Smarter, Not Harder

Want to follow seasoned pros? WEEX lets you auto-copy strategies from 5,000+ profitable Pro traders, giving you instant access to high-performance trading flows.

🎁 A Welcome Package Worth Claiming

New users get a 20% deposit bonus (limited time) plus surprise trading coupons ranging from 10 to 100 USDT.

And if you're looking for more rewards, here’s what you can stack:

- Deposit 100 USDT + trade $5,000 futures → Earn $20 bonus

- Deposit 500 USDT + trade $20,000 futures → Earn $100 bonus

Bonuses stack up — you can earn up to 30,000 USDT throughout the event.

WEEKLY MARKET MAYHEM🔥

For this week's market mayhem, here’s what we got for you today:

The USD Is Catching L’s While Markets Party On

The US Dollar Index keeps sliding toward 99.00, and traders are treating the Greenback like that one friend who always shows up late to dinner. Everyone’s in a risk-on mood, and USD is the one paying for it.

The vibe in markets flipped fast. With the US government finally reopening, risk appetite charged back in, and the Dollar… well, it kind of tripped on the way in. The DXY just touched two-week lows near 99.15, putting it at the bottom of the G7 leaderboard for the day. 📉

But the story isn’t just “government reopens, USD drops.” The real plot twist is what comes next.

📅 The Data Flood… or Data Drought?

Now that the 43-day freeze on federal operations is over, traders were expecting a big wave of delayed economic reports to hit the tape.

Except… nobody knows what’s actually coming.

The release calendar is still foggy, and key indicators like jobs and inflation may not appear anytime soon.

So yes, the government is open again, but the data faucet is still running on drip mode. 🚰

US Dollar Index Daily Chart as of November 13th, 2025 (Source: TradingView)

🧠 The Market Can’t Decide What the Fed Will Do

Here’s where things get spicy.

The market tried to price in a December rate cut, but Fed officials are basically delivering mixed signals.

Some policymakers see weakening labor conditions and think easing is needed. Others warn that if inflation expectations keep drifting higher, cutting rates could backfire in a big way.

And traders are starting to believe the latter.

Futures markets trimmed the odds of a December cut to 54 percent, down from 64 percent last week, and way below the 90 percent probability seen a month ago. 📉

Translation:

The Fed may talk softly, but the market isn’t betting big on a rate-cut Christmas anymore.

📌 The Big Picture

Risk appetite is alive, the Dollar is sliding, and the Fed narrative is getting more chaotic than a group chat during Black Friday. Until economic data actually hits the screen, traders are flying half-blind… but enjoying the ride.

🤔 Asia Forex Mentor Insights

The DXY’s move toward 99.00 signals momentum shifting toward risk assets, which could create short-term trading opportunities in pairs like EURUSD, AUDUSD, and GBPUSD.

Uncertain US data flow may fuel volatility, so traders should watch for sudden repricing events once releases start dropping.

Fed expectations are softening, which typically pressures USD, but mixed messaging means intraday swings may be sharp. Risk management becomes even more crucial here.

The Shutdown Is Over… But Uncle Sam’s Hangover Is Just Getting Started

The US government is finally back open for business, but the return is looking less “flip the switch” and more “Monday morning after an all-nighter.” Some parts restart instantly, others need a week, and a few might need much longer to get back in shape. 😵💫

The 43-day freeze didn’t just pause things. It created a massive backlog in everything from payroll to environmental permits to loan processing. Think of it like returning from vacation and opening your inbox to 11,738 unread emails… multiplied by a few million.

🏢 A Slow, Messy Reboot

Federal workers were called back in as soon as the funding bill cleared Congress and got the President’s signature. But reopening the doors is the easy part.

Updating payroll systems, clearing overdue applications, restarting inspections, and unstacking months of pending projects is what takes time.

Even the basics, like customer service calls and grant disbursements, are backed up after sitting untouched for six weeks.

And those long-awaited paychecks? They’ll start rolling out soon, but agencies caution that recomputing missed wages takes time. The aim is to get everyone fully paid by mid-November, though some workers, like air-traffic controllers, might see their back pay arrive in multiple waves.

Oh, and workers technically kept earning leave during the shutdown, even though they couldn’t use any of it. So the government now owes more paid time off than before. 📈

✈️ Travel & Transport: Almost Back to Normal

Transportation officials expect flight restrictions to ease within about a week, just in time for the Thanksgiving travel crush. Airlines are optimistic too, predicting a strong holiday season once operations normalize.

But even here, nothing snaps back instantly. Airports, airlines, and federal agencies all have their own recovery timelines, and syncing them up is part art, part science… and part crossing fingers.

📌 The Big Picture

The government may be open again, but the country is still dealing with the aftershocks. Think of it as a nationwide systems reboot where every department has to clear caches, fix corrupted files, and restart a thousand processes at once.

The shutdown is done.

The recovery is just beginning. 🧹

🤔 Asia Forex Mentor Insights

Prolonged operational delays can weigh on US consumer sentiment and short-term economic momentum, which may influence USD volatility in the coming weeks.

Missing economic data leaves markets hungry for clarity, meaning upcoming releases could trigger stronger-than-usual reactions once the pipeline resumes.

Lingering shutdown costs could subtly weaken growth expectations, which traders should monitor when assessing medium-term USD direction and interest rate outlooks.

MEMES OF THE DAY

When one red candle convinces you the bull run is over 🐂

Hope is not a strategy… but risk management sure is 😅