TOGETHER WITH

Today’s edition is brought to you by WEEX, a full-range crypto trading platform that offers spot, futures, OTC, and copy trading all in one place. With over 1,700+ trading pairs, up to 400× leverage on futures, and support in 130+ countries, WEEX is designed for both newcomers and seasoned traders.

What’s up traders, Ezekiel here to unpack today’s market moves and what they signal for your trading strategy.

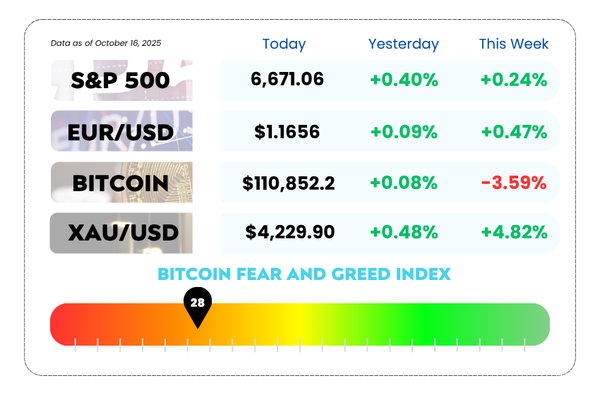

- Today's market mayhem. S&P, EUR/USD, Bitcoin, and XAU/USD today

- Stocks inch up as traders bet on earnings and dodge trade war crossfire

- Markets brace as Trump drops the “We’re in a Trade War” bomb

- Learn how to trade smarter and spot real momentum using a proven MACD strategy with our video

Partner Spotlight: WEEX — The Exchange Built for Serious Traders

Since its launch in 2018, WEEX has grown to serve over 7 million users across 200+ countries and regions, consistently ranking among the Top 5 CEXs on CoinGecko and Top 12 on CoinMarketCap.

Here’s why more traders are moving to WEEX 👇

- 💧 True Liquidity: With 7M+ users worldwide, WEEX offers one of the most organic order books in crypto — real depth, tight spreads, and smooth execution across leading altcoins.

- 👥 Smarter Trading: Instantly copy and mirror the strategies of 5,000+ profitable WEEX Pro traders with just a few clicks.

- 🎁 Welcome Bonus: New users can enjoy a 20% deposit bonus (limited-time), plus random trading coupons between 10 – 100 USDT.

WEEKLY MARKET MAYHEM🔥

For this week's market mayhem, here’s what we got for you today:

Futures Creeping Up While Wall Street Plays Tug-of-War with

Earnings & China 📈

US stock futures tiptoed higher Wednesday night — just enough to make traders squint at the green numbers and whisper, “Is this a rally… or just another tease?” 👀

The Dow and S&P 500 futures crawled up around 0.1%, while the Nasdaq 100 managed a slightly more energetic 0.2% lift.

After hours, Salesforce flexed with a strong outlook, sending its stock higher. J.B. Hunt Transport also impressed with earnings that outdrove expectations 🚛💨. Meanwhile, United Airlines had a bumpy landing — softer revenue clipped its wings. ✈️

S&P 500 Daily Chart as of October 16th, 2025 (Source: TradingView)

During the day session, Wall Street saw a modest uptick, helped by strong bank earnings and the ever-present hope that the Fed might deliver more rate-cut love later this year. 💘

But while traders were celebrating, the US-China drama was heating up again. President Trump confirmed the trade war is very much “on,” while Treasury Secretary Scott Bessent hinted the tariff pause could maybe get an extension. Confused? So are investors. It’s like watching two referees disagree mid-game. 🏀

And as if that weren’t enough, the US government shutdown just entered Week 3. That means no fresh economic data, more uncertainty, and a Washington gridlock that might last longer than your Netflix backlog.

Looking ahead to Thursday: TSMC and Charles Schwab will take the earnings spotlight. Expect more tea to spill. ☕

🤔 Asia Forex Mentor Insights

The market’s cautiously optimistic mood shows how earnings can offset geopolitical noise — for now. But with US-China tensions flaring and data drying up, volatility could sneak back in fast. Keep your charts close and your stop losses closer. 📊🔥

Trump Confirms US–China Trade War (Again) While Bessent Hints at a Tariff Timeout 🇺🇸🔥

Just when markets thought the US–China trade drama might chill out, President Trump dropped another bombshell 💣

When asked if the two nations were heading for a long trade war, he replied, “Well, you’re in one now.”

That’s one way to set the tone for the week.

Meanwhile, Treasury Secretary Scott Bessent tried to calm nerves, suggesting the tariff pause might get extended — but the markets aren’t exactly buying the peace talk.

The Plot So Far 🍿

- Trump plans to meet President Xi Jinping later this month, even as relations hit fresh lows.

- Last Friday, he said the US will slap an extra 100% tariff on Chinese goods from Nov. 1, after Beijing announced new export controls on rare earth minerals (aka the stuff tech companies really need).

- On Monday, Trump pulled a 180 — telling everyone “don’t worry about China” — before China hit back by sanctioning US units of a South Korean shipping firm.

- The result? 🌪️ Mixed signals, shaky markets, and traders trying to make sense of the chaos.

Right now, tariffs up to 145% on Chinese imports are on pause until Nov. 10, while both sides try to hash out a deal. China’s own tariffs — which ballooned to 125% — are also frozen for now.

What Else Is Brewing 🧭

- American consumers are footing the bill: Goldman Sachs estimates they’ll pay over half the cost of Trump’s tariffs.

- The Supreme Court is taking up a major tariff challenge next month. If the court strikes it down, Trump’s “reciprocal” tariff plan could crumble.

- New duties kicked in recently:

- Kitchen cabinets & vanities (Oct 1) 🪚

- Timber, furniture, and wood goods (Oct 14) 🪵

- Stellantis (STLA) just pledged a $13B US investment and 5,000 new jobs to offset the tariff hit.

- And in a twist, Apple (AAPL) CEO Tim Cook told Beijing’s industry minister that Apple will boost investments in China, even as Trump threatens to target their foreign-made products 🍏🤝🇨🇳

🤔 Asia Forex Mentor Insights

The market’s mood is as volatile as Trump’s social feed. Expect currency swings — particularly in USD/CNH — as traders price in fresh tariff fears and potential policy shifts. A temporary tariff pause could bring short-term relief, but with November deadlines looming, the next few weeks might test even the most patient forex traders.

MEMES OF THE DAY🤣

Me: “It’ll bounce back.” Market: proceeds to burn my portfolio. 😂

They say “think about me,” but all you see are candlesticks. 💔