TOGETHER WITH

Hello traders, Ezekiel here. Let’s take a look at today’s shifts and how they could shape your next decision.

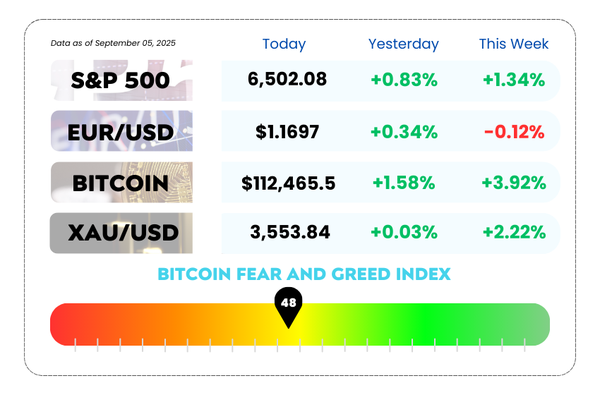

- Today's market mayhem. S&P, EUR/USD, Bitcoin, and XAU/USD today

- Dollar index rises 0.17% on stronger US Productivity and Services Data

- BTC ETFs see $633M inflows, strongest Two-Day run since August

- Expose the hidden rules and pressure points that trip up traders with your YouTube video

Unlock a 10% Boost on Your First USDT Deposit with BTCC!

Why this bonus rocks:

- No KYC needed—privacy-friendly and effortless

- No trading volume minimums—what you see is what you get

- Credited within a week—fast and simple

Whether you’re just kicking off or scaling up, this is one of the easiest and most transparent deposit bonuses in crypto today.

WEEKLY MARKET MAYHEM🔥

For this week's market mayhem, here’s what we got for you today:

The Dollar’s Glow-Up: Productivity Flex & Service Gains 💵

The US dollar hit the gym this week and walked out looking stronger, thanks to a cocktail of better productivity, cheaper labor costs, and a services sector on caffeine.

Here’s the scoop:

- Productivity got an upgrade → Q2 numbers were bumped up to +3.3% (from +2.4%), showing workers are squeezing more juice out of the same lemons.

- Labor costs cooled off → Revised lower to +1.0%, which eases inflation fears.

- Services are booming → The ISM services index jumped to a 6-month high of 52.0, beating forecasts.

That triple-shot gave the dollar index (DXY) a +0.17% lift.

But hold the champagne 🥂…

- Job growth disappointed, with ADP reporting only +54,000 new jobs (vs. +68,000 expected).

- Jobless claims hit a 10-week high at 237,000.

- Treasury yields slid to 4.16%, trimming some of the dollar’s shine.

US Dollar Index Daily Chart as of September 5th, 2025 (Source: TradingView)

🌍 Around the World

- Euro got smacked → Down -0.10% after weak July retail sales (-0.5%, the worst in 13 months) and lingering uncertainty over the Ukraine war.

- Yen weakened → USD/JPY rose +0.24% as Japan’s political shuffle hints at looser fiscal policy. Lower US yields, though, kept the yen from falling further.

- Gold & silver dipped → Gold dropped -0.79%, silver -1.53%. A stronger dollar and strong stocks dimmed safe-haven demand, though ETF buying and geopolitical tensions are still giving gold some fans.

🔮 What’s Next?

Markets are betting 99% odds on a Fed rate cut this September, with a coin-flip chance of another cut in October. Translation: the dollar’s ride may not stay this bumpy forever.

🤔 Asia Forex Mentor Insights

The dollar is balancing on a tightrope: strong productivity and services keep it firm, but weak labor signals are already whispering “rate cuts.” For traders, this means volatility is your best friend, especially across USD/JPY and EUR/USD pairs.

Can Bitcoin ETFs Break the “September Curse”? 🍂

Bitcoin is walking into September with some baggage. Historically, it’s been a red month 8 out of the last 12 years, and BTC is already limping after a 1.3% drop below $110K this week.

But there’s a twist this time… ETF inflows are heating up, and they might be the wildcard that saves Bitcoin from another gloomy September.

🚀 ETF Demand = Old HODLers Cashing Out?

Over the past two sessions, Bitcoin ETFs pulled in $633M — their best run since early August. A lot of that appears to be long-term holders moving coins into ETFs.

In simple terms, OG whales are handing off supply while ETF demand hoovers it up.

That’s unusual. We’ve seen similar “redistribution” waves before, but never this many in such a short cycle. If ETFs keep slurping up BTC, supply shock dynamics could flip the script.

🏦 Enter the Treasury Titans

One player to watch is Metaplanet, Japan’s “MicroStrategy.” The firm just added 1,009 BTC (worth ~$112M), bringing its stash to a clean 20,000 Bitcoin. Even though its stock has cratered 60% since June, the company insists it’s never selling. Their stack now sits near $2.2B.

If September turns red, don’t expect them to bail, they’ll likely keep buying.

📊 Traders Still Split

On prediction markets, 65% of users see BTC falling to $105K before climbing higher. Binance’s latest poll shows most investors expect Bitcoin to stay in the $100K–$150K range through year-end, with only 25% betting on a run above $150K.

But the real wildcard? The Fed’s September 16–17 meeting. If rate cuts arrive, liquidity improves and risk assets like Bitcoin could see a 5–10% boost.

🤔 Asia Forex Mentor Insights

Bitcoin’s September curse is real, but this year is shaping up differently. With ETFs soaking up supply and treasury giants like Metaplanet doubling down, dips may find stronger floors than in past cycles. Still, all eyes are on the Fed, a rate cut could be the rocket fuel BTC needs to flip September green.

MEMES OF THE DAY🤣

Big brain move… or just coping? 🤔

When your “safe trade” turns into a rollercoaster 🎢