Learn To Trade Forex • Best Forex Trading Course • AsiaForexMentor

THE ONE CORE PROGRAM™

The Proven Trading System Trusted by Banks, Institutions and Thousands of Traders Worldwide

The same proprietary trading system Ezekiel uses to make six-figure trades — now available inside a monthly Cohort with exclusive bonuses that are NOT available anywhere else.

A Message From Ezekiel Chew

Founder, Asia Forex Mentor • Trainer to Banks, Funds & Professional Traders

If you want to learn how to trade with precision, confidence, and the ability to generate meaningful returns — I’m not talking about small, symbolic gains… I’m talking about real money — then you’re in the right place.

Because what you’re about to discover is the exact trading system I’ve used for over two decades…

- the same system I use today to generate six-figure trades,

- the same system I train banks and institutions with,

- the same system thousands of my students use to finally break through and trade profitably.

And now, for the first time, this system is available to you inside our Cohort-based One Core Program, along with exclusive bonuses designed to give you clarity, structure, and a genuine pathway to mastery.

The Cohort Advantage: Why TODAY Matters

When you join the current One Core Cohort, you get access to exclusive bonuses that are not included in the standard One Core Program:

- The 2-Day Live Masterclass with Me (Limited Cohorts Only)

This is where I personally walk you through building a customized trading system, advanced executions, and scaling strategies. You cannot get this outside the Cohort.

- Your Free 1-on-1 Customisation Coaching Call

My head coach will personally help you refine your system, your analysis process, and your execution steps.

- Lifetime Support From Me & My Team

This is not guaranteed to remain part of future cohorts. If we remove this in future, you will still retain permanent access.

- And more… (full bonus list expanded later in the page)

These bonuses are the reason why the Cohort exists — to give you deeper guidance, direct interaction, and accelerated breakthroughs.

THE ONE CORE SYSTEM™

A simple, repeatable, ROI-driven trading system — designed for beginners, struggling traders and experienced traders alike.

Whether you're brand new to trading, have been inconsistent for years, or already managing meaningful capital…

The One Core System gives you a clear, structured way to:

- Read charts with total clarity

- Find high-probability Grade-A setups

- Execute with precision

- Grow your account safely

- Scale returns without increasing risk

This is the system that turned a struggling 16-year-old with a $500 account into a professional trader training banks.

And today, it’s the system that fuels six-figure trades, including:

- Multiple 100K+ trades

- ROI explosions like 950% in 2 weeks

- Consistent month-over-month returns reported by students globally

All achieved through the same repeatable system you’re about to learn.

Join the One Core Cohort Now — Get All Cohort Bonuses + Full Program Access

Special Cohort Price: $897

Meet the Trader Behind the System

*From a 16-year-old blowing multiple accounts…

to training banks, funds and making six-figure trades.*

My journey didn’t start with money.

It started with a $500 account funded by part-time jobs during school breaks.

Like most beginners, I struggled.

I blew accounts.

I made every mistake possible.

But the turning point came when I stopped chasing “strategies”…

and started building a system — a repeatable, data-driven, ROI-based framework that removed the stress, randomness, and emotional rollercoaster from trading.

This system — the One Core System — changed everything.

It took me from a confused teenager…

- To a full-time trader,

- To someone who trains banks, funds and professional traders,

- To someone whose trades often generate six-figure profits.

Not occasionally.

Not “lucky trades.”

This is simply what happens when you operate with a proven, repeatable system.

And that’s the power of a real system —

it scales with you as you grow.

Why Banks & Institutions Hire Me to Train Their Traders

I’m not a “course seller” who trades on the side. I’m a trader first — teaching is something I do because I want to, not because I need to.

Financial institutions bring me in to train their traders because The One Core System is:

- Simple enough for beginners

- Robust enough for institutions

- Powerful enough to scale to deep six-figure trades

I’ve been featured in:

- The Straits Times (multiple times)

- Major investment publications

- Industry conferences worldwide

I’ve spoken alongside CEOs and heads of global trading firms, including:

- FTMO

- Oanda

- Major brokers and liquidity providers

When institutions want their traders to level up, they come to me.

And now, for the first time, you’re getting access to the same system — inside a Cohort designed for accelerated learning.

Real, Documented Six-Figure Trades

Here are just a few examples of trades generated using the exact same principles you’ll learn inside the One Core Program:

Executed with the same system you are about to learn.

Not luck. System + volatility = opportunity

And then scaling that into a $300K account shortly after.

- Several hundred thousand in accumulated trades using the same system

These outcomes are predictable when you follow a repeatable, rules-based framework that’s designed for:

- High-quality entries

- Safe, intelligent scaling

- Protecting downside

- Multiplying upside

And this is exactly what the One Core System gives you.

But what matters more than my results… are my students' results.

Traders of all levels — beginners, retirees, engineers, business owners, full-time employees — are reporting REAL breakthroughs:

-Paing Soe

-Wayne Cressy

-Maggie Hiew

-Zack Lee

-Adrian

These traders come from:

- Zero experience

- Multiple failed strategies

- Burnout from trying YouTube trading tactics

- Advanced traders stuck at a plateau

And the reason the system works for all of them is simple:

It’s built on universal principles — not gimmicks. Not indicators. Not luck.

A solid framework works regardless of:

- Timezone

- Account size

- Market conditions

- or experience level.

Ready to Learn the Same System Behind Six-Figure Trades and Thousands of Success Stories?

Join the current One Core Cohort and unlock all cohort-only bonuses + full system access.

What You Get Inside the One Core Program

The Complete Beginner-to-Advanced System Trusted by Banks, Funds & Thousands of Traders

The One Core Program isn’t a collection of random strategies.

It’s a complete trading system — step-by-step, structured, and designed to take you from:

Zero knowledge → consistently profitable → advanced scaling → high-level precision trading.

Here's everything inside:

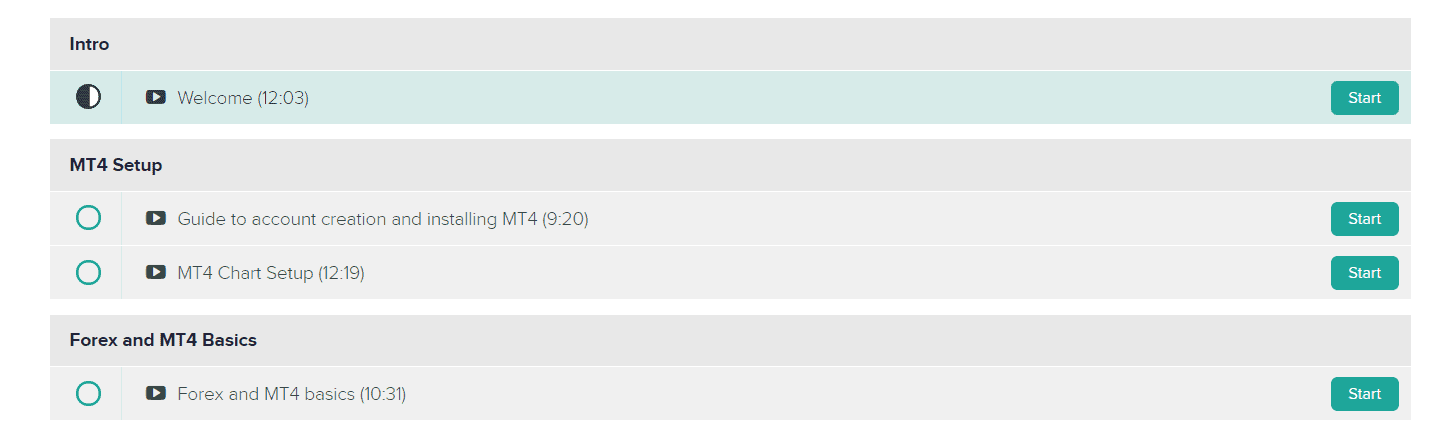

Module Breakdown

Click on the + button at the left of each section to learn what is covered

Objective: Lay the foundation for how professionals think, plan, and execute trades.

What You’ll Learn:

- How the entire AFM system fits together

- Why most retail traders fail (and how to avoid the traps)

- What it means to trade like a business

- How to prepare your mindset for consistent profitability

- How to avoid years of trial-and-error by following a structured approach

This module sets the stage for everything that follows — and gives you the mental framework required for long-term success.

Objective: Lay the foundation for how professionals think, plan, and execute trades.

What You’ll Learn:

- How the entire AFM system fits together

- Why most retail traders fail (and how to avoid the traps)

- What it means to trade like a business

- How to prepare your mindset for consistent profitability

- How to avoid years of trial-and-error by following a structured approach

This module sets the stage for everything that follows — and gives you the mental framework required for long-term success.

PRICE ACTION –THE KING OF CHART READING

Next, we dive right into the most important aspect of trading – Price Action. Price action is the King of Chart Reading. Every professional trader knows this and is a master at price action in some way or another.

I have broken down the study of price action into simple steps, making this complicated topic into an easy-to-understand learning method. Once you go through my way of reading the chart with price action, every time you see a new chart, you will be able to read it with ease – just like reading a book. Learning price action is like learning a new language – the language of charts.

It fundamentally involves dissecting what the chart is trying to tell us. Once you go through the price action section, you will know with a good degree of certainty why the market is going sideways, trending up or down, whether it is a real reversal or just a retracement. You will be able to tell the story of the chart and anticipate with a good level of confidence where will it head next.

Price action is the skill that every trader who wants to be professional needs to acquire. That’s why I placed learning it right at the start of the program. Because once you learn it, the rest of the chart reading and execution will fall into place.

This is why some traders just randomly learn some trading strategy online and, after trying it out in the live market, it didn’t work as it “should”. The real reason is that you can’t simply just apply any strategy any time you see the pattern occurring. You must first read the chart using price action and to generate a good understanding of where the price is likely to head.

For example, with good chart reading skills, you will be able to tell that the current movement is likely just a retracement, not a real reversal that shoots down. If that’s the case, you shouldn’t be selling, but instead, be looking for an opportunity to buy. But without chart reading with price action and seeing that it’s the same pattern that tells you to sell, you will probably end up losing that trade.

This is why learning chart reading and especially price action comes first. Once you know how to read the charts like a book, this is when you’ll know when to apply the right strategy and when to skip the trade.

This is the heart of professional trading.

You’ll learn:

- How to read any chart — forex, stocks, crypto, commodities, indices

- How to see exactly what institutional traders see

- How to identify only Grade A setups

- How to remove “noise” and focus on what actually moves the market

- How to recognise momentum, structure, exhaustion, and key turning points

This is where most beginners “unlock” trading.

Once you see price properly, everything changes.

Now that you know how to read the chart with price action, I’m going to show you how exactly to enter, exit and place your stop loss with price action.

Please note that I haven’t started talking about strategy yet. This section is to give you a good understanding right from the start to show you how to execute trades with price action in the right way.

In this section, I cover many different entry methods and stop loss methods – the different methods to use in different situations. This is intended to lead you to becoming a professional trader where there isn’t a one-size-fits-all method but it’s more about applying the right method in the right situation. It’s really not complicated once you learn it and, if anything, it’s rather straightforward.

The reason why we have different methods is that I do not just want to teach you just one method. Because the market is live, it’s moving. Therefore, in order for you to be a professional, you must have a series of tools and know which one to use in different scenarios. That’s what makes a good trader and of course a good program.

That’s why this is the One Core Program –the only program you’ll ever need.

Now for the exit methods – this is the easy part. And our way of exiting is very defined plus it makes us good profits. Our exit methods allow us to win with good probability and profitability. That’s part of the key to being a profitable trader.

You will learn the execution framework used by professional desks:

- High-probability entry patterns

- How to place stop-losses the professional way

- Exact exit criteria for maximum ROI

- How to eliminate emotional decision-making

- How to turn your trades “risk-free” using the system

Most traders lose because of poor entries or poor exits.

This module fixes both permanently.

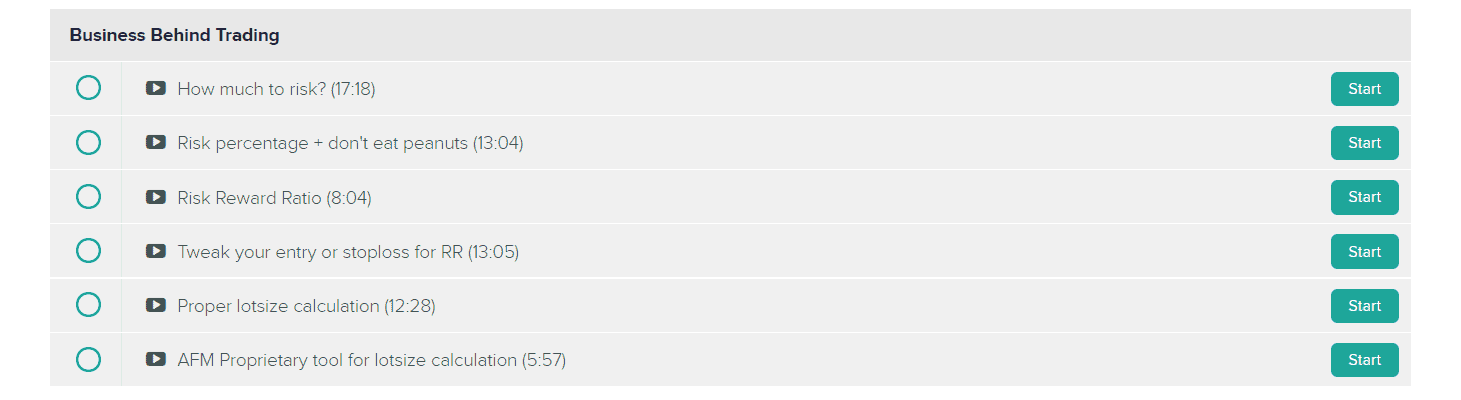

As professional traders, we are very serious about this business. Trading is not a gamble, speculation or a toss of the coin. If it’s any of these things, we might as well go to a casino. The above mentality could be appropriate for an amateur but is definitely not the mindset and methodology of a professional trader.

Look, we trade for a living. Gambling, speculation and luck can only bring us so far. But to make not just a living but a very good living out of it – it’s a skill and it’s a proper business.

Therefore, in this section, you will learn how we treat trading as a business. With the proper “accounting”, system and methodology. In such a way that everything is structured. We leave nothing to chance. There is nothing random in our trading. Every trade we enter is based on a properly structured plan. There’s no scenario for gut feeling, gambling or anything like that.

With the way we trade, we will know whether or not we will be profitable. Everything is calculated mathematically. This is why we are professionals.

If you are an existing trader, this section alone will likely turn you from a losing/break-even trader to becoming a profitable one.

And guess what? More than 70% of the traders out there don’t know this or apply it correctly.

Once you apply the business of trading into your trading, you WILL see an increase in profitability. Thus leading to an increase in ROI.

Trading is not guessing.

It is a structured business.

Inside this module:

- How real traders track results

- How to measure performance like a fund manager

- How to build your personal trading business plan

- How to protect capital

- How to create consistency through process — not luck

90% of traders fail because they skip this.

You won’t.

Now that you have learnt price action, let’s progress to some advanced chart reading methods and combinations. The reason why I haven’t already moved on to strategies yet is that chart reading really is the skill that you’ll need to master before talking about strategies.

The reason is simple, once you master the reading of charts you will be able to open any chart and tell where the market is heading. This gives you a strong winning edge in the game, doesn’t it? By knowing what price will likely do next you will know whether or not to go for a long or a short (to buy or to sell).

That’s why I spend a tremendous amount of time drilling you on your chart reading skills. Once you master chart reading, you will be among the top 10% of the traders around.

So right off the bat, we jump into one of the most powerful chart reading methods – Elliott Wave.

Ask any professional trader – the ones who are really good at their game. There’s a high chance that they understand the Elliott wave to a certain degree. Some of them are masters at it. Elliott wave theory revolves around the market moving in a wave pattern. And, by understanding which specific wave the market is in, gives you a good probability of knowing whether or not should you buy or sell and how far it is likely to go.

I have digested all the information that you need to know about the Elliott wave in this segment. Of course, you can go ahead and attend a 2-day seminar on the Elliott wave. But honestly, it’s not necessary. Everything taught here is more than enough to equip you to use it for profitable trading with our system.

Next up – Fibonacci.

Fibonacci is something most traders know. It’s a mathematical formula of numbers and levels. The reason why traders use it is that it works fantastically for the technical charts. The price can be seen in tremendous examples respecting the levels of Fibonacci. And traders use it to time retracement, exits and levels of rejection. It’s not going to be anything complicated I assure you. Anything that is will anyway be straightforward in the way I put it across, so straightforward that even my two kids aged 7 and 8 can understand it.

Trendline is the third module in this section. Some people may think that trendline isn’t strong. How wrong can they be? As simple as trendline may seem… when drawn correctly, it’s one of the most important tools out there.

In this section, I’ll show you the right way to draw trendlines. And once you learn it, you will start to see how simple and powerful it is. A trendline, when drawn correctly, gives you very high accuracy in chart reading and also in trade execution. It’s a highly effective tool that we use in our arsenal.

The fourth module in chart reading is Support and Resistance Level. How can we not talk about this, right? The reason being, that every trader knows this. Even someone on the street can tell you that, for example, a 3000 level at X index/stock is a very strong level. So you see… if the layperson knows that, they will probably get their profits out at that level or even sell there. That’s why the support and resistance level works so well.

Now, knowing the support and resistance level and applying it correctly is a different story. Here, I will show you my way of drawing these levels, when to move them, when it is strong and when it’s not needed anymore. You will learn a straightforward method of applying them. With these levels drawn, you will now be able to know how to read the charts effectively and use them together with our other combinations.

Next up is the 150 and 365 Exponential Moving Average. As you can see, I’m not hiding these levels. I’ll tell you upfront that these are the levels that I use. But what’s important is HOW I use them. That’s what makes the difference. Really, when applied correctly, they give us a great amount of profits. Best of all, they are automated. ;)

The sixth module is Bollinger Bands. I like Bollinger bands, and configure them in a way whereby it’s powerful and effective. In this module, I share with you exactly how to use Bollinger bands, the common ways to use them, and how we use them in our own style to our benefit.

The seventh module is Stochastics and Macd. If price action is like the core body, these are like the clothes that we put on. It gives us the extra firepower, extra confirmation and increased probability. Here I’ll be giving you the exact customized tool that I use, one which is configured differently from the default MT4 Macd. Yeah! Good stuff here.

The eighth module is the understanding of Higher Highs and Lower Lows. This is a powerful module to add on to our chart reading. Most people don’t understand this concept the way we do. Because once you see it in the way that I teach you, it becomes a no-brainer. Chart reading becomes so easy. And it really is. Can’t really reveal too much here… But once you learn it, it really changes the way you look at charts.

The final module of the advanced chart reading section is where we put it all together. The Combination. When used individually everything above gives you only so much power, but when you combine them in the way that I’ll show you together with price action, it gives you such an amazing way of reading the charts. Trust me on this. When you learn how to read the chart using the combination of everything above – my proprietary way – you will never see charts the same way again.

And again I emphasize, you can use it on any vehicle. Forex, stocks, indexes, commodities, crypto and anything that has charts – it’s that powerful, it really is.

When you complete this entire section, your chart reading skillset will now be in the top 10% amongst the world’s traders. The next time someone shows you a chart, you can start talking about it like a pro. Because… you are.

Take your chart-reading to the next level:

- How to analyse market context

- How institutions view charts

- How to identify hidden levels that retail traders miss

- How to adapt your reading across multiple vehicles

By the end, you’ll be able to read charts with absolute clarity.

Now that you have learnt price action, let’s progress to some advanced chart reading methods and combinations. The reason why I haven’t already moved on to strategies yet is that chart reading really is the skill that you’ll need to master before talking about strategies.

The reason is simple, once you master the reading of charts you will be able to open any chart and tell where the market is heading. This gives you a strong winning edge in the game, doesn’t it? By knowing what price will likely do next you will know whether or not to go for a long or a short (to buy or to sell).

That’s why I spend a tremendous amount of time drilling you on your chart reading skills. Once you master chart reading, you will be among the top 10% of the traders around.

So right off the bat, we jump into one of the most powerful chart reading methods – Elliott Wave.

Ask any professional trader – the ones who are really good at their game. There’s a high chance that they understand the Elliott wave to a certain degree. Some of them are masters at it. Elliott wave theory revolves around the market moving in a wave pattern. And, by understanding which specific wave the market is in, gives you a good probability of knowing whether or not should you buy or sell and how far it is likely to go.

I have digested all the information that you need to know about the Elliott wave in this segment. Of course, you can go ahead and attend a 2-day seminar on the Elliott wave. But honestly, it’s not necessary. Everything taught here is more than enough to equip you to use it for profitable trading with our system.

Next up – Fibonacci.

Fibonacci is something most traders know. It’s a mathematical formula of numbers and levels. The reason why traders use it is that it works fantastically for the technical charts. The price can be seen in tremendous examples respecting the levels of Fibonacci. And traders use it to time retracement, exits and levels of rejection. It’s not going to be anything complicated I assure you. Anything that is will anyway be straightforward in the way I put it across, so straightforward that even my two kids aged 7 and 8 can understand it.

Trendline is the third module in this section. Some people may think that trendline isn’t strong. How wrong can they be? As simple as trendline may seem… when drawn correctly, it’s one of the most important tools out there.

In this section, I’ll show you the right way to draw trendlines. And once you learn it, you will start to see how simple and powerful it is. A trendline, when drawn correctly, gives you very high accuracy in chart reading and also in trade execution. It’s a highly effective tool that we use in our arsenal.

The fourth module in chart reading is Support and Resistance Level. How can we not talk about this, right? The reason being, that every trader knows this. Even someone on the street can tell you that, for example, a 3000 level at X index/stock is a very strong level. So you see… if the layperson knows that, they will probably get their profits out at that level or even sell there. That’s why the support and resistance level works so well.

Now, knowing the support and resistance level and applying it correctly is a different story. Here, I will show you my way of drawing these levels, when to move them, when it is strong and when it’s not needed anymore. You will learn a straightforward method of applying them. With these levels drawn, you will now be able to know how to read the charts effectively and use them together with our other combinations.

Next up is the 150 and 365 Exponential Moving Average. As you can see, I’m not hiding these levels. I’ll tell you upfront that these are the levels that I use. But what’s important is HOW I use them. That’s what makes the difference. Really, when applied correctly, they give us a great amount of profits. Best of all, they are automated. ;)

The sixth module is Bollinger Bands. I like Bollinger bands, and configure them in a way whereby it’s powerful and effective. In this module, I share with you exactly how to use Bollinger bands, the common ways to use them, and how we use them in our own style to our benefit.

The seventh module is Stochastics and Macd. If price action is like the core body, these are like the clothes that we put on. It gives us the extra firepower, extra confirmation and increased probability. Here I’ll be giving you the exact customized tool that I use, one which is configured differently from the default MT4 Macd. Yeah! Good stuff here.

The eighth module is the understanding of Higher Highs and Lower Lows. This is a powerful module to add on to our chart reading. Most people don’t understand this concept the way we do. Because once you see it in the way that I teach you, it becomes a no-brainer. Chart reading becomes so easy. And it really is. Can’t really reveal too much here… But once you learn it, it really changes the way you look at charts.

The final module of the advanced chart reading section is where we put it all together. The Combination. When used individually everything above gives you only so much power, but when you combine them in the way that I’ll show you together with price action, it gives you such an amazing way of reading the charts. Trust me on this. When you learn how to read the chart using the combination of everything above – my proprietary way – you will never see charts the same way again.

And again I emphasize, you can use it on any vehicle. Forex, stocks, indexes, commodities, crypto and anything that has charts – it’s that powerful, it really is.

When you complete this entire section, your chart reading skillset will now be in the top 10% amongst the world’s traders. The next time someone shows you a chart, you can start talking about it like a pro. Because… you are.

You receive all 16 battle-tested trading strategies, developed over 20+ years.

Each strategy includes:

- When to use it

- The step-by-step rules

- Case studies

- Chart walkthroughs

- Best practices

You only need ONE to change your life, but I give you ALL — because different traders click with different styles.

This alone is worth the price of the program.

This is the formula that changed the way I trade forever.

You’ll learn:

- How I scale accounts using math, not emotion

- How to grow your account even with small starting capital

- The compounding framework behind my six-figure trades

- The “professional mindset” for exponential scaling

- How to build wealth predictably using structured growth

Once you understand this formula, you will never see trading the same way again.

This is the formula that changed the way I trade forever.

You’ll learn:

- How I scale accounts using math, not emotion

- How to grow your account even with small starting capital

- The compounding framework behind my six-figure trades

- The “professional mindset” for exponential scaling

- How to build wealth predictably using structured growth

Once you understand this formula, you will never see trading the same way again.

This is where I change your entire frame of thinking and trading. It’s a paradigm shift from here on. Here I share my story of how I lost it all, figured this new way of trading and changed my perspective from then on. This is the Road to Millions Formula. This is the method that took me from ground zero, from scratch and grew my account size again to way bigger than it was before and faster.

I don’t want to reveal too much here. But it’s a shift in mentality and trading approach that puts you right at the top of the game. If I can attribute my success to a single thing. It is this. The Road to Millions Formula. This is gold.

This module teaches you:

- When to hold

- When to exit

- How to handle losing streaks

- How to maximise winners

- How to reduce risk without reducing returns

This turns you into a disciplined, system-driven trader.

A lot of traders find it tough to figure out whether or not should they hold on to a trade – when should they just enter a trade, set the entry, stop loss and profit target and forget it. When should they actively manage the trade? And how do you properly manage the trade? These are the key to successful traders. But note that when I say actively manage, don’t worry… You don’t have to look at your computer all the time. We have a way of doing it and yet, at the same time, have a life.

The trade management methods here give you the different options and perspectives for you to use and to choose the right one for yourself. I like to give people options, so that you’ll know the methods available and what works for you, rather than joining a course only to realize that your method doesn’t “click” or work for you and to then have to find another program and then another.

This is it. Here’s where I lay down everything that I’ve learnt that works and when to use it. You can use all these techniques in combination or you can use the one that fits your life, your schedule and your personality – whether you are a more conservative or aggressive trader or somewhere in the middle.

This section here can turn an existing trader from being non-profitable to becoming very profitable – even without learning and implementing the strategies above.

Learn how to interpret the market like an analyst:

How different markets influence one another

How spreads affect your execution

How to combine fundamentals with price action

How to avoid correlated risk during volatile periods

This makes you a well-rounded trader with a holistic view of the market.

A lot of traders find it tough to figure out whether or not should they hold on to a trade – when should they just enter a trade, set the entry, stop loss and profit target and forget it. When should they actively manage the trade? And how do you properly manage the trade? These are the key to successful traders. But note that when I say actively manage, don’t worry… You don’t have to look at your computer all the time. We have a way of doing it and yet, at the same time, have a life.

The trade management methods here give you the different options and perspectives for you to use and to choose the right one for yourself. I like to give people options, so that you’ll know the methods available and what works for you, rather than joining a course only to realize that your method doesn’t “click” or work for you and to then have to find another program and then another.

This is it. Here’s where I lay down everything that I’ve learnt that works and when to use it. You can use all these techniques in combination or you can use the one that fits your life, your schedule and your personality – whether you are a more conservative or aggressive trader or somewhere in the middle.

This section here can turn an existing trader from being non-profitable to becoming very profitable – even without learning and implementing the strategies above.

Inside:

- How to increase precision without increasing complexity

- Hidden techniques used by institutional traders

- How to improve selectivity and avoid marginal setups

- How to combine confluences for maximum edge

Perfect for intermediate & advanced traders.

A lot of traders find it tough to figure out whether or not should they hold on to a trade – when should they just enter a trade, set the entry, stop loss and profit target and forget it. When should they actively manage the trade? And how do you properly manage the trade? These are the key to successful traders. But note that when I say actively manage, don’t worry… You don’t have to look at your computer all the time. We have a way of doing it and yet, at the same time, have a life.

The trade management methods here give you the different options and perspectives for you to use and to choose the right one for yourself. I like to give people options, so that you’ll know the methods available and what works for you, rather than joining a course only to realize that your method doesn’t “click” or work for you and to then have to find another program and then another.

This is it. Here’s where I lay down everything that I’ve learnt that works and when to use it. You can use all these techniques in combination or you can use the one that fits your life, your schedule and your personality – whether you are a more conservative or aggressive trader or somewhere in the middle.

This section here can turn an existing trader from being non-profitable to becoming very profitable – even without learning and implementing the strategies above.

My personal system for:

- Scoring trades

- Removing ambiguity

- Evaluating edge

- Making decisions objectively

This is one of the most powerful mental models in the program.

Trading was never meant to consume your life.

Here you’ll learn:

- How to trade with minimal screen time

- How to treat trading as a skill, not a job

- How to integrate trading into your life sustainably

- My personal time-saving frameworks

This is where students realise they can trade more effectively with less time.

My personal system for:

- Scoring trades

- Removing ambiguity

- Evaluating edge

- Making decisions objectively

This is one of the most powerful mental models in the program.

My 100-trade blueprint will:

- Build your confidence

- Validate your strategy

- Help you find your personal “sweet spot”

- Show you your true performance patterns

- Turn you into a consistent trader

This is the same blueprint I give bank traders.

My personal system for:

- Scoring trades

- Removing ambiguity

- Evaluating edge

- Making decisions objectively

This is one of the most powerful mental models in the program.

Inside:

- How to reduce hesitation

- How to eliminate revenge trading

- How to stay calm during big swings

- How to detach emotions from outcomes

- How pros maintain confidence through uncertainty

This module alone can transform your performance.

My personal system for:

- Scoring trades

- Removing ambiguity

- Evaluating edge

- Making decisions objectively

This is one of the most powerful mental models in the program.

This is one of the rarest opportunities in trading education.

You will literally watch me trade:

- One bar at a time

- Why I enter

- Why I skip

- How I manage winners

- How I manage losers

This is one of the rarest opportunities in trading education.

You will literally watch me trade:

- One bar at a time

- Why I enter

- Why I skip

- How I manage winners

- How I manage losers

- How I think

- How I make decisions in real time

It’s like sitting behind a professional trader for an entire year.

Students say this is the biggest breakthrough in the whole program.

This is one of the rarest opportunities in trading education.

You will literally watch me trade:

- One bar at a time

- Why I enter

- Why I skip

- How I manage winners

- How I manage losers

Finally, you’ll get:

- Tracking sheets

- Performance scorecards

- Reflective tools

- Growth milestones

- Your long-term trading roadmap

This ensures you stay consistent and continue improving long after you finish the program.

Student Success Stories & Transformations

Real traders. Real results. Real transformations from the One Core Program.

The One Core Program has helped thousands of traders across all levels — complete beginners, struggling traders, and professionals — achieve consistency, confidence, and meaningful returns.

Below is a curated selection of real student results, rewritten for clarity while keeping their original meaning intact.

-David Ang

Wayne struggled for years with complicated strategies and inconsistent results.

After learning the AFM system, he immediately started executing profitable trades.

“I was profitable immediately. With further experience, I will accelerate my rate of return. This is, in essence, a license to print money.”

-Adrian

Maggie had taken 10 different courses before discovering this program.

“This is the best forex course I’ve ever attended — out of 10 different courses, seminars, and trainings. I started trading my live account and it has grown by 10% over the last 2 weeks!”

-Capt John

David applied the strategies directly after completing the early modules.

“I’ve made 30% profit in just 4 days in 5 trades. And that’s with only 1–2 hours of trading before I sleep.”

-Royston Poh

Royston began with zero experience. His results speak for themselves:

“At first I was skeptical… but ever since I purchased the course, although being a first-time trader, I’ve already made profit of USD 30,000 to 65,000 in just two months.”

-Mulia

Mulia was already trading, but without structure or consistency.

“Now I really believe in my vision and understand where the market will move. I make 20% profit consistently every month.”

-Casey Chong

Casey mastered discipline through the AFM framework.

“It’s been 40 days after your course. I’ve made 30% since then. Maximum loss streak is 3 trades = 6% drawdown. Following your rules works.”

Why These Success Stories Matter

These stories come from:

- Full beginners

- Struggling traders

- Working professionals with limited time

- Experienced traders looking for scaling

- People from every timezone and occupation

The common thread?

They followed one structured, repeatable system — the AFM Proprietary Trading Framework.

This curriculum page exists to show you exactly what that system includes, how it works, and why so many people see meaningful results.

Who the One Core Program Is For

Built for beginners. Trusted by professionals. Designed for anyone serious about mastering trading.

The One Core Program is not a hobby course.

It is a professional-grade trading curriculum built for people who want clarity, consistency, and a real money-making skill they can rely on for life.

It doesn’t matter whether you’re brand new to trading or have been trying for years — the AFM system is designed to meet you exactly where you are, and elevate you step-by-step into a confident, capable, consistent trader.

Below is a clear breakdown of who this program is ideal for:

Objective: Lay the foundation for how professionals think, plan, and execute trades.

What You’ll Learn:

- How the entire AFM system fits together

- Why most retail traders fail (and how to avoid the traps)

- What it means to trade like a business

- How to prepare your mindset for consistent profitability

- How to avoid years of trial-and-error by following a structured approach

This module sets the stage for everything that follows — and gives you the mental framework required for long-term success.

If you’ve never traded before, the AFM system gives you:

- A complete A–Z roadmap

- Clear, simple explanations

- Step-by-step guidance

- Real chart breakdowns

- Exercises that accelerate learning

Many of our most successful students started with zero knowledge — and built their first profitable system inside this program.

The structure removes overwhelm and teaches you exactly where to start, what to ignore, and how to build confidence quickly.

PRICE ACTION –THE KING OF CHART READING

Next, we dive right into the most important aspect of trading – Price Action. Price action is the King of Chart Reading. Every professional trader knows this and is a master at price action in some way or another.

I have broken down the study of price action into simple steps, making this complicated topic into an easy-to-understand learning method. Once you go through my way of reading the chart with price action, every time you see a new chart, you will be able to read it with ease – just like reading a book. Learning price action is like learning a new language – the language of charts.

It fundamentally involves dissecting what the chart is trying to tell us. Once you go through the price action section, you will know with a good degree of certainty why the market is going sideways, trending up or down, whether it is a real reversal or just a retracement. You will be able to tell the story of the chart and anticipate with a good level of confidence where will it head next.

Price action is the skill that every trader who wants to be professional needs to acquire. That’s why I placed learning it right at the start of the program. Because once you learn it, the rest of the chart reading and execution will fall into place.

This is why some traders just randomly learn some trading strategy online and, after trying it out in the live market, it didn’t work as it “should”. The real reason is that you can’t simply just apply any strategy any time you see the pattern occurring. You must first read the chart using price action and to generate a good understanding of where the price is likely to head.

For example, with good chart reading skills, you will be able to tell that the current movement is likely just a retracement, not a real reversal that shoots down. If that’s the case, you shouldn’t be selling, but instead, be looking for an opportunity to buy. But without chart reading with price action and seeing that it’s the same pattern that tells you to sell, you will probably end up losing that trade.

This is why learning chart reading and especially price action comes first. Once you know how to read the charts like a book, this is when you’ll know when to apply the right strategy and when to skip the trade.

If you’ve been trading but feel:

- Confused

- Inconsistent

- Unsure of your entries/exits

- Unsure why some trades work and others fail

- Stuck in cycles of win → lose → win → lose

This program will finally give you:

- A repeatable structure

- A professional framework

- A way to evaluate trades objectively

- A system to avoid C- and D-grade trades

- A blueprint to stay consistent

Most struggling traders aren’t “bad at trading” — they simply lack a system.

The One Core Program solves that permanently.

Now that you know how to read the chart with price action, I’m going to show you how exactly to enter, exit and place your stop loss with price action.

Please note that I haven’t started talking about strategy yet. This section is to give you a good understanding right from the start to show you how to execute trades with price action in the right way.

In this section, I cover many different entry methods and stop loss methods – the different methods to use in different situations. This is intended to lead you to becoming a professional trader where there isn’t a one-size-fits-all method but it’s more about applying the right method in the right situation. It’s really not complicated once you learn it and, if anything, it’s rather straightforward.

The reason why we have different methods is that I do not just want to teach you just one method. Because the market is live, it’s moving. Therefore, in order for you to be a professional, you must have a series of tools and know which one to use in different scenarios. That’s what makes a good trader and of course a good program.

That’s why this is the One Core Program –the only program you’ll ever need.

Now for the exit methods – this is the easy part. And our way of exiting is very defined plus it makes us good profits. Our exit methods allow us to win with good probability and profitability. That’s part of the key to being a profitable trader.

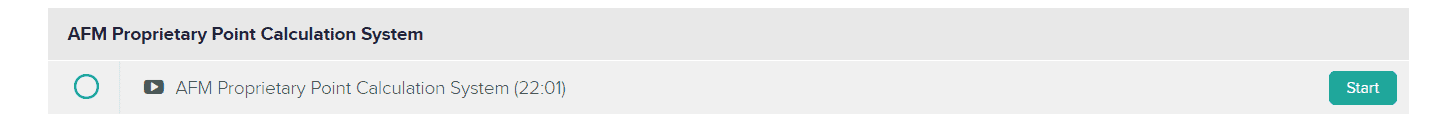

If you already understand the basics but want:

- Higher win rate

- Bigger returns

- Better precision

- Stronger discipline

- Advanced strategies

- A system to scale your account responsibly

You will benefit massively from:

- The Road to Millions Formula

- The AFM Point Calculation System

- 16 proprietary strategies

- Advanced trade management

- Institutional mindset training

- One full year of my live trading breakdowns

These modules are specifically designed for traders who want to move from “good” to elite.

As professional traders, we are very serious about this business. Trading is not a gamble, speculation or a toss of the coin. If it’s any of these things, we might as well go to a casino. The above mentality could be appropriate for an amateur but is definitely not the mindset and methodology of a professional trader.

Look, we trade for a living. Gambling, speculation and luck can only bring us so far. But to make not just a living but a very good living out of it – it’s a skill and it’s a proper business.

Therefore, in this section, you will learn how we treat trading as a business. With the proper “accounting”, system and methodology. In such a way that everything is structured. We leave nothing to chance. There is nothing random in our trading. Every trade we enter is based on a properly structured plan. There’s no scenario for gut feeling, gambling or anything like that.

With the way we trade, we will know whether or not we will be profitable. Everything is calculated mathematically. This is why we are professionals.

If you are an existing trader, this section alone will likely turn you from a losing/break-even trader to becoming a profitable one.

And guess what? More than 70% of the traders out there don’t know this or apply it correctly.

Once you apply the business of trading into your trading, you WILL see an increase in profitability. Thus leading to an increase in ROI.

If you have:

- A full-time job

- A busy schedule

- A family

- Limited hours to sit in front of charts

The AFM system is built exactly for you.

You’ll learn:

- How to trade with minimal screen time

- How to use checklists and pre-planned rules

- How to execute with clarity, not emotion

- How to streamline your entire workflow

Trading isn’t about staring at charts all day — it’s about using a repeatable system.

Now that you have learnt price action, let’s progress to some advanced chart reading methods and combinations. The reason why I haven’t already moved on to strategies yet is that chart reading really is the skill that you’ll need to master before talking about strategies.

The reason is simple, once you master the reading of charts you will be able to open any chart and tell where the market is heading. This gives you a strong winning edge in the game, doesn’t it? By knowing what price will likely do next you will know whether or not to go for a long or a short (to buy or to sell).

That’s why I spend a tremendous amount of time drilling you on your chart reading skills. Once you master chart reading, you will be among the top 10% of the traders around.

So right off the bat, we jump into one of the most powerful chart reading methods – Elliott Wave.

Ask any professional trader – the ones who are really good at their game. There’s a high chance that they understand the Elliott wave to a certain degree. Some of them are masters at it. Elliott wave theory revolves around the market moving in a wave pattern. And, by understanding which specific wave the market is in, gives you a good probability of knowing whether or not should you buy or sell and how far it is likely to go.

I have digested all the information that you need to know about the Elliott wave in this segment. Of course, you can go ahead and attend a 2-day seminar on the Elliott wave. But honestly, it’s not necessary. Everything taught here is more than enough to equip you to use it for profitable trading with our system.

Next up – Fibonacci.

Fibonacci is something most traders know. It’s a mathematical formula of numbers and levels. The reason why traders use it is that it works fantastically for the technical charts. The price can be seen in tremendous examples respecting the levels of Fibonacci. And traders use it to time retracement, exits and levels of rejection. It’s not going to be anything complicated I assure you. Anything that is will anyway be straightforward in the way I put it across, so straightforward that even my two kids aged 7 and 8 can understand it.

Trendline is the third module in this section. Some people may think that trendline isn’t strong. How wrong can they be? As simple as trendline may seem… when drawn correctly, it’s one of the most important tools out there.

In this section, I’ll show you the right way to draw trendlines. And once you learn it, you will start to see how simple and powerful it is. A trendline, when drawn correctly, gives you very high accuracy in chart reading and also in trade execution. It’s a highly effective tool that we use in our arsenal.

The fourth module in chart reading is Support and Resistance Level. How can we not talk about this, right? The reason being, that every trader knows this. Even someone on the street can tell you that, for example, a 3000 level at X index/stock is a very strong level. So you see… if the layperson knows that, they will probably get their profits out at that level or even sell there. That’s why the support and resistance level works so well.

Now, knowing the support and resistance level and applying it correctly is a different story. Here, I will show you my way of drawing these levels, when to move them, when it is strong and when it’s not needed anymore. You will learn a straightforward method of applying them. With these levels drawn, you will now be able to know how to read the charts effectively and use them together with our other combinations.

Next up is the 150 and 365 Exponential Moving Average. As you can see, I’m not hiding these levels. I’ll tell you upfront that these are the levels that I use. But what’s important is HOW I use them. That’s what makes the difference. Really, when applied correctly, they give us a great amount of profits. Best of all, they are automated. ;)

The sixth module is Bollinger Bands. I like Bollinger bands, and configure them in a way whereby it’s powerful and effective. In this module, I share with you exactly how to use Bollinger bands, the common ways to use them, and how we use them in our own style to our benefit.

The seventh module is Stochastics and Macd. If price action is like the core body, these are like the clothes that we put on. It gives us the extra firepower, extra confirmation and increased probability. Here I’ll be giving you the exact customized tool that I use, one which is configured differently from the default MT4 Macd. Yeah! Good stuff here.

The eighth module is the understanding of Higher Highs and Lower Lows. This is a powerful module to add on to our chart reading. Most people don’t understand this concept the way we do. Because once you see it in the way that I teach you, it becomes a no-brainer. Chart reading becomes so easy. And it really is. Can’t really reveal too much here… But once you learn it, it really changes the way you look at charts.

The final module of the advanced chart reading section is where we put it all together. The Combination. When used individually everything above gives you only so much power, but when you combine them in the way that I’ll show you together with price action, it gives you such an amazing way of reading the charts. Trust me on this. When you learn how to read the chart using the combination of everything above – my proprietary way – you will never see charts the same way again.

And again I emphasize, you can use it on any vehicle. Forex, stocks, indexes, commodities, crypto and anything that has charts – it’s that powerful, it really is.

When you complete this entire section, your chart reading skillset will now be in the top 10% amongst the world’s traders. The next time someone shows you a chart, you can start talking about it like a pro. Because… you are.

Many students join because they want:

- A skill they can rely on for life

- A way to build long-term wealth

- A profession-level ability to generate income

- Something they can pass to their children

- A system that isn’t dependent on luck or market hype

Trading is one of the most timeless financial skills in the world — and this program teaches the craft at the highest standard.

Now that you have learnt price action, let’s progress to some advanced chart reading methods and combinations. The reason why I haven’t already moved on to strategies yet is that chart reading really is the skill that you’ll need to master before talking about strategies.

The reason is simple, once you master the reading of charts you will be able to open any chart and tell where the market is heading. This gives you a strong winning edge in the game, doesn’t it? By knowing what price will likely do next you will know whether or not to go for a long or a short (to buy or to sell).

That’s why I spend a tremendous amount of time drilling you on your chart reading skills. Once you master chart reading, you will be among the top 10% of the traders around.

So right off the bat, we jump into one of the most powerful chart reading methods – Elliott Wave.

Ask any professional trader – the ones who are really good at their game. There’s a high chance that they understand the Elliott wave to a certain degree. Some of them are masters at it. Elliott wave theory revolves around the market moving in a wave pattern. And, by understanding which specific wave the market is in, gives you a good probability of knowing whether or not should you buy or sell and how far it is likely to go.

I have digested all the information that you need to know about the Elliott wave in this segment. Of course, you can go ahead and attend a 2-day seminar on the Elliott wave. But honestly, it’s not necessary. Everything taught here is more than enough to equip you to use it for profitable trading with our system.

Next up – Fibonacci.

Fibonacci is something most traders know. It’s a mathematical formula of numbers and levels. The reason why traders use it is that it works fantastically for the technical charts. The price can be seen in tremendous examples respecting the levels of Fibonacci. And traders use it to time retracement, exits and levels of rejection. It’s not going to be anything complicated I assure you. Anything that is will anyway be straightforward in the way I put it across, so straightforward that even my two kids aged 7 and 8 can understand it.

Trendline is the third module in this section. Some people may think that trendline isn’t strong. How wrong can they be? As simple as trendline may seem… when drawn correctly, it’s one of the most important tools out there.

In this section, I’ll show you the right way to draw trendlines. And once you learn it, you will start to see how simple and powerful it is. A trendline, when drawn correctly, gives you very high accuracy in chart reading and also in trade execution. It’s a highly effective tool that we use in our arsenal.

The fourth module in chart reading is Support and Resistance Level. How can we not talk about this, right? The reason being, that every trader knows this. Even someone on the street can tell you that, for example, a 3000 level at X index/stock is a very strong level. So you see… if the layperson knows that, they will probably get their profits out at that level or even sell there. That’s why the support and resistance level works so well.

Now, knowing the support and resistance level and applying it correctly is a different story. Here, I will show you my way of drawing these levels, when to move them, when it is strong and when it’s not needed anymore. You will learn a straightforward method of applying them. With these levels drawn, you will now be able to know how to read the charts effectively and use them together with our other combinations.

Next up is the 150 and 365 Exponential Moving Average. As you can see, I’m not hiding these levels. I’ll tell you upfront that these are the levels that I use. But what’s important is HOW I use them. That’s what makes the difference. Really, when applied correctly, they give us a great amount of profits. Best of all, they are automated. ;)

The sixth module is Bollinger Bands. I like Bollinger bands, and configure them in a way whereby it’s powerful and effective. In this module, I share with you exactly how to use Bollinger bands, the common ways to use them, and how we use them in our own style to our benefit.

The seventh module is Stochastics and Macd. If price action is like the core body, these are like the clothes that we put on. It gives us the extra firepower, extra confirmation and increased probability. Here I’ll be giving you the exact customized tool that I use, one which is configured differently from the default MT4 Macd. Yeah! Good stuff here.

The eighth module is the understanding of Higher Highs and Lower Lows. This is a powerful module to add on to our chart reading. Most people don’t understand this concept the way we do. Because once you see it in the way that I teach you, it becomes a no-brainer. Chart reading becomes so easy. And it really is. Can’t really reveal too much here… But once you learn it, it really changes the way you look at charts.

The final module of the advanced chart reading section is where we put it all together. The Combination. When used individually everything above gives you only so much power, but when you combine them in the way that I’ll show you together with price action, it gives you such an amazing way of reading the charts. Trust me on this. When you learn how to read the chart using the combination of everything above – my proprietary way – you will never see charts the same way again.

And again I emphasize, you can use it on any vehicle. Forex, stocks, indexes, commodities, crypto and anything that has charts – it’s that powerful, it really is.

When you complete this entire section, your chart reading skillset will now be in the top 10% amongst the world’s traders. The next time someone shows you a chart, you can start talking about it like a pro. Because… you are.

This program is not for people looking for:

❌ gambling

❌ get-rich-quick shortcuts

❌ signals to follow blindly

❌ luck-based trading

It is for people who want:

✔ Structure

✔ Precision

✔ Discipline

✔ Clarity

✔ Predictability

✔ Growth

If you want to understand the market the way professionals do — this curriculum is built for you.

How the One Core Program Works

A structured, step-by-step professional learning system designed for clarity, mastery, and long-term success.

The One Core Program isn’t a random collection of videos or scattered strategies.

It is a progressive, layered, curriculum-based training system — built the same way institutional traders are trained.

Every lesson has a purpose.

Every module builds on the last.

Every exercise is designed to move you one step closer to mastery.

Here’s exactly how the program works from the moment you join:

Objective: Lay the foundation for how professionals think, plan, and execute trades.

What You’ll Learn:

- How the entire AFM system fits together

- Why most retail traders fail (and how to avoid the traps)

- What it means to trade like a business

- How to prepare your mindset for consistent profitability

- How to avoid years of trial-and-error by following a structured approach

This module sets the stage for everything that follows — and gives you the mental framework required for long-term success.

The program is structured in a logical sequence:

- You start with foundational concepts

- Then you learn to read charts the way professionals do

- Then you master entries, exits, and execution

- Then you develop your strategy

- Then you build your trading business

- Then you scale your returns responsibly

Nothing is skipped.

Nothing is assumed.

Every concept leads naturally into the next.

Even complete beginners can follow the progression with confidence.

Objective: Lay the foundation for how professionals think, plan, and execute trades.

What You’ll Learn:

- How the entire AFM system fits together

- Why most retail traders fail (and how to avoid the traps)

- What it means to trade like a business

- How to prepare your mindset for consistent profitability

- How to avoid years of trial-and-error by following a structured approach

This module sets the stage for everything that follows — and gives you the mental framework required for long-term success.

Every teaching module is followed by:

✔ real chart examples

✔ historical breakdowns

✔ “why this trade works” explanations

✔ “why this trade was avoided” commentary

✔ examples from multiple markets (forex, stocks, crypto, indices, commodities)

✔ homework assignments for mastery

This ensures you’re not just learning what to do — but why the market behaves the way it does.

You’ll build market intuition much faster than through YouTube or fragmented courses.

Objective: Lay the foundation for how professionals think, plan, and execute trades.

What You’ll Learn:

- How the entire AFM system fits together

- Why most retail traders fail (and how to avoid the traps)

- What it means to trade like a business

- How to prepare your mindset for consistent profitability

- How to avoid years of trial-and-error by following a structured approach

This module sets the stage for everything that follows — and gives you the mental framework required for long-term success.

After each training lesson, you get a clear guided exercise that helps you:

- practice the concept

- train your eyes

- build pattern recognition

- apply the lesson immediately

- develop real skill, not theoretical knowledge

This “learning by doing” approach is why students improve so quickly.

Objective: Lay the foundation for how professionals think, plan, and execute trades.

What You’ll Learn:

- How the entire AFM system fits together

- Why most retail traders fail (and how to avoid the traps)

- What it means to trade like a business

- How to prepare your mindset for consistent profitability

- How to avoid years of trial-and-error by following a structured approach

This module sets the stage for everything that follows — and gives you the mental framework required for long-term success.

You get full digital access to the program, which means you can:

- learn at home

- learn while traveling

- learn on your phone

- pause, replay, and review anytime

- fit training around your schedule

This is especially valuable for:

- working professionals

- people in different timezones

- students with families

- people who learn best in short sessions

Trading is a lifelong skill — and the learning format respects that.

Objective: Lay the foundation for how professionals think, plan, and execute trades.

What You’ll Learn:

- How the entire AFM system fits together

- Why most retail traders fail (and how to avoid the traps)

- What it means to trade like a business

- How to prepare your mindset for consistent profitability

- How to avoid years of trial-and-error by following a structured approach

This module sets the stage for everything that follows — and gives you the mental framework required for long-term success.

When you enroll through the Cohort, you receive Lifetime Support from me and my team.

This includes:

- answers to your questions

- clarifications when something is unclear

- video explanations when email isn’t enough

- feedback on your understanding

- ongoing guidance as you progress

You will never feel stuck or confused — because we help you overcome any roadblock.

And because this level of support takes significant resources, it will not always be included in future cohorts.

Objective: Lay the foundation for how professionals think, plan, and execute trades.

What You’ll Learn:

- How the entire AFM system fits together

- Why most retail traders fail (and how to avoid the traps)

- What it means to trade like a business

- How to prepare your mindset for consistent profitability

- How to avoid years of trial-and-error by following a structured approach

This module sets the stage for everything that follows — and gives you the mental framework required for long-term success.

Markets change.

Strategies evolve.

Professional traders adapt.

That’s why One Core includes Lifetime Updates to:

- new refinements

- new corrections

- new implementations

- new lessons

- new templates

- new market insights

When the system evolves, your version evolves with it.

This keeps your skillset sharp and future-proof.

Objective: Lay the foundation for how professionals think, plan, and execute trades.

What You’ll Learn:

- How the entire AFM system fits together

- Why most retail traders fail (and how to avoid the traps)

- What it means to trade like a business

- How to prepare your mindset for consistent profitability

- How to avoid years of trial-and-error by following a structured approach

This module sets the stage for everything that follows — and gives you the mental framework required for long-term success.

This is one of the most powerful components of the entire program.

You get to watch me trade:

- one bar at a time

- one decision at a time

- one market condition at a time

You’ll see:

- why I entered

- why I skipped some setups

- how I managed winners

- how I handled losses

- how long I held trades

- how I exited

- how I adjust to market behavior

This is the closest thing to sitting next to a professional trader for a year — and it dramatically accelerates your growth and confidence.

Objective: Lay the foundation for how professionals think, plan, and execute trades.

What You’ll Learn:

- How the entire AFM system fits together

- Why most retail traders fail (and how to avoid the traps)

- What it means to trade like a business

- How to prepare your mindset for consistent profitability

- How to avoid years of trial-and-error by following a structured approach

This module sets the stage for everything that follows — and gives you the mental framework required for long-term success.

Once you understand the fundamentals, you’ll learn:

- how professionals scale

- how to grow accounts responsibly

- how to manage risk while increasing returns

- how to compound strategically

- how to build wealth without emotional decision-making

This formula is a breakthrough for many students — and often the missing ingredient in their trading journey.

Objective: Lay the foundation for how professionals think, plan, and execute trades.

What You’ll Learn:

- How the entire AFM system fits together

- Why most retail traders fail (and how to avoid the traps)

- What it means to trade like a business

- How to prepare your mindset for consistent profitability

- How to avoid years of trial-and-error by following a structured approach

This module sets the stage for everything that follows — and gives you the mental framework required for long-term success.

This isn't a one-week crash course.

This is a complete transformation of how you:

- see the market

- plan your trades

- execute with confidence

- manage your mind

- grow your account

- think like a professional

The goal is not quick money.

The goal is skill mastery — and lifetime earning potential.

Objective: Lay the foundation for how professionals think, plan, and execute trades.

What You’ll Learn:

- How the entire AFM system fits together

- Why most retail traders fail (and how to avoid the traps)

- What it means to trade like a business

- How to prepare your mindset for consistent profitability

- How to avoid years of trial-and-error by following a structured approach

This module sets the stage for everything that follows — and gives you the mental framework required for long-term success.

Once you join, you unlock:

- all current modules

- all future versions of the program

- all refinements

- all updates

- all strategy enhancements

Your access never expires.

This is one of the most valuable parts of the entire bundle.

The Learning Experience in One Sentence

Simple to start. Powerful to scale. Structured to master.

This is why students say One Core is the most complete, most effective trading education they’ve ever taken.

Now that you’ve seen the full curriculum… here’s your next step.

You now understand exactly what’s inside the One Core Program — the full framework, the modules, the strategies, the psychology, the system, the blueprint, and the professional structure behind everything.

The curriculum page exists to give you clarity.

The Cohort page exists to give you access.

If you’re ready to learn directly under the February 2026 Trader Cohort — with the live masterclass, the 1-on-1 customisation call, lifetime support, and all included bonuses — then your next step is simple: