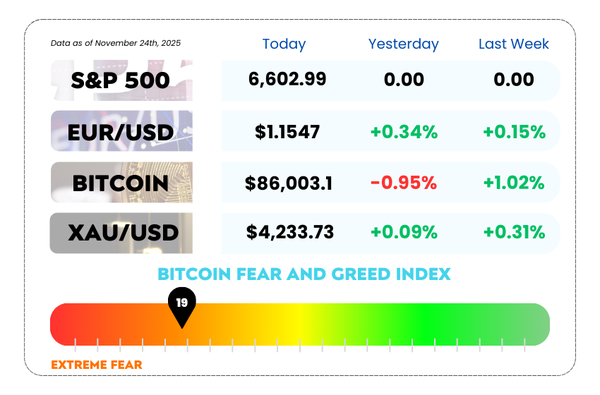

- Today's market mayhem. S&P, EUR/USD, Bitcoin, and XAU/USD today

- FOMC drama heats up as Fed officials clash over a December rate cut

- Bitcoin ETFs hit a wall as massive outflows smash market confidence

- Discover the #1 Parabolic SAR Trading Strategy for Pros with our Youtube video

3 Hours to Go: Our Black Friday Deal Goes Live at Midnight (SGT)! 🔥

The moment traders wait for all year is almost here. At 12:00 AM Singapore Time, the AFM One Core Program officially opens for Black Friday enrollment, and for 7 days only, you can join for $399 instead of the usual $940.

This is the complete trading education system designed to help you build real skills, real confidence, and real mastery — step by step, with structure and clarity.

And remember:

There are no extensions, no reopens, and no second rounds. When doors close on December 2 at midnight, the opportunity is gone until next year.

If you want first dibs the moment the sale goes live,

join the waitlist now and get notified the second doors open.

WEEKLY MARKET MAYHEM🔥

For this week's market mayhem, here’s what we got for you today:

FOMC Drama Heats Up as Fed Officials Clash Over a December Rate Cut 😬

The Federal Reserve just slipped into its own version of The Avengers: Civil War — except instead of superpowers, it’s rate-cut probabilities and academic speeches.

The latest comments from Fed officials make one thing clear: the central bank is deeply split on whether December should bring the next rate cut, and markets are watching every hint like it’s a leaked FOMC script.

Let’s break down who’s pushing for cuts, who’s pumping the brakes, and why the dollar isn’t moving the way you’d expect.

The Fed Officials Hitting the Panic Button

The loudest voice in the room right now? Fed Governor Michelle Bowman, who basically said, “If we wait any longer, the job market’s going to fall apart.”

She’s calling for three cuts this year, arguing that delaying action risks a deeper slowdown.

Bowman also voted against the Fed’s July hold because she wanted an immediate 25 bps cut instead, one of the strongest dissenting signals we’ve seen all year.

Joining her:

- John Williams, New York Fed President, now openly backing a December cut.

- Stephen Miran, newly aligned with the Trump camp, saying he’ll take a smaller cut if that’s what it takes to get a majority.

- Waller and Kashkari, both easing-leaning and increasingly nervous about softening labor data.

Together, they’re forming what looks like an emerging majority for a cut at the final meeting of the year.

The Dollar Doesn’t Care… Yet 💵

Here’s where things get weird:

Despite rising odds of a December cut, the dollar ended the week stronger.

Why? Because markets aren’t obsessing over the next 30 days — they’re zooming out to the entire rate-path.

Investors know that:

- December’s cut doesn’t matter as much as

- how far the Fed goes in 2025, and

- whether the new projections show a deeper easing cycle.

That’s why analysts say the December meeting might look calm on the surface… but could still drop some heavy market-moving fireworks through updated dot plots and new economic projections.

US Dollar Index Daily Chart as of November 24th, 2025 (Source: TradingView)

Why Fed Politics Are Also Shaking the Outlook 🏛️

As if rate-cut drama wasn’t enough, Trump’s friction with the Fed is adding extra heat.

His plans to nominate Stephen Miran to the Board of Governors signal a shift toward more dovish, politically aligned leadership — meaning 2025’s Fed could look very different from today’s.

This is why traders are laser-focused on Bowman’s comments. She’s not just disagreeing on timing, she’s framing a bigger narrative:

Cut now, or risk cutting a lot more later.

Labor Market Weakening Faster Than Expected

Bowman highlighted a stat that got markets' attention:

• Job growth over the past 3 months: only 35,000 per month

That’s a dramatic slowdown, pushing rate-cut expectations above 98% for September, according to market pricing.

And while inflation isn’t fully cooperative, Bowman emphasized that tariff-related price spikes are temporary, meaning the Fed shouldn’t panic about those readings.

In other words:

Inflation noise can be ignored, labor deterioration cannot.

🤔 Asia Forex Mentor Insights

The key takeaway isn’t the December rate cut itself — it’s the underlying shift within the Fed. When dissenters include both long-time economists and newly political appointees, it signals a real transition toward a more dovish landscape.

Expect:

- A softer dollar into year-end,

- Higher volatility around the December dot plot, and

- A greater likelihood that 2025 becomes a multi-cut cycle, not a one-and-done.

Traders should watch the September meeting closely, but the real market-moving moment may come from December’s updated economic projections.

Bitcoin ETFs Hit a Wall as Massive Outflows Smash Market Confidence 😬

The crypto market just got a harsh wake-up call. After months of excitement, institutional inflows, and “we’re so back” energy, the Bitcoin ETF machine has suddenly slammed into reverse.

And not just a tap on the brakes — more like someone yanked the handbrake at full speed.

Investors have pulled $3.5 billion from Bitcoin ETFs this month, putting November on track to become the worst outflow month in ETF history since the products launched nearly two years ago.

Let’s break down the mess.

A Historic Flood of Outflows

Spot Bitcoin ETFs were the golden child of crypto for nearly a year. They were the reason every chart suddenly looked vertical, the reason Wall Street rediscovered Bitcoin, and the reason BlackRock became crypto’s unofficial mascot.

But now?

IBIT alone — BlackRock’s giant — has bled $2.2 billion in November.

That’s nearly 60% of all ETF outflows.

This isn’t profit-taking.

This isn’t a “healthy correction.”

This is institutional exhaustion.

Bitcoin’s price action confirms it. The crypto king sank to $80,553, clawing back to the mid-$80Ks over the weekend, still down for the month and barely holding its 2024 gains.

The Vicious Cycle: ETF Outflows Make Drops Even Worse 🔄💣

Here’s the dangerous part:

When ETFs bleed, Bitcoin bleeds.

When Bitcoin bleeds, ETFs bleed more.

Citi Research quantified it:

Every $1B in ETF outflows = roughly a 3.4% drop in Bitcoin price.

And the reverse is true as well.

This feedback loop explains why Bitcoin hasn’t been able to recover despite favorable macro winds earlier this year.

With nearly $3.5B pulled and counting, Citi analysts even floated a bearish year-end target of $82,000 assuming inflows don’t return.

Right now?

They’re not returning.

BTC/USD 5-day Chart as of November 24th, 2025 (Source: TradingView)

Why the Selling Flooded In

It’s not one reason — it’s a cocktail:

- Hotter inflation data pushed back rate-cut hopes

- Growing doubts about crypto valuations

- Hedge funds unwinding basis trades

- ETF users taking advantage of volatility to offset derivatives positions

- Gold rally stealing some of Bitcoin’s shine

Even with ETF trading volumes hitting a record $11.5 billion on Friday, the big takeaway wasn’t excitement…

It was fear.

Large volumes + large outflows =

Institutional buyers stepping back.

The Bigger Picture: Risk Assets Are Hurting Everywhere 📉

It’s not just crypto.

- AI plays

- Robotics

- Quantum Tech

- High-beta momentum stocks

- Meme names

All have taken hits this month.

Even the S&P 500 is heading toward its worst performance since March.

A top strategist described it perfectly:

Bitcoin ETF flows are becoming a barometer for risk appetite across the entire market.

And right now?

Risk appetite is shrinking.

🤔 Asia Forex Mentor Insights

This drop isn’t about Bitcoin fundamentals. It’s about macro pressure, institutional risk management, and tightening liquidity across all speculative assets.

Watch for:

- Whether ETF outflows stabilize in early December

- How inflation and rate-cut expectations shift

- Volatility spikes leading to further hedge-fund deleveraging

- Bitcoin’s ability to defend the $80K–$82K zone, the new line in the sand

If ETF flows flip back to positive, Bitcoin could recover fast.

If not?

The market may be bracing for another leg lower.