TOGETHER WITH

Today's edition is sponsored by TMGM. With TMGM’s Cashback Promo, you can pocket up to $700 in rewards just for trading like usual. No extra steps, just extra cash.

💸 Start earning while you trade today!

Hey traders, Ezekiel here! 👋 Let’s break down today’s market action so you’re always trading ahead of the curve. Here’s what’s moving the charts right now:

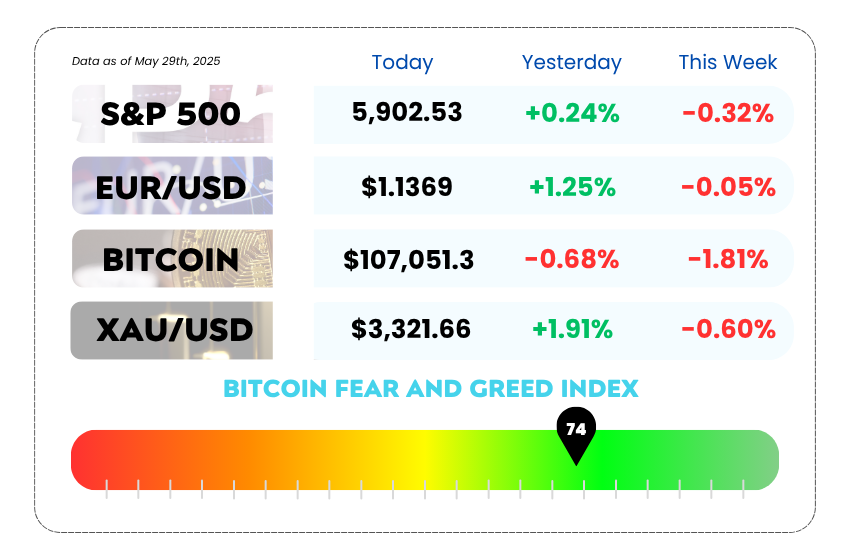

- Today's market mayhem. S&P, EUR/USD, Bitcoin, and XAU/USD today

- Wall Street shrugs off $8B China hit and buys more Nvidia

- Elon Musk exits Washington and reboots Tesla’s robotaxi dream

- Learn how to trade forex like the top 1% with our YouTube video

Get Paid to Trade? Don’t Mind If We Do. 💸

You’re already trading? Might as well get up to $700 in cashback while you're at it. 🤑

Thanks to TMGM’s Cashback Promo, every trade you make stacks up real rewards in your pocket. No gimmicks, no hidden hoops, just straight-up bonus cash for doing what you already do.

Why traders are loving it:

- More Volume = More Money — The more you trade, the bigger your cashback.

- Boost Your Balance — Earn without needing to top up your account.

- Lightning-Fast Execution — TMGM’s tech delivers performance where it counts.

- Pro Tools, Tight Spreads — Serious firepower for serious traders.

WEEKLY MARKET MAYHEM🔥

For this week's market mayhem, here’s what we got for you today:

Nvidia Shrugs Off China Hit, Still Prints Gains Like a Beast 🚀

Nvidia just dropped its earnings, and despite losing billions in China, the stock still soared 5% like nothing happened. 🧠💰

Wall Street took one look at the $8 billion slap from export restrictions and said, “Cool story, what about AI?” Because once again, Nvidia proved it’s the engine under the hood of the AI boom, and not even a geopolitical curveball could derail the hype train.

The company’s first-quarter numbers were a mixed bag, but still strong enough to beat expectations and keep the bulls running.

📊 AI Hype > China Drama

Let’s break it down. Nvidia pulled in $44.1 billion in revenue, beating the forecast of $43.3 billion. Not a massive beat, but enough to keep the dream alive. Adjusted earnings per share clocked in at $0.96, also above the expected $0.93.

Yeah, data center revenue came in slightly under at $39.1 billion (vs. $39.2B expected), but that’s still up from $22.5 billion last year, so no one’s sweating it.

Meanwhile, the China story was rough: Nvidia expects an $8 billion revenue hit in Q2 from U.S. export bans on its AI chips, and their CEO admitted to already losing $15 billion in sales to China. Ouch. But guess what?

Investors simply didn’t care.

Why? Because Blackwell chips are coming, demand is red-hot, and Microsoft, Meta, and Amazon are throwing billions at Nvidia’s feet like it’s a tech altar.

NVIDIA Corporation (NASDAQ) Daily Chart as of May 29th, 2025 (Source: TradingView)

🤖 Nvidia = AI’s Power Plug

The street’s takeaway? Nvidia is still the only game in town when it comes to powering generative AI, machine learning, and all those GPU-hungry workloads. That’s why everyone’s happy to overlook the China mess… for now.

Sure, losing access to a $50 billion market hurts, but the rest of the world can’t get enough of Nvidia’s silicon. The AI gold rush is still raging, and Nvidia's selling the shovels (at a markup, of course).

🤔 Asia Forex Mentor Insights

Here’s the real alpha: Nvidia’s stock is now moving more on AI narrative momentum than clean earnings beats. Even if it takes a hit in one region, it’s still riding the wave of trillion-dollar infrastructure upgrades across the world.

The market’s message? As long as Nvidia keeps dominating the AI hardware race, it’s going to stay on top, even if it loses a few big customers along the way.

Keep your eye on Blackwell rollout, data center demand, and how competitors like AMD respond in the next quarters.

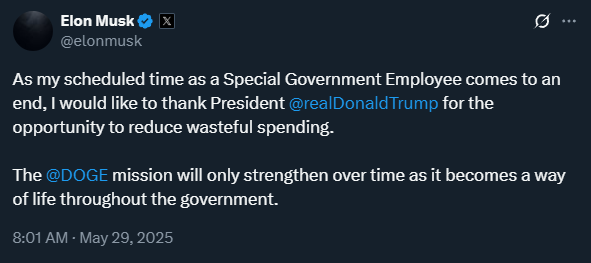

Tesla’s Robotaxi Dream is Finally Hitting the Streets 🤖

June 12. Austin, Texas. No driver in the front seat. That’s the day Tesla is expected to officially kick off its long-awaited robotaxi testing, and Wall Street’s eating it up. 🚗📈

Tesla stock popped over 2% after two major updates hit overnight:

- A leaked start date for robotaxi deployment

- Elon Musk officially clocking out of his government gig to go back into full “sleeping-under-his-desk” mode

Translation? Tesla’s making real moves on autonomy, and Elon’s back in the trenches, not in D.C.

And that second point matters because in the same tweet storm, Elon also announced he's done with Washington. His stint as a Special Government Employee is over, and he’s now back to 24/7 work mode, sleeping in server rooms and conference chairs like it’s 2018 again.

That tweet was a signal flare to investors: the distraction is over, the boss is back, and Tesla’s next chapter is about to get real.

🚘 From Musk to Machines

According to insiders, Tesla plans to roll out 10 driverless Model Ys in Austin. If all goes according to plan (and let’s be real, that’s a big if), this could scale into thousands of test rides per month. We're talking fully autonomous cars, no one in the driver's seat, cruising around like it's the Jetsons.

And it’s not just testing. Elon says “self-delivering Teslas” could start next month, cars driving themselves straight from the factory to your driveway. Welcome to the golden age of robotaxis, folks.

🛠️ Tesla’s Trillion-Dollar Vision?

Tesla isn’t just dabbling here, this is the company’s next frontier. Musk has bet big on full self-driving and robotaxi dominance, and analysts are calling it a $1 trillion opportunity. The Cybercab (Tesla’s dedicated robotaxi vehicle) is slated for 2026, but what happens this summer could set the tone for years.

Of course, the road to autonomy isn’t smooth. Technical hiccups? Guaranteed. Regulatory friction? Count on it. But if Tesla pulls this off, it doesn’t just stay ahead of the EV race, it leapfrogs into the AI transportation game.

🤔 Asia Forex Mentor Insights

Tesla is moving from EV maker to AI-powered mobility giant. And if the robotaxi rollout goes well, we could see a new wave of investor interest fueled by real-world tech and a revived Musk focused on execution.

What to watch:

- The June 12 launch: Are the robotaxis smooth or sketchy?

- Elon’s focus: Now that he’s out of Washington, does he lock in on Tesla?

- Investor reaction: This could spark a long-term revaluation of Tesla if the vision feels real.

Bottom line: The robotaxi revolution has officially left the garage, and Tesla’s trying to be the first across the finish line. 🏁📊

MEMES OF THE DAY

The life of a scalper: 100 wins, 1 candle, total wipeout ⚔️

Can’t see the chart, but at least the screen looks impressive 😬