TOGETHER WITH

Today’s edition is brought to you by Phemex, the exchange built for traders who want more from every move.

Trade smarter with zero fees, earn 20% cashback, and unlock up to $4,800 in welcome rewards while you dive into both spot and contract markets.

Hey traders, Ezekiel here. Let’s walk through today’s market shifts and turn them into your next winning setup. 💪

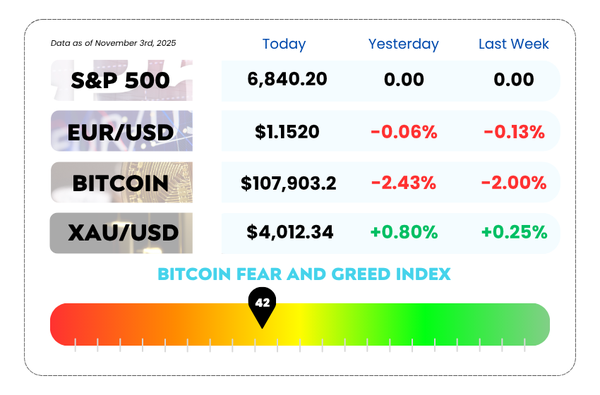

- Today's market mayhem. S&P, EUR/USD, Bitcoin, and XAU/USD today

- Eurozone factories stabilize… but the euro still can’t find its mojo

- Wall Street kicks off November with gains as AI and earnings hype stay strong

- Discover how pros read market structure and momentum with our video

Bottom In? Time to Trade with 0 Fees! 💰

If the market’s found its floor, it’s time to hit the charts — Phemex style. 🚀

New or inactive users get the ultimate head start: zero trading fees + 20% cashback. Yep, you read that right — you trade, and they pay you back.

But wait, there’s more juice for everyone:

🔥 Free entry for all traders

💵 Up to $50 per valid referral

🎁 $4,800 in welcome rewards

✅ Spot & Contract Trading both count

✅ Trade any pair you like

🏆 Earn a slice of the prize pool based on your total trading volume

It’s open season for traders, no fees, full throttle, and plenty of rewards waiting at the finish line. 🏁

WEEKLY MARKET MAYHEM🔥

For this week's market mayhem, here’s what we got for you today:

EUR/USD Keeps Sliding — Dollar’s Still Flexing 💸

The Euro is catching Ls for the fourth straight day, with EUR/USD slipping to around 1.1515 and flirting with fresh 3-month lows. The culprit? A buffed-up US Dollar that just won’t quit.

Last week’s Fed and ECB moves are still rippling through the markets. While the Fed poured some cold water on hopes for a December rate cut, the ECB basically said, “We’re watching, not moving.” The result? Risk appetite took a backseat and the greenback strutted into the week like it owned the place 🕶️💪

Meanwhile, Europe’s factory data tried to make a comeback cameo… but yeah, not quite blockbuster material. The Eurozone manufacturing PMI nudged up to 50.0 (a technical “meh”), showing stabilization but not strength. Even comments from Bundesbank’s Joachim Nagel about data staying “on track” didn’t do much to help the single currency find its footing.

EUR/USD Daily Chart as of November 3rd, 2025 (Source: TradingView)

Traders are now waiting on PMI releases from both sides of the Atlantic — the Eurozone’s final October print and the US ISM manufacturing number — to see if sentiment shifts at all. Spoiler alert: if the US data beats, the dollar might flex even harder.

From a technical view, the pair broke below its monthly triangle pattern last week — not great news for the bulls. The bias stays bearish, and dips under 1.1530 could open doors to 1.1440, maybe even 1.1390 if momentum keeps building.

Any short-term rebounds? Probably just snacks for the bears 🐻.

🤔 Asia Forex Mentor Insights

The market’s saying it loud and clear — the dollar’s dominance isn’t done yet. Until traders see real signs of life in Eurozone growth (or softer US data), EUR/USD might stay stuck in the red zone. Smart money’s watching 1.1500 and below for the next potential moves.

Stay sharp, trade smart, and keep your stop losses tight. ⚡

Wall Street Starts November With That “New Month, New Gains” Energy 🚀

US stock futures kicked off the week in the green, trying to keep the October rally rolling into November. S&P 500 and Nasdaq futures climbed about 0.3% and 0.6%, while the Dow squeaked out a smaller 0.1% rise.

After a hot October — S&P up 2.3%, Dow up 2.5%, Nasdaq up nearly 5% — investors are still betting big on AI names and tech giants, aka the “Magnificent Seven.” Think of it as Wall Street’s favorite boy band — and everyone’s still buying concert tickets. 🎤💻

Beyond the tech hype, there’s a whiff of optimism around cooler US–China vibes, which also helped keep markets chill last month.

But the rally’s not all smooth sailing…

⚖️ The Plot Twists

Washington is still in a bit of a mess. The government shutdown is delaying major economic data (including the jobs report traders love to obsess over). Meanwhile, the Supreme Court is set to weigh in on the legality of Trump-era tariffs, a move that could rattle global trade flows.

Over in chip land, Nvidia made waves after US officials hinted that its top-tier chips might stay home, reserved for US firms and off-limits to China. That adds another layer of intrigue to the ongoing AI race 🧠💥

💼 Earnings Parade Continues

Roughly 300 S&P 500 companies have already reported Q3 earnings, and the scoreboard’s looking decent so far. This week, another 100+ names take the stage — including Palantir, Super Micro, and AMD — so expect more fireworks.

One standout: Berkshire Hathaway jumped over 1% premarket after announcing a 17% profit bump, helped by mild hurricane season losses and some juicy investment gains. Warren Buffett’s empire quietly keeps printing. 💰

📊 What Traders Are Watching

With government data stuck in limbo, investors are laser-focused on ISM manufacturing and services numbers, S&P Global readings, and Friday’s University of Michigan sentiment report. Any sign of consumer slowdown could quickly test this rally’s strength.

🤔 Asia Forex Mentor Insights

Momentum’s back — but it’s fragile. The market’s living off AI optimism and Big Tech muscle, while the Fed, data delays, and trade policy risks still hover in the background. If this bullish mood is going to last, we’ll need confirmation that earnings growth and economic stability can keep up with the hype.

Trade smart, stay nimble, and remember — even bull runs need coffee breaks ☕🐂

MEMES OF THE DAY