TOGETHER WITH

Today's edition is sponsored by TMGM. Want to get rewarded for your trades? With TMGM’s Cashback Promo, you can earn up to $700 simply by trading as you usually do.

What’s up, traders! Ezekiel here, let’s dive into the latest market moves so you stay one step ahead. Here’s what’s shaking up the charts today:

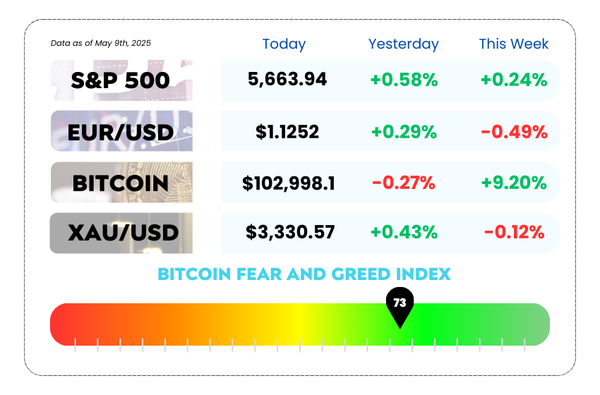

- Today's market mayhem. S&P, EUR/USD, Bitcoin, and XAU/USD today

- Oil prices rise as markets await US–China trade negotiations

- Trump administration eyes lower tariffs as US–China trade discussions approach

- Stop getting faked out and enter pullbacks like a pro by watching our video

👀You’re Trading Anyway… Why Not Earn Up to $700 for It?💰

Turn your trading into real rewards with TMGM’s Cashback Promo – earn up to $700 just by doing what you do every day.

Why it’s a no-brainer:

✅ More trades = more cashback. Rack up rewards as your volume increases.

✅ Grow your funds without extra deposits – get bonus cash on top of your gains. 💸

✅ Trade like a pro with low spreads and advanced tools at your fingertips.

✅ Fast, reliable execution on TMGM’s high-performance platforms ⚡

👉 Grab your slice of the $700 cashback — don't let this offer slip by!

WEEKLY MARKET MAYHEM

For this week's market mayhem, here’s what we got for you today:

🛢️ Oil’s On a Comeback Tour… But It’s Got Trust Issues 🛢️

Oil prices are creeping back up — but not because the market suddenly found inner peace. It’s more like “maybe things won’t get worse” vibes.

Here’s what’s heating the pot:

🔥 US and China are getting ready to talk (again), and traders are betting that fewer tariffs = less global pain

🔥 Brent’s inching toward $64, after a solid 2.8% jump

🔥 The UK just locked in a trade deal with the US, giving markets a little more hopium to sip on

But don’t let the candles on the chart fool you — this isn’t a full recovery party just yet.

Oil’s been under pressure since mid-Jan thanks to:

- 📉 Fears that tariffs would hit global growth like a freight train

- 🛢️ OPEC+ quietly revving up production again (yep, supply’s rising)

- 😬 A not-so-“historic” UK–US deal with more fluff than fuel

CFDs on WTI Crude Oil Daily Chart as of May 9th, 2025 (Source: TradingView)

Now the focus shifts to the weekend’s US–China negotiations. Washington's thinking about cutting tariffs to ease the pain — but Beijing is basically saying: “Cancel them first or we ghost.” 😤📞

Oh, and it gets messier.🇺🇸 The US just slapped sanctions on another Chinese “teapot” refinery (plus some ships and folks) for allegedly dealing in Iranian crude.🇬🇧 Meanwhile, the UK’s planning to blacklist up to 100 tankers tied to Russia’s shady oil shuffle — cargo worth over $24B.

Markets are cautiously hopeful, but this feels like watching a rom-com couple that’s broken up three times already. They might kiss again, but you're not betting the house on it.

🤔 Asia Forex Mentor Insights

- Short-term oil moves = sensitive to trade talks, so keep an eye on weekend headlines

- Any tariff rollback news could pump risk assets, especially commodities and FX pairs tied to oil-exporting nations

- But don’t get overconfident — geopolitics are still the wild card

- Consider technical setups with strong support around $60–$61 if oil pulls back again

💰 Trump's Tariff Twist: From 145% to… Friend Request? 🧾➡️🕊️

Hold onto your spreadsheets, traders — the US–China trade war might finally be moving from Mortal Kombat to Maybe Let’s Talk?

Here’s what’s cooking in Geneva this weekend:

👉 The US is considering a major tariff rollback on Chinese goods — from a sky-high 145% down to below 60%. That’s not a typo. That’s basically the Black Friday of trade policy.

So why the sudden change of heart?

Because a full-on trade meltdown isn’t good for anyone. not for the US, not for China, and definitely not for markets.

The goal? Get China to return the favor and cut some of its own tariffs too. It’s a game of economic chicken, and someone’s finally easing off the gas.

But wait, there’s more.

🦾 Trump just flexed a new trade deal with the UK — the first one since all the “reciprocal tariffs” chaos kicked off in April. It’s being sold as a “breakthrough” that’ll boost exports like beef and ethanol. Mmm, trade-fueled steak dinners. 🥩🔥

At the same time, China’s reportedly making a “secret list” of US goods that might dodge its 125% tariff wall — a silent nod that maybe, just maybe, they’re open to negotiation. But they’re doing it quietly… no confetti, no press release.

Meanwhile in Europe:

The EU’s taking a different approach — they’re sharpening their pitchforks. If US–EU talks flop, the bloc’s got a list of American goods they’re ready to slap with tariffs faster than you can say “Ford F-150.”

Oh, and while all this is happening, Fed Chair Jerome Powell is sitting tight, basically saying “we’re not panicking… yet.” The Fed held rates steady and is watching how this all plays out before deciding if it needs to step in with rate cuts or economic CPR.

So yeah, this weekend's trade talks are a big deal. Could be peace talks. Could be more fire. Could be both. 😬🔥🕊️

🤔 Asia Forex Mentor Insights

- Tariff cuts = short-term bullish for risk assets, including equities, emerging market currencies, and even commodities

- Watch USD/CNH, USD/JPY, and AUD/USD — these pairs are sensitive to shifts in trade tone

- No real progress = more volatility ahead, so keep risk tight until there’s clarity

- A surprise Trump–Xi meet-up could move markets sharply — watch headlines closely over the weekend

MEMES OF THE DAY

One's building a career, the other's chasing dopamine 😅

Strategy said hold. Anxiety said GET OUT NOW 😵💬